Gold & Precious Metals

Goldman Sachs boosts gold price forecast, sees $1,450/oz in 12 months

Posted by From a report by analysts Michael Hinds and Jeffrey Currie

on Thursday, 8 February 2018 14:17

The report shows that they raised their 3, 6, and 12 months forecast to $1,350, $1,375, and $1,450/oz respectively.

Fear Creeps Back into Stocks, Shining a Light on Gold

Posted by Frank Holmes - US Global Investors

on Wednesday, 7 February 2018 13:10

Monday’s monster stock selloff is exhibit A for why I frequently recommend a 10 percent weighting in gold, with 5 percent in bullion and jewelry, the other 5 percent in high-quality gold stocks, mutual funds and ETFs.

Monday’s monster stock selloff is exhibit A for why I frequently recommend a 10 percent weighting in gold, with 5 percent in bullion and jewelry, the other 5 percent in high-quality gold stocks, mutual funds and ETFs.

What began on Friday after the positive wage growth report extended into Monday, with all major averages dipping into negative territory for the year. The Dow Jones Industrial Average saw its steepest intraday point drop in history, losing nearly 1,600 points at its low, while the CBOE Volatility Index, widely known as the “fear index,” spiked almost 100 percent to hit its highest point ever recorded.

Gold bullion and a number of gold stocks, however, did precisely as expected, holding up well against the rout and helping savvy investors ward off even more catastrophic losses. Klondex Mines and Harmony Gold Mining, among our favorite small-cap names in the space, ended the day up 4.6 percent and 4.8 percent, respectively. Royalty company Sandstorm Gold added 1.4 percent.

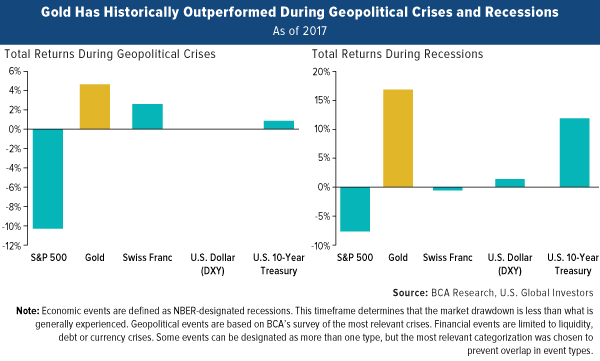

The research backs up my 10 percent weighting recommendation. The following chart, courtesy of BCA Research, shows that gold has historically outperformed other assets in times of geopolitical crisis and recession. Granted, the selloff was not triggered specifically by geopolitics or recessionary fears, but it’s an effective reminder of the low to negative correlation between gold and other assets such as equities, cash and Treasuries.

“We expect gold will provide a good hedge against a likely equity downturn, as the bull market turns into a bear market” in the second half of 2019, BCA analysts write in their February 1 report.

The reemergence of volatility and fear raises the question of whether we could find ourselves in a bear market much sooner than that.

So how did we get here, and what can we expect in the days and weeks to come?

Gold Has Helped Preserve and Grow Capital in Times of Rising Inflation

It’s important to point out that the U.S. economy is strong right now, so the selloff likely had little to do with concerns that a recession is near or that fundamentals are breaking down. The Atlanta Federal Reserve is forecasting first-quarter GDP growth at 5.4 percent—something we haven’t seen since 2006. And FactSet reports that S&P 500 earnings per share (EPS) estimates for the first quarter are presently at a record high. A correction after last year’s phenomenal run-up is healthy.

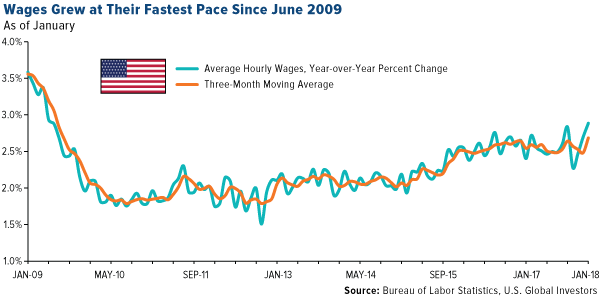

Several factors could have been at work, including algorithmic and high-frequency quant trading systems that appear to have made the call Monday that it was a good time to take profits. Other investors seemed to have responded to Friday’s report from the Labor Department, which showed that wages in December grew nearly 3 percent year-over-year, their fastest pace since the financial crisis. This is a clear sign that inflationary pressure is building, raising the likelihood that the Federal Reserve will hike borrowing costs more aggressively than some investors had anticipated.

As I’ve explained many times before, gold has historically performed very well in climates of rising inflation. When the cost of living heats up, it eats away at not only cash but also Treasury yields, making them less attractive as safe havens. Gold demand, then, has surged in response. This is the Fear Trade I talk so often about.

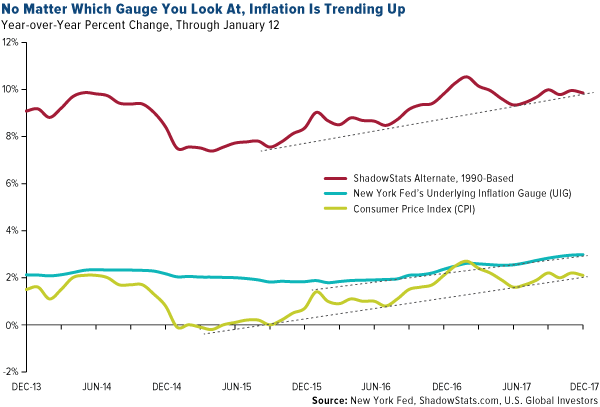

But which measure of inflation is most accurate? The Fed’s preferred gauge, the consumer price index (CPI), rose 2.1 percent year-over-year in December. Then there’s the New York Fed’s recently launched Underlying Inflation Gauge (UIG), which claims to forecast inflation better than the CPI by taking into consideration a “broad data set that extends beyond price series to include the specific and time-varying persistence of individual subcomponents of an inflation series.” The UIG rose nearly 3 percent in December. And finally, the alternate CPI estimate, which uses the official methodology before it was revised in 1990, shows that inflation could be closer to 10 percent.

Whichever one you choose to look at, though, they all indicate that inflation is trending up.

Making predictions is often a fool’s game, but I believe that after lying dormant for most of this decade, inflation could be gearing up for a resurgence on higher wages and borrowing costs. Now might be a good time to rebalance your gold holdings to ensure a 10 percent weighting.

“This pick-up in inflation and inflation expectations is positive for gold,” says BCA, “which we’ve shown to be an attractive hedge against rising prices.”

Long-Standing History of Performance

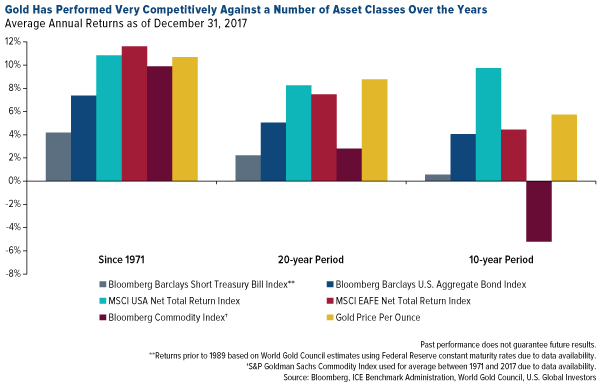

Besides being favored as a safe haven in times of crisis, gold has a history of attractive performance over the long term. Compared to many other asset classes, the yellow metal has been very competitive in multiple time periods.

Since 1971, when President Richard Nixon finally took the U.S. off the gold standard, gold has outperformed all asset classes except domestic and international equities, as of December 31, 2017. In the 20-year period, gold crushed domestic and foreign stocks, bonds, cash and commodities. Most impressive is that, in every period measured above, the precious metal has beaten cash, bonds and commodities.

Having a 5 to 10 percent weighting in gold and gold stocks during these periods could have helped investors minimize their losses in other asset classes.

To learn more about gold’s role in times of rising inflation, click here.

Feb 6, 2018

- The appointment of Jerome Powell as new Fed chair is likely the catalyst that ushers in a multi-decade era of rising inflation and soaring gold stocks.

- I’ve announced a long term target for GDX of $15,000. That really isn’t very high… given the strong inflation numbers that I am projecting for America in the years ahead.

- Having said that, Powell has only been on the job for one day. Investors need to show patience. Wait to see what he actually does before taking “back up the truck” market actions.

- Powell’s first significant actions are likely to be announced at the March 21 Fed meeting. I expect a firm commitment to more rate hikes and more quantitative tightening.

- That’s inflationary because it boosts bank profit margins and they become more willing to take lending risk. That produces a rise in the velocity of money.

- As the cost of borrowing rises, companies will raise prices and workers will demand higher wages. If Powell also makes a firm commitment to deregulating America’s thousands of small banks on or before March 21, inflation would accelerate even more rapidly.

- Please click here now. It’s my contention that wage inflation of 20%+ is not just theoretically possibly, but morally justified. Here’s why:

- For many years, global governments have colluded with central banks to run socialist/fascist QE programs. These programs moved money from workers and savers to government bonds and stock markets. Additional money was simply printed and taken.

- QT, higher rates, and small bank deregulation are beginning to re-empower Main Street. This is happening while “Government Street” (the bond market and the dollar) and Wall Street risk disintegrating.

- Please click here now. Double-click to enlarge this exciting bond market chart. A head and shoulders top pattern is in play. The neckline has been crushed.

- Please click here now. Around the world, governments are announcing import duties. That’s inflationary. If India’s government had cut the gold import duty, it would have increased demand, but the duty itself is also inflationary.

- Please click here now. Institutional money managers are starting to focus on the inflationary implications of Trump’s tax cuts that I highlighted when he first proposed them. In the context of QT, rate hikes, and deregulation, these cuts can increase inflation quite significantly.

- Please click here now. Double-click to enlarge. The bond market is building what I have dubbed a “super top” pattern. The target of the super top is about 80.

- The Fed has projected that rates will take many years to reach “normal” levels. This chart suggests the normalization process will take about seven more years.

- This “normalization” sounds great in theory. In the real world, it involves a decline to 80 for the T-bond price. That would drive borrowing costs for the US government to incredibly painful levels.

- In addition, rates could rise much more quickly than this chart suggests if Trump ordered T-bond creditors to take a haircut on what they are owed. That’s one of his campaign promises.

- As inflation surges, Trump may be forced to devalue the dollar and revalue gold to prevent the US government from imploding or becoming a full dictatorship. Inflate, default, or die. In the near -immediate future, these are the only choices President Trump will have to manage the US government’s horrific size, power, and debt.

- On that note, click here now. Double-click to enlarge. The dollar could go into free fall if it breaks cleanly under 108 against the yen, and the bear flag chart action suggests that is going to happen very soon.

- A breakdown would almost certainly correlate with a gold price surge to about $1370. Please click here now. Double-click to enlarge this daily gold chart.

- There is a small head and shoulders top pattern in play that could push gold modestly lower to the $1310 – $1290 area. The good news is that a bull flag-like pattern is also forming that could negate the top pattern.

- Given the fast-growing inflationary fundamentals, gold investors should now be walking the price gridlines with maximum confidence. Fresh buying for eager gamblers and investors should be done at key levels that I’ve noted on the chart.

- Gold has been rising as the T-bond has fallen hard, and rising as the T-bond has rallied. That’s because gold price discovery for the fear trade is not about rates per se, but about risk. As stock and bond market investors get rocked hard, gold looks like the ultimate asset iron lady!

- Please click here now. A major gold stocks versus gold bull era will occur as the T-bond super top ushers in extraordinarily high inflation for the long term.

- Gold stock enthusiasts need to watch Powell’s actions, because they are the catalysts that will push GDX above $26 and officially begin that fabulous era. Gamblers can buy call options on a two-day close over $26. I’ve urged long term investors to be aggressive buyers in my $23 – $18 tactical accumulation zone. The bottom line is that it’s the cusp of a new era for gold stock investors, and Powell officially launches it on March 21!

Thanks!

Cheers

st

Feb 6, 2018

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

email for questions: stewart@gracelandupdates.com

email to request the free reports: freereports@gracelandupdates.com

Gold Stock Consolidation Continues

Posted by Morris Hubbartt - Super Force Signals

on Friday, 2 February 2018 13:49

Today’s videos and charts (double click to enlarge):

SF60 Key Charts & Video Update

SF Juniors Key Charts & Video Analysis

SF Trader Time Key Charts & Video Analysis

Morris

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

Graceland Updates Points 1-24

1. Technically and fundamentally, gold is poised to resume its magnificent rally that is taking investors into what I call a “bull era”.

2. The next FOMC meeting announcement is tomorrow. I expect the Fed to strongly signal more rate hikes and ramped up quantitative easing. There’s an outside chance that bank deregulation is addressed, but that’s likely going to happen in the next meeting.

3. Regardless, everything the Fed is doing is positive for inflation, negative for government bonds, and negative for the dollar.

4. Please click here now. Nothing is more terrifying to institutional bond market analysts than the prospect of significant inflation.

5. The US government is on the ropes. Rates are rising, QT is creating bond market liquidation, and wages are starting to surge. The inability of the US government to finance itself in an inflationary environment means rate hikes and QT are negative for both the bond market and the dollar.

6. Please click here now. Double-click to enlarge this key short term gold chart.

7. Even though gold has rallied more than $100 an ounce in a very short time frame, the pullback action is very positive. It’s taking the shape of a small positive wedge formation. Solid Chinese New Year demand is likely behind the positive nature of this soft pullback. Global gold investors should be buyers at $1328, $1310, and $1300, with a bigger focus on gold stocks than bullion.

8. During deflationary times, bullion is the leader. During the inflationary times that are beginning now, mining stocks are poised to dramatically outperform bullion.

9. Global growth with inflation and the end for the great global bond market should create at least a decade of gold stock outperformance against gold. These stocks are essentially poised to enter a period of growth much like Main Street America experienced in the 1950s.

10. While all the current news is very positive for gold market investors, the best news of all may be coming on Thursday. Please click here now. On Thursday, India’s national budget is announced and a duty cut may finally happen!

11. Gold’s uptrend against US government fiat ended in 2011 – 2012 as India began increasing the import duty aggressively. This essentially put millions of jewellery workers on the bread line and shuttered hundreds of thousands of small jewellery shops.

12. The bottom line is that Indian government duty hikes basically nuked Western gold mining stock enthusiasts and put the survivors in a horrifying gulag.

13. For the past several years, jewellers have begged the government to begin reducing the duty. Unfortunately, the government has shown no interest in announcing even a tiny cut.

14. Until now. While the commerce department has called for a duty cut for years, this is first time the all-powerful finance department has addressed the issue in a positive way. So, a cut on Thursday is not a “done deal”, but the odds of it happening are now vastly higher than at any time since the import duty peaked at 10% in 2013.

15. Jewellers and dealers are not buying gold in any size now, because they are anticipating the government will finally give them a cut. That’s created some gold price softness over the past week. I’ve suggested that a duty cut could be the catalyst that blasts gold over the $1370 area highs. In turn, that would usher in the start of a rally to massive resistance at $1500.

16. For gold, a duty cut in India has truly gargantuan ramifications. It is the equivalent of a corporate tax cut in America. It restores confidence amongst citizens and shows that the government understands not just sticks, but carrots. When citizens feel good they are more productive. GDP grows, bringing the government more tax revenues. Thursday could be a truly epic win-win day for gold and all its global stakeholders. Are investors prepared?

17. Please click here now. Institutional money managers are starting to see the myriad of inflationary lights flashing that I predicted were coming.

18. Money velocity is starting to rise. The upturn is subtle, but it’s there! As Powell takes over the Fed and ramps up QT, I expect money velocity to surge aggressively from the 60-year lows that it sits at now. As this happens, gold stocks should essentially “run rickshaw” over bullion.

19. Also, key Chinese gold mining stocks that I use (and own) as key lead indicators for Western miners are staging what can only be described as massive long term chart breakouts.

20. Please click here now. Double-click to enlarge this GDX chart.

21. In the summer of 2017, I outlined the $23 – $18 price zone as a key buying area for all gold stock enthusiasts. Investors who took my recommendation are looking good now.

22. Note the return line that I’ve highlighted on the chart. The price is almost there now. Solid rallies often begin from these technical return lines.

23. Chinese “Golden Week” holidays begin around Valentine’s Day. That’s still two weeks away. Gold markets close for a week, and the price usually softens. The jobs report is this Friday. Gold typically rallies in the days following the report. A duty cut, gold-positive statements from the Fed, and post jobs report market strength could see GDX reach my $25 – $26 target by Valentine’s Day.

24. From there a significant market correction would be expected, followed by a major surge to multi-year highs. Please click here now. Double-click to enlarge this GDX weekly chart. In 2018, GDX should surge out of the significant symmetrical triangle that I’ve highlighted. With powerful institutions buying, it should easily reach my $30 – $32 target zone. Gold stocks investors are basically sitting on an inflation-themed money train that the Fed is going to turbocharge with rate hikes, QT, and bank deregulation. All aboard!

Thanks

Cheers

St

Stewart Thomson

Graceland Updates

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair