Gold & Precious Metals

Improving Investor Sentiment Helped Drive the Price Higher in 2019: Interim Silver Market Review

Posted by Larry Kahaner

on Monday, 6 January 2020 12:01

The last few months have seen a major improvement in investor sentiment towards silver, according to Philip Newman, Director at Metals Focus, who recently presented the Metals Focus / Silver Institute Interim Silver Market Review. The silver price benefitted in 2019 from a host of factors, including global economic and political concerns, as some investors sought safe haven investments, such as silver.

Highlights of the Interim Silver Market Review include:

• Healthy gains were projected for physical silver investment in 2019, with sales of silver bars and coins projected to rise by 7% to a three-year high. In the US, investment was on track to record its first annual increase in four years, thanks to improving price expectations and rising price volatility, although levels remained historically low. In India, the partial recovery that started in 2017 continued in 2019, although the sharp rally in the rupee price saw sales ease recently, particularly in rural areas.

• Disruptions and strikes across South America impacted global mine production, which was expected to fall by 0.7% in 2019 to 849.3 million ounces.

• For the second year in a row, silver industrial fabrication was expected to hold at a record high. However, in the wake of the escalating US-China trade war, several areas of silver electrical and electronic end-uses have struggled. That said, any negative impact on silver demand had been mitigated by higher silver usage in other categories, especially in the automotive sector.

• Global silver jewelry and silverware demand was projected to grow by 3% and 4% respectively in 2019. For both, the year’s increases were almost entirely led by India, where gains had been assisted by increasing awareness of sterling silver, and growth in organized retailing, along with the benefits from restrained silver prices in the first half of 2019. • Overall, the silver market was expected to record a small surplus in 2019. However, this metal should have been easily absorbed by investors as rising macroeconomic uncertainties and fresh monetary easing by major central banks rejuvenated the appeal of safe haven assets from mid-2019 onwards which, looking ahead, should continue to benefit precious metal prices.

For more information about the report including a supply & demand chart, click here.

Will Gold Stocks Continue To Climb Higher?

Posted by Adam Hamilton

on Monday, 6 January 2020 9:47

Gold miners’ stocks blasted higher this past week, breaking out of their correction downtrend. Rapidly-improving psychology fueled such strong upside momentum that sector benchmarks are challenging months-old upleg highs. Most traders assume this is righteous, that gold stocks’ next upleg is starting to accelerate. But key indicators argue the contrarian side, that this breakout surge is a head fake within a correction.

In early September, a major gold-stock upleg peaked after soaring higher on gold’s decisive bull-market breakout in late June. The GDX VanEck Vectors Gold Miners ETF, this sector’s leading benchmark and trading vehicle, had powered 76.2% higher over 11.8 months. It crested the same day gold’s own upleg did, hitting $30.95 on close. That major 3.1-year high proved the apex of that impressive gold-stock upleg…CLICK for complete article

Gold Trend Bullish – Short and Long Term

Posted by Martin Straith/The Trend Letter

on Thursday, 2 January 2020 10:59

Gold’s current strength is driven primarily on the short-term weakness in the $US and this short-term trend will likely continue until mid/late January, when we could see the effects of a Repo crisis start to affect all markets. We will be watching the next month very closely and subscribers can expect Flash Reports should things start to unravel. Investors need to understand that although gold does act as a safe-haven play it is usually the $US where the first wave of safe-haven capital flows to.

While gold and the $US typically move inverse to each other (gold up when $US down, gold down when $US up), there are times when gold…click here for full article.

CPM Group Sees Precious Metals Prices Rising in 2020

Posted by Bradford Cooke

on Tuesday, 17 December 2019 15:29

Jeffrey Christian is one of the precious metals analysts that my team and I follow. This forecast is a must-read for investors in the sector – and more importantly – for investors considering adding precious metals to their portfolios in 2020. ~ Bradford Cooke, CEO Endeavour Silver

CLICK to read the complete article.

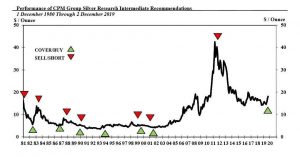

CPM Group Issues Intermediate-Term Silver Buy Recommendation

on Wednesday, 11 December 2019 14:54

Welcoming some voices from the wilderness with this silver buy recommendation ~Brad Cooke. CPM Group today issued a silver buy recommendation for investors with an intermediate-term investment horizon, which CPM puts as a two- to three-year time horizon.

“The silver market is at a critical vertex at present,” CPM Group’s Vice President in charge of Research Rohit Savant said in announcing the buy recommendation. “Silver market fundamentals are precariously similar to the critically poor conditions that existed in 1989. Our expectations are that the market may avoid the long period of net investor silver selling and low prices that followed from that year, however. Prices seem more likely to rise in the years ahead rather that to decline. There are many external as well as internal factors behind our analysis. That said, super bulls will continue to be disappointed by silver.”

“CPM has waited until now for a variety of reasons known to our clients. For one, the market has not supported strongly higher prices over the past few years. As a result prices have not moved sharply off their 2015 – 2016 lows, as the attached chart shows,” CPM Managing Partner Jeffrey M. Christian said.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair