Energy & Commodities

Crude oil prices could jump as high as US$250 a barrel if Iran goes through with its threat to close the Strait of Hormuz in response to U.S. pressure on oil buyers to cut their Iranian purchases to zero, RT reports, quoting…. CLICK for the complete article

A flurry of activity is raising optimism that Royal Dutch Shell Plc and its partners are ready to go ahead with the nation’s largest infrastructure project: a $40 billion liquefied natural gas terminal that could at last unlock energy exports to Asia.

“I would put money on it — it’s going ahead,” says Phil Germuth, mayor of Kitimat, who recently hosted a banker from Barclays Bank Plc visiting from the U.K. to examine the project. Germuth also met a group of officials reporting to the board of Mitsubishi Corp., one of the project’s five partners, who visited the site in May.

LNG Canada, as the project is called, is stunning in scale. It proposes to eventually ship as much as 28 million tons a year out of Kitimat, the equivalent of 10 per cent of global LNG supply in 2017, according to reports by…. CLICK for the complete article

Suncor Energy Inc. says production at the Syncrude oilsands complex is expected to ramp up to full production in early to mid-September after a power disruption in June that shut down operations.

The company, which holds a 58.7 per cent stake in the partnership, says a preliminary investigation indicates the disruption was caused by a transformer malfunction the cut power on June 20…. CLICK for complete article

Battery metals such as lithium and cobalt, as well as platinum group metals, are on the US government’s list of critical minerals.

The list, announced in the Federal Register, finalizes a draft list of 35 minerals that was released in February in response to an executive order issued last December regarding “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals.”

“The United States is heavily reliant on imports of certain mineral commodities that are vital to the Nation’s security and economic prosperity,” the Federal Register notice said.

“This dependency of the United States on foreign sources creates a strategic vulnerability for both its economy and military to adverse foreign government action, natural disaster, and other events that can disrupt supply of these key minerals,”…. CLICK for the complete article

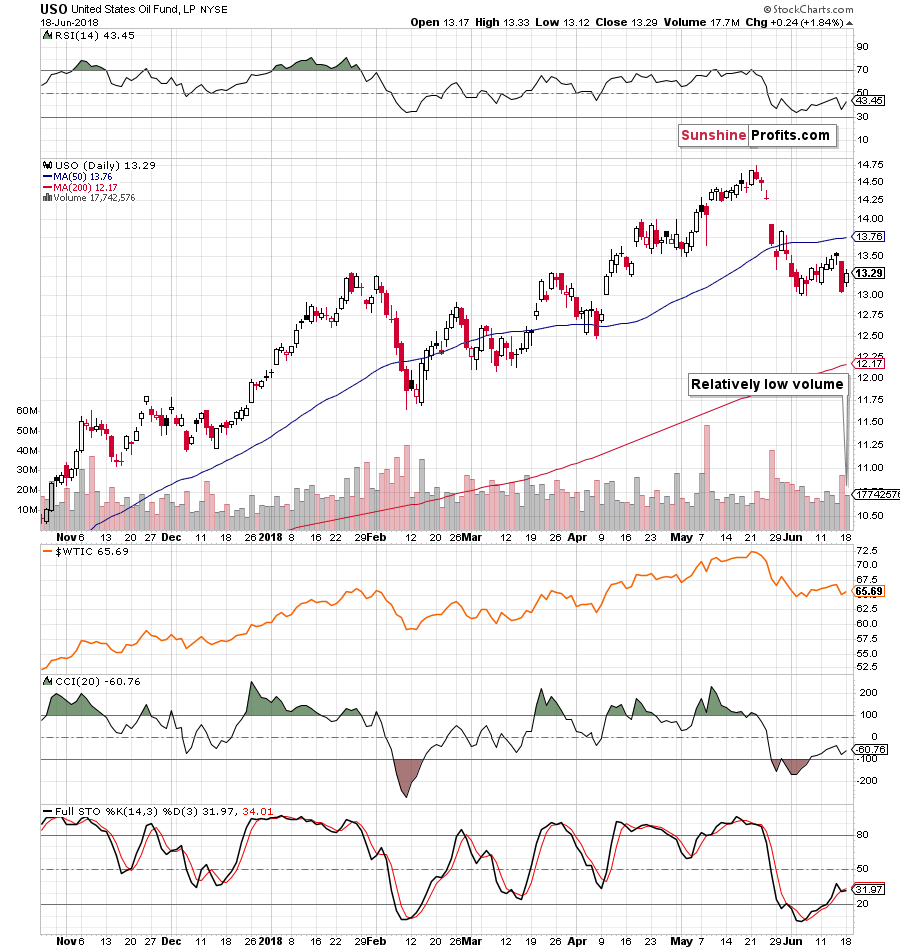

Crude oil’s Friday’s huge daily decline was not followed by yet another daily slide, but by a profound reversal. The price has surely turned by 180 degrees, but can we say the same thing about the outlook for the following days?

No. The volume doesn’t support this outcome and as you’ve seen in the previous several days, indications and confirmations from volume are very important. In fact, the low volume was one of the key reasons that made us open the short position at $66.78 on Wednesday.

We wrote it many times before and we’re going to write it again – a reversal without significant volume does not indicate what it should. It doesn’t show a fierce battle that was won by one side on a decisive manner. It shows that there was a pause that looks like a reversal, but really isn’t one and definitely doesn’t have one’s implications.

Let’s take a look at yesterday’s price move and the corresponding volume level.

The volume was higher than what we saw during Friday’s decline, but it’s still low compared to what we saw previously this month. Compared to the last few days, the volume was average and compared to the past month, the volume was low. It was definitely not high. Therefore, there are no bullish implications of yesterday’s session, and even if they are, they are very insignificant.

The above chart features the USO ETF, which is a proxy for the price of crude oil. It’s also a proxy for its volume readings and the latter is the reason that we are featuring it today. The volume that we saw in USO yesterday was nothing to call home about and thus, there are no bullish implications of the upswing. It seems to be a breather within a decline, not the end thereof.

Moreover, please note that we don’t see such signal in case of crude oil, as far as the USO is concerned, we have a sell signal from the Stochastic indicator. This divergence has bearishimplications.

Summing up, no market moves up or down in a straight line and periodic corrections are inevitable in all markets and it seems that we have just seen an example of this rule in case of crude oil. At the first sight, yesterday’s move may appear to be bullish as it looks like a bullish reversal. However, looking closely at the volume levels reveals that it was actually a pause that only looked like a real reversal and thus implications are not bullish. Consequently, the outlook remains bearish.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager