Energy & Commodities

Kevin Puil thinks analysts need to be realistic when it comes to copper. The Malcolm Gissen & Associates portfolio manager points to copper’s historic levels at over $3/lb as proof that there are brighter times ahead for base metals as economies around the world continue to industrialize. On the other hand, with economic projects less abundant than they once were, supply is under severe pressure. The good news is, as Puil remarks in this Metals Report interview, there’s money to be made for investors who can pinpoint the right projects. Read on to learn who’s on Puil’s list – HERE

Condensate is essentially a very light oil which is condensed from rich natural gas and solution gas from oil. And the price of it is skyrocketing, because it’s used to dilute both regular heavy and synthetic oil from the oilsands. It’s the saving grace for a lot of Canadian producers.

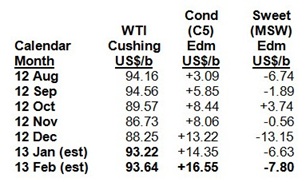

See this chart below. It shows Canadian condensate prices against WTI—see how the value of condensate is rising rapidly? In August 2012 it was only $3/barrel more than WTI. Now it’s $14 more—giving producers with lots of condensate even better economics than most oil producers!

And prices will only get better for condensate producers, one Alberta based oil and gas marketer told me, asking to remain anonymous.

“Supply and demand (for condensate) are just touching each other. Any more heavy oil coming onto market will have a big impact. We need to find other sources (of condensate).”

Or, he says, condensate prices could go even higher. He estimated that if the oilsands increases production by some 400,000 barrels per day (bopd) a year for the next several years, an extra 100,000 bopd of condensate is needed—each and every year.

I’ll explain in my next story, condensate part III, how US imports of condensate are happening, but not fast enough.

In Canada, most condensate is found in shale and tight gas formations. In the US, it’s mostly in gas associated with shale oil, especially the fast-rising Eagle Ford play.

In the United States, all this condensate is almost a problem. US refiners spent billions of dollars over the last decade to process more heavy oil. As a result they can’t really handle this light stuff.

But for Canadian gas producers, condensate is the only product that gives them substantial positive cash flow (a very few producers do make some cash flow on dry gas.) That’s why it’s so important to know how much condensate the gas producers are flowing.

Canada’s Thirst for Condensate

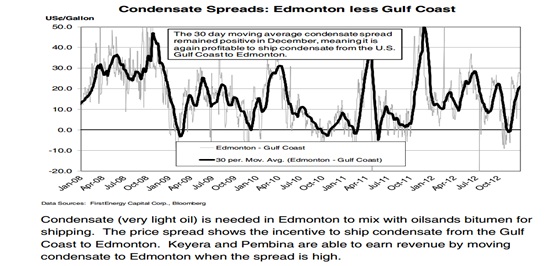

In the oil sands, condensate is used as a diluent to ‘thin down’ bitumen – a thick, sludgy substance – so it will flow through pipelines. Since bitumen production is climbing steadily, condensate demand is on the rise. Supply is struggling to keep up.

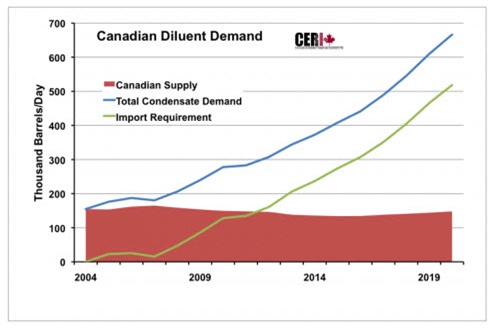

Canada now uses some 275,000 barrels of condensate per day as diluent. Canadian producers churn out 165,000 barrels per day (bpd), meaning oil sands operators already rely on imports to fill a 110,000-bpd gap.

That’s good, but it will probably get even better. Capital spending in the oil sands is expected to exceed $20 billion per year for the next five years. The more bitumen that is pulled from the sands, the more diluent Alberta will need to move all that heavy oil to market.

This year Canadian demand for condensate is expected to average 300,000 bpd. By 2020 demand is expected to reach 670,000 bpd, according to the Canadian Energy Research Institute, which also provided the following chart.

One issue is that Canadian NGL processing facilities are basically full. That is impacting (reducing) condensate production in the short term—creating further supply stress.

So Canadian producers are shipping in tanks directly to their wellsites, and trucking it to local markets; they’re not sending via pipe to processing plants (fractionation plants). The other reality is—and I’ve said this many times—the energy game is changing so fast in North America—fast rising production in both oil and gas, new channels to market (rail)—that nobody knows what the landscape is going to look like 2-4 years from now.

That uncertainty is causing Big Energy Money to be cautious about increasing refining capacity for oil and gas in Canada—which again, is good for commodity prices.

The second bottleneck is pipeline capacity INTO Canada.

The US is actually swimming in condensate–it accounts for as much as half of the output from US shale oil and gas basins. Refiners are buying some of it simply because it is cheap, but a condensate glut is also developing in the Lower 48.

Now however, there is only Enbridge’s Southern Lights pipeline bringing condensate into Canada, and it’s not near enough. (There is some incoming condensate by rail, but now that is still small.) In Part II of this series, I’ll explain in detail this bottleneck, and what’s happening to get rid of it.

Once that glut starts moving into Canada apace, the price premium that Canadian condensate producers are currently enjoying will shrink. Condensate will still carry a good price, but the edge will be smaller.

But I expect that to be at least two years away, and if oilsands production keeps increasing, it may be even longer.

In conclusion—the growing demand for condensate in the oil sands is driving up its price. This isn’t just saving the lucky Canadian gas producers who have high condensate levels, it’s giving them better economics than most oil producers.

Pipeline bottlenecks in the US and processing plant issues in Canada should conspire to keep condensate prices high—making it the best (and least volatile) upstream commodity stories in North America.

Next, I’ll explain in detail what’s happening to condensate in the US, and the efforts to get as much up to Canada as fast as possible. In general, ‘fast’ means 2014 at the earliest, giving investors lots of time to benefit from strong domestic condensate prices.

Keith

P.S. I think mid-February is one of the BEST times for investors to discover my #1 condensate play in Canada. Learn all about my Top Pick risk-free right HERE.

“In the first half of this year the Dow and most of the other major indexes in the US will make a new all-time high. It will create a short-term excitement and then, and only then, I have suggested that I would look to put my bear hat on but not before that. I do think we need that to take place before we can seriously look for the market to top out. And many people, particularly those in the hard-asset arena, have remained bearish throughout this rise and– pretty well going to need them also to throw in the towe”l.

SCP: So junior markets had a terrible year during 2012. Do you think that junior resource stocks have bottomed and 2013 will be a relatively better year? If yes, what makes you more optimistic this year?

…..read all HERE

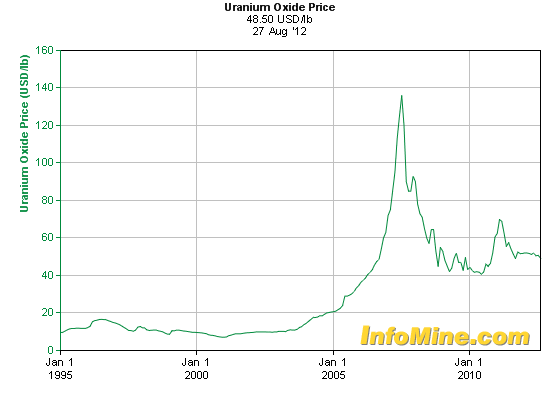

Currently at $44/lb – Ed

What’s the easiest way to track the ups and downs of energy markets? Watch what governments are doing rather than what they are saying, says S&A Resource Report Editor Matt Badiali. He has been watching behind-the-scenes nuclear energy importing in Germany and Japan and has concluded that the uranium market has hit bottom and is coming back up. What companies could benefit from these gyrations? He has an answer to that one in this Energy Report interview, plus some words of wisdom on U.S. oil and gas bottlenecks.

The Energy Report: In a recent piece for the S&A Resource Report titled “Government Lies and an Emerging Resource Opportunity,” you said that statements by German and Japanese officials that they plan to be nuclear free in the next two decades were a cover-up for what they’re really doing, which is importing nuclear power from other countries and secretly developing uranium supplies in former Soviet countries. How long can they hide these energy sources?

Matt Badiali: It’s not a case of hiding them. In both cases, the governments are playing politics. In Germany, the government was reacting to negative press and in Japan, which had just experienced a serious natural disaster. The Japanese government told people for decades that nothing of that sort could ever happen, that the nuclear reactors were completely impervious to natural disasters. That put them in a position where if they tried to make any improvements, they would lose face. They backed themselves into a corner and the only solution seemed to be to turn off the reactors. But the reality is that Japan needs nuclear energy. Without it, liquefied natural gas (LNG) imports have soared and the country doesn’t have the infrastructure to move it around. The result was a horrendous summer of spiking electricity prices and rolling brownouts; it was bad news.

Germany used the Fukushima disaster and the negative sentiment that followed to push through a carbon-free agenda. What is really ironic is that Germany is not in a place that gets earthquakes or tsunamis. It is not at any risk for that. It also isn’t a place where solar power works really well. Turning off the nuclear plants leaves the country without adequate energy generation infrastructure, so they increased imports of electricity from France. However, over 75% of France’s electricity is generated by nuclear power plants. So really all they did was outsource their nuclear reactors. At the same time, they brought on an enormous amount of coal power, which is the single-worst contributor of carbon dioxide. It was politics at its finest.

TER: Is the German press not reporting on this? Are people not wondering where their energy is coming from?

MB: I don’t read the German press, but what I do see is that the Germans are paying an enormous surcharge for a modest amount of carbon-free electricity. I don’t know why there has not been a massive backlash in Germany. If I lived there, I would be furious about the costs. In France, it costs about €0.14 per kilowatt hour (KWh) of electricity. In Italy it costs about €0.20/KWh. In Germany it costs €0.25/KWh. That’s an 85% increase in the cost of electricity. It’s really amazing, and I haven’t seen any pushback.

TER: Is the public as accepting of the higher prices and rolling brownouts in Japan?

MB: In Japan, we’ve seen a massive pushback. Shutting down nuclear reactors imposed an almost $56 billion ($56B) loss to the four major Japanese electric companies. That is not economically sustainable. You can’t bankrupt your power companies. On the supply side, think about Tokyo: It is an electric-centric life. Rolling brownouts and soaring power prices had an enormous impact on individuals. They reacted by electing a pro-nuclear government.

Even before that, the state-owned Japan Oil, Gas and Metals National Corp. (JOGMEC) was spending a significant amount of money exploring for uranium deposits in Uzbekistan. The government was saying one thing and doing another.

TER: After Shinzo Abe was elected prime minister at the end of December, the price of uranium bumped up. Was that just a coincidence? Is that a sustainable increase or just a temporary headline reaction?

MB: That was absolutely a market response to the idea that Japan is not shutting down nuclear reactors. It is also a reflection of the supply reality. Prices in the $40 per pound ($40/lb) range are significantly below production costs That led to many big projects being shut down, delay of BHP Billiton Ltd.’s (BHP:NYSE; BHPLF:OTCPK) Olympic Dam (Australia) project and AREVA’s (AREVA:EPA) Trekkopje (Namibia) and Imouraren (Niger) projects, to name a few. A total of 65 million pounds (65 Mlb) has come off of the market or will be delayed because the companies can’t justify the cost at these prices.

TER: How much of an impact could a loss of 65 Mlb in planned supply make on the price? Will we see $130/lb again?

MB: It’s not just supply loss in reaction to a real or perceived decrease in demand in Germany and Japan. We also have increasing demand from Russia, which has 33 operating reactors and 10 more under construction. Globally, another 65 reactors are under construction and 167 are in planning. Unfortunately, companies can’t just jump back in and turn on these new supplies of uranium.

The Olympic Dam expansion will take 3–5 years once the budget is approved. However, this is an 11-year, $20–33B project that requires some confidence that the price of uranium will be enough to pay for the investment. There is a lot of wiggle room for price increases. In the big picture for nuclear reactors, the price of fuel is a very small part of the operating cost. You can double the price of uranium with very little impact on a nuclear power plant’s bottom line.

TER: If uranium is ~$42/lb today, do you think it could be $84/lb in 2013?

MB: I have looked at the numbers for all the big public miners and the average cost to run the businesses is about $106/lb. So at $40/lb they are losing about $66 on every pound they sell. You can’t make that up without the price going up. So, yes, I think we are going to see the price come up. I absolutely think that we’ve seen the bottom. I think $80/lb is not unreasonable and $100+/lb is more likely.

TER: How much would the price have to go up in order to turn on some of those projects that have been put on hold, like Olympic Dam?

MB: I think it’s going to be more about sustainable prices. When you are spending billions of dollars, you really need to be making a good profit to pay those loans back. We have to see the prices go up and stay up and then three to five years later we could see production increase.

TER: If the supply and demand equation you’re outlining here comes about, what companies are poised to profit from that?

MB: We have actually already seen some. In my December 4 newsletter, I recommended Cameco Corp. (CCO:TSX; CCJ:NYSE), Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT) and Uranium One Inc. (UUU:TSX). Recently, Uranium One’s partner, the Russian state-owned nuclear power company, Rosatom Nuclear Energy State Corp. (ROSATOM), which owns 51% of Uranium One through a holding company called ARMZ, decided to take the whole thing off the board. That put investors up 46% in five weeks. We also saw earlier this week that Denison Mines has acquired Fission Energy Corp. (FIS:TSX.V; FSSIF:OTCQX), a junior exploration company with a nice discovery in the Athabasca Basin in Canada. It was the other half of Hathor’s Rough Rider, which was bought by Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) in 2011. We saw a nice premium for that takeout. I thought Denison did a good job acquiring Fission. The Athabasca Basin is basically Saudi Arabia for uranium. These are high-grade, high-quality uranium deposits in a very safe jurisdiction.

TER: Do you think there will be more M&A?

MB: I do because the companies see that we are coming off the bottom and in order to buy low, now is the time to do the acquisition.

TER: Who, in your view, are the likely acquirers and acquirees in 2013?

MB: I think Cameco will likely go shopping. Some of the Chinese companies have been aggressive over the last couple of years. I wouldn’t be surprised to see them get involved in this too. And Russia is clearly acquiring new assets and moving into new areas.

One promising exploration project that could get taken over is Uranium Energy Corp. (UEC:NYSE.MKT) in Texas, Amir Adnani’s company. It is an in situ leach mining company that is just starting production in the Texas uranium belt right now. The company injects water that is enriched with oxygen into a uranium-heavy sand body. As the water moves through this sand body, it dissolves the uranium. The liquid is pumped out on the other side of the sand body and the uranium is extracted. The company has been successful doing that and the low-impact method could be attractive to an acquirer.

TER: What other acquisition candidates are out there?

MB: UEX Corp. (UEX:TSX) has some projects partnered with AREVA doing exploration work so that is a potential acquirer.

TER: Do you like the project or the partnership?

MB: I like both. UEX has two good projects in the Athabasca Basin, Shea Creek and Hidden Bay. I’m interested in companies with assets in the Athabasca Basin.

However, I haven’t put UEX or Uranium Energy Corp. in any of my letters yet. I told my readers about the big, safe assets first and looking back, we did a pretty good job, timing wise. Now that we have established the trend, we will start to pick off the best of the exploration plays because I think that that’s a good place to make some money over the next year or two. I will definitely look at Athabasca Uranium Inc. (UAX:TSX.V; ATURF:OTCQX) and Energy Fuels Inc. (EFR:TSX). But I’m not going to overpay or rush into these because we are already making money on the producers.

One company I was concerned about was Paladin Energy Ltd. (PDN:TSX; PDN:ASX). I told my readers that they should be very careful. It has some great assets and a long-term supply contract with one of the French utilities, but it’s experienced some problems turning a profit. So going back to acquisitions, it might make sense for a big mining company to take over Paladin. It has a lot of debt. It’s a $712 million ($712M) market value with $830M in debt. In addition, the company has $125M of convertible bonds coming due in two months, which will lead to converting up to 147M shares. That’s a big dilution. This might be something for readers to look at down the road after these bonds convert. If the share price sinks below a significant point where the dilution’s not going to hurt quite as badly, that could be a possibility. It may be that Paladin is worth a flyer for its assets after the dilution happens.

TER: The other energy play you have written about is shale oil and how it could flood the market with cheap gas. You sold a number of your oil and gas positions over the summer. What is your oil and gas outlook for 2013?

MB: I’m staying out of North America; I really am. A number of problems are going on right now that make me bearish on these companies. There are so many bottlenecks involved in getting oil from the new shale plays to the refiners. You can’t get your oil out of the Bakken. Producers are getting paid a discount to West Texas Intermediate (WTI), which sells at a discount to Brent. Companies are drilling lots of wells and producing lots of oil but they are getting beaten up on price. Meanwhile, companies are paying a lot of money to ship on railcars. It is twice as expensive to put a barrel of oil on a railcar as it is to put it in a pipeline. I’m keeping my eye on a few places. I like some of the emerging shale plays like the Tuscaloosa marine shale. It’s brand new. I’m looking for small caps. But I haven’t made any investments in oil and gas yet. I’m just playing the field right now. I want companies that are exploring outside of North America that are getting paid on Brent prices. It is just easier for companies in Australia, New Zealand and Africa to make a profit because they can charge $20/barrel higher than companies stuck in the Bakken.

TER: What companies outside the U.S. do you like?

MB: One company that is trading at a premium now, but that I like very much is Africa Oil Corp. (AOI:TSX.V). I also like Lundin Petroleum Corp. (LUPE:OMX; LUP:TSX). I don’t have either one of those stocks recommended in my letters right now. Africa Oil was a great buy and then it just took off and I’m waiting for that one to come back to us. But I think Lundin’s a great one.

TER: Streetwise President Karen Roche recently interviewed Porter Stansberry and he’s pretty excited about the idea of American oil independence. Do you think that he’s more upbeat than you are on oil in the U.S.?

MB: He’s playing it a different way. Porter’s investments are different than mine. I’m strictly a resource stock investor. I don’t get into the infrastructure so much. Some of our other guys like Porter and Frank Curzio have both done very well. Frank did really well with an investment in Westport Innovations Inc. (WPT:TSX; WPRT:NASDAQ), a natural gas engine company. It converts long-haul trucks so they can run on natural gas engines. I am incredibly bullish on North American petroleum. I am a geologist; I have seen these oil kitchens first hand. The shales are where the oil resource formed before it migrated to the oil fields. Years ago, these were interesting but not really useful. You wanted to drill the sands that made up the oil fields. But now we can go back and actually drill the “kitchens,” these giant shale deposits. It’s an enormous, game changing thing.

Some of the largest shales in North America haven’t been tapped yet. The Monterey shale in California is going to blow people away. The Mancos shale in western Colorado has huge potential. The Tuscaloosa shale stretches from Louisiana to Florida. There are more in Texas. The question is whether people will take the time to understand the techniques that the industry uses to crack the rocks and make it happen, or will the emotional reactions take over and the energy, jobs and investment potential be left in the ground?

TER: So you’re bullish on the amount that’s there but not on the price that companies are going to get pulling it out?

MB: Exactly. We need to get out of our own way and build the pipelines to move enormous volumes of oil out of the middle of the country.

TER: Are you a fan of investing in the infrastructure plays such as MLPs, pipeline companies and service companies?

MB: There are definitely opportunities there. I like some of the midstream companies, but they fall outside of my bailiwick. Gathering the gas is a pretty good place to be because they are getting paid for the quantity they move and aren’t reliant on the price of the commodity itself.

TER: Any final advice for energy investors?

MB: I’m pretty excited about the developments that are going to happen, but you have to be careful.

TER: Thank you for your time.

MB: Thank you.

Matt Badiali is the editor of the S&A Research Report, a monthly investment advisory that focuses on natural resources, including silver, uranium, copper, natural gas, oil, water and gold. He is a regular contributor to Growth Stock Wire, a free pre-market briefing on the day’s most profitable trading opportunities. Badiali has experience as a hydrologist, geologist and consultant to the oil industry. He holds a master’s degree in geology from Florida Atlantic University.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

Energy Stocks & Oil Special Trend Analysis Report

Crude oil has been trading ways for the past year between the 2011 high and low. The trading range through 2012 has been contracting with a series of lower highs and higher lows. This pennant formation because it is taking place after an uptrend is a bullish pattern with $110 and possibly even $140+ per barrel in the next 6-18 months.

If you look at the weekly investing chart of crude oil the key support and resistance levels area clearly marked. A breakout of the white pennant will trigger a move to the next support or resistance level. And judging from the positive economic numbers not only form the USA but globally the odds are increased for the $110+ price target to be reached sooner than later.

Crude Oil Price Chart – Weekly Investing

Crude Oil Price Chart – Daily short term Analysis & Target

If we zoom into the daily chart and analyze price and volume you will notice the $100 per barrel level is potentially only 2-3 days way… But keep in mind whole numbers (decade & Century Numbers) naturally act as support and resistance levels. So when the $100 century price is reached there will be a wave of sellers with fat thumbs who will slam the price back down to the $96 and possibly back down to the $92 level before oil continues higher.

Utility Stocks – XLU – Weekly Investing Chart

The utility sector has done well and continues to look very bullish for 2013. This high dividend paying sector is liked by many and the price action speaks for its self… Keep in mind you can view my actual watchlist of stock and ETFs I trade in real-time with my analysis free:https://stockcharts.com/public/1992897

Energy Sector Weekly Investing Chart

Energy stocks which can be followed using the XLE exchange traded fund (ETF) typically leads the price of oil. Looking at energy stocks we can see that they are outperforming the price of crude oil and on the verge of breaking out of a large Cup & Handle pattern. If so then $90 is the next stop but prices may go much higher in the long run.

Energy Stocks and Crude Oil Conclusion:

In short, crude oil is stuck in a large trading range much like gold and silver which I just wrote about here: http://www.thegoldandoilguy.com/articles/precious-metals-miners-making-waves-and-new-trends/

Once a breakout takes place on either the white or yellow lines on the first crude oil weekly chart we should see oil, energy and utility stocks start making some big moves. Depending on the direction of the breakout (Up or Down) it must be played in that direction to generate substantial profits obviously.

Get my daily analysis, updates and trade alerts here: www.TheGoldAndOilGuy.com

Chris Vermeulen