The Energy Report: Looking forward to the end of this quarter, Joe, what is the prognosis for uranium pricing in terms of global supply and demand?

Joe Reagor: We expect to start seeing nuclear plant restarts in Japan. Each one of the restarted plants will consume 0.5 million pounds (0.5 Mlb) a year on average. With restarts lining up for early Q3/14, a resurgence of spot purchasing in the market will likely rally up the price of uranium.

TER: With a level of popular dissatisfaction about nuclear power roiling Japan, what is propelling the restarts?

JR: Earlier this year, there was a lot of speculation that Japan might move away from nuclear power. But the simple truth is that fossil fuels cost too much to import. Although uranium-based nuclear power is a bit more dangerous, as proved by the Fukushima situation, at the end of the day, it is a much cleaner and cheaper source of energy for Japan. As a result, the Japanese government is updating its policies in support of nuclear energy. Although the average person in Japan might not approve of this policy move, nuclear energy is the most cost-effective way for the country to move forward.

TER: Is there a growth curve for the long term?

JR: There are 53 shut-down reactors. If 30 of those are restarted, that will increase demand by 15 Mlb a year. Right now, worldwide, there is less than 10 Mlb of uranium idled. With the Highly Enriched Uranium (HEU) Agreement completed, and Russia no longer blending down its high-grade uranium stockpile, there is definitely a shortfall in the future supply of uranium. There are a couple of large-scale projects that can step in as we go along, but, globally, there are over 60 additional power plants in varying stages of permitting and construction. That is another 30 Mlb a year, so the potential upside scenario by 2030 for demand is an additional 45 Mlb/year uranium, roughly.

TER: How have companies that explore and produce yellowcake in the major uranium mining areas of the U.S. been faring post Fukushima?

“Energy Fuels Inc. has the scalability to move from being an alternative feed producer of 500 Klb/year this year, to being as much as a 3 Mlb producer in a couple of years.“

JR: Some firms have been forced to idle. For example,Uranium Resources Inc. (URRE:NASDAQ) has a smaller-scale facility in Texas. Right now, it has about 600 thousand pounds (600 Klb) in resources sitting on the sidelines that it could produce in a healthy market. And Energy Fuels Inc. (EFR:TSX; EFRFF:OTCQX; UUUU:NYSE.MKT) has the White Mesa mill, with a capacity of 8 Mlb/year, running at a 1 Mlb/year rate. It began idling that in the middle of last year. And it is expected to be fully idled by the middle of this year, barring a change in the uranium spot market. It will deliver to contracts using both spot production, alternate feed production, and a little bit of production that was left over from its own mines. It is a tough ride for the U.S.-based junior uranium producers, in general.

On the other hand, the larger companies, like Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT) andAREVA SA (AREVA:EPA) are doing alright. Obviously, their share prices are tied to the uranium price, but they are moving forward with plans to expand production. There are delays, of course. Cigar Lake, owned by Cameco, has been delayed before, but it is ramping up now.

TER: Do these troubles sweeten the deal for acquirers?

JR: There were a few smaller, undercapitalized groups. Energy Fuels picked up one of those—Strathmore Minerals Corp. But most of the large projects are consolidated down to a few players at this point in the U.S. The essential issue is that when the price finally turns, these companies will still be too undercapitalized to fully develop all of their projects simultaneously. They will have to cherry pick their best projects, and the other ones will sit on the sidelines. So there is not a lot of hope for a resurgence in supply in the short term, even if the price moves up significantly.

TER: If the price does move up significantly, will exploration take off?

JR: Around the world, there are numerous uranium deposits that could be brought into production, but in the U.S., the process of permitting and environmental approvals can take years. Historically, when there is a shortage of uranium, the spot price tends to jump significantly. It was riding a strong rally right before the Fukushima incident occurred, and that was on the back of the realization that there was going to be a 24 Mlb shortfall when the HEU Agreement went away. So if the supply shortage mounts, the uranium price will likely move upward, and the process of permitting new projects will take years, leaving the shortage in place or the foreseeable future.

TER: What firms are your top picks in the uranium area at this point?

JR: Let’s highlight Energy Fuels. It still uses conventional mining methods, as opposed to in situ recovery (ISR). Most people will argue that using conventional is a higher-cost method of recovering uranium. But looking at the potential for a strong uranium price environment, I believe that flexibility and scalability will become valued over cost of production metrics. Now, take a firm like Uranium Resources; it might be able to produce using ISR at a lower cost metric than Energy Fuels does conventionally, but Energy Fuels has the scalability to move from being an alternative feed producer of 500 Klb/year this year, to being as much as a 3 Mlb producer in a couple of years. Other companies will have a very hard time achieving that type of scalability.

TER: How do in situ mining techniques affect profit margins?

JR: In situ mining was originally touted as a significant cost saver, but it has not performed as a cost saver compared to conventional mining on a direct cost-per-pound of production, or at least not to the extent once anticipated. Generally, the all-in cost is in the $30–40 range for ISR, while conventional mining sits in the $40–50 range. Obviously, there is a difference, but it is just not as significant as people once believed it would be. The other side of that coin is the upfront cost to develop a mine. It can take hundreds of millions of dollars to develop a new conventional mine, whereas an ISR project can be brought online for, in some cases, less than $10 million ($10M). That significant cost saving is making the biggest impact for producers around the world. There are various tradeoffs between conventional and ISR methods to consider depending on the particular situation and access to capital.

TER: What’s the capital market looking like for uranium firms in this environment?

JR: It is better than it was six months ago. The average portfolio manager in the space is aware of the potential for a uranium price recovery in H2/14. Generally, you find that the market looks six months ahead. In the early part of this year, mostly in February, there was a strong move up in the share prices of a number of uranium producers and explorers. That occurred because of the expectation that, six months from then, or in August of this year, there would be a healthier commodity price environment, and investors are trying to get ahead of that curve on uranium. Capital for nuclear energy ventures is available, albeit at depressed valuations compared to what these companies were worth when the price of uranium was closer to $70/lb. The determinant consideration on all sides is how much new capital a management team can take into its kitty.

TER: Do you have any favorites the oil and gas space?

JR: One of our Top Picks is Synergy Resources Corp. (SYRG:NYSE.MKT). Its management team is continuing to deliver on its promises. The company has experienced some minor delays, but nothing that is a value-changing proposition. We believe that coming out of the end of its fiscal year in August, Synergy will be in a very strong position to build on its past success. This is a young company, remember, that only 18 months ago was not even drilling horizontal wells, and it is now developing its fourth drill pad. Synergy understands its drilling environment. It is in a rural area outside Denver, where there are a lot of people concerned with noise levels. Synergy uses pad drilling to keep noise levels consolidated to a single area. It is attention to that kind of seemingly minor, but important detail, that provides a good growth story to investors.

TER: How does pad drilling tamp down noise?

JR: Pad drilling confines the work to a single area and drills out horizontally. Drillers can access a large area with wells by using longer-reach laterals instead of having to space their wells out and drill closer to homes, businesses or schools. Instead, Synergy finds an area where the noise level is not a neighborhood concern, and it drills a series of horizontal wells from that point.

TER: Given oversupply issues in the U.S., what is your prognosis for the shale fields?

JR: The biggest supply issue in the shale fields is with natural gas. A lot of midstream firms are flaring off their natural gas. My personal view is that the midstream constraints are actually going to result in positives for the natural gas price. Earlier this year, natural gas spiked to over $6 per thousand cubic feet ($6/Mcf). That occurred because there were a few midstream shutdowns for maintenance reasons. One shutdown significantly impacted Synergy Resources; its midstream processing facility at the Leffler pad was shut down for 35 days. With the combination of the shutdown and the cold winter, the natural gas price spiked back up. This example demonstrates that all the excess supply of natural gas in the U.S. is still not enough to feed the system if the midstream does not keep up. Supply is relative to situation.

On the oil side, we are still not oil independent. We are approaching energy independence, but not oil independence. A significant increase in the production of oil should help to cap the worldwide oil price, but I do not believe that we are reaching a point of oversupply of oil in the U.S. or anywhere near it. The growth of the shale play is going to keep impacting worldwide oil supply during the next few years. There is going to be a tipping point that forces down the oil price. Most people believe that the forward curve of oil showing an $80–85 per barrel ($80–85/bbl) value of oil in a few years is accurate. It is just a matter of timing and how political issues around the world play out. Currently, the Ukraine situation is forcing up the price of oil, as there are fears of shortages. When that situation resolves itself, we could see a small pullback in the oil price. Then, the fundamentals should take over again and pull it down into the $80–85/bbl range.

TER: Can you suggest a reasonable weighting for a profitable energy portfolio?

JR: It really is important to have a balance of different types of energy sources. Some of the clean energy ideas out there—solar and wind and electric car batteries—all have their place. Weighting an investment portfolio toward any one specific energy type is not an investment strategy I would personally recommend! I believe that the uranium price has a strong fundamental story to go up in the next 12 months. I believe that the oil price has a strong fundamental story to go down in the next 12 months, while natural gas will be more seasonal, especially in the U.S. On the basis of these commodity price movements, I suggest a slightly stronger weighting toward uranium than oil and gas. From a production standpoint, however, many oil companies are growing at exceptional rates. As long as the oil price remains high, they are going to outperform most of the uranium producers, barring a significant change in the uranium price.

TER: Do you have any other picks in the energy space for us today?

JR: We cover a small natural gas company in Poland called FX Energy Inc. (FXEN:NASDAQ). It fell out of favor last year after drilling a dry hole on a well that had a 10% chance of success. If it had worked out, the well would have been a game changer, but it turned out to be watery and a loss of money. In today’s market, though, the valuation of FX Energy is a bit low. The company is now drilling a new well on a 100%-owned piece of land. It will not be an overnight game changer if successful, but it will allow the firm to develop a second situation like the Fences. The Edge Concession play could slowly develop into a second source of natural gas production in Poland for FXEN.

The nice thing about natural gas in Poland is that it gets $8/Mcf, compared to the roughly $4.5–5/Mcf that gas goes for in the U.S. today. That depression of prices caused by the shale boom in the U.S. has not taken hold in Europe. And since no one has been successful with the Polish shale plays, natural gas prices in Poland have remained strong.

TER: Is FX Energy only in Poland, or is it in other countries as well?

JR: It has some small legacy assets in the U.S., but 95% of the valuation of the company is based on the natural gas asset that it holds in Poland.

TER: Do you have a target price for FX Energy?

JR: Our target price for FX Energy is $5.75. It just goes to point out that stories that are out of favor tend to be the most interesting investment ideas when the firm is fundamentally strong, despite the momentary market disconnect.

TER: Thanks for joining us, Joe.

JR: Happy to be here.

Joe Reagor is a research analyst with ROTH Capital Partners, providing equity research coverage of the natural resources sector. Prior to joining ROTH, he worked in equity research at Global Hunter Securities and at Very Independent Research, covering a wide array of resource companies, including metals (steel and aluminum), mining (gold, silver and base metals) and forest products (containerboard, OCC, UFS and pulp). Reagor earned a Bachelor of Arts degree in economics and mathematics from Monmouth University.

Read what other experts are saying about:

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Interviews page.

Related Articles

- Prepared for the Attack of the Short Sellers: Joe Reagor

- Ed Sterck: Russian Sanctions May Have Utilities Squeezing Less Juice from Uranium Supply

- Do You Practice Quality of Life Investing? Michael Berry Does

DISCLOSURE:

1) Peter Byrne conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Energy Fuels Inc. and FX Energy Inc. Streetwise Reports does not accept stock in exchange for its services.

3) Joe Reagor: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: Within the last twelve months, ROTH has received compensation for investment banking services from Uranium Resources Inc. ROTH makes a market in shares of Uranium Resources Inc. and as such, buys and sells from customers on a principal basis. ROTH makes a market in shares of Energy Fuels Inc. and as such, buys and sells from customers on a principal basis. ROTH makes a market in shares of FX Energy, Inc. and as such, buys and sells from customers on a principal basis. ROTH makes a market in shares of Synergy Resources Corp. and as such, buys and sells from customers on a principal basis. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Are You Smarter than the Average Portfolio Manager? Joe Reagor Says to Invest in Energy Six Months Ahead

Are You Smarter than the Average Portfolio Manager? Joe Reagor Says to Invest in Energy Six Months Ahead

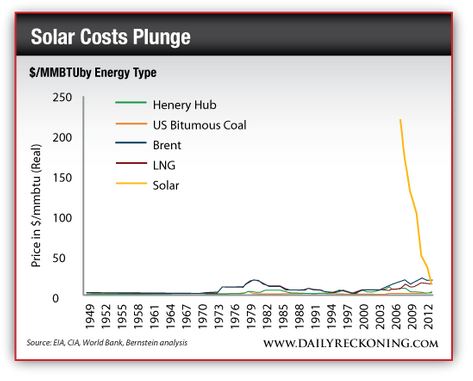

Solar power is celebrating a big event. The solar panel turns 60 on Friday– but this birthday celebration will be unlike any other the industry has seen so far.

Solar power is celebrating a big event. The solar panel turns 60 on Friday– but this birthday celebration will be unlike any other the industry has seen so far.