Gold & Precious Metals

Coup d’État That May Shake the World

Posted by Arkadiusz Sieron, Ph.D.

on Friday, 13 April 2018 14:47

Everyone focuses now on the chemical attack in Syria. Meanwhile, the most important turnover in the world remains mostly unnoticed. But we’re on guard. Let’s read our analysis of the key revolution of 2018 and find out the implications for the gold market.

Hawks Take Over the Fed

Are we going to write about Syria? North Korea? China? No. You already know everything you should about these geopolitical threats. The media bomb you with news about bombings, trade wars, nuclear trials, etc. But the key upheaval is taking place in silence, in the cool marble rooms of the Federal Reserve Banks. ‘The Hawkish Revolution’ – this is how the future historians will call it.

What is going on? We will tell you – but first read the key paragraph of the minutes from the recent FOMC meeting the Fed published yesterday.

Some participants suggested that, at some point, it might become necessary to revise statement language to acknowledge that, in pursuit of the Committee’s statutory mandate and consistent with the median of participants’ policy rate projections in the SEP, monetary policy eventually would likely gradually move from an accommodative stance to being a neutral or restraining factor for economic activity.

What does it mean? The FOMC members have started to consider the end of its accommodative stance. This is a real revolution, as the U.S. central bank has been supporting growth since the outbreak of the financial crisis. Now, for the first time since the Great Recession ended a decade ago, the Fed is talking about adopting a neutral or even tight stance. The possible consequences are enormous. More interest rate hikes are up ahead. Gold investors, be prepared!

Before we discuss the conclusions for gold, let’s analyze the rest of the latest minutes. Generally speaking, even without the remarks about possibly dropping the accommodative bias, the minutes had a hawkish tone. Why? Well, the FOMC members agreed that the nation’s economic outlook had recently strengthened:

All participants agreed that the outlook for the economy beyond the current quarter had strengthened in recent months. In addition, all participants expected inflation on a 12-month basis to move up in coming months.

Have you noticed something interesting? Look carefully. “All” – isn’t this a rare show of unity? We are all hawks now. Indeed:

Most participants commented that the stronger economic outlook and the somewhat higher inflation readings in recent months had increased the likelihood of progress toward the Committee’s 2 percent inflation objective.

And another hawkish strike:

A number of participants indicated that the stronger outlook for economic activity, along with their increased confidence that inflation would return to 2 percent over the medium term, implied that the appropriate path for the federal funds rate over the next few years would likely be slightly steeper than they had previously expected.

Brace yourself for further hikes.

Fed Comments Trade Wars

Interestingly, the FOMC members discussed the potential impact of Trump’s trade wars. Although they downplayed the importance of U.S. tariffs, the central bankers worried about retaliatory trade actions:

A number of participants reported concern among their business contacts about the possible ramifications of the recent imposition of tariffs on imported steel and aluminum. Participants did not see the steel and aluminum tariffs, by themselves, as likely to have a significant effect on the national economic outlook, but a strong majority of participants viewed the prospect of retaliatory trade actions by other countries, as well as other issues and uncertainties associated with trade policies, as downside risks for the U.S. economy.

The Fed officials were also uncertain about the impact of the American fiscal policy. Generally, they believed that it should boost growth, but some question marks remained.

Tax changes enacted late last year and the recent federal budget agreement, taken together, were expected to provide a significant boost to output over the next few years. However, participants generally regarded the magnitude and timing of the economic effects of the fiscal policy changes as uncertain, partly because there have been few historical examples of expansionary fiscal policy being implemented when the economy was operating at a high level of resource utilization. A number of participants also suggested that uncertainty about whether all elements of the tax cuts would be made permanent, or about the implications of higher budget deficits for fiscal sustainability and real interest rates, represented sources of downside risk to the economic outlook.

Implications for Gold

Is gold doomed after the hawkish revolution? Well, the price of gold has indeed declined after the minutes were released, as one can see in the chart below.

Chart 1: Gold prices from April 9 to April 11, 2018.

It makes sense, as higher interest rates are bearish for gold, which doesn’t bear any yield. The hawkish revolution would lead to the normalization of monetary policy – which is bad for gold. The yellow metal shines the brightest during crazy times and irresponsible policies, not during normal periods and a neutral policy stance.

However, usually when the Fed presses the brakes as it fears overheating, it triggers recession after some time. Revolutions often lead to crises. The current gradual approach reduces such a risk – but it doesn’t eliminate it. Gold should shine in the recessionary scenario.

And monetary policy is only one part of the equation. The fiscal and trade policies are the other – and they are likely to lift gold prices. Another issue is that a more hawkish Fed has been already priced in, at least partially. Last but not least, the elevated anxiety about a military conflict about Syria could provide a short-term – let’s emphasize it: short-term – support for the price of gold. So, the ongoing coup d’état at the Fed may shake the gold market, but its impact will be neutralized by other factors. Always take a broader perspective – and stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold Tests Resistance – Again

Posted by John Rubino - Dollarcollapse.com

on Wednesday, 11 April 2018 15:42

Gold is rattling against $1367 resistance as Donald Trump tweeted early this morning “Russia vows to shoot down any and all missiles fired at Syria. Get ready Russia, because they will be coming, nice and new and “smart!”. Two takes below, one a wait and see, the other by an analyst who wrote yesterday before all of these Syrian missle tweets and Gold’s rise that “The Time is Now” for Gold to make a move. So far they are both right, but if Gold should break through this resistance at $1365 barrier the latter could be significantly more right – R. Zurrer for Money Talks

Gold Tests Resistance – Again

Just when everyone was getting used to gold sitting around and doing nothing while tech stocks provided non-stop thrills and chills, the metal took off this morning on the “news” (read “Tweet”) that Trump is aiming some cruise missiles at Syria.

Now the $1,360 resistance level that has been an absolute brick wall since 2014 is looming once again, and gold-bugs are – once again – wondering where the next resistance lurks if this level is finally pierced.

The correct answer is that the chart doesn’t (or at least shouldn’t) matter in a world where Russia might soon be trying to shoot down US cruise missiles, Chinese and US aircraft carriers are staking competing claims to the South China Sea and trillion-dollar deficits are explicit and unapologetic government policy.

But until fundamentals retake control and precious metals start acting like bitcoin circa 2017, charts like this one are a fun diversion.

Gold Market Nirvana: The Time Is Now

Apr 10, 2018

- The main drivers of global stock, bond, and gold markets are interest rates and demographics. Unfortunately, most investors focus on items that get a lot of media attention but are almost irrelevant to price discovery in the markets.

- Please click here now. I’ve predicted that there will be no trade war, but governments around the world will roll out a modest amount of mildly inflationary tariff taxes.

- Clearly, top economists at both Fitch and Goldman have the same outlook that I do. Moderate tariffs are getting a lot of flashy media coverage, but what really matters to the major markets is Fed policy, US citizen demographics, and Chindian citizen demographics.

- Some tax cuts have now been passed in America. Yellen and most democrats call them “ill-timed stimulus”. Most republicans appear to believe the tax cuts are well-timed stimulus that combined with deregulation could create tremendous GDP growth, using ridiculous demographics to do it. Throughout world history, this type of thinking has been typical in the late stages of ruling empires.

- Libertarians believe there is no bad time to do a tax cut because tax cuts are about the restoration of citizen freedom and morality rather than economic stimulus. They believe these tax cuts must be accelerated until the income and capital gains taxes are eliminated.

- The libertarians believe the US government resembles a mafia extortionist operation more than a government. Are they correct?

- Well, probably. I don’t think most republicans or democrats really want to face the reality of what governments around the world have become, and nor do the governments themselves.

- Regardless, with the Fed engaging in significant QT and a rate hiking cycle, the ability of the US government to finance itself is about to come under stress that is unprecedented in America’s history. Sanctions and tariffs are irrelevant to this stress. QT, rate hikes, and demographics are of epic relevance.

- Please click here now. Double-click to enlarge. I don’t think it’s wise to try to pick an exact top in the US bull market for stocks, but it’s very wise to understand that QT and rate hikes are creating the “beginning of the end” for this market.

- In 1980 the Fed began a 35-year rate cutting cycle with the baby boomers entering their prime working and investing years. Tax cuts from Reagan increased the government debt, but the demographics of the baby boomers and the Fed’s massive rate cuts made the government’s debt problem a minor issue.

- Today, the Fed is engaging in a tightening cycle and the baby boomers are pensioners. The millennials don’t trust banks or government. Elderly savers are destroyed and generally soaked in debt. Tax cuts are morally correct, but they are turning the US government’s debt problem into an epic nightmare. Trump has more cuts planned, and rightly so. These cuts are going to ramp up the government’s debt nightmare, and from a libertarian gold enthusiast’s “end the extortionist insanity” perspective, that’s fantastic.

- The bottom line: More stimulus is coming from the US government, and more tightening is coming from the Fed. This is what is known as “gold market nirvana”. Trump will soon announce infrastructure spending stimulus, and do so as Powell announces more rate hikes and accelerated QT. This will crush the bond market and unleash the inflation genie from her bottle.

- Western stock and bond markets are going to enter a period of massive volatility and then collapse. Gold is going to continue to rise steadily and then go ballistic as that happens.

- Millions of Chinese gold market gamblers that bought physical bullion at $1450 – $1320 in 2013 are being “made whole” as gold moves steadily higher now. The world’s largest gold gambler class is poised to begin a new phase of aggressive buying once gold trades at $1450.

- India’s “Gold Board” will soon be launched, which will likely have the power to decide the import duty. In Dubai, talks are underway between gold jewellers and the government to streamline the VAT.

- On the supply front, mine supply is poised to decline overall and in most countries except Canada and Russia. I’ve described the emergence of a “gold bull era” based on events in both the West and the East, and any gold market investor reading even a portion of what I’ve written here today can only come to the same conclusion.

- Please click here now. Double-click to enlarge this key daily gold chart. Gold is poised in what I call a “golden coil” formation, and there’s a miniature bull wedge in play as well. It’s unknown whether gold drifts down one more time within the coil or just blasts above $1370 now. What is known is that the upside blast is coming. Fed tightening, Chindian buying, and US government stimulus are going to make it happen.

- Please click here now. Double-click to enlarge this T-bond chart. The next big theme that US institutional money managers are going to face is the end of the bull market in bonds.

- For 35 years, investors’ stock market meltdowns have been buffered by bond market rallies. In early 2018, that changed. The bond market barely rallied on stock market crash days, and fell on some of them. It has not reached the panic stage for money managers, but they are getting concerned.

- Not since Paul Volker ruled the Fed has a Fed chair been as forceful about tightening as Powell. Last week, with the Dow down 700 points, he gave a speech to the media stating that more rate hikes were coming. A lot of money managers think he is bluffing. They don’t believe he will hike relentlessly or keep ramping up QT if the stock market falls.

- These money managers are greatly mistaken, and as more rate hikes, QT, and fiscal stimulus turn their supposed safe haven of T-bonds into flaming rice paper, they will turn to gold. It’s already starting. GLD-NYSE has seen tonnage rise to 859 tons during the latest stock market gyrations. The bond bull market is dead, and fiscal stimulus and Fed tightening are going to pressure the dollar as well as the stock and bond markets, leaving gold as the only safe haven for investors.

- Please click here now. One of my largest gold stock holdings is of course Chow Tai Fook, China’s biggest gold jewellery retailer. I cover the action at my www.gracelandjuniors.com website. This chart tells the story of Chindian demand for gold. Chinese gamblers don’t gamble much on paper gold markets. They buy gold bullion and jewellery to get in on the upside price action.

- This stock is a key leading indicator for Western gold miners. On that note, please click here now. Double-click to enlarge this interesting GDX chart. I’ve coined the term “Safehavenization of Gold Stocks” to describe the rise of institutional money manager interest in gold stocks as an actual safe haven from the coming implosion of US government, debt, and stock markets.

- The volume pattern is positive for GDX and most gold stocks, but what’s most interesting is that a price rally of just a few dollars a share represents almost a ten percent gain. For institutional money managers facing the hurricane winds created by fiscal stimulus and Fed tightening in stock and bond markets, gold stocks are becoming an ever-more enticing opportunity for both shelter and gain. Gold investors around the world should be totally comfortable buying various gold stocks on all two and three-day pullbacks. Sell a portion of what is bought on rallies, and hold the rest to enjoy the biggest rewards offered in the glory of the gold bull era!

Thanks!

Cheers

st

Apr 10, 2018

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

Great Alignment – Metals – Shares – Tangible Assets

Posted by Martin Armstrong - Armstrong Economics

on Monday, 9 April 2018 15:49

Martin reinforces the case that it is just not time for Gold yet but that there is a necessary alignment taking place. How about this quote in Martin’s answer: “99% of analysis out there on gold is just so wrong it is laughable”. More from Martin below is “Understanding the Markets – R Zurrer for Money Talks

QUESTION: Hi Mr. Armstrong, I notice that the gold market and the Dow Jones they both had a high in January and since then they have been treading water, are these markets getting in sync or is just a coincidence. Also when it comes to the markets you have explained that we will always see the “if then” situation, my question is a what point do we know that this is the right time to pull the trigger on buying or selling? Thank you – NMP

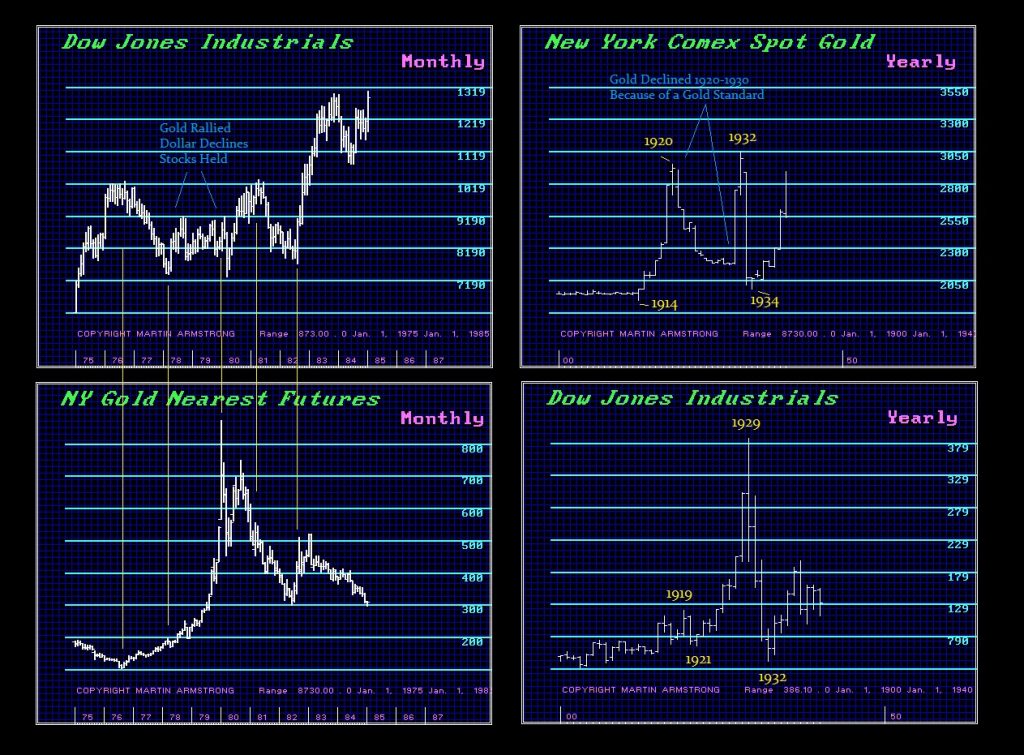

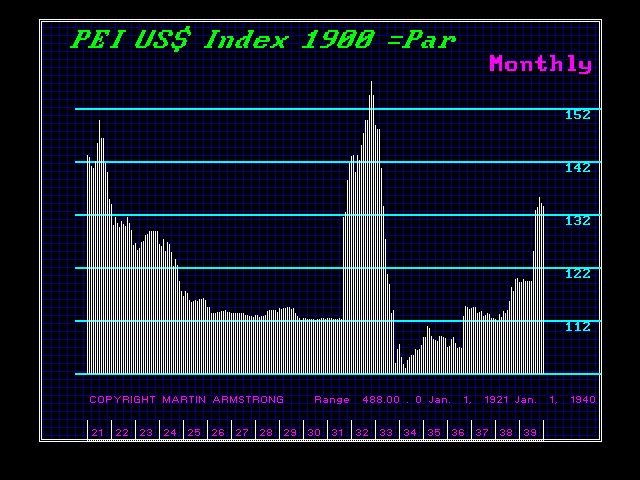

ANSWER: We are not there just yet. However, we are starting the Great Alignment and this is what needs to take place as we move into the future. The 99% of analysis out there on gold is just so wrong it is laughable. They typically call the dollar to collapse and gold will soar. They look at historical charts without understanding the economics behind them. Yes, you see gold rally between 1930 and 1932 so they forecast gold will rally with the collapse of the dollar and the stock market. However, 1931 was the Sovereign Debt Crisis where most of the world permanently defaulted on their National Debts. The USA did not. So because we were on a gold standard, if the price of gold rose, so did the dollar. OMG! That must be heresy!

When you are on a gold standard, then tangible assets drop in terms of currency so yes gold rises. But when you are NOT on a gold standard, then gold is just a tangible asset that declines against the currency along with everything else. Most of these people are clueless about understanding the monetary system

During the rally for gold into 1980 when the dollar was declining in the floating exchange rate system, the stock market did not crash – it consolidated. These people spin out total sophistry that sounds great, cause so many people to lose their savings, and they never repent or try to understand why they have been wrong ever since 1980

The Great Alignment will be when all tangible assets rise against a declining purchasing power of the currencies which today are NOT linked to gold.

We are getting closer. Do not rush in where only fools are found.

…..also from Martin:

Key Junior Miners Look Impressive

Posted by Morris Hubbartt - Super Force Signals

on Friday, 6 April 2018 13:05

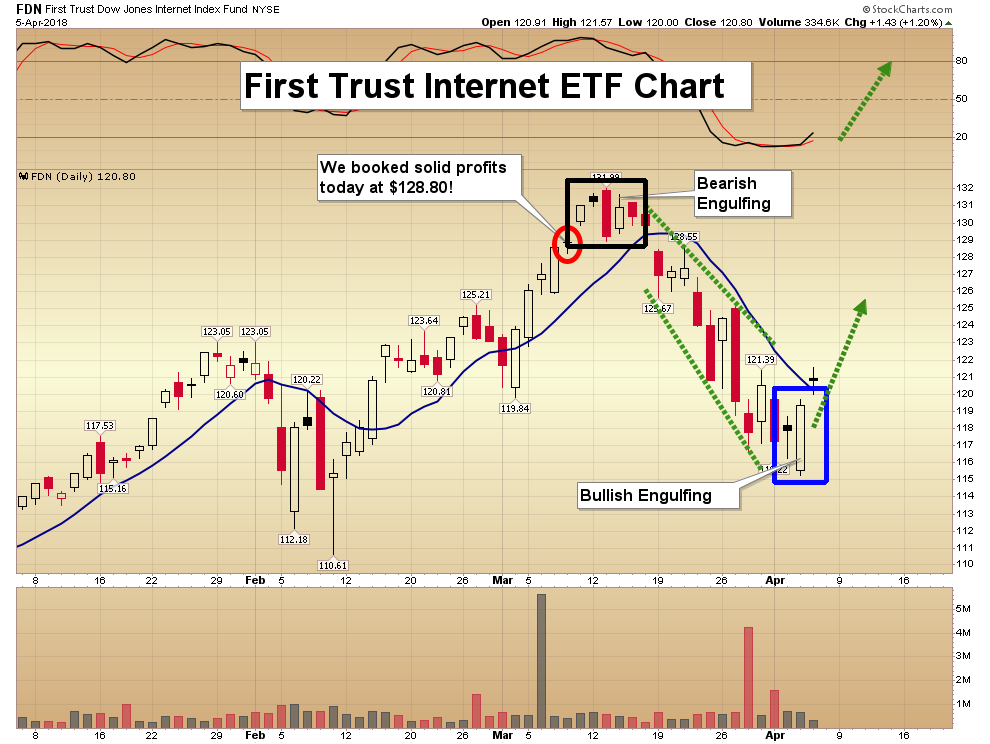

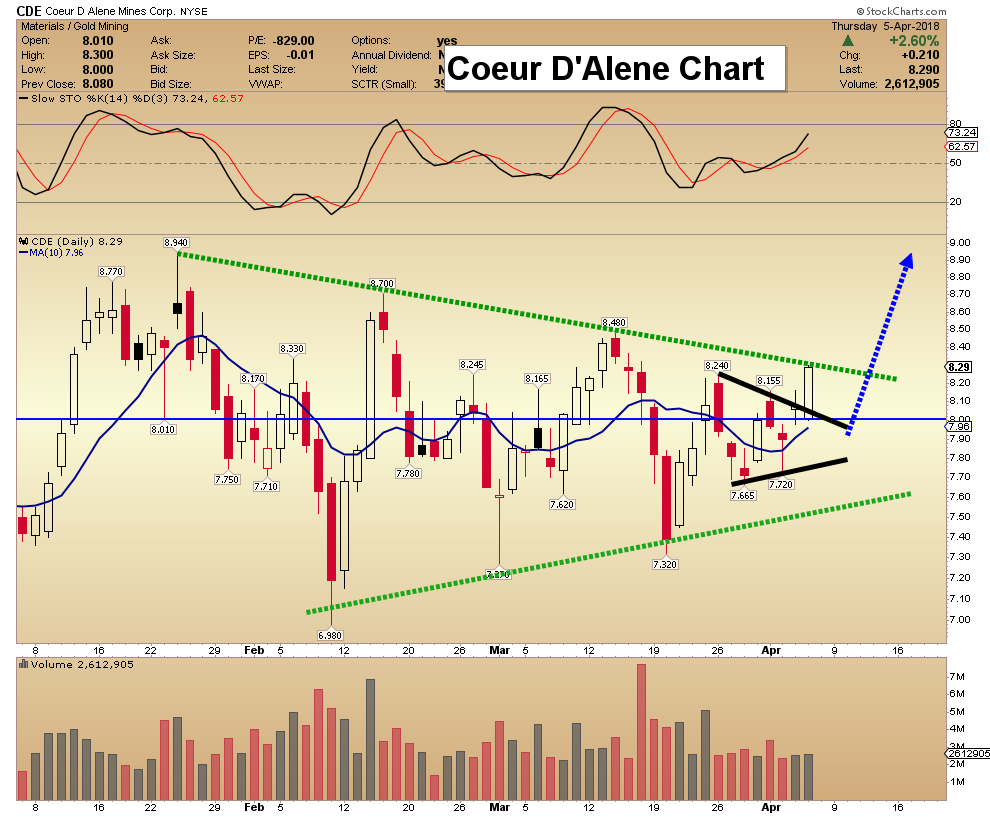

During the nearly 2 years Gold has been capped by the $1360 – $1370 level Morris Hubbartt thinks junior mining stocks have been tracing out some impressive patterns and several juniors are poised to move sharply higher. Analysis of the Dow and Nasdaq is also included below. Before pulling the trigger, read this missive Gold is not Saying Something – Its Screaming It– R. Zurrer for Money Talks

Here are today’s videos and charts (double click to enlarge):

SFS Key Charts & Video Update

SF60 Key Charts & Video Update

SF Juniors Key Charts & Video Analysis

SF Trader Time Key Charts & Video Analysis

Morris

website: www.superforcesignals.com

No surprise there are two distinctly different takes on Gold & Gold Stocks right now. First we have a minority thinking It’s Not Yet Time for Gold, which includes Martin Armstrong in “this public article” and in this more specifically in Private Blog Post at month end. Alternatively there is a major industry that continues to market Gold aggressively despite its declining trend since 2011, the same time period the Dow Industrial Average doubled from 11,917 to yesterdays 24,007. This article looks at the upward performance of Gold and Gold stocks while the Dow shed 800 points over the the last 3 days – R. Zurrer for Money Talks

April 3, 2018

1. Will this Friday’s US jobs report be the catalyst that sends gold above the key $1370 resistance zone and ushers in a new era of institutional enthusiasm for gold stocks?

2. Please click here now. Double click to enlarge. The US stock market suffered yet another “cardiac arrest” moment yesterday.

3. Market breadth has thinned horrifically, and the low rates and QE that have incentivized corporate buybacks have been replaced with rising rates and QT. That’s akin to replacing a firetruck’s water with gasoline.

4. I’ve outlined the case for a possible minor rally in April from current price levels, but the market is so weak internally that it is risk of a much bigger cardiac arrest event.

5. I don’t think Jay Powell will announce a rate hike at the early may Fed meeting, but he might. If he does, stock market investors should be ready to trade in their “Sell in May and go away” mantra for… “Sell in May after getting blown away by Jay.”

6. If he wants to do four hikes in 2018 but avoid doing a hike in the September stock market “crash season” month, he is likely to seriously consider doing a hike in May. Are investors prepared for such a surprise? If they own lots of gold, the answer is yes!

7. Please click here now. So far in 2018 almost eighteen billion US dollars in institutional money has flowed out of the main S&P500 ETF. This market is very sick, and getting sicker.

8. The bottom line: US stock market rallies should be sold and the proceeds should be placed in cash, gold bullion, and gold stocks.

9. Please click here now. Double-click to enlarge this horrifying T-bond chart. On a day that the Dow Industrials fell more than 700 points at one point, the T-bond could barely rally at all.

10. Institutional money managers and sovereign wealth funds are beginning to realize that rate hikes and QT are a tremendous headwind to the US government’s ability to finance itself.

11. During the latest stock market mini crashes, they have clearly started to move their focus from T-bonds to gold.

12. As more rate hikes and QT create much bigger and more frequent crash events in the stock market, I expect this institutional interest in gold to accelerate.

13. Please click here now. Technically, gold’s price action is very impressive. A small head and shoulders top formation was quickly destroyed with yesterday’s safe haven rally.

14. Please click here now. Indian demand for the Akha Teej festival is solid. It should serve as great support for an imminent surge through upside resistance at $1370.

15. For an important look at that resistance zone, please click here now. Double click to enlarge. Gold is coiling in what I call a bull “super flag” pattern, and seems eager to burst higher in a rally that should carry it to $1425.

16. What’s particularly exciting is that in addition to bullion, the GDX ETF is beginning to act as a safe haven!

17. “Newbie” investors to the precious metals asset class have memories of the deflationary declines in 2008. They get nervous when they see the stock market fall, and wonder if gold stocks will also fall.

18. The goods news for these investors is that the current situation is more akin to the late 1960s or early 1970s than 2008.

19. Please click here now. While institutional money is pouring out of stock market ETFs, it’s starting to pour into the GDX gold stocks ETF.

20. Inflation is on the move, and savvy institutional money managers are moving their safe haven focus from bonds to gold and gold stocks.

21. Please click here now. Double-click to enlarge this GDX chart. I’ve urged gold stock investors to be eager buyers of all two and three-day pullbacks. Aggressive players can buy GDX call options and look for 20% gains on those options as a profit booking target.

22. For individual stock enthusiasts, the focus should be on the component stocks of the precious metal ETFs that show the best overall performance from 2016 to the present time.

23. In the 1970s the famous newsletter writer Harry Schultz was known as the “Dean of Gold”. He promoted the use of two and three-day pullbacks to purchase South African gold stocks. The current price action in GDX and many of its component stocks is beginning to display an eerie similarity to the price action of gold stocks in the early 1970s.

24. Gold stock enthusiasts who missed the most recent two-day pullback buying opportunity will have to wait for the next one to get in on the upside fun. Following that pullback, gold and gold stocks could be ready to surf an Akha Teej themed wave, right through $1370 and on towards my $1425 area target price!

Thanks

Cheers

St

Stewart Thomson

Graceland Updates

https://www.gracelandupdates.com

Special Offer: Please send an Email to freereports4@gracelandupdates.com and I’ll send you my free “Golden Components” report. I’ve produced a comprehensive five part report on most of the GDX component stocks, showing investors how to separate the golden wheat from the chaff!

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair