Gold & Precious Metals

Key Gold Stocks In Launchpad Mode

Posted by Morris Hubbartt - Super Force Signals

on Friday, 1 December 2017 14:07

Today’s videos and charts (double click to enlarge):

SFS Key Charts & Video Update

SF60 Key Charts & Video Update

SF Juniors Key Charts & Video Analysis

SF Trader Time Key Charts & Video Analysis

Morris

| Friday, Dec 1st 2017 Super Force Signals Unique Introduction For 321Gold Readers: Send an email to trading@superforcesignals.com |

Gold Being Odd and USD Being Tricky

Posted by Przemyslaw Radomski - Sunshine Profits

on Thursday, 30 November 2017 13:41

Every now and then we see some kind of anomaly on the precious metals market. Sometimes it’s particularly useful and sometimes it’s just something random. Yesterday was one of those days when something didn’t seem right. The USD Index rallied, silver declined, mining stocks declined and yet, gold closed the session higher. What can we infer from this uncommon event?

Unfortunately, not much. It was just one day when gold behaved in this way, so at this time we have no reasons to believe that gold’s one-metal rally was anything important. One thing that was visible in the gold market and that wasn’t visible in other parts of the precious metals market was gold’s breakoutabove the triangle pattern. Consequently, yesterday’s strength might have simply been a consequence of the breakout and we already described it yesterday. We wrote that we could see an upswing, but we don’t think it will be anything major, for instance a move to the October high. So, in a way, nothing changed, even though the relative moves during yesterday’s session might have raised many eyebrows.

Let’s take a closer look at the gold chart for details (chart courtesy of http://stockcharts.com).

In yesterday’s alert, we wrote the following:

Gold moved higher on declining volume yesterday, but overall it continues to move back and forth below the $1,300 level. Its move above the 50-day moving average and then 2 closes above are somewhat similar to the October top. The Stochastic and RSI levels are similar as well. The above is a weak, but still, bearish sign. Even though Stochastic is at similar levels, we can see that the current reading is higher. In a way, even though the price of gold is lower, the above means that gold is closer to being overbought now, than it was in October.

On a bullish note, gold confirmed the breakout above the triangle pattern, which could result in a short-term rally. Still, we don’t expect the upswing to take gold much higher – the October high seems to be a likely target if gold’s rally continues. Again, that’s a big if, as based i.a. on the 61.8% Fibonacci retracement in the USD, the latter could rally immediately and gold could decline immediately as a result.

While Monday’s volume during the upswing was relatively low, the volume that we saw yesterday was very low. This, plus the fact that both silver and mining stocks declined, suggests that gold’s rally was most likely accidental – not an indication of a looming rally.

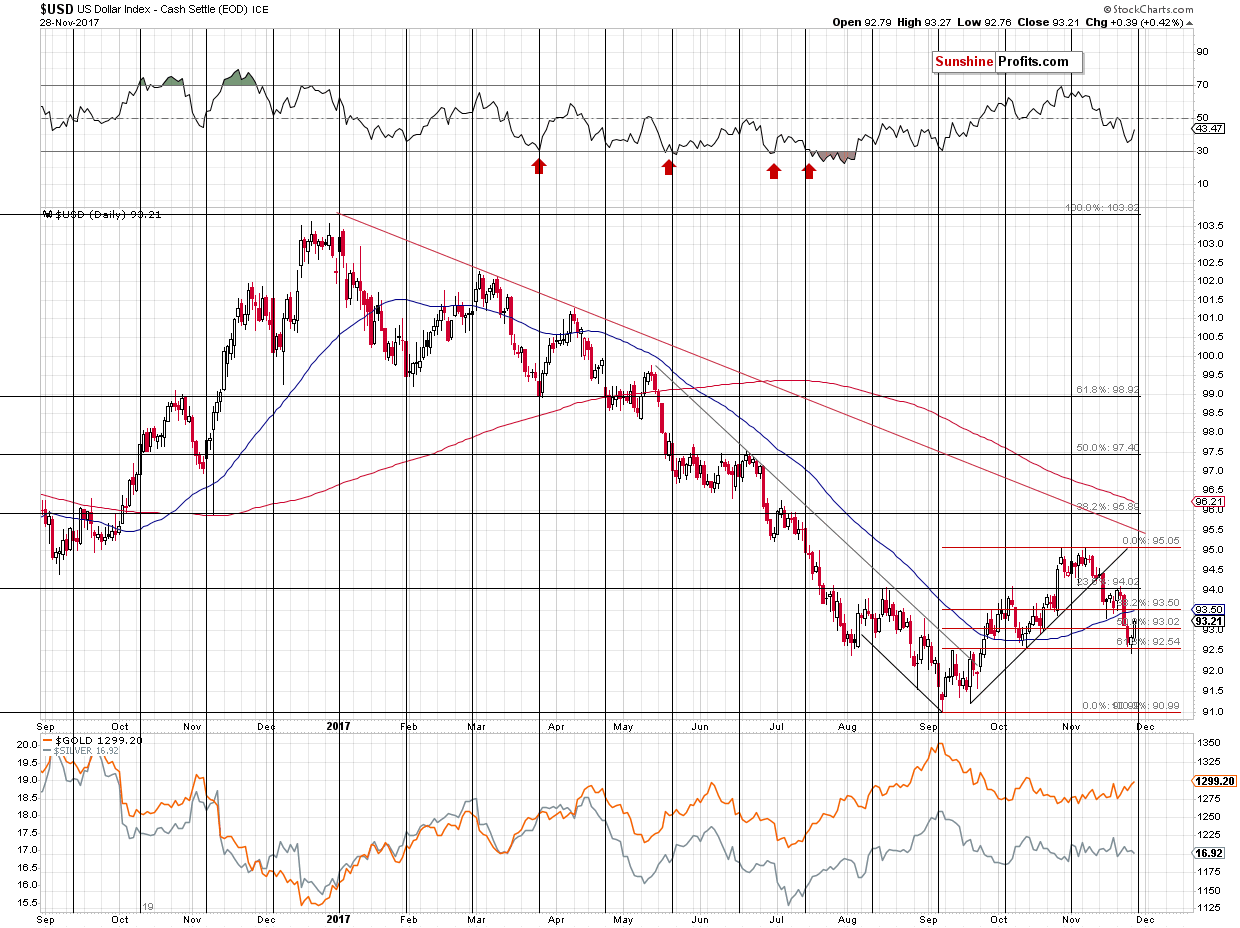

Having said the above, let’s discuss the situation in gold’s main adversary (after all, they tend to move in the opposite ways), the USD Index. If the latter was about to take a dive, we might still expect gold to soar. But is it likely?

No.

The USD Index moved lower in the past few weeks, but not in the past few days. In Monday’s alert, we wrote about a possible move below the 61.8% Fibonacci retracement level and a subsequent invalidation – that’s exactly what we saw during Monday’s session. The reversal took place quite close to the cyclical turning point, which further increases the odds that the bottom is really in and yesterday’s rally further confirmed it.

This is likely also based on the analogy in terms of time to the previous corrections in the early parts of major rallies in the USD.

One of the reasons due to which we expect the USD Index to rally in the coming months is the analogy to its behavior during previous series of rate hikes. The USD didn’t start to rally immediately after the rates were increased in the recent past and while it may seem surprising, this is exactly how things developed in the past. There was a specific delay in the USD’s reaction and it seems that it will also be the case this time. If the history is to repeat itself, it seems that the series of rate hikes is going to trigger a massive rally in the USD Index any week now.

But didn’t USD Index just decline for a few weeks? Doesn’t it invalidate any bullish implications here?

That’s a very good question and we decided to take a closer look at the analogy to the previous major bottoms and the early parts of major rallies. It is often said that time is more important than price and we analyzed the previous upswings and the early corrections with the above in mind. Namely, we checked how long the initial rallies lasted and how long the USD was correcting. You will find the details below:

- 1998 – 1999: the initial rally: 6 weeks, followed by 2 weeks of declines

- 1999 – 2000 the initial rally: 7 weeks, followed by 5 weeks of declines

- 2005 – the initial rally: 6 weeks, followed by 4 weeks of declines

- 2008 – the initial rally: 7 weeks, followed by 5 weeks of declines

- 2009 – 2010 – the initial rally: 4 weeks, followed by 3 weeks of declines

- 2011 – the initial rally: 10 weeks, followed by 2-5 (unclear) weeks of declines

- 2014 – 2015 – the initial rally: 4 weeks, followed by 4 weeks of declines

- 2016 – the initial rally: 4 weeks, followed by 3 weeks of declines

- 2017 (current upswing) – the initial rally: 7? weeks, followed by 4? weeks of declines

The initial rallies lasted between 4 and 10 weeks with the 10 number being the outlier. The average is 6, while the most recent rally either took 7 weeks (quite in tune with the past patterns) or it’s not over yet with 10 weeks so far. If it’s not over, then it would need to rally for an additional week or two, thus making the entire rally even longer than the previous outlier at 11 or 12 weeks (or longer).

Is it therefore possible that the rally will still continue before a bigger correction is seen? Yes. Is it likely? No. Based on the above time analogies it’s more likely that the initial rally is already over and we are after 3 weeks of declines.

Is the above good or bad? Both. It’s good, because we’re likely closer to the big decline in the precious metals market than it first appeared, but it’s bad because we may not get a meaningful and tradable corrective upswing in the precious metals sector after the USD Index moves close to the 96 level. Ultimately, it’s not really a matter of deciding whether the current environment is better or worse, but adapting to it and tweaking the strategy so that it remains up-to-date with the most recent observations. After all, trading is like a game of poker – at times you will get a good hand and at times you will get a back hand, but by having a good strategy toward both situations you’ll likely come out ahead over time.

So, what’s the likely follow-up action from here? If we are indeed after 3 weeks of declines, then if we can estimate how long the rally is likely to last, we could check how long it should take, additionally, for the USD to bottom.

The average length of the correction is between 3.5 and 3.875 weeks depending on the interpretation of the 2011 action. We are already after 4 weeks.

What if instead of using the average, we take into account the most similar cases – where the initial rallies took 6 or 7 weeks. In this case we get an average of 4 weeks (based on 2, 5, 4, and 5 weeks). 5 weeks is the most common analogy (half of the cases), though.

Finally, what if we assume that the most recent rally (2016) is most likely to be repeated as it’s most similar fundamental-wise? In this case, we should expect the decline to take 3 weeks. In other words, it could be over.

All in all, if we average the above approaches, it seems likely that we have either already seen the final bottom in the USD or we’re going to see it this week. Next week is also a possible time target, but it’s not as likely.

Summing up, gold’s rally that we saw yesterday is either inconsequential, if we focus on its performance relative to the rest of the precious metals market, or actually bearish, if we focus on it on a stand-alone basis and compare it to the size of the volume. Moreover, let’s not forget that even though the USD Index declined visibly in the past weeks, mining stocks were unable to invalidate the breakdown below the rising resistance line and the implications remain bearish. There are many signs pointing to a big move lower in the coming weeks and it seems that any short-term strength will be reversed sooner rather than later, especially if the decline in the USD Index is already over. The odds for the latter increased based on yesterday’s rally and the analogy to the previous early parts of major upswings.

Thank you.

Sincerely,

Przemyslaw Radomski

We hope you enjoyed today’s analysis, even though it might appear controversial. If you’d like to receive follow-ups, we invite you to subscribe to our Gold & Silver Trading Alerts.

Nov 28, 2017

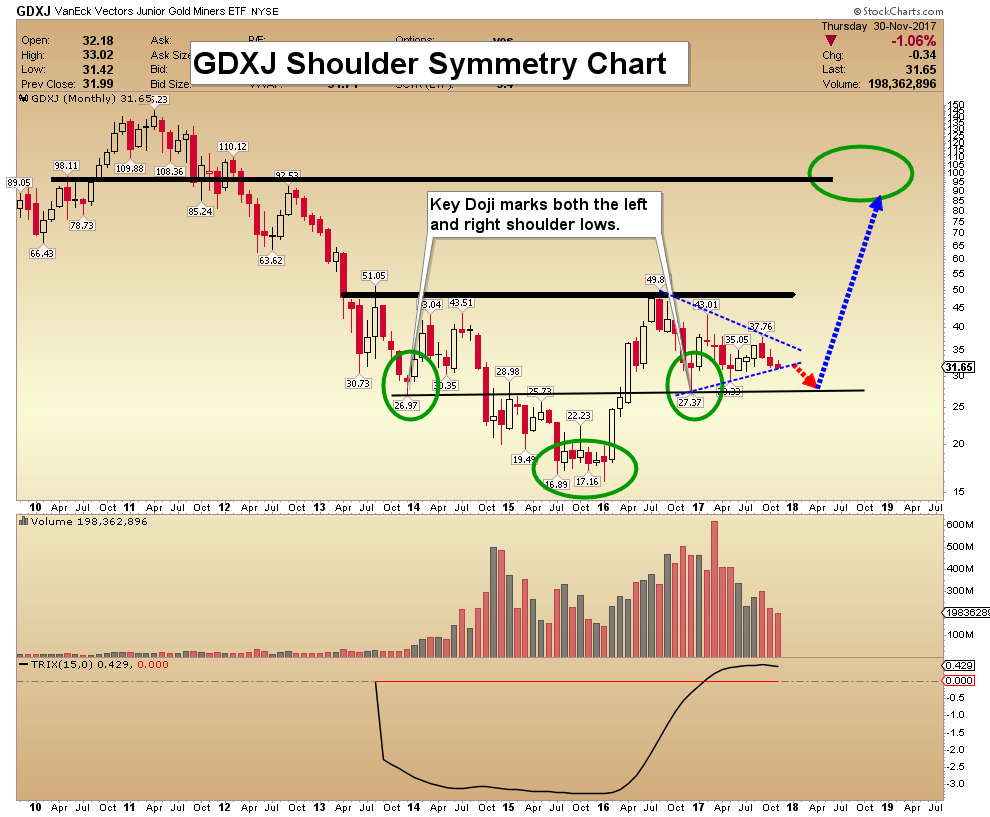

- The big picture for gold continues to strengthen. Please click here now. Double-click to enlarge.

- In 2016, gold began the year at about $1100, soared $300 an ounce to about $1400, but then it gave back about $250, and ended the year at about $1150 with only a $50 gain.

- That price action fit perfectly with my 2014 – 2017 theme of “rough sideways action, initially with a downside bias that develops into an upside bias”.

- The year 2018 should see solid Chindian demand, a reversal in US money velocity, and a peak in mine supply. That should push gold up from the enormous sideways trading pattern and into a substantial uptrend.

- Please click here now. Double-click to enlarge this key weekly gold chart.

- Note the fabulous increase in volume since 2016. This is very positive.

- One of my most important market mantras is that fundamentals make charts. I postulated the “gold will trade sideways with a slight downside bias” thesis in 2014 because I saw gold price discovery transitioning (slowly) away from the fear trade of the West and towards the love trade of the East.

- The imposition of the vile 10% import duty in India put millions of jewellery workers on the unemployment line and it caused a huge restructuring of the jewellery industry.

- The way it was playing out fundamentally suggested that an enormous inverse head & shoulders pattern would be created as that restructuring progressed.

- The transition in America from deflation to inflation and the peak in mine supply are supporting fundamental factors for the way the inverse head and shoulders pattern has been built.

- The bottom line is that in the right shouldering area of a massive inverse head and shoulders bottom pattern, investors should expect the price to trade sideways with an upside bias, and as the pattern nears completion, that upside bias will intensify.

- That’s exactly what is happening now. Gold is poised to end 2017 giving back very little of what it gained.

- Please click here now. Double-click to enlarge. The dollar’s action against the yen is a key indicator of the amount of risk that institutional investors are likely to take.

- On that note, the dollar has been very weak recently against the yen, breaking down from a bear wedge formation and forming a potential head & shoulders top. A potential weak right shoulder has yet to even materialize.

- Why is the dollar so weak? For the possible answer, please click here now. The US stock market has no more QE and falling interest rates to power it higher in the face of rather anemic real economy growth.

- Institutional investors are betting on tax cuts to keep the stock market party going, but it’s possible that major bank FOREX traders are selling the dollar in anticipation of a delay in getting the cuts done.

- I’m very disappointed with Corker’s plan to raise revenues (taxes) if tax cuts don’t generate growth. A chainsaw needs to be taken to US government spending, but it’s not happening. The US stock market could take a major hit if the tax cuts legislation fails.

- That could cause institutions to buy a lot more gold and assets like it. On that note, please click here now. Double-click to enlarge this spectacular bitcoin chart.

- Effective immediately, I’m raising my long term bitcoin target from $500,000 to $2million. I’ll go over the fundamentals and mathematics of that target upgrade in my next www.gublockchain.com update, but I’ll note that the reasoning is quite mundane.

- Still, I advised my subscribers to book some solid partial profits in the current $10,000 round number area early this morning. My accountant tells me that nobody gets poorer by booking a profit, and I agree!

- Do I think bitcoin has inherently more risk or less risk than the US dollar? That’s hard to quantify, but great profits can be booked now, and that’s really all that matters.

- Please click here now. Double-click to enlarge this nice GDX chart.

- There’s no question that some of the risky junior miners have had a very disappointing year, but most of the seniors are starting to look quite “perky”.

- GDX sports a beautiful bull wedge pattern, and the next US jobs report is scheduled for Friday, December 8. That report should be the catalyst for a great gold stocks rally. It should also start gold on its final advance towards the key $1400 neckline area of the massive inverse H&S bottom pattern, with an upside breakout occurring in 2018!

Thanks!

Cheers

st

Nov 28, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

Are Trend Following and Gold a Perfect Match?

Posted by Charlie Bilello - Pension Partners

on Monday, 27 November 2017 14:21

Market participants are often heard saying things like “you can’t trade Gold on fundamentals.” With no cash flows to discount, Gold is a different animal than stocks or bonds. It is said to swing higher and lower due to changes in investor sentiment alone. Many a trader will advise you to simply follow the trend:

- When Gold is in an uptrend, own Gold.

- When Gold is in a downtrend, go to cash.

Going back to 1975 (when Gold futures began trading), how would such a strategy have fared?

At first glance, pretty good. Owning Gold when it closed above its 200-day moving average and moving to cash when it closed below it would have resulted in a higher return (5.1% vs. 4.6%) with lower volatility (16.5% vs. 20.0%) than buy-and-hold.

The maximum drawdown: 51% for trend following versus -69.6% for buy-and-hold.

Case closed, trend following wins?

Not so fast. We have yet to include the transaction costs that exist in the real world. The trend following strategy would have traded around 3.75 times per year going back to 1975. At a cost below 0.14% per trade, trend following still beats buy-and-hold. At anything above 0.14%, trend following underperforms.

While 0.14% may seem somewhat high in today’s world, for a long time it would have been deemed quite cheap (see chart below). It’s likely that the average transaction cost (slippage and commission) since 1975 was well above 0.14%. Which means it would have been difficult for trend following to beat a buy-and-hold strategy in practice.

Source: A Century of Stock Market Liquidity and Trading Costs, Jones (2002)

Does that mean trend following in Gold “doesn’t work”? It depends on what your definition of “work” is. If by “work” you simply mean a higher return, then that might be be an accurate assessment (if we include transaction costs). But looking back at history, the real value in trend following is not on the return side of the equation, but on the risk side. (Note: we showed something similar in our research paper on moving averages and leverage in the equity market).

As evidence of this, trend following produced a higher return in all of the worst years for Gold. This is what leads to the lower volatility/drawdown profile, as you are cutting your losses after a break of the 200-day moving average that continues lower.

The trade-off, beyond higher transaction costs? Missing out on upside during strong periods (ex: 2002 – 2012) and being whipsawed in choppy, sideways markets (ex: 1990, 2014, 2017). Overall, the trend following strategy would have outperformed in only 35% of years since 1975 (ignoring transaction costs). This includes a long stretch from 1998 through 2009 where a simple buy-and-hold of Gold outperformed a trend-following strategy in every year except one (2002, when they were tied).

What should a trader/investor take away from all of this?

Markets are hard. The notion that simply “following the trend” in Gold will lead to vast riches is a false one. It would have been far from easy for someone to stick with such a trend following strategy over time (many, many periods of underperformance) and far from conclusive that doing so would have been superior than buy-and-hold (if we include transaction costs). And while most traders talk of trend following in terms of capturing profits from strong upward moves, the real value in trend following is just the opposite: in avoiding strong downward moves that continue lower for a period of time.

So while the saying “you can’t trade gold on fundamentals” may be true, that doesn’t mean trading it on technicals is any easier.

***

Related Posts:

To sign up for our free newsletter, click here.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Pension Partners, LLC in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Pension Partners, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

CHARLIE BILELLO, CMT

First published on Sunday Nov 19 for members: While I would love to believe that the rally we saw on Friday is the start of the next larger degree break out in the metals complex for which many have been eagerly awaiting, there are many signs that suggest it is only part of a corrective rally.

As I noted in my update last weekend:

“But, please, do not assume we have struck a bottom and expect that we are now ready to break out simply because we see another rally begin in the coming weeks. The market still has a lot to prove to us, especially since the primary set up we now have on our charts suggest we can see prices that are lower than where we closed on Friday. But, again, I will certainly maintain an open mind depending upon how the next REAL rally takes shape.”

Now, the question that I still maintain in my mind is if this is even the “real rally” that I have been looking for over the last few weeks. And, yes, I am still questioning it.

While my primary expectation has been looking for a larger b-wave rally to take shape in gold and silver, many of the stocks I track in the mining complex do not look ripe for the major break out to begin.

First, I want to focus on the metals. The attached 144-minute silver chart is quite representative of the “mess” we have been experiencing in the metals of late. My primary expectation is that we should see a rally in the metals, but I am still not quite certain if we will see one more spike down before the larger b-wave rally I am expecting takes shape in earnest. Unfortunately, due to the messy structure of late in the charts, I have no high probability perspective that suggests we have begun that rally with the move on Friday. In fact, we still have potential for one more spike down before we are able to strike our targets overhead.

But, I think the bigger perspective is that, whatever rally we see, it seems more likely than not that the rally will only set us up for a c-wave down before the market will be ripe for a break out set up into 2018.

That now brings me to the miners. And, I am going to again begin with the leading miner I watch, the ABX. As I have been noting for the last several weeks, the ABX has not likely bottomed. And, I do not believe that the complex is going to be ready to run when one of the largest holdings in the GDX is not ready to run. It will certainly act as a major weight upon the GDX.

As you can see from my daily chart, I am patiently awaiting a wave iv rally in the ABX. But, the micro structure suggests that we could have one more spike down before wave iii has completed. While it is certainly “possible” that the wave iii ended with a truncated bottom, it would take a move through the 14.20-14.30 region to convince me of that potential. As long as we remain below that resistance region, we can still see one more spike down in wave iii before the wave iv rally takes shape. So, in effect, this is presenting in the same way as I view the metals themselves right now. Again, another reason as to why I have been tracking the ABX a bit more closely of late.

So, for now, I am still looking for a rally to take hold in the overall complex. But, I think the jury is still out as to whether the rally seen on Friday is the start of that move higher, or just a head fake before the real rally takes hold.

And, again, I would like to reiterate that any rally that is seen in the coming weeks will likely be followed by a bout of weakness. I see that weakness as a c-wave down in wave (2) in the metals, which could also be something even a bit more bearish in GDX, depending on whether GDX can exceed the 24 region in impulsive fashion to fill in the yellow count or not. My expectations on GDX is supported by the fact that I do not believe we will be ripe for a GDX break out until the ABX completes its waves iv-v, which suggest the ABX will see a lower low below that created in its current wave iii down. A break out in the ABX through its resistance could change that expectation.

Lastly, anyone who can take a longer term perspective on the metals complex would realize that the market is now giving you one last opportunity to board the train which will likely provide us with an extraordinarily powerful rally which will likely begin in early 2018.

See charts illustrating the wave counts on the Silver (YI), GLD, GDX & ABX.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair