Gold & Precious Metals

Richard Russell: It’s “inflate or die”

Posted by Richard Russell - Dow Theory Letters

on Friday, 31 January 2014 14:43

“I understand that there was almost a revolt at the Fed. Certain members warned Bernanke to halt the Fed’s wild money creation, fearing that it would wind up in hyper-inflation. But the Fed cannot completely halt its QE. The Fed is now buying 90% of the Treasuries that are put out for sale.

If the Fed halts its buying of Treasuries, who will buy them? Certainly not China or USA investors. Bernanke’s thinking or hoping is that continued Fed stimulus will result in the US economy becoming so strong on its own that in due time it won’t need any Fed stimulus.

However, matters are not working out in the way Bernanke wishes. The economy is still dragging its feet, and employment is still lagging. In the meantime, the banks, not the US populace, have prospered. The banks’ reserves have been swelling. What dissenting Fed members are worried about is that bank reserves are growing and are beginning to resemble water behind a dam, pressuring to be released. When the dam finally breaks, all assets will go through the roof, and, as usual, leave the ever-suffering middle class behind.

So that’s the story and the problem of the era. As I said years ago, the choice is, “inflate or die.”

Then there’s another excellent reason why Bernanke can’t cut back completely on the Fed’s machinations. You see, the Fed has manipulated interest rates to ridiculously low levels. The US must manage or carry trillions of dollars in Federal debt. We are currently rolling over this debt at very low Fed-controlled interest rates. But if interest rates are allowed to climb to their normal uncontrolled levels, the cost of carrying the nation’s debt (now $250 billion dollars annually) could rise to prohibitive levels — even into the trillions of dollars.

So there we are — to continue the Fed’s stimulation and manipulation adventures — or to back off and let the economy survive on its own?

So what do we do as investors and survivors? My own choice is to hold physical gold with just enough cash to carry us through each week. The amount of physical gold in the US is shrinking, and it’s going to China and India. I believe the only danger to my plan is that possibly, in desperation, the US could confiscate gold from its people.

True, this was done by FDR back in 1933. But this is a different world, and it’s not 1933. I believe there would be so much opposition to a “gold confiscation” today that the government could not get away with it. Besides, today many wealthy and influential people own gold, and they would constitute a powerful force against a government attempt to call in the people’s gold.

At any rate, I’ve been doing a lot of thinking on this subject, and my conclusion is that holding physical gold in your possession is safe and the best policy for surviving the difficult years that I believe lie ahead.

Question — what about buying and holding gold mining stocks, a category that has been denigrated and battered unmercifully? Answer — I think they represent a good speculation, but I prefer the real deal, and that’s physical gold.

There is something else I want to talk about. It’s China, now the world’s second biggest economy. China’s debt is now 70% of its GDP, a ratio the analysts consider dangerous. If China runs into trouble it will affect all of Asia and the rest of the world.

So let’s take a look at China on a chart. What I see is a huge head-and-shoulders top that has just plunged below support. The chart is telling me that the world’s second largest economy is in serious trouble.

To subscribe to Richard Russell’s Dow Theory Letters CLICK HERE.

About Richard Russell

Russell began publishing Dow Theory Letters in 1958, and he has been writing the Letters ever since (never once having skipped a Letter). Dow Theory Letters is the oldest service continuously written by one person in the business.

Russell gained wide recognition via a series of over 30 Dow Theory and technical articles that he wrote for Barron’s during the late-’50s through the ’90s. Through Barron’s and via word of mouth, he gained a wide following. Russell was the first (in 1960) to recommend gold stocks. He called the top of the 1949-’66 bull market. And almost to the day he called the bottom of the great 1972-’74 bear market, and the beginning of the great bull market which started in December 1974.

The Letters, published every three weeks, cover the US stock market, foreign markets, bonds, precious metals, commodities, economics –plus Russell’s widely-followed comments and observations and stock market philosophy.

Gold To See A Rapid $280 Super-Surge From Current Levels

Posted by Kevin Wides via King World News

on Thursday, 30 January 2014 20:39

With investors around the world now wondering what to expect from major markets in the aftermath of the Fed decision, today Kevin Wides out of Switzerland sent King World News a fantastic piece which illustrates the roadmap for gold from current levels. Below is what Wides had to say along with his outstanding charts….

….read and view it all HERE

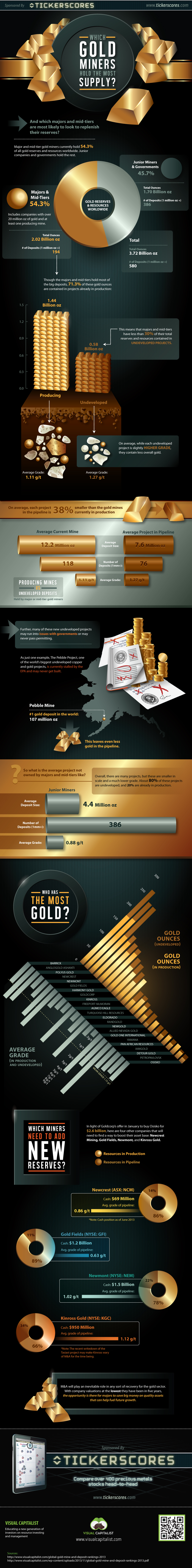

Which Gold Miners Hold The Most Supply?

Posted by Tickerscores.com

on Thursday, 30 January 2014 14:38

Major and mid-tier gold miners hold 54.3% of global reserves and resources worldwide. The rest is held by junior miners and governments. While bigger companies such as the majors hold the largest deposits, more than 70% of them are already in production.

In light of Goldcorp’s offer for Osisko for $2.6 billion, we show how much gold all of the majors have left to mine in their reserves and resources. Then, we break down a few majors that we think may be the next ones to make a major transaction.

Get a Free Trial of Tickerscores and Compare Over 400 Precious Metals Stocks

Will Silver Make A Comeback?

Posted by Lior Cohen

on Wednesday, 29 January 2014 17:43

Despite the recent fall in the price of silver during last week, silver is still up in January. Will silverresume its upward trend in the coming weeks? Let’s analyze the recent developments that may affect silver (SLV).

Despite the recent fall in the price of silver during last week, silver is still up in January. Will silverresume its upward trend in the coming weeks? Let’s analyze the recent developments that may affect silver (SLV).

The rally in silver price has also reflected in the rise in demand for leading precious metals’ ETFs including iShares Silver Trust. During January, Silver Trust’s price rose by 2.5%. The upcoming FOMC meeting may affect the direction of silver price. Let’s take a closer look at this issue.

FOMC’s monetary policy

The upcoming FOMC meeting will be Bernanke’s last meeting as Chairman of the Federal Reserve. The current expectations are that the FOMC will announce another tapering of $10 billion. Thus, the long-term asset purchase program will decline to $65 billion a month. In the previous meeting, the decision of the FOMC to taper QE3 has resulted in a sharp drop in the price of silver the following day.

….read more HERE

Why now’s the time to be bullish on gold-mining stocks.

Several weeks ago I bought the one asset that all investors seem to hate.

I bought some stock in gold mining companies.

No, I haven’t gone gold bug or paranoid. I’m not dressing up in camo or wearing tin foil on my head to stop radio waves from NSA satellites.

The actual cause was simple. Gold mining stocks had fallen so far out of favor that they had triggered the Bennett Rule—a rule named for my old friend, and money manager extraordinaire, Peter Bennett in London.

…continue reading HERE

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair