For the first time in over 30 years, talk of a return to the gold standard has become part of mainstream politics in the United States.

(Ed Note: In Prepare! “The Only Way the World-Debt Problem is Going To Be Solved Richard Russell say’s “The US owns the world’s greatest hoard of gold. It will, in the end, be solved by devaluation (as Roosevelt did in 1933, when he suddenly and unilaterally raised the price of gold from 20 to 35 dollars an ounce. They should unilaterally, overnight raise the price of gold to a high value, maybe around $10,000 an ounce. Thus, each dollar would be worth one ten-thousandth of an ounce of gold. This would allow our enormous debt to be paid off with vastly devalued dollars.”

Part of the official Republican policy adopted it at the recent Republican Convention and called for the commission to look at reestablishing the link between gold and the U.S. dollar. No doubt that plank was added to soothe supporters of Texas Congressman Ron Paul.

However, gold bugs holding gold bullion or even those holding gold ETFs such as the SPDR Gold Shares (NYSE: GLD) shouldn’t hold their breath in anticipation of the gold standard returning. There was a similar commission – the Gold Commission – set up in 1981 by President Ronald Reagan. After a lot of ‘commissioning’, the decision was made to go with the status quo of using fiat Federal Reserve dollars.

Any commission set up under the current president would likely come to the same conclusion. There are simply too many practical obstacles to return to a full-fledged gold standard. Even pro-gold advocates including the World Gold Council and the Gold Anti-Trust Action Committee (GATA) don’t see a gold standard returning.

The key problem would be at what price of gold would the United States peg its currency. Great Britain returned to the gold standard in 1925, after going off it in 1914, at the 1914 peg price. This was a mistake made by Winston Churchill (he called it the biggest he ever made) since it basically ignored the vast inflation in the British pound in those intervening years. The result was a vast overvaluation of the pound and deflation and high unemployment soon followed.

What price would a new Gold Commission set as the “correct” price of the U.S. dollar versus gold? $1,000? $2,000? $5,000? The answer is that there is no “correct” price. Whatever price is set will eventually be tested by the financial markets and fail much as the pegged currencies system failed. So there will be no return to the gold standard.

But that does not mean there will not be a ‘back-door’ gold standard. The move to such as a system is already underway as central banks all over the world are rebuilding their stockpiles of gold. After two decades of heavy selling, central banks became net buyers of gold in 2010 and the momentum has built since. Gold will likely end up being used as ‘good’ collateral by global central banks, as opposed to the shaky collateral sovereign bonds are turning into.

Central bank purchases, led by the emerging markets, are on track this year to hit a record high according to the World Gold Council. China alone in 2011 bought around 490 tons of gold. Other countries including Russia, Turkey and South Korea have added gold to their official holdings in recent months. This buying showed up as central bank purchases in the second quarter of 2012 were more than double the level reported a year earlier at 157.5 metric tons. If the buying continues at current levels, central banks gold purchases would total around 500 tons this year, easily surpassing last year’s 458 tons.

The bottom line for investors from the global central banks’ buying of gold? The gold standard is working its way back into the international monetary system through the back door. This should, in the long-term, put a floor under gold and help maintain it on its steady upward path.

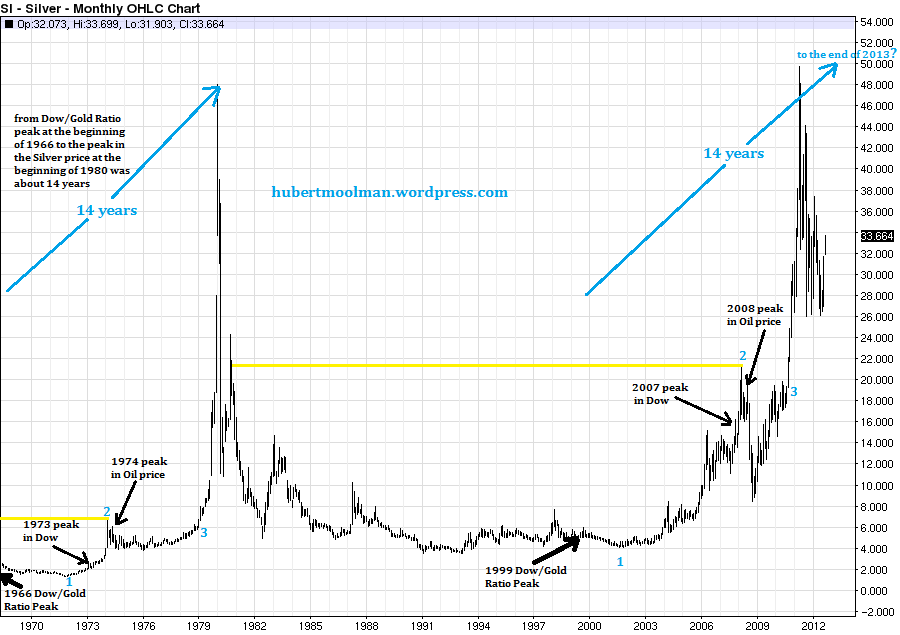

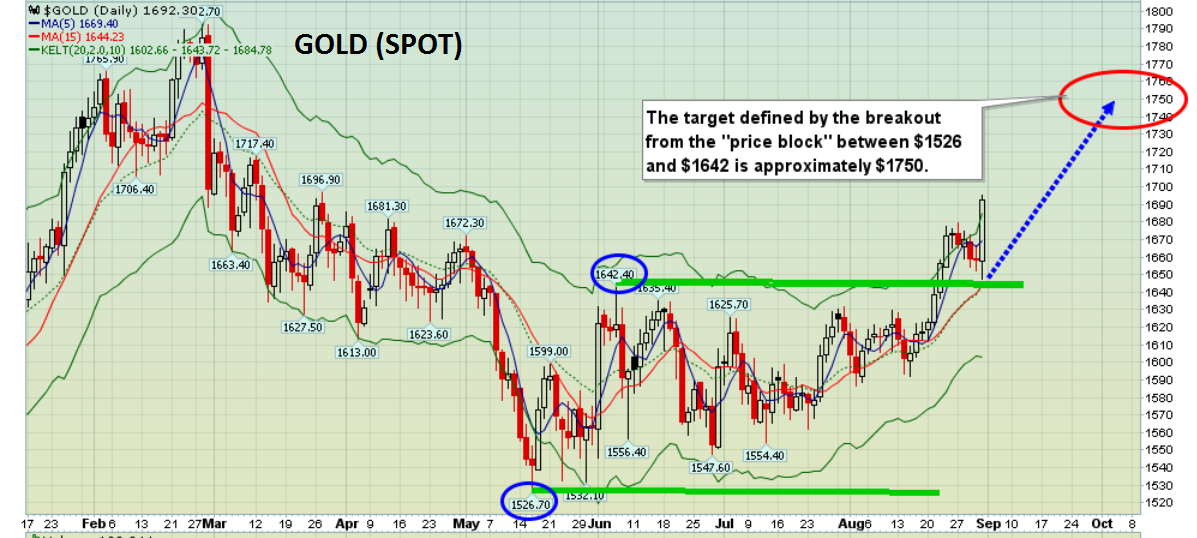

Just last week we started to see gold bullion, silver bullion and gold miner share prices start to breakout to the upside of a 12 month consolidation pattern. This could be the start of the next major rally in precious metals as future uncertainty fears continue to rise. The large bullish technical pattern we see on the gold chart points to much higher prices over the coming 24 months. But keep in mind this is a monthly chart and it could still take months to truly breakout to new highs and start another rally.

If you would like to get my weekly analysis on precious metals and the board market join my free newsletter at www.TheGoldAndOilGuy.com

Chris Vermeulen