The Energy Report: Brian, in your last interview with The Energy Report in May, you were watching the price of West Texas Intermediate crude as compared to the average of the past six major bottoms. What is the chart telling you now?

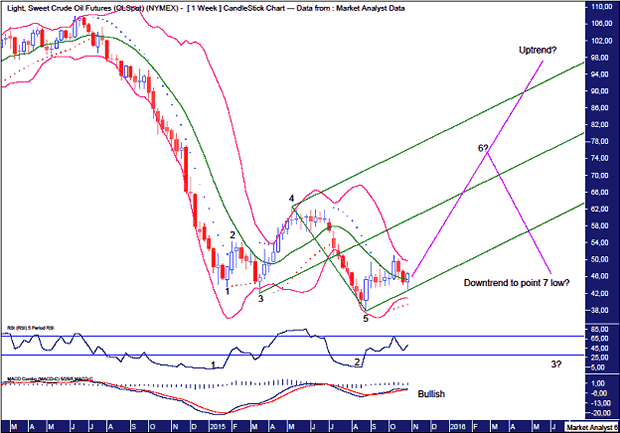

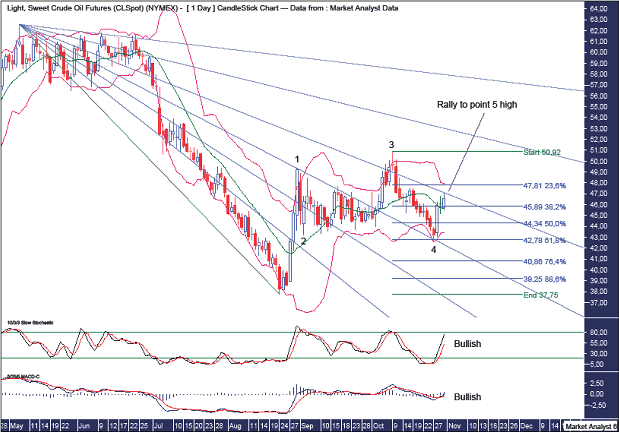

Brian Hicks: It appeared in April and May that we might see a recovery in crude oil prices. A lot of folks were excited about the rapid decline in the rig count. However, U.S. production remained quite resilient, trending north of 9 million barrels per day (9 MMbbl/d). That caught a lot of people by surprise—the fact that production had not rolled over—and led to a dip in crude oil prices over the summer; they dropped below $40 a barrel ($40/bbl) briefly.

“We feel like BNK Petroleum Inc.is undervalued if you look at the reserves in the ground.”

Approaching the end of the year, we see some signs of production slowing. There is a lot of carnage in the energy patch

right now. A number of operators are going through their bank redeterminations, are seeing their credit lines cut and are no longer able to issue any high-yield debt, so that’s started to crimp drilling budgets. You are going to see even more of a drop-off in drilling activity, which could lay the groundwork for a strong rebound in 2016.

TER: What indicators do you watch to determine where the larger economy, and energy prices in particular, are going?

Frank Holmes: I focus on the global Purchasing Managers Index (PMI), which is an alternative to gross domestic product and indicates commodity demand. And I am watching China. Second-tier city real estate is still going up, which bodes well for energy prices.

BH: We need emerging market currencies to stabilize. That would be supportive for crude oil demand. Encouragingly, we have seen some stabilization in the emerging market space recently. China is increasing stimulative economic packages that could help revive demand, both in China and around the world.

TER: The last time we chatted, you were moving to mid- and larger-cap names, as you were seeing value in stocks that paid a dividend and offered low volatility. Is that still the direction you’re going?

BH: We have moved up the food chain. Given that companies are finding it very difficult to get access to capital and the cost of capital has gone up, we felt like it was better to invest in larger companies. We are gravitating toward companies with strong balance sheets that can continue to grow through the drill bit even in this low commodity price environment. That would imply that they have very high-quality, low-cost acreage. We feel like we’ve been able to identify some strong candidates in that regard.

“Royal Dutch Shell Plc has been able to grow the dividends, in some cases, at very high, double-digit rates over the last decade.“

BNK Petroleum Inc. (BKX:TSX) is still a legacy holding. It’s obviously a long-term position with some of the projects it’s undertaken in Europe. Those will be slowed quite a bit given this price environment, but we like the acreage BNK has in Oklahoma, and the crude oil growth we’ve seen. We feel like the company is undervalued if you look at the reserves in the ground. At some point, that value will be realized.

TER: You also mentioned Royal Dutch Shell Plc’s (RDS.A:NYSE; RDS.B:NYSE) acquisition of BG Group Plc (BRGYY:OTCQX; BG:LSE) as one of the reasons you owned the stock. How has that worked out?

BH: Royal Dutch is moving into the execution phase on that deal. Shell will to have to bring the two companies together, optimize the organization, and look for synergies—areas where costs can be cut back. That will be a developing story. The high dividend yield is the biggest reason to own a company of Shell’s size. That is what makes them attractive. This company has been able to grow the dividends, in some cases, at very high, double-digit rates over the last decade. I think a lot of folks who require income look to those names.

TER: Let’s talk about some new names that are performing well in your portfolio.

BH: In our exploration and production (E&P) portfolio, we’re focusing on companies that can continue to grow production and expand their reserve bases in this difficult environment. They have the balance sheets to withstand the downturn, and the acreage to continue to drill. Obviously, it’s not an optimal time to be ramping up. These companies are generally keeping drilling budgets within their cash flow. That is what we like to see.

The first company is Callon Petroleum (CPE:NYSE). It’s been around since the 1950s, but the company has shifted its focus over the last five or six years from the Gulf of Mexico back onshore and, specifically, to the Permian Basin in West Texas.

“We are going to see even more of a drop-off in drilling activity, which could lay the groundwork for a strong rebound in 2016.”

The Permian has been a legacy oil producing basin for the U.S. for many decades. Horizontal drilling has completely revived the Permian Basin, enabling production to increase to 2 MMbbl/d in 2015, up from about 800 Mbbl/d in 2007. Some 180–200 rigs are still drilling; that’s down from about 550 rigs, but relative to the other shale plays, you’re seeing the most activity in the Permian right now because companies in the core of this area have been able to drill very prolific wells that offer high economic rates of return.

Companies like Callon Petroleum can deliver positive returns at oil prices as low as $40–42/bbl. We estimate this company can generate internal rates of return of close to 28–30% at current strip prices. That’s very robust in this environment. You’re seeing a number of companies in the Permian continue to drill and maintain their activity levels, even though we’re in a depressed commodity environment.

TER: Callon seems to have a lot of partnerships in place. How does that help investors manage risk?

BH: The Permian Basin is such a vast area that joint ventures and farm-ins make sense given the large inventory of prospects to drill. Callon has a large acreage position—roughly 7,000 (7K) acres—in Midland County. It has another 10K or so in the southern portion of the play, in Upton and Reagan Counties. It has a tremendous amount of potential growth, a very long reserve life at the two rigs it’s using right now—approximately 17 years—and has already identified inventory of roughly 492 locations. For a company its size, Callon offers strong growth visibility. We see the company being able to increase production at well over double-digit rates over the next two to three years, and increasing its cash flow quite a bit. There is still a lot of potential on the drilling front, as the company continues to delineate its acreage position and optimize costs and drilling.

TER: What is another name in the Permian?

BH: We like Parsley Energy, Inc. (PE:NYSE), an emerging mid-cap E&P company based in Austin, Texas, just up the road from us in San Antonio. It is a focused pure play on the Permian Basin. Once again, Parsley fits within our overall theme of being able to grow the production base through the drill bit organically, and offer visible, debt-adjusted, per-share growth rates while maintaining a flexible balance sheet.

Parsley has about 84K acres in the Midland Basin and another 30K acres in the Delaware Basin. The Midland has been drilled out the most and seems to offer higher economic rates of return, but the Delaware has been improving recently, and you’re starting to see some interesting zones being developed in that play that could offer significant upside for a company like Parsley. Drilling activities in some individual wells could offer a lot of upside from a net asset value (NAV) standpoint. This company has over 2K net locations—a very deep portfolio of drilling locations. The company also will be drilling within its cash flow. It has tremendous economics and can break even in some locations at around $37/bbl.

Additionally, it’s the small- to mid-cap companies in the Permian Basin, like Parsley and Callon, that could be potential takeout candidates for a larger company because of this kind of inventory potential.

TER: How about one more?

BH: Moving away from the Permian, the next shale play in the U.S. that has garnered a lot of attention, and is starting to provide some very high rates of return and economics, is the Niobrara, located in Weld County in northeastern Colorado. A few companies there also look to be increasing production at double-digit rates. In addition, insider and employee ownership is approximately 10%, which is a big plus for us as it aligns management incentives with its shareholders.

“We are watching China. Second-tier city real estate is still going up, which bodes well for energy prices.”

We like Synergy Resources Corp. (SYRG:NYSE.MKT), a small-cap pure play in the space. The company has been around since 2008 and has focused operations in that particular area. In around 2013, it began its horizontal drilling campaign.

We feel like this is the best small-cap play for this particular shale development, again with the same themes—good balance sheet and strong visibility for production growth. There’s a lot of growth to be had given the company’s size. Some 40 MMbbl of reserves are booked at this moment, up 25% from last year. Production for Q4/15 is estimated to be around 11,000 barrels per day (11 Mbbl/d). That’s up 30% quarter-over-quarter and is a pretty big ramp-up in production for a company its size, representing a tremendous number of drilling locations. Synergy has well over 1K locations, many of which are in its core area, but it’s also developing other areas that look to have a lot of potential upside. The company currently has around 50K acres in the NE Wattenberg Extension that could really expand its drilling locations beyond the core Wattenberg area. The company is targeting the Greenhorn formation via the Conrad well test, in particular, which could be very accretive to its NAV if successful. Those results are not out yet, but we’re watching to see how that develops.

TER: Synergy just purchased acreage in the Wattenberg Field, along with more acreage in the Niobrara, for about $78M. Could that make enough of a difference in production to move the share price?

BH: It is a nice tuck-in acquisition. I think it’s not so much about the production or the current reserves that the company is buying, but the potential of that resource base. Synergy bought the package from a private company and will apply its larger financial and operational resources to fully develop that play.

We do feel like it is meaningful. That greater Wattenberg area offers a tremendous amount of potential going forward. It’s good that management is looking both at organic growth as well as M&A opportunities to build the portfolio. Synergy will be picking up an additional 4,300 net acres next to its current land position, and an incremental 1,200 barrels of oil equivalent per day production. The company has more cash than debt as of Q3/15, so the balance sheet is very strong. Roughly a third of its production is hedged this year at $70/bbl, so it’s very well insulated from these lower oil prices.

TER: You have also moved the portfolio into the base metal space. It looks like you have some copper and zinc. What is it about the fundamentals of these two metals that appeals to you?

BH: This is a long-term view. We still need to see some improvements in China’s overall economy, but in the long run, urbanization in that country will continue in order to balance the less urbanized west with the highly urbanized coastal or eastern regions. A lot of investment will go into fixed assets, and that bodes well for commodities, specifically for copper, zinc and iron ore to go into steel production.

“We are gravitating toward companies with strong balance sheets that can continue to grow through the drill bit even in this low commodity price environment.”

Right now, those commodities are out of favor. However, when we looked at the equity values for those mining companies, we felt like we would be able to buy at bargain basement levels. These are patient, long-term companies bought at once-in-a-decade valuations. The supply and demand fundamentals for those commodities require prices to meet future demand. We feel very constructive right now about mining and energy shares and feel now is an attractive time to look at those names.

TER: What were the specifics of the two companies you added to the portfolio?

BH: Nevsun Resources Ltd. (NSU:TSX; NSU:NYSE.MKT) is a company with pristine financials, very high rates of return and a dividend yield north of 5%. It has done a good job transitioning from precious metals into copper, and in picking up production. It will be moving more into zinc over the next few years.

Zinc should become quite attractive from a supply perspective. Upcoming mine closures should tighten up the fundamentals for that metal. We feel like Nevsun will be able to capitalize on that. It has begun exploration programs around its Bisha property. It looks like there are some encouraging signs that the company might be able to extend the reserve life of that project. That would help to increase Nevsun’s production visibility longer term.

First Quantum Minerals Ltd. (FM:TSX; FQM:LSE) has some debt on the balance sheet and the market has punished the shares for its leverage during this downturn. The market has become very concerned about company debt levels and large capex projects, such as the Cobre Panama, which are going to require a large amount of money to develop. The new Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) stream helped validate First Quantum and backstopped the recent share price decline. This coupled with the operational developments at Sentinel gave us confidence that there was enough financial stability to justify getting involved. Given our positive views on copper, we felt like it would be a good way to leverage the metal price.

TER: What words of wisdom do you have for investors looking to end 2015 with a strong resource portfolio?

BH: Patience is the key word. Equity values at current prices are not reflecting equilibrium economics for many of the commodities trading below marginal cost. You want to buy commodity stocks when they’re out of favor, because they are cyclical. If you look out 12, 18, 24 months from now, those equity values should reflect equilibrium commodity prices and move significantly higher from here.

TER: Thank you for your time.

Brian Hicks joined U.S. Global Investors Inc. in 2004 as a co-manager of the company’s Global Resources Fund (PSPFX). He is responsible for portfolio allocation, stock selection and research coverage for the energy and basic materials sectors. Prior to joining U.S. Global Investors, Hicks was an associate oil and gas analyst for A.G. Edwards Inc. He also worked previously as an institutional equity/options trader and liaison to the foreign equity desk at Charles Schwab & Co., and at Invesco Funds Group, Inc. as an industry research and product development analyst. Hicks holds a master of science degree in finance and a bachelor’s degree in business administration from the University of Colorado.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors Inc., which manages a diversified family of mutual funds and hedge funds specializing in natural resources, emerging markets and gold and precious metals. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve global conflict, and is an adviser to the William J. Clinton Foundation on sustainable development in nations with resource-based economies. Holmes is a much sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications.

Read what other experts are saying about:

Related Articles

- U.S. Global Investors’ Frank Holmes and Ralph Aldis: Gold Companies That Create Extra Value Will Always Reward Investors

- Marin Katusa: Follow the Good Guys in Mining

- Why Opportunistic Investor Chen Lin Is Hoping for $20/Barrel Oil

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: BNK Petroleum Inc., Royal Dutch Shell Plc. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Brian Hicks: I own, or my family owns, shares of the following companies mentioned in this interview: None outside the portfolio. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. As of the date of the interview, U.S. Global Investors holds the following companies mentioned in the interview: BNK Petroleum Inc., Callon Petroleum, First Quantum Minerals Ltd., Franco-Nevada Corp., Parsley Energy Inc. and Synergy Resources Corp. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

In China, even after years of economic growth, per capita copper usage is about 5.4 kg. As China’s populace urbanizes, builds up its infrastructure and becomes more of a consuming society, there’s no reason to suspect Chinese copper consumption won’t approach or even surpass U.S., Japanese and South Korean levels. There’s 1.3 billion people in China, several billion more in developing countries – India, with its 1.2 billion people, is presently using 0.5 kg of copper per person. Africa, the fastest growing continent, has virtually no copper consumption per capita.

In China, even after years of economic growth, per capita copper usage is about 5.4 kg. As China’s populace urbanizes, builds up its infrastructure and becomes more of a consuming society, there’s no reason to suspect Chinese copper consumption won’t approach or even surpass U.S., Japanese and South Korean levels. There’s 1.3 billion people in China, several billion more in developing countries – India, with its 1.2 billion people, is presently using 0.5 kg of copper per person. Africa, the fastest growing continent, has virtually no copper consumption per capita.

It is said that nature abhors a vacuum and that history is broadly the history of leaders. The vacuum that is the Middle East is now drawing in Vladimir Putin, one of the boldest characters on the world stage. By drastically raising its military presence in the region, Russia is taking advantage of political confusion and paralysis in the West to create a Middle East that may be more supportive of her interests. While the focus now is on Syria, highlighted by the surprise visit of Bashir al Assad to Moscow, the real target of Russia’s gambit may be Saudi Arabia, which is now incurring massive military expenditures as a result of fighting in Yemen and by proxy in Syria. Like Russia, Saudi Arabia is being hurt by low oil prices. Given both country’s dependency on the price of crude oil, they may have more in common than many may expect.

It is said that nature abhors a vacuum and that history is broadly the history of leaders. The vacuum that is the Middle East is now drawing in Vladimir Putin, one of the boldest characters on the world stage. By drastically raising its military presence in the region, Russia is taking advantage of political confusion and paralysis in the West to create a Middle East that may be more supportive of her interests. While the focus now is on Syria, highlighted by the surprise visit of Bashir al Assad to Moscow, the real target of Russia’s gambit may be Saudi Arabia, which is now incurring massive military expenditures as a result of fighting in Yemen and by proxy in Syria. Like Russia, Saudi Arabia is being hurt by low oil prices. Given both country’s dependency on the price of crude oil, they may have more in common than many may expect.  Commodity Prices to go Higher if a War Breaks out in The Middle East – I own more Gold than I do Dollars

Commodity Prices to go Higher if a War Breaks out in The Middle East – I own more Gold than I do Dollars