Featured Article

Palladium Price on Fire

Posted by MoneyTalks Editor

on Tuesday, 25 February 2020 12:05

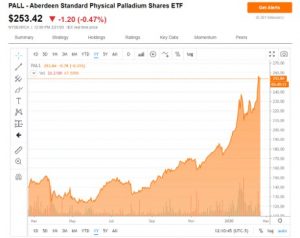

Palladium (Pd) prices are up 75% in the past 12 months. Do you play it, or has the train already left the station?

The Market

The automobile sector, specifically for use in catalytic convertors, annually consumes about 80% of the available palladium. And stricter global emissions regulations are increasing the usage on a per vehicle basis in big consumer markets like China and India. The increased demand has pushed the palladium market into a deficit since 2012, and 2020 looks to be another year of shortage.

If you want to participate, you can buy physical palladium or you can buy the ETF PALL. But one look at the PALL chart may cause you to remember the Great Fool Theory.

A better way may be to buy shares in a few companies that either mine or explore for the precious metal, as they offer more leverage to the gains in Pd pricing. Of course, they also carry additional risks.

David and Goliath…but Goliath needs David

The top 5 mining companies deliver 85% of the global platinum and palladium production and have, in aggregate, over US$100 billion in market capitalization:

- Nornickel – US$55B market cap – (GMKN: MSE)

- Anglo Platinum – US$25B market cap – (AMS: JSE)

- Impala – US$9B market cap – (IMP:JSE)

- Sibayne Stillwater – US$8B market cap – (SSW: JSE & SBGL: NYSE)

- Northam – US$4B market cap – (NHM:JSE)

There is a major issue, and potential opportunity, with these companies. Around 80% of that global palladium mine production comes from countries with pretty significant political risk, i.e. South Africa 39% and Russia 40%.

Neal Froneman, CEO of Sibanye Goldone, one of South Africa’s biggest Pd miner said last month: “We don’t see growth opportunities here, so we have to think outside of South Africa”.

The South Africans have already made acquisitions in USA and Canada in the past few years in a bid to diversify away from South Africa. Sibanye Gold paid US$2.2B for Stillwater’s USA assets in May 2017 and in December 2019 Impala paid $750 million for North American Palladium’s Canadian assets.

Which means there may be an opportunity to look farther down the mining and exploration development and risk scale for potential value. Here is a list of Toronto Venture Exchange listed Platinum Group Metals (which includes Platinum and Palladium) explorers which have projects in the Americas.

- Generation Mining (GENM: CSE & GENMF:OTCPK) – US$38M market cap

- ValOre Metals (VO: TSX-V & KVLQF:Grey Market) – US$21M market cap

- Group Ten Metals (PGE: TSX-V & PGEZF: OTCQB) – US$20M market cap

The key driver for these early stage players? Palladium miners are cash rich and looking to grow their production in safe countries.

Happy hunting!

Resource Maven – A Sneak Peak

Posted by Gwen Preston

on Friday, 21 February 2020 14:48

Gwen Preston, editor of the Resource Maven newsletter has been kind enough to let us share a recent subscriber-only edition. If you think the long term commodity cycle is starting to turn (as we do) her perspective on how to identify value in the mining space going forward is a must-read – plus she shares some pretty detailed stock recommendations! – Ed

CLICK HERE to read The Maven Letter

Doug Casey on Silver’s Many Uses and What It Means for Its Future Price

Posted by Doug Casey

on Friday, 17 January 2020 15:04

Throughout history, three metals have been used as money: gold, silver, and copper. All share the five qualities of good money—durability, divisibility, portability, consistency, and intrinsic value—but in different proportions. All three metals can be bought for the same reasons…Click to read full article.

The Silver Lining in the Gold Bull Market

Posted by Larisa Sprott

on Friday, 10 January 2020 9:32

This article was suggested by our friends at Endeavour Silver.

Gold prices, which are up more than 35% during the past four years, recently eased into a trading range following a double digit price jump during 2019. So far this year, silver prices are running just slightly behind.

Long-time traders liken silver to “gold on steroids” because in past rallies it has tended to lag the yellow metal at the start, but then vault past as retail buyers flocked in.

I remember well silver nearly tripling in value to nearly $50 USD an ounce amidst the 2008 financial crisis.

We are seeing many of the same signs right now. Silver shipments by the Royal Canadian Mint spiked by 42% during the third quarter and are up 29% year to date.

Wholesalers tell me they can’t get enough of the stuff, particularly 100 ounce silver bars….CLICK for complete article

Three Reasons Precious Metals Are On The Rise

Posted by Alex Kimani

on Tuesday, 7 January 2020 10:26

For what seems like an eternity for the bulls, the gold market has suffered from a strange cognitive dissonance, stubbornly refusing to react to the signs of the times.

At a time when interest rates everywhere fell to historical lows, signs of a synchronized slowdown of the global economy abounded while trade wars and geopolitical tensions continued to rise, the gold market remained a snoozefest as investors’ love affair with the stock market endured.

But reality appears to have hit home–finally.

Gold prices have hit the highest level since 2013 as declining housing market sales, intensifying geopolitical risks and a retest of key levels worked in tandem to fuel a massive rally…CLICK for complete article

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair