Energy & Commodities

Oil prices rose on Monday, bouncing off early losses after Israeli Prime Minister Benjamin Netanyahu said Israel had proof that “Iran lied” about its nuclear capabilities, and that he was sure U.S. President Donald Trump would do “the right thing” in reviewing the country’s nuclear deal with western powers… Click for complete article

Russia paired with the Organization of the Petroleum Exporting Countries last year in cutting oil output jointly by 1.8 million barrels per day (bpd), a deal they say has largely rebalanced the market and one that has helped elevate benchmark Brent prices close to four-year highs.

Now, the relatively high prices brought about by that pact, coupled with surging U.S. output, are making it harder to sell Russian, Nigerian and other oil grades in Europe, traders said.

“U.S. oil is on offer everywhere,” said a trader with a Mediterranean refiner, who regularly buys Russian and Caspian Sea crude and has recently started purchasing U.S. oil. “It puts local grades under a lot of pressure.”… Click Here for complete article

There is a huge problem in the Copper Market. Despite strong demand growth from electric cars and battery production about 40% of the world’s current copper production will close over the next 10 to 20 years. In other words demand is going up while supply is scheduled to shrink. Check out The world’s top 10 highest-grade copper mines for investment opportunities after reading this analysis – R. Zurrer for Money Talks

The next big commodity story isn’t some exotic metal like cobalt or palladium…

It’s much more simple and important. The next boom in natural resources is copper.

Copper demand is soaring. You know the story. Electric cars, municipal-scale batteries and millions of other electronics out there. They all need copper.

While we know the story, the numbers are incredible. The price of copper is up 44% in the last two years.

If you don’t have a position in copper mining, you should buy right now.

A Huge Problem for the Copper Market

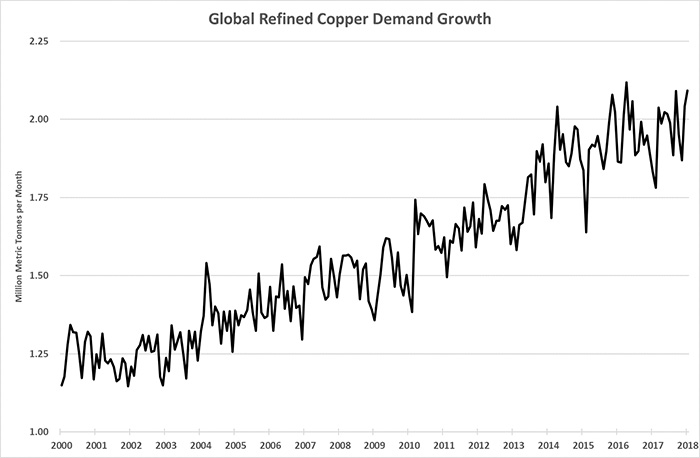

Monthly demand for copper rose 82% since January 2000, as you can see from the chart below:

As you can see, the trend works out to about 3.4% annual growth in copper demand. That’s setting up a huge problem for the copper market in the next 10 years.

According to a mining analyst with CRU, around 220 mines — about 40% of the world’s current copper production — will close over the next 10 to 20 years. In addition, mines that continue to produce will do so with lower grades — less metal per ton of rock moved.

Mines can only produce so much material in a year. If the rock has less copper, then the supply will fall. That’s happening at BHP Billiton and Rio Tinto’s giant Escondida mine. After a $7.6 billion upgrade in 2015, the output fell by 200,000 metric tons per year.

The average mined grade fell from 1.4% per ton in 1990 to under 1% today. That works out to a decline of 8 pounds of copper per ton of ore.

In other words, demand is going up, and supply is struggling to keep up. They will diverge soon. While demand growth is 3.4% per year, supply growth will struggle to hit 1% per year.

By 2028, the market will be 15 million metric tons short. Mining analysts at CRU forecast a 25% increase in demand by 2025. That’s 1.1 million metric tons more than we used in 2017.

This Natural Resource Bull Market Is Rolling

The best analog to this situation was the period from 2000 to 2015. During that time, the three-year average price of copper rose 400% from $0.74 per pound to over $3.70 per pound in 2013. The projected demand growth will send copper prices soaring higher over the next 10 to 15 years.

While some substitution will occur (we can substitute metals like aluminum in place of copper in some cases), the price escalation is coming.

Real Wealth Strategist readers are prepared. We own a suite of high-quality copper miners, and we will be adding new names to that list over the next year. If you haven’t done the same, you absolutely should start now.

The bull market is rolling, and you can profit from it today.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist

According to the Game Plan for Late-Cycle Investing, as the economy moves towards its latter stages, commodities tend to outperform equities and other asset classes. Frank Barbera—market technician & portfolio manager believes we’re likely in that process right now & if Gold pushes through $1,365 the first push up will take it to $1,480 to $1,525 – R. Zurrer for Money Talks

Listen to this podcast on our site by clicking here or subscribe on iTunes here.

Volatility Is a Return to Normal

Stock market volatility has picked up this year, though in percentage terms this really just a return to historical norms, Barbera explained.

The real anomaly occurred over the last 2 years where the market was moving straight up in parabolic fashion before culminating in a blow-off top late-January.

“Think of this more as a return to normal than anything else,” Barbera said. “Comparatively speaking, it is a rise in volatility, but at least so far we really haven’t seen the stock market averages breakdown below major key levels.”

Possible Topping Process

One disquieting point is that after the big break we saw in early February, we swung from very high momentum to deep oversold conditions without anything in between, Barbera noted.

“We had this abrupt break in the market,” he said. “That’s very historically unusual. Usually, when you have high momentum, you’ll get a pullback, getting a push to new highs or maybe two pushes to new highs before you get a decent-sized break, and this just flipped on a dime.”

Larger Chart – Source: Bloomberg, Financial Sense Wealth Management

This is consistent with a parabolic move, and it can sometimes mean that we’ve seen the final peak. Even if that were the case, however, Barbera believes we’ll likely see an approach or retest of the highs before the market definitively turns down.

“For the time being, I would give the stock market the bullish benefit of the doubt, but I don’t think we’re going to see another runaway advance on the upside,” Barbera said. “I think what you’re seeing here is the market moving into a distribution top. There is some potential for a double top … but the real message is it’s getting very late in the cycle.”

Gold and Bonds May Shine

Barbera thinks we’re likely in the process of a late-cycle run in commodities.

If the economy turns down, this does pose a risk for most industrial commodities, but we’re not quite there yet, he said. Bonds, on the other hand, especially Treasuries and high-grade corporates, appear to be making a base. Now might be a good time to follow traditional risk-off bonds, high-grade corporates and some of those funds that can do really well in a down cycle.

Gold recently attacked the $1,365 area, which has been key resistance, while $1,305 to $1,310 has been key support. If we go through $1,365, gold may target $1,480 to $1,525 on the first push up, Barbera believes.

For more information about Financial Sense® Wealth Management and our current investment strategies, click here. For a free trial to our FS Insider podcast, click here.

This article examines who is likely to come out on top in the manufacture of Lithium-ion batteries. Currently dominated by China with 60% of the Global market, with Panasonic and Tesla having together built a huge factory in Reno, Nevada, known as the Gigafactory – R. Zurrer for Money Talk

This article examines who is likely to come out on top in the manufacture of Lithium-ion batteries. Currently dominated by China with 60% of the Global market, with Panasonic and Tesla having together built a huge factory in Reno, Nevada, known as the Gigafactory – R. Zurrer for Money Talk

In 1991, Sony released the world’s first lithium-ion battery, which is now a central component of electric vehicles, plug-in hybrid vehicles (PHVs), and hybrid vehicles (HVs). Up until just a few years ago, Japanese companies commanded over half of the global market for lithium-ion batteries. Today, however, Chinese companies control 60 percent of the global market. Japanese companies now have fallen down to a market share of little more than 20 percent, while South Korea’s share is less than 10 percent.

There are about 200 battery manufacturers operating in China. This crowded field is led by Contemporary Amperex Technology (CATL) and BYD Auto.

The Chinese government has identified the promotion of the EV industry as a main pillar of its national strategy, and set a target of having 5 million new energy vehicles, including EVs, on the road by 2020. In China, the government sends clear policy signals to the market. More precisely, in certain strategic industries the Chinese government and corporations act in unison, with subsidies and regulatory measures (for example, setting sales quotas) used to stimulate consumer demand and create a new market.

Chinese battery manufacturers are significantly expanding their output capacity. CATL has declared that by 2020 it will have a productive capacity for 50 gigawatt per hours annually — almost six times larger than its current level.

Beijing will likely press foreign auto manufacturers operating in the Chinese market to build electric vehicles. Then, the Chinese government may use local content policies to ensure that these vehicles are equipped with Chinese batteries.

In that event, China’s geopolitical relations with not only Japan and South Korea, but also with the United States and Europe, will cast a long shadow. Anticipating growth of Chinese demand, the South Korean lithium-ion battery manufacturers LG Chem and Samsung SDI built new factories in China. However, both companies were excluded from China’s list of manufacturers eligible for government subsidies. The friction between China and South Korea over the latter’s deployment of the THAAD (Terminal High Altitude Air Defense) system was deemed to have factored in the Chinese government’s decision.

China will likely require the use of Chinese batteries by all foreign carmakers operating into the Chinese market, along with prodding them for transfer of battery-related technology to local manufacturers.

European countries have made the entry of their automakers into the Chinese EV market a top priority. However, given the fact that Britain, France, and Germany have all adopted the transition to electric vehicles as their own national policy, it is difficult to imagine that they will allow their domestic EV industries to remain dependent on Chinese batteries. At some point the European Union or Germany will attempt a counter-offensive with European batteries.

Meanwhile, China is attempting to widen the reach of Chinese standards on electric vehicles and batteries along its Belt and Road Initiative (BRI).

China plans to beef up its own satellite navigation system by increasing the number of its satellites from the current 24 to 35 by 2020. In addition, China will build roughly 2,000 ground stations across the Eurasian continent that will be spanned by the BRI. This will enable China to develop the type of high-precision navigation system with “centimeter-level accuracy” required for self-driving cars. This massive new infrastructure installation is intended for Chinese-made autonomous electric vehicles, equipped with Chinese batteries. This field is led by the company Baidu, which has embarked on the development of autonomous cars.

Whoever controls the battery supply will command the electric vehicle industry. Without taking the lead on batteries, we won’t be able to lead the competition in not just electric vehicles but all electrified vehicles such as PHVs, HVs and fuel-cell vehicles. At present, batteries comprises a full 70 percent of the total production cost of an electric vehicle.

Batteries represent the pinnacle of manufacturing. Manufacturers must figure out how to cram components into a small area while increasing energy density and electrical output. Batteries are also, in a sense, “raw goods” whose longevity depends on temperature control. It is a field where the magic of chemistry determines everything.

In Japan, Panasonic alone has made a good showing in this field. The technology of its state-of-the-art cylindrical lithium-ion battery is acknowledged to be the best in the world. Both Tesla and Toyota have sought out Panasonic for joint projects on battery development, and Panasonic and Tesla have together built a huge factory in Reno, Nevada, known as the Gigafactory.

Yet Panasonic, Tesla, Toyota and the various Chinese manufacturers are all rushing to compete in the “great transformation”: the race to discover the next generation technology to succeed the lithium-ion battery. Toyota is moving to the development of a solid-state battery.

There is yet another consideration. Countries are desperately seeking to secure access to the raw materials needed for manufacture of batteries, such as cobalt and nickel. Cobalt reserves are concentrated in the Democratic Republic of Congo, and already China is deemed to dominate access to over half of these reserves. Technological breakthroughs may allow countries to overcome economic constraints, but compelling geopolitical constraints — in this case, the need to secure scarce resources — remain.

Japan must strengthen its resources diplomacy in order to open up a new horizon in the electric revolution.

Yoichi Funabashi is chairman of the Asia Pacific Initiative and was editor-in-chief of the Asahi Shimbun. This is a translation of his column in the monthly Bungei Shunju.