Energy & Commodities

Man, the S&P 500 is on a roll. It’s up 14.2% this year so far. But you know what’s doing even better? Copper! Just look at this chart.

Copper’s up 27% so far this year. Wow!

Prices are up because demand for copper is red-hot. And global copper demand is led by China. China’s copper demand is projected to increase 3.1% this year alone. That leads the 2.5% rise in global copper demand.

In fact, on Monday, Goldman Sachs raised its 2018 price target for copper by 28%. The bank now expects a global copper deficit of 130,000 tons in 2018.

Here’s where it gets really interesting. Copper is said to have “Ph.D. in economics.” We call the metal “Doctor Copper” because it takes the pulse of the global economy.

The Pulse of a Megatrend

What this pulse might be measuring now is a megatrend — the big shift to electric vehicles.

See, there’s no copper in lithium-ion batteries. But there’s a heck of a lot more wiring in electric cars. In fact, an electric car can have three to four times the total electric wiring of a car running on an internal combustion engine (ICE).

And China’s government has mandated that one out of every five cars sold in the country be “new energy vehicles,” or NEVs, by 2025. (NEV is China’s category for pure electric and plug-in hybrid electric cars.)

Estimates are that 35 million vehicles will be sold in China by 2025. That’s up from 28 million last year. So we’re talking about 7 million NEV cars. That’s up from 500,000 this year. And only 295,000 of those are fully electric.

A Copper-plated Bombshell

And here’s the copper-plated bombshell. Those surging estimates may be too low.

I’m not talking about the fact that the growth of electric cars has exceeded even the wildest estimates so far. Though sure, there’s that.

I’m talking about the fact that the chairman of China’s leading seller of electric vehicles, BYD Co. (OTC Pink: BYDDF), let slip a secret when he talked to the press last week.

What, you’ve never heard of BYD? Well, you know who has heard of it? Warren Buffett. Yep, ol’ Warren is a big investor in BYD.

Buffett first bought BYD in 2008. The stock is up 73% in 2017 alone.

Anyway, BYD Chairman Wang Chuanfu told the press that all new vehicles in China will be “electrified” by 2030.

That is WAY ahead of any previous estimates. Heck, when Great Britain and France said they will ban new gasoline and diesel cars starting in 2040, that seemed pie-in-the sky.

But if anyone would know what China’s leadership is thinking about electric cars, that would be BYD’s chairman.

Could China have all its new cars electrified in some way by 2030? Experts say yes. They say that if anyone can do it, China can.

Put the Pedal to This Metal to Profit

What’s that going to do to copper demand?

I’d say it will shift into higher gear.

You can play this through the iPath Bloomberg Copper Subindex Total Return ETN (NYSE: JJC). It tracks copper nicely.

Or you could buy up-and-coming copper miners that are leveraged to the metal. Just do your due diligence before you buy anything.

We’re on the highway to this megatrend. The future for electric vehicles is wide open, and China is putting the pedal to the metal.

Make sure you’re along for this profitable ride.

All the best,

Sean Brodrick

North Carolina-based utility provider Duke Energy is betting on the rise of increasingly efficient battery technology to propel the rise of solar and wind power over the next five years, according to a new report by Forbes.

North Carolina-based utility provider Duke Energy is betting on the rise of increasingly efficient battery technology to propel the rise of solar and wind power over the next five years, according to a new report by Forbes.

“There’s going to be a lot of excitement around batteries in the next five years. And I would say that the country will get blanketed with projects,” Duke Energy business development managing director Spencer Hanes said on Thursday as part of a conference in Chicago.

also from OilPrice.com

As I read through the blogs and public articles on miners and the GDX, it has become quite evident that many have now turned either bearish or completely indifferent to this complex. In fact, it seems as though the number of hits being seen in the Seeking Alpha metals section has dropped dramatically over the last year.

It seems most are looking for the metals to just drop from right here for a myriad of reasons. (Well, that is, other than those who only see the word “UP” when you mention the word “gold” to them). For those who usually place their expectation upon the immediate direction of the complex, it would seem that the recent drop in price has them expecting it will immediately continue to drop. Isn’t linear analysis wonderful? So, it would make sense, at least from a sentiment standpoint, that we need to get a number of them believing that the market is about to rally strongly, which will then trigger our trap door.

While my perspective is also a bit bearish in the intermediate term, I think we can be setting up a bit of a surprise in the short term.

Price pattern sentiment indications and upcoming expectations

So, as many are expecting continuation of the weakness in the GDX and mining stocks, I think we could be setting up more of a rally before the true weakness takes hold later this year.

As long as the GDX remains over the lows struck in early October, I think the GDX can approach the 24.50-25 region. While there is still some potential that it can stretch as high as the 26 region, if it is unable to reach that high on the next rally, and then breaks back down below the October lows, that opens the door to a 30% decline in the GDX.

Moreover, as I look to ABX, a leading stock in the GDX, as long as it remains below 18.35 on its next rally, and then breaks down below the lows we are currently striking, it opens a trap door for us to drop towards the 11 region. This supports the estimated 30% drop I would expect in GDX, again, should we be unable to reach the 26 region in GDX or over 18.35 in ABX on the next rally.

See charts illustrating the wave counts on the GDX.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

If you like precious metals, you probably like gold and silver. Let me tell you about a shiny metal that is leaving both gold and silver in the dust.

That metal is palladium – and it’s up 42.6% since the start of the year. And up 73% since the start of the new bull market in metals at the beginning of 2016. That runs rings around gold’s performance. The yellow metal is up “only” 12.5% this year and 20.5% since the start of the new bull market.

So, yeah. Palladium is the hot ticket among the shinier, non-energy metals.

Side note: I’ve told you about the energy metals before. They’re in a supercycle, and looking good. That’s part of the big megatrend of the world’s move to electric cars.

But the sun doesn’t rise and set on electric cars. So, let’s get back to the shiny stuff. The metals that can protect you from central bank money-printing.

Here is a chart of these metals, as tracked by the ETFs that hold the physical metal, since the start of the new bull market.

Wow! Just look at palladium. Why is it so hot? And why is platinum – which is much rarer than the other metals shown here – doing so poorly?

Demand Shifts into High Gear{jcomments on}

The reason is that both palladium and platinum are also industrial metals. And even there, the metals’ fortunes are zooming in different directions.

Palladium is used in catalytic converters for gasoline engines. And global car sales are shifting into high gear. World vehicle sales jumped 4.1% in August. In China, the world’s biggest car market, sales are up a whopping 8% year-over-year. Zoom-zoom!

That is revving up demand for palladium.

But what about platinum? Well, platinum is mainly used for pollution controls in diesel engines. Volkswagen is the world’s biggest car maker. Remember how its diesel cars were supposed to be so clean?

Maybe not so much. Volkswagen was caught red-handed cheating on its diesel emissions tests. The company is now liable for billions of dollars in fines.

But it’s not just Volkswagen. According to a recent study, EVERY diesel car company is emitting more pollution than tests show.

This is hurting the popularity of diesel-powered vehicles. Especially in Europe. Europe’s diesel-engine market share may fall by half by 2025. And that will remove 300,000 to 600,000 ounces of platinum demand in the next decade, according to Citigroup.

Meanwhile, the supply/demand picture in palladium is very tight. Citigroup says mine supply of palladium could fall short of demand by more than a million ounces next year.

Just recently, palladium climbed above $1,000 an ounce for the first time since 2001. Its increase is fueled by hopes for rising demand from the car industry amid a shortage of supply.

What’s more, palladium became more expensive than platinum last month for the first time in 16 years.

A Smart Way to Play Palladium

Don’t buy now. Wait for a pullback. That’s what I’m going to do, and I think you should too.

After hitting a 16-year high on Monday, palladium has already started dropping hard, and it could take a while longer before it hits bottom.

But when that time comes, probably very soon, there’s going to be a tremendous buying opportunity. And it’s just one of many!

In fact, that’s precisely the kind of buying opportunity we talked about in the first session of our Supercycle Investing Summit, which we just completed 90 minutes ago. If you missed it or want to see it again, just click here for the recording.

All the best,

Sean Brodrick

Today’s videos and charts (double click to enlarge):

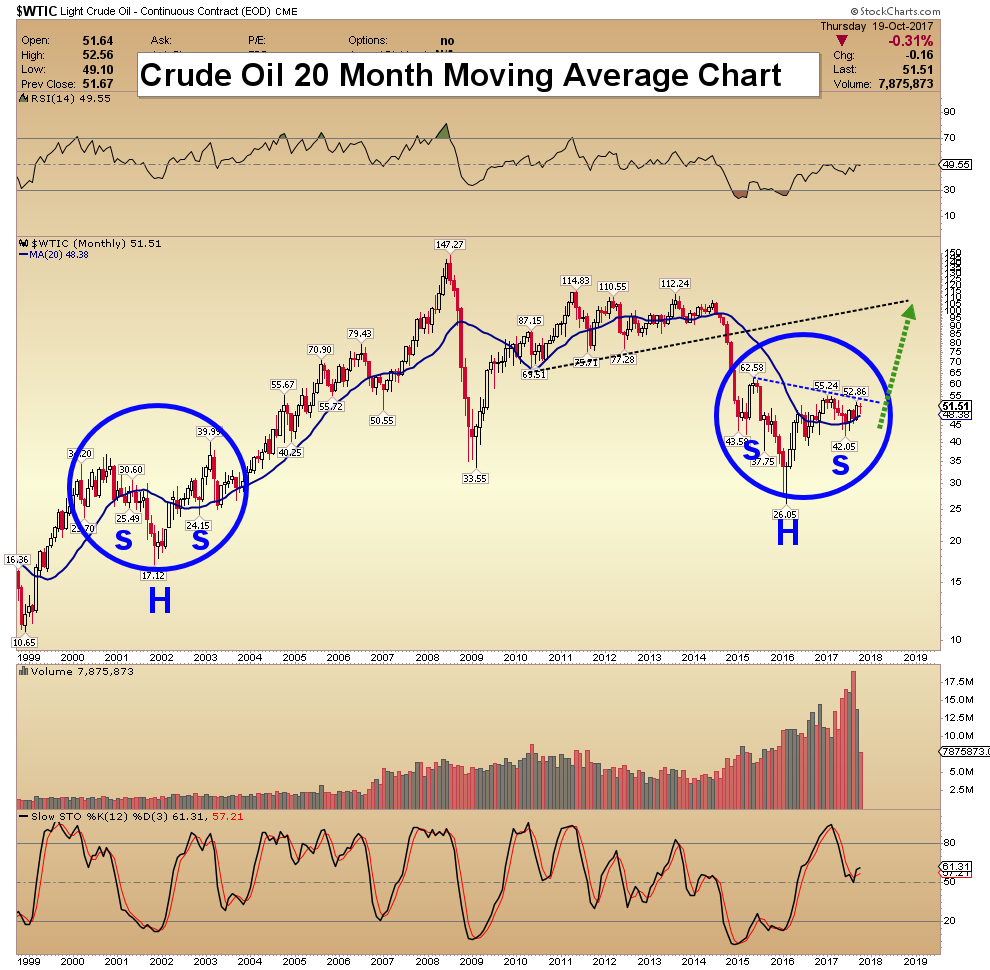

CRB & Crude Oil Long Term Charts & Video Update

Franco & SIL Long Term Charts & Video Update

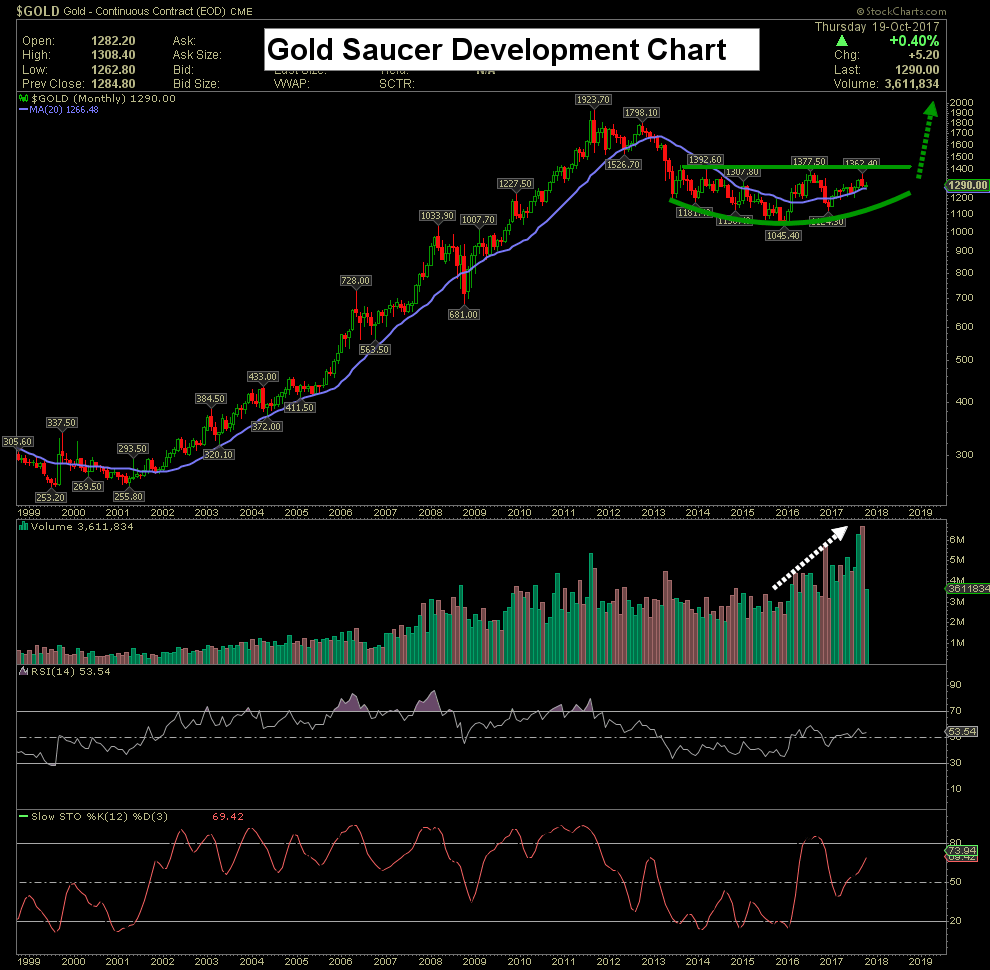

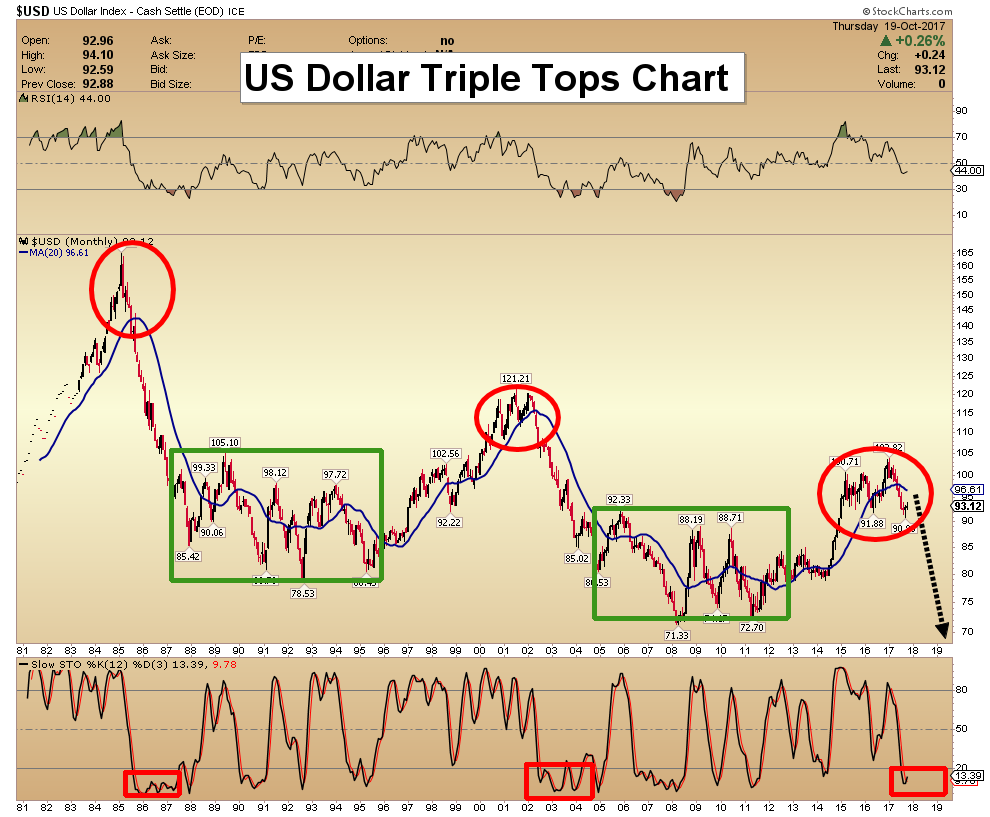

Gold, Silver, & USD Long Term Charts & Video Update

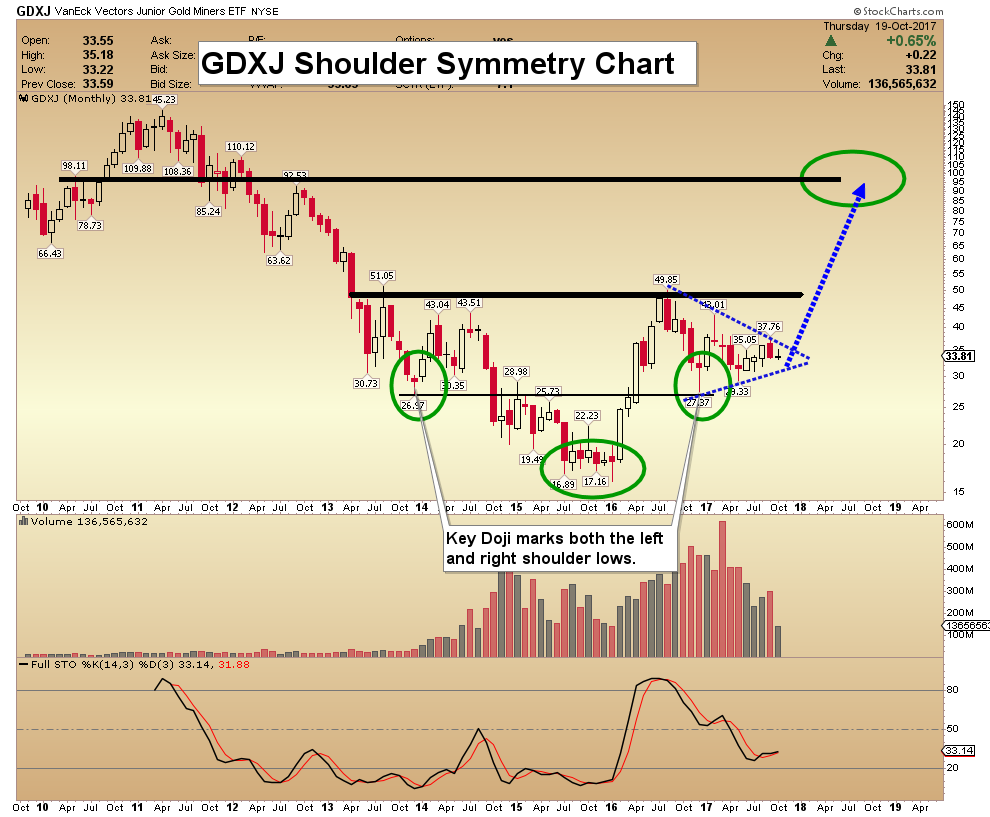

GDX & GDXJ Long Term Charts & Video Update

Thanks,

Morris

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com