Energy & Commodities

Recently, I had the privilege of appearing on “Countdown to the Closing Bell,” Liz Claman’s program on Fox Business. When asked if I was nervous that stocks are heading too high, I said that I’m very bullish. All around the world, exports are up, GDPs are up and the global purchasing manager’s index (PMI) is up.

Oil prices continue to remain low, however, thanks in large part to the ingenuity of Texas fracking companies. As I told Liz, this has served as a multibillion-dollar “peace dividend” that has mostly helped net importing markets, including “Chindia”—China and India combined, where 40 percent of the world’s population lives—Japan and the European Union.

I can’t emphasize enough how impressive it is that Texas shale oil producers continue to ramp up output even with crude remaining in the $50 per barrel range.

This underscores their efficiency and innovation in drawing on oil reserves that were largely out-of-reach as recently as 10 or 12 years ago. What’s more, common law property rights here in the U.S. benefit mining companies in ways that simply can’t be found in Latin America and other parts of the world that operate under civil law.

According to the Energy Information Administration’s (EIA) most recent report on drilling productivity, total U.S. shale oil output is expected to climb above 6 million barrels a day for the first time in September. The biggest contributors are Texas shale oilfields, which will exceed 4 million barrels a day. West Texas’ Permian Basin alone represents nearly 400 percent of these gains, according to research firm Macrostrategy Partnership.

The typical Permian well remains very profitable even with $50-a-barrel oil, according to Bloomberg New Energy Finance. The research group estimates that oil would need to drop below $45 a barrel for some Permian wells to become unprofitable.

Christi Craddick, the Texas Railroad Commissioner, praised the Texas fracking industry in her address at the annual Panhandle Producers and Royalty Owners Association (PPROA) meeting last week. She noted how essential shale oil producers are to the Texas economy, adding that despite the downturn in oil prices, “the Texas oil and gas industry has shown extraordinary resilience.”

“When times were tough, the industry did what it does best—innovate,” she said. “Because of your ingenuity, we’re seeing industry growth today despite the price of oil.”

Again, it’s this ingenuity that’s kept oil prices relatively low, which in turn has helped strengthen GDPs in oil-importing emerging markets and squeeze the revenue of exporters such as Russia, Qatar, Saudi Arabia and others.

Texas-based oil and gas exploration company Anadarko Petroleum was one of the top performing natural resource stocks last week, gaining more than 12 percent. The surge came on the heels of the company’s announcement that it approved a $2.5 billion stock buyback program.

Explore investment opportunities in oil and other natural resources!

Coming Together as a Community

A month after the Texas Gulf Coast was devastated by the unprecedented wind and rains of Hurricane Harvey, the cleanup and rebuilding continues. As I shared with you in an earlier post, the Texas economy is one of the strongest in the world, and its residents are committing to rebuilding Houston and other affected areas better than ever before. As a proud Texan by way of Canada, I can say that it’s in our culture to come to one another’s aid in times of need and help rebuild.

Synchronized Global Growth Is Finally Here: OECD

I believe that my bullishness was validated last week with the release of the Organization for Economic Cooperation and Development’s (OECD) quarterly economic outlook. According to the Paris-based group, synchronized global growth is finally within sight, with no major economy in contraction mode for the first time since 2008. World GDP is expected to advance 3.5 percent in 2017—its best year since 2011—and 3.7 percent in 2018.

This news comes only a couple of weeks following the release of the August global manufacturing PMI, which shows that manufacturing activity around the world accelerated to its highest level in over six years. Not only is the index currently above its three-month moving average, but it’s also now held above the key 50 threshold for a year and a half, indicating strong, sustained industry expansion.

As I’ve shown before, the global PMI has been a good indicator of exports and commodity prices three to six months out, so I see this as very positive.

Where to Invest in the Global Bull Run

World markets seem to agree. Not only are domestic averages closing at record highs on a near-daily basis, but global stocks continue to head higher as well. The MSCI World Index, which tracks equity performance across 23 developed countries, is up 14 percent so far this year as of September 20. And just so we’re clear that emerging countries aren’t being left out, the MSCI Emerging Markets Index has gained close to 30 percent over the same time period.

One of the most attractive regions to invest in right now is Asia, specifically the China region, which has outperformed both the American and European markets year-to-date. The Hang Seng Index has advanced more than 27 percent, driven mostly by financials and tech stocks such as Tencent and AAC Technologies.

In addition, Asian stocks look very cheap, trading at only 13.97 times earnings. The S&P 500 Index, by comparison, is currently trading at 21.44 times earnings.

A Rebalance of Monetary and Fiscal Policies Needed for Sustainable Growth

But back to the OECD report. The group points out that the good times could easily come to an end if world governments don’t make efforts to balance monetary and fiscal policies, something I’ve been urging for years now.

Central banks are eyeing the stimulus exit door, with the Federal Reserve planning to begin unwinding its $4.5 trillion balance sheet as early as next month. The European Central Bank (ECB) ready to reduce its monthly bond-purchasing program sometime in early 2018, and the Bank of England (BOE) isexpected to raise interest rates in November for the first time since 2007.

As such, governments need to strengthen business investment, global trade and wage growth. The OECD adds that “more ambitious structural reforms” in emerging economies “are needed to ensure that the global economy moves to a stronger and more sustainable growth path.”

Only then can this new period of synchronized global growth be sustained in the long term.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The J.P. Morgan Global Purchasing Manager’s Index is an indicator of the economic health of the global manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The MSCI World Index is a free-float weighted equity index. It was developed with a base value of 100 as of December 31, 1969. The index includes developed world markets, and does not include emerging markets. The MSCI EM (Emerging Markets) Index is a free-float weighted equity index that captures large and mid-cap representation across Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong. The components of the index are divided into four subindices: Commerce and Industry, Finance, Utilities, and Properties. The index was developed with a base level of 100 as of July 31, 1964. The S&P 500 Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index was developed with a based level of 10 for the 1941-43 based period.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 6/30/2017: Tencent Holdings Ltd., AAC Technologies Holdings Inc.

Strengths

- Typical of FOMC meeting weeks, we tend to see the precious metals take a hit. The best performing precious metal for the week was palladium, off 0.43 percent on little market moving news. Ford announced that it will add more downtime to five North American automobile plants due to a decrease in demand as inventories rise on dealer lots.

- The gold price could soon recover, says Jason Schenker, president and founder of Prestige Economics, the reason being that the Federal Reserve might raise rates less rapidly because of low U.S. inflation. “The fact that the Fed members lowered their forecast for their own future Fed funds rate indicates that the Fed may again kind of undershoot what they’re predicting they’re going to do for rates,” Schenker told Bloomberg. This could end up being neutral to bearish for the dollar, which would help support the gold price.

- Gold has begun to climb back toward $1,300 an ounce on safe-haven demand now that tensions between Washington and Pyongyang are steeply escalating. Following new U.S. sanctions against North Korea, the rogue Asian country’s leader Kim Jong-un threatened to detonate a hydrogen bomb in the middle of the Pacific Ocean. With the back-and-forth rhetoric intensifying, investors’ interest in safe havens, gold included, has been renewed.

Weaknesses

- The worst performing precious metal for the week was platinum, off 3.77 percent. Platinum prices has been out of favor for the last couple of years, recently prompting Impala Platinum, the world’s second largest producer, to propose some job cuts in South Africa that could lead to supply disruptions if labor is not on the same page. Earlier this week, gold dropped below $1,300 an ounce as risks receded of another hurricane striking the mainland U.S. and as major stock market averages continued to hit record highs on a near-daily basis. In addition, a diplomatic resolution to the nuclear standoff with North Korea appeared likely, with Secretary of State Rex Tillerson saying the U.S. is seeking a peaceful conclusion.

- The gold price responded negatively to Fed officials’ announcement that the central bank would begin unwinding its $4.5 trillion balance sheet as soon as October and also signaled additional rate hikes in 2018 following a December hike. Speaking with Bloomberg, RJO Futures’ Bob Haberkorn said that “the unwinding, coupled with the hawkish tone for December and the three hikes next year, could weigh on gold for the time being.”

- The world’s 20 leading gold producers’ share of metal output is expected to fall to its lowest level in a decade in 2019, according to Bloomberg industry analyst Eily Ong. The mining group’s share of world output fell from 47 percent in 2010 to 39 percent in 2016, and could fall even further by 2019. “As gold producers’ focus shifts from volume to profitable ounces, their existing gold mines’ life expectancies have also continued to declined,” Ong writes.

Opportunities

- Thursday and Friday of last week, Klondex Mines hosted a visit to its operations in Nevada to update the market on Hollister, Fire Creek, and Midas. We attended the site visits. Klondex is in a unique situation, having three, high-grade mines filling one centrally located mill at the Midas site. Overall, we would say investors and analysts came back with a favorable outlook. The share price outperformed the major gold equity ETF’s by over 550 basis points this week as several more positively toned analyst reports made the rounds. What we also think is noteworthy, was the quality of new people that have been attracted to Klondex, as operations have expanded, and the buy-in to the values of Klondex’s culture of safety at its operations. Prior to the trip, Klondex Mines completed the donation of the Rock Creek Lands to the Western Shoshone. For thousands of years, the Rock Creek Lands, about 20 miles northeast of Battle Mountain, Nevada, were used by the Western Shoshone. This was a goal of management and the board of Klondex to repair community relations with the Native Americans in the area which the previous owner of Hollister had ignored. Consequently, Klondex received drilling permits to now drill from the surface at Hollister to expand the exploration potential of the land package more cost effectively.

- Wesdome Gold Mines announced management changes driven by the CEO, Duncan Middlemiss, with full support of the board. The current CFO, COO and VP of Corporate Development & Exploration were all replaced immediately, which completes a realignment of staffing started by the addition of Chairman Charles Page to the board a little over a year-and-a-half ago. We see Wesdome Mines, with its Kiena Deeps exploration target, becoming more catalyst rich heading into the fourth quarter.

- With two of the bigger gold mining conferences for the year being held this week and next, there has been a swath of news releases distributed. Barsele reported a drill hole that intersected 19.75 meters grading 5.07 g/t gold, indicating continuity along a 100-meter gap between two lobes of the deposit. Jaguar Mining rose in excess of 25 percent on drill results that showed down plunge continuity of the principal ore body contained within the Banded Iron Formation. Both Golden Star and Red Pine Exploration reported double-digit grades from their respective orebodies that should lead to resource additions. In addition, Roxgold increased its production guidance for the year from 105,000-115,000ounces, up to 115,000-125,000 ounces.

Threats

- According to U.S. Trade Representative Robert Lighthizer, President Donald Trump’s chief trade negotiator, China poses an “unprecedented” threat to world trade, highlighting the country’s massive subsidies to “create national champions” and “distort markets.” Because current global rules are too inadequate to address the problem, Lighthizer adds, the president should unilaterally impose tariffs on China and any other country that practices “unfair” trade policies. Doing so, it should be noted, could lead to a U.S. trade war with China, the second-largest economy in the world, causing dramatic price swings in commodities and other raw materials.

- B&N Bank, a top-five closely held lender in Russia, has asked the country’s central bank for a bailout, reports Bloomberg, making it the second nationalization in less than a month. This highlights the complications accompanying the Bank of Russia’s efforts to clean up the financial sector after the dual economic shocks of a collapse in oil prices and international sanctions in 2014, the article continues. “The story of Otkritie, and now B&N, seriously raises questions about the actual state of private banks,” Dmitry Polevoy, chief economist for Russia at ING Groep NV in Moscow said.

- With the debt-cap suspension expiring on December 8, Bloomberg reports that there is a growing sense among investors and analysts that the Treasury will have to “slow or hold off on the inevitable.” It is unknown how the Treasury will respond to the Federal Reserve’s tapering. “The mix of maturities it decides on has far-reaching implications for the world’s biggest bond market, with the potential to alter the shape of the yield curve for years to come,” the article reads.

Oil prices hit a four-month high on bullish data from the Energy Information Administration (EIA), strong global and U.S. demand and the fact that oil products are at a multi-year low (see chart below). That situation is not going to improve after Hurricane Maria dealt a devastating blow to Puerto Rico and St Croix, wiping out small refineries and oil product storage tanks. But the threat to the rally is the Fed pronouncement that they want to raise interest rates in December, giving strength to the dollar and a downgrade to the Chinese credit rating, which will potentially raise future demand concerns. Yet talk that OPEC and non-OPEC may cut back on more production give oil bulls a slight edge even though the market fails to officially break-out, staying below that upper Bollinger band resistance.

Oil product declines were the big story from yesterday. The EIA reported supplies of product overall fell to the lowest level since 2011. A 5.69 million barrel drop in distillate supplies, the biggest drop since 2011, was a major concern as fall grain harvest and winter is just around the corner. This came as even as oil refiners ran the most barrels of oil through the refineries since 2008. The October future rose to the highest closing level since July 2015.

Gasoline supply also took a hit, falling by 2.13 million barrels as gas demand held up better than expected. This contrast though with distillate stocks means that the long ultra-low sulfur diesel vs. short RBOB gasoline should continue to work.

Even the larger than expected 5.42 million barrel increase build in oil supply wasn’t enough to break oil because the number included a big release from the Strategic Petroleum Reserve that will be needed to rebuild supply of products that overall are at what could be considered dangerously low levels. This offset the fact that U.S. oil production increased again this week by an impressive 157,000 barrels a day. This comes on a news report that oil traders are emptying one of the world’s largest crude storage facilities, located near the southernmost tip of Africa, as the physical market tightens amid booming demand and OPEC production cuts.

The low oil price is negatively impacting another OPEC oil exporter as it continues to liquidate its foreign exchange reserves. Algeria, like Saudi Arabia, has seen its international reserves plummet by more than 40% as the oil price fell in half since 2014.

Algeria joined OPEC back in 1969 and is currently producing 1.1 million barrels of oil per day (mbd). While Algeria is not one of the larger OPEC members, it still exports roughly 670,000 barrels of oil per day. At $50 a barrel, the country receives $33.5 million a day in oil revenues. However, Algeria’s oil revenues have taken a nose-dive as the oil price declined from over $100 in 2014 to below $50 currently:

As we can see in the chart above, Algeria’s net oil export revenues fell from $61 billion in 2012 to $19 billion last year. Thus, Algeria’s net oil export revenues fell nearly 70% in the past four years. This has negatively impacted the country’s financial balance sheet. To make up for declining oil revenues, Algeria has liquidated $70 billion of its international reserves since the end of 2014:

Unfortunately, the liquidation of Algeria’s foreign exchange reserves hasn’t been enough to stem the tide of its falling oil revenues. According to the article on Zerohedge, Algeria Officially Launches Helicopter Money Amid Sliding Oil Revenue, Budget Crisis:

On Sunday, Algeria’s prime minister unveiled a plan to plug the country’s budget deficit as the the OPEC member state looks to offset lower oil revenue by directly borrowing from the central bank, while avoiding international debt markets. In other words, direct monetization of debt, which bypasses commercial banks as a monetary intermediate, and is better known as “helicopter money.”

According to Bloomberg, the five-year plan presented by Prime Minister Ahmed Ouyahia aims to balance the budget by 2022, and reverse a deficit that ballooned with the plunge in global crude prices, which also cut foreign reserves by nearly half.

“If we turn to external debt, as the IMF suggests, we will need to borrow $20 billion a year to repay the deficit and within four years we will be unable to repay the debt,” Ouyahia said. “This is what made the government look at non-traditional financing.”

Algeria’s Prime Minister has decided to print money directly from its central bank rather than access debt via the international market. Thus, Algeria is now embarking on the policy of “Helicopter Money dropping” to offset the massive decline in its oil revenues.

I knew more OPEC oil exporting countries would succumb to alternative monetary policies as the low oil price is gutting the entire global oil industry. Furthermore, the article linked above stated the following:

Incidentally, while other OPEC nations have been rumored to consider such a currency devaluation “nuclear option” in light of oil prices that are far below “budgetary breakevens” for most OPEC nations, it was not until today that it was finally implemented. And now that that the first country has succumbed, the question is who is next.

So, Algeria was the first OPEC member to select the “nuclear option” of outright unsterilized monetary printing. This could cause serious inflation in the Algerian economy. If the oil price does not head back up to $70-$80, we will likely see more OPEC members elect to implement additional “monetary options” besides liquidating international reserves to fortify its balance sheet.

The U.S. and global oil industry is in serious trouble… but we have only begun to see just how bad things will get over the next few years.

Check back for new articles and updates at the SRSrocco Report.

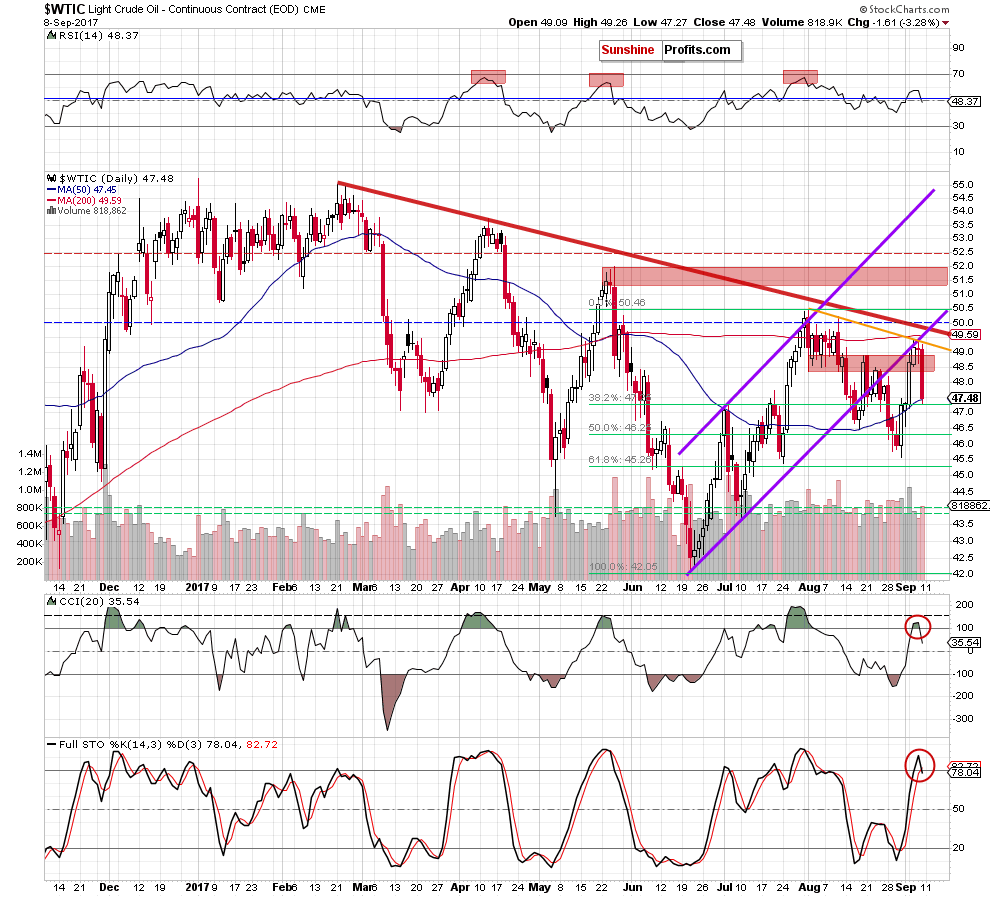

On Friday, crude oil moved sharply lower and lost over 3% after investors digested the EIA report and reacted to the increase in crude oil inventories. Thanks to these circumstances, light crude invalidated the earlier breakout above the resistance area and slipped well below $48. What does it mean for the commodity?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

On Thursday, we wrote the following:

Yesterday, crude oil extended gains, but did this increase change anything? In our opinion, it didn’t. Why? As you see on the weekly chart, despite Wednesday’s move, the black gold is still trading under the purple declining resistance line based on the previous highs and the 50-week moving average, which together were strong enough to stop oil bulls in the previous months.

Additionally, the commodity increased to two important lines: the orange resistance line based on the August highs and the previously-broken lower border of the purple rising trend channel, which increases the probability of reversal – especially when we factor in the size of yesterday’s volume. (…) Wednesday’s move materialized on visibly lower volume than Tuesday’s increase, which raises some doubts about oil bulls’ strength (similarly to what we saw in mid-August).

What’s next for light crude?

(…) if the commodity increases to the lower border of the purple rising trend channel and then reverses and declines, we will see another verification of the earlier breakdown under this short-term resistance, which will give oil bears a very important reason to act in the following days.

From today’s point of view, we see that the situation developed in line with the above scenario as crude oil reversed and declined sharply on Friday. Thanks to this drop light crude created a bearish candle on the weekly chart (visibly longer upper shadow suggests a turning point), which verified the earlier breakdown below the long-term purple declining resistance line (based on the February and April highs) and the 50-week moving average once again. Taking this bearish development into account and combining it with the sell signal generated by the weekly Stochastic Oscillator, we think that further deterioration is more likely than not.

When we take a closer look at the daily chart, we can easily notice more bearish factors. As we assumed in our Thursday’s alert, crude oil reversed and declined after an increase to the lower border of the purple rising trend channel, which resulted in another verification of the earlier breakdown under this short-term resistance. Additionally, the commodity invalidated the earlier breakout above the red resistance zone and closed the day below it. On top of that, CCI and the Stochastic Oscillator generated the sell signals, supporting oil bears and further deterioration.

How low could the commodity go in the coming days?

In our opinion, if light crude declines under the Friday low of $47.27, the next downside target will the August low (around $45.58) or even the 61.8% Fibonacci retracement and the late July low (around $45.26-$45.40).

Summing up, profitable short positions continue to be justified from the risk/reward perspective as crude oil moved sharply lower after another verification of the breakdown below the medium-term purple declining resistance line based on the February and April highs, the 50-week moving average and the lower border of the purple rising trend channel. Additionally, the weekly Stochastic Oscillator and both daily indictors generated the sell signals, supporting further deterioration in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist