Gold & Precious Metals

Why Gold Stocks are Leading Gold

Posted by Jordan Roy-Byrne - The Daily Gold

on Friday, 24 January 2014 14:30

At the start of the year we asserted that the mining equities could lead the metals higher. Since then, the shares have roared higher while the metals have remained subdued. Gold has gained a bit but Silver has really struggled. Why are the stocks performing so well if the metals are not confirming?

The main reason is the stocks led the metals down (specifically Gold) during the bear market. The chart below plots CDNX (Canadian juniors), GDXJ (US juniors), GDX (large caps) and Gold. Note that both junior markets peaked months before Gold. GDX technically peaked at the same time but began its topping process in December 2010, well before Gold peaked.

The stocks essentially began to underperform in December 2010 and then peaked a few months later. Most companies peaked even before Gold went parabolic! As a result, most mining stocks have been in a bear market longer than Gold and may have already discounted the worst. It makes sense that they would bottom first and there is a precedent for that scenario.

The chart below shows the action in the HUI and Gold during the 2000-2001 bottom. The HUI bottomed in November while Gold formed a double bottom in February and April. The HUI barely corrected when Gold declined to its first bottom. The HUI did decline nearly 20% before the April bottom in Gold but that was after it rebounded 70% in only four months. Moreover, the HUI exploded after Gold’s final bottom in April.

Moving along, another reason for stock outperformance is because the relationship to Gold recently reached a historic extreme. I am usually not a fan of comparinggold stocks to Gold. Over time the gold stock sector as a whole struggles to outperform Gold. It badly underperformed in the 1970s and has badly underperformed over the past five years. However, this relationship (gold stocks vs. Gold) recently hit a 70-year low! When something reaches that type of extreme, we have to take note. (Source: NowandFutures.com)

It turns out that there have been two great buying opportunities in the stocks (June 2013 and December 2013) with a possible third to come. During Gold’s final decline in 2001 the HUI shed about 20%. Yet Gold rebounded strongly and the HUI did too, exploding 65% in less than two months. If Gold hasn’t bottomed then its final bottom (presumably in the coming months) could offer another major opportunity for the mining stocks.

That being said, an investor should not wait for a correction or buying opportunity just weeks after an important bottom. What happened to those who waited for the S&P in 2009, the gold stocks in November 2008, the S&P in 2003 or the gold stocks in 2001? As we said last week, the risk has shifted from getting caught in a final plunge to missing out on the rebound. Make your list of favorites and selectively accumulate rather than chase strength. If you’d be interested in learning about the companies poised to rocket out of this bottom then we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Next Week’s Second Fed Taper Will Test Gold Bulls’ Resolve

Posted by Sumit Roy - Hard Assets Investor

on Thursday, 23 January 2014 18:58

The Fed may taper again one week from today.

Gold prices were little changed over the past week as the rally that began at the start of the year lost steam. The current rebound off December’s low near $1,180 hasn’t been that powerful, which is in contrast to when prices first bottomed at $1,180 last June. Following that initial bottom, prices zoomed higher over the next two months, hitting $1,350 in July and $1,450 in August.

This time around, prices reached as high as $1,260—granted, it’s only been about three weeks since the December bottom.

At this point, we don’t necessarily see any specific positive catalysts to send prices higher. Rather, it will be gold’s ability to shrug off bad news that will be most telling, and dictate whether we see continued gains in prices.

The next test will come on Jan. 29, when Ben Bernanke and the Federal Open Market Committee make the last monetary policy decision in which he is at the head of the central bank. Bernanke is set to retire at the end of the month.

Currently, expectations are that the FOMC will go ahead and taper its bond-buying program by another $10 billion, bringing monthly purchases down from $75 billion to $65 billion. If that happens, we will look to see gold’s reaction.

Following the first taper in December, gold bounced off $1,180. Will the yellow metal test that level again? Or will it shrug off the news and build on the current rally?

In our view, if gold can break $1,275 on the upside, it will indicate the rally has legs, and prices may continue higher to above $1,300, even $1,400. On the other hand, a move back below $1,200 will put the bears in charge once again.

GOLD (YTD)

SILVER (YTD)

PLATINUM (YTD)

PALLADIUM (YTD)

….read pages 23 4 5 & 6 HERE

Eric Lemieux: What Does 2014 Hold for Metals?

Posted by Eric Lemieux via The Gold Report

on Thursday, 23 January 2014 12:34

Eric Lemieux, a mining analyst with Laurentian Bank Securities in Québec, is a realist, which makes his optimistic outlook for miners in 2014 that much more compelling. Lemieux believes that with the wheat separated from the chaff over the past tumultuous year, the truly strong companies have emerged. But you may be surprised by his predictions for 2014. Lemieux makes some startling, but happy forecasts in this interview with The Gold Report.

The Mining Report: Eric, your top stock pick in 2013—Virginia Mines Inc. (VGQ:TSX)—outperformed the S&P/TSX SmallCap Index. What’s your recipe for picking stocks in 2014?

Eric Lemieux: The secret to success in picking stocks in 2014 will be simple: management. The senior vice president of Laurentian Bank Securities, who recruited me, asked me a question during my interview way back in 2007: What was the most important element when I was looking at a company? I started to talk about some financial ratios, etc. He began to laugh. He said there are three things: management, management and management. I know that’s easy to say, but it is true. It is the team that’s behind the company. That’s the most important secret for success.

TMR: What’s your top pick for 2014?

EL: It remains Virginia Mines because the company has an exceptionally well-managed team and a focused business model. CEO André Gaumond has said he wants to be at the beginning of the food chain and the end of the food chain with a royalty portfolio. I think he is adamant about applying what he’s good at and that’s being a top explorer and being able to decipher royalty portfolio opportunities. He has always said he is not a producer and I respect that. So far he has been proven right. That should remain the same in 2014.

EL: It remains Virginia Mines because the company has an exceptionally well-managed team and a focused business model. CEO André Gaumond has said he wants to be at the beginning of the food chain and the end of the food chain with a royalty portfolio. I think he is adamant about applying what he’s good at and that’s being a top explorer and being able to decipher royalty portfolio opportunities. He has always said he is not a producer and I respect that. So far he has been proven right. That should remain the same in 2014.

TMR: The royalty that you’re referring to is Goldcorp Inc.’s (G:TSX; GG:NYSE) Éléonore project in the James Bay region of Québec, which should go into production in 2014. What’s interesting is that some exploration done by Goldcorp seems to have delineated an entirely new zone of mineralization. What do you know about that?

EL: Goldcorp disclosed a new zone called 494, which would be about 500 meters (500m) north of the Roberto zones. It appears as a new ore shoot. It still has to be fully defined, but the hypothesis is that its geometry looks to be another Roberto. It’s most interesting because it’s not too far from the mining infrastructure that’s being built. It could effectively double the size of Éléonore; which is also wide open at depth. That deposit is set to grow.

The key catalysts for the Éléonore royalty in 2014 are 1) new reserve and resource numbers that most likely will be disclosed by Goldcorp in February and 2) the start of production by the end of the year. There could be a major rerating of the value of Virginia’s royalty. It is tremendous. I think it is going to be a world-class operation soon.

TMR: You’re predicting an average gold price of $1,400/ounce ($1,400/oz) in 2014. That’s down from the previous estimate of $1,750/oz. Nonetheless, most observers would call $1,400/oz optimistic given the current spot price. What gives you confidence that the gold price will rise in 2014?

EL: I’m fairly optimistic. The price of gold is gravitating around $1,200/oz, so there’s a substantial difference. I’m looking at the global picture. Yes, the price of gold has gone down, but it’s approaching a floor of production costs. By midyear the price of gold will be higher.

TMR: Many of the companies you cover operate in Québec, which just passed a new mining act. Is that good news for investors?

EL: By and large, all this is good news for companies operating in Québec. It’s not perfect. There are a few irritants, but it is a middle ground—a relatively well-balanced law.

TMR: An application for a mining lease now requires a feasibility study. What do you make of that?

EL: Well, feasibility studies are necessary. A company needs to go through the steps of a feasibility study for the normal process of calling a mineral reserve and getting financing, etc. The industry has to realize certain levels of obtainment and it is a normal process to have feasibility studies to receive the proper permits to achieve the proper level. The new act (as amended) states that an application for a mining lease must be accompanied with a scoping study and market study; note that previous Bill 43 had proposed a feasibility study for securing second and third transformation. The new dispositions are fair and less burdensome.

TMR: Does Québec remain the best jurisdiction in Canada in which to operate a junior mining exploration company?

EL: I would simply say no, but I would point out the positive is that Québec has stopped dropping in the standings. We’ve gained clarity with the Québec mining law and royalty revisions. All in all, we’re not the best jurisdiction anymore, but at least we’re not falling down the slope. I would highlight, however, that Goldcorp’s recent offer to acquire Osisko suggests that Québec has seen the worst, and perception is improving.

TMR: What would you say is the best jurisdiction?

EL: This is an ever-evolving element. What is considered the best jurisdiction today could not be so a year from now. Québec is a case-in-point. It was one of the best jurisdictions a few years ago and it slid down. At least with the passage of the royalty and mining law, the worst is over.

TMR: Despite your optimism for precious metals, you’ve rolled back almost all of the target prices on the companies you cover, some by as much as 35%. What prompted that action?

EL: General market sentiment has obliged me to remove or decrease substantially my exploration goodwill, which was a proxy of the quality of the teams, the quality of the projects and the general market sentiment. I had to bring that goodwill down, and for certain explorers I had to completely remove it. Having said that, companies that are well managed, have a good portfolio of projects and are able to sustain a minimum of activities will be poised to bounce back eventually. Although I brought down the target price, I kept my recommendations. That’s a powerful statement. I just needed to effectively downsize some of the expectations.

TMR: What are some of the companies you cover with speculative buy ratings?

EL: There are quality explorers in Québec, Balmoral Resources Ltd. (BAR:TSX; BAMLF:OTCQX) andMidland Exploration Inc. (MD:TSX.V), for example.

Midland has more than $4 million ($4M) in its coffers. That is not a lot compared to other strong companies, but Midland uses the partnership model so its exploration costs are quite low as its partners are funding the programs. Partners for Midland are the likes of Teck Resources Ltd. (TCK:TSX; TCK:NYSE), Agnico-Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and the Japanese consortium JOGMEC. Midland has the financial capacity to maintain some level of good activity. That’s a testament to a well-managed company.

TMR: Which of its projects are you most excited about?

EL: There are a few of them. You never know which one will be the star that will finally emerge. Maritime-Cadillac, a partnership with Agnico-Eagle, is right beside Agnico’s Lapa mine, which has just a few years left of production. Agnico would want to sustain, or at least continue to build on, the infrastructure that it has invested in there. Anything that’s found in the Maritime-Cadillac project will probably go through the Lapa head frame.

The Éléonore Centre project is 100% owned by Midland, but it could eventually find a partner. It’s working slowly but surely and as Goldcorp’s Éléonore mine is about to go into production; that whole area will reignite interest once people realize Éléonore is a world-class deposit. Any acreage around there will gain value directly. Midland will have to decide if it wants to find a partner before it drills Éléonore; it has the financial capacity to do that. No matter what happens, that area will light up from Éléonore’s conservative production of 40,000 to 60,000 oz of gold in 2014.

TMR: Tell us about what those potential partners could look like.

EL: Midland has a diversified portfolio of properties: a palladium-platinum project in the northern part of the Labrador Trough near Kuujjuaq, some base metal projects in areas not known as mining camps, some early-stage zinc projects. Midland has a lot of arrows in its quiver. Any time some of these arrows could attract some attention. It also has a track record of good relationships in current and previous partnerships. Midland is well positioned to find new strategic partners for its different portfolio of projects.

TMR: Let’s delve into Balmoral.

EL: Balmoral has done a very good job in amassing a strong portfolio of properties in the Detour Trend. Balmoral is a shining star right now in Québec. The company was nominated as the prospector of the year in November 2013, a testament to the good work that CEO Darin Wagner and his team are doing.

EL: Balmoral has done a very good job in amassing a strong portfolio of properties in the Detour Trend. Balmoral is a shining star right now in Québec. The company was nominated as the prospector of the year in November 2013, a testament to the good work that CEO Darin Wagner and his team are doing.

The Martiniere project along the Detour Trend holds some more surprises. The drilling Balmoral has done—about 90 holes—has shown that there’s a gold system there. The deepest hole, at about 400m, is just scratching the surface.

Balmoral is well positioned to continue to work in 2014, with about $8M in cash and equivalents. It has a hot project, the financial capacity, a good team and the geological knowledge—it’s a very well-positioned project in 2014.

TMR: Balmoral received a $6M private placement in October. Did that surprise you?

EL: A little bit. I found the timing a bit questionable. Having said that, when the money is on the table, maybe you take it.

TMR: Have some of the struggles at Detour Gold Corp. (DGC:TSX) trickled down to Balmoral?

EL: The Detour story has had a major impact. The whole area has lost its shine with the difficulties (for example a slower ramp-up) going on at the Detour Lake mining operations. There’s a direct impact for Balmoral, Midland and Adventure Gold Inc. (AGE:TSX.V), which is another company I cover.

Having said that, the target is of a higher grade on the Québec side. So far, Balmoral has been hitting high grade. Midland’s drilling last winter with Osisko Mining Corp. (OSK:TSX) did not hit a homerun, but it was a solid single. Smoke could lead to fire. All in all, the Québec Detour Trend will be able to hold its own in 2014.

While the Detour Lake operations have had an impact, it’s more of a step back to eventually take two steps forward.

TMR: Detour Gold recently closed its mill and scaled back its guidance again for 2013.

EL: Detour is going through hardships. Ramping up a mining operation takes time and there are always some surprises. I still believe that it has the capacity to make this a winning proposition. There’ll be hiccups, but it should be able to press all the wrinkles and make this a viable operation.

TMR: What about outside of Québec?

EL: Every jurisdiction has its issues and Ontario is no exception, but overall it is one of the better places in the world to work. Goldcorp and other majors are there, but there is still mining to be done in Ontario.

Premier Gold Mines Ltd. (PG:TSX) is in Ontario. The company’s assets in the Red Lake and Geraldton areas and its Hardrock and Trans Canada projects are sitting on solid footing. It also has projects in Nevada. Premier has the financial capacity to remain active. It’s my understanding that in 2014 Premier will come out with a scoping study for the Hardrock project, which will be able to move quickly into the prefeasibility stage.

TMR: What did you make of the initial resource estimate on the Helen zone, which is part of the Cove project in Nevada?

EL: It was a little bit below my expectations, but it’s important to underpromise and overdeliver in this business. The Helen zone was Premier’s first resource estimate. It is an improvement from what was done previously by Victoria Goldfields, which was a terrible saga where the company had to restate its numbers. Premier’s numbers should be rock solid. There’s potential to increase that internally, in infill drilling and with some proximal works. I feel comfortable with the Helen zone for the Cove property.

TMR: Is that the same case for Eastmain Resources Inc. (ER:TSX)?

EL: I have to confess that there was some disappointment over the pace of work in 2013 and 2012. I’ve always been quite forthright about thinking Eau Claire is an excellent project, but I’m still in the dark about how Eastmain can mine it. It’s something that I’ve been pestering management about for the last few years. There was an expectation that there would be a new mineral resource estimate in 2013 and that hasn’t come out yet. Eastmain did put out a press release recently saying that it had retained mining engineer Serge Bureau, who has a background with Barrick Gold Corp. (ABX:TSX; ABX:NYSE), as a special adviser. It’s very positive news that Eastmain realizes the importance of bringing Eau Claire to the next level. I take a lot of comfort in Serge Bureau counseling Eastmain CEO Donald Robinson and his team on how to best advance Eau Claire, as well as the Eastmain-Ruby Hill project.

Eastmain is focused in the James Bay area near Éléonore, again the area that I believe might reignite. Éléonore will become a world-class operation and anything that’s around there will gain from that. Hopefully Eau Claire will be able to monetize that.

TMR: What’s going to keep you optimistic in 2014?

EL: I’m optimistic. It was a difficult year for the mining industry in 2013. The fundamentals are still strong and the long-term story is solid. I believe that this will be able to set in during 2014. Companies have been tightening their belts and streamlining operations. Juniors are going back to the basics. There’s no more waste. There’s been a reality check. The companies that have been able to survive and sustain a minimum of operations and activities are going to be set for 2014.

The mining industry is a necessity. There’s always a reason to go out and search for metals and commodities because the population continues to grow and needs resources. It may be through electronic devices. It may be through food or infrastructure. The overall portrait is interesting and positive. I’m optimistic for 2014.

TMR: Thanks for chatting today. I’ve enjoyed it.

EL: You’re certainly welcome and as we say in French—merci!

Eric Lemieux is a mining analyst who joined Laurentian Bank Securities in 2008. He worked for nine years as a consultant responsible for applying Regulation NI 43-101. He has worked at the Montreal Exchange, and prior to that managed exploration projects for Cambior, Noranda and Soquem. He holds two masters degrees, in mineral economics from the Colorado School of Mines and in metamorphic-structural geology from Laval University.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Related Articles

- Eric Lemieux: There Will Be Winners in Quebec

- Amanda Van Dyke: A Dozen Gold, Copper, Phosphate and Uranium Standouts

- The Longwave Winter of Ian Gordon’s Discontent

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Reportas an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Virginia Mines Inc., Balmoral Resources Ltd., Midland Exploration Inc. and Premier Gold Mines Ltd. Goldcorp Inc. is not affiliated with The Gold Report. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Eric Lemieux: I or my family own shares of the following companies mentioned in this interview: Agnico-Eagle Mines Ltd., Barrick Gold Corp., Adventure Gold Inc., Eastmain Resources Inc., Midland Exploration Inc., Teck Resources Ltd. and Virginia Mines Inc. I personally am or my family is paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

LONDON: Gold in 2014 will not push much lower from current levels around $1,250, although investors hoping last year’s 28 per cent battering will bring a bounce back face disappointment, consensus estimates in a Reuters poll show.

Gold last year hit its lowest since August 2010 at $1,180.71 an ounce. That blew away expectations of analysts polled this time last year, who had forecast a modest 6 per cent rise from 2012’s average.

A Reuters poll of 37 analysts conducted in the last month returned an average gold price forecast of $1,235 an ounce for this year, while in 2015 prices are seen rising only marginally, to $1,260 an ounce.

While that suggests heavy selling of the metal may have ended, it offers little comfort to investors looking for gains after last year’s crash, its biggest annual loss in 32 years.

….continue reading page 1 & 2 HERE

Gold Stocks Pause, But Not For Long

Posted by Stewart Thomson - Graceland Updates

on Tuesday, 21 January 2014 16:50

- Most junior gold and silver stocks have taken a horrific beating over the past few years, even while gold prices have remained relatively elevated.

- Bank analysts suggest that high mine costs are largely to blame for this sell-off.

- Recently, naked shorting seems to have diminished. Gold stocks have rallied very strongly over the past month, on enormous volume.

- Can the rally continue, and is it related to lower mining costs? In the short term, there’s no question that gold and gold stocks are technically overbought.

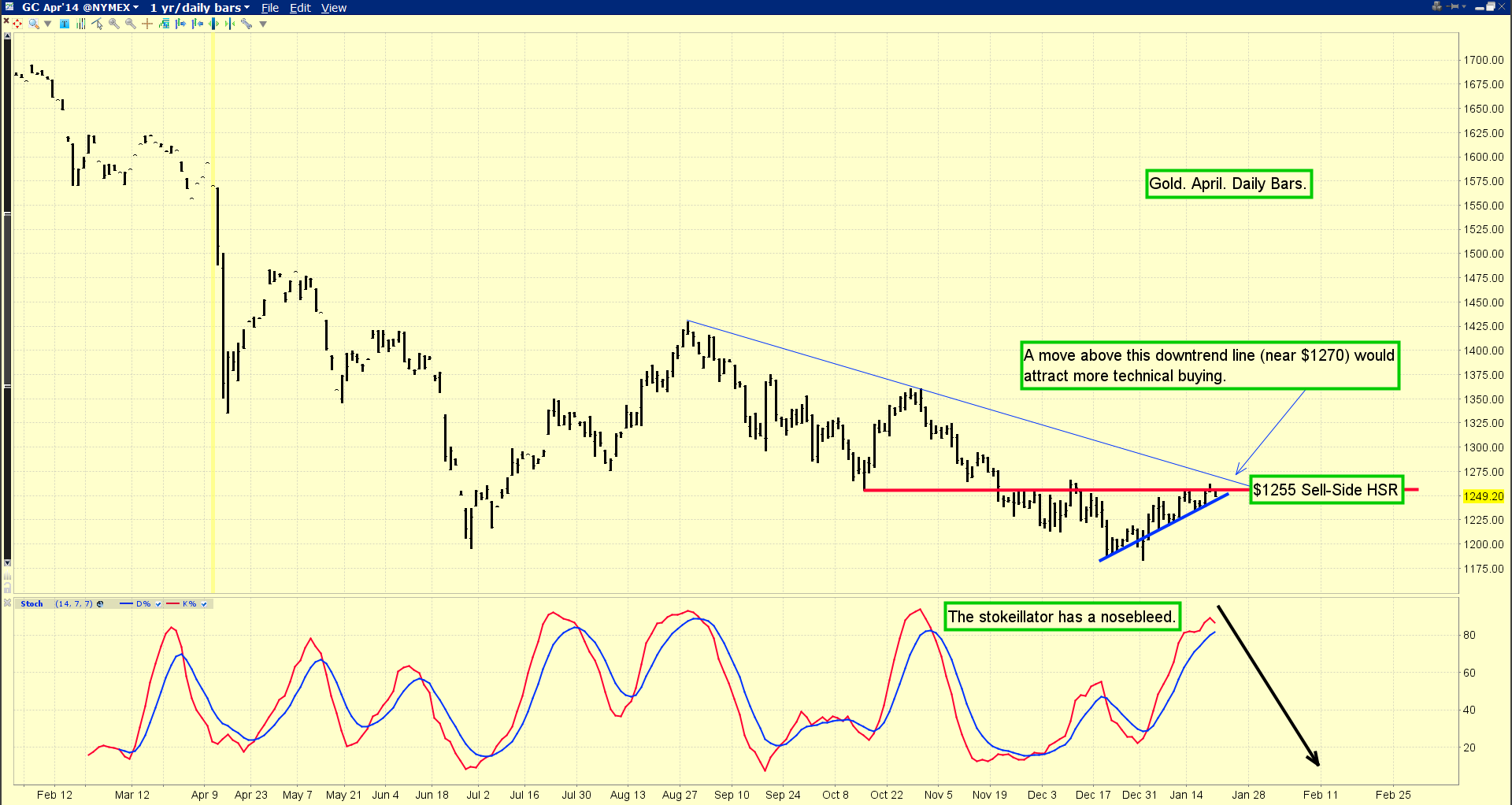

- Note the position of my stokeilllator (14,7,7 Stochastics series) on this daily gold chart. After reaching about 90, the lead line is rolling over. Click to enlarge

- It could be said that this key oscillator has a nosebleed, from altitude sickness.

- So, light trading profits in gold and related items should be booked by aggressive investors now.

- In the bigger picture, a rise above the light blue trend line in the $1270 area could attract strong technical buying, initiating a very powerful move to the upside.

- From a fundamental perspective, the cost of energy is very important to mining companies. Lower mine costs, combined with a relatively stable gold price, mean more profits for mining companies. Larger profits can attract very strong institutional buying of high quality gold shares.

- Please click here now. This interesting weekly chart compares GDXJ to oil. The 14,3,3 Stochastics and RSI oscillators are both very bullish, and volume is powerful.

- Against oil prices, junior gold stocks appear to have broken out to the upside. A short term pullback after such a strong breakout is to be expected, followed by a much bigger rally.

- I’ve compared the recent price performance of junior gold stocks to heavyweight boxer George Foreman, because they are crushing every other asset in their path.

- Please click here now. This daily chart shows that over the past month, GDXJ has gained about 25% against the Dow.

- It’s now running into some overhead HSR (horizontal support and resistance). I’ve marked that in red colour on the chart. After such a powerful move to the upside, a brief pause is perfectly normal.

- The “health” of an intermediate trend rally is maintained by the occurrence of regular minor trend sell-offs.If that doesn’t happen, a much more painful sell-off often ensues.

- Many investors sold gold stocks for a “tax write-off” in December, and some of them bought the Dow with the proceeds of that transaction. I think investors should sell gold stocks at a profit, not a loss, and I wouldn’t buy the Dow with any of those profits.

- As 2014 progresses, the Fed will probably taper more aggressively, because money supply velocity (via M1V and M2V) is likely to accelerate, catching the Fed by surprise.

- That accelerated taper is likely to cause the economy to slow a bit, weighing on energy prices.

- Institutional money managers would then be quite likely to move funds from the Dow into gold stocks.

- Yesterday was a US holiday, and stock markets were closed. The Toronto market was open, and gold stocks had a good day of trading.

- Please click here now. Double-click to enlarge. This daily ZJG.TO chart (Bank of Montreal junior gold stocks ETF) is the Canadian version of GDXJ. Investors in Canadian gold stocks should book light trading profits, but be open to the possibility that a much bigger rally will follow any pullback.

- The US markets are all open again today. Where should US junior gold stock investors look to re-enter the market, using the GDXJ chart?

- For the likely answer, please click here now. On this two hour bars chart, I’ve highlighted three key re-buy price zones. Gamblers could buy in the $34.99 area, with an optional stoploss order placed under the minor trend low at $33.20. I don’t use stoplosses, and I’m not a big gambler, but I will lightly buy that $34.99 area.

- On any potential pullback for junior gold stocks, the buy-side HSR at $33.40 is what should be the “meat and potatoes” buy zone. It’s where junior gold stock investors may want to re-buy GDXJ, and their favourite individual stocks, with a bit more size!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Cameco & Barrick Parade Leaders!” report. Both Cameco and Barrick may be key leading indicators of what is coming for junior uranium and precious metal stocks. I’ll show you why that is, and which juniors may be poised to lead phase two of the gold stocks rally!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: stewart@gracelandupdates.com

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair