Gold & Precious Metals

1. Without growth in Western gold ETF holdings, the “decent but not spectacular” demand from China and India is not strong enough to move the gold price higher.

2. Please click here now. The SPDR (GLD-nyse) fund gold holdings currently sit at about 843 tonnes. There has been very little change in the total tonnage for several months. That’s neutral for the gold price.

3. Governments don’t like their citizens to own much gold. Restrictions they impose (like India’s import duty as a recent example) dampen demand enough so that the price rises very slowly most of the time.

4. Economic growth in China and India are increasing demand (the love trade) and mine supply is contracting, but the process is essentially “Chindian water torture” for investors who want to see the price skyrocket like it did in the late 1970s.

5. Investors that want “big action” in the gold price need to wait patiently for the US business cycle to peak.

6. For the price of gold to really sizzle, the business cycle needs to have an inflationary peak. That hasn’t happened since the 1970s. Many gold price analysts have used overlap charts that suggest the gold market now is akin to the 1976-1978 period.

7. I look at fundamentals first, and charts second. From an inflationary standpoint, the US economy looks more akin to the late 1960s than the late 1970s.

8. The winds of inflation are beginning to blow, but they won’t become a hurricane for some time. Having said that, I’ve noted that the St. Louis Fed has calculated that the QE program would have sent the US inflation rate above 30% if money velocity had been at normal levels.

9. The Fed is projecting seven rate hikes over the next 24 months, and Goldman Sachs projects there could be nine. I’ve predicted there will be six. Whatever the number turns out to be, it will likely be enough to move a lot of money into bank accounts.

10. As that happens, banks are likely to become very aggressive with new loans, because the fractional reserve banking system makes the potential reward worth the risk. The Fed’s new accelerated quantitative tightening program will also help push money into banks.

11. Odds are very high that money velocity begins to rise quite strongly later in 2018 and into 2019. The bottom line is that inflation could rise much faster than anticipated over the next 24 months.

12. That could essentially create an institutional and retail investor stampede into gold.

13. For now, in the $1200 – $1000 price zone gold is well-supported but sluggish.

14. I don’t expect that to change until money velocity moves higher, and that’s unlikely to happen until institutions see that the Fed is serious about consistent hikes and accelerated QT.

15. Trump’s tax cuts and tariffs can speed up the arrival of inflation, but the tariff action has been modest, and his tax cuts are bogged down in congress and the senate. The meandering gold price reflects this quagmire.

16. Please click here now. Double-click to enlarge. Gold’s technical price action also fits with the slow arrival of inflation. Bulls and bears are equally frustrated.

17. My www.gudividends.com investors are happy, because they get paid to wait. There’s no question that gold investors need to wait. If investors must wait for something, they should get paid with a bird in the hand, not just a promise of a bird in the bush!

18. Dividends are probably the least exciting type of investment for gold bugs. A lot of the stock market’s gains have really come from dividends, but few investors think about this fact.

19. Compounded 4% – 8% payouts can build significant wealth over time, and reduce the frustration of waiting for gold market “blastoff” moments.

20. Please click here now. Double-click to enlarge. The dollar-yen price action correlates strongly with dollar-gold.

21. There’s a bear wedge in play and overhead resistance at about 114. There’s also a potential head and shoulders top formation. The dollar “should” fall down, but it may not happen until Chinese New Year gold buying begins and the Fed does its next rate hike.

22. Please click here now. Double-click to enlarge this GDX chart. A beautiful bull wedge is in play and my 14,7,7 Stochastics oscillator is moving higher.

23. Unfortunately, without a rally in gold bullion, GDX is unlikely to perform as well as the bull wedge pattern implies it will.

24. Gold bugs have incredible patience and intestinal fortitude. That’s necessary because debt-soaked governments will do anything and everything to avoid paying the piper. I’ve described the $23 – $18 price zone as a key accumulation zone for investors, and GDX is in the upper part of that zone now. Buying gold stocks value is vastly more important than predicting the price, and that value is here for the taking in this key accumulation zone!

Thanks

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

My Conviction in Gold Royalty Companies and Bitcoin

Posted by Frank Holmes - US Global Investors

on Tuesday, 14 November 2017 12:41

Some of you reading this might already be familiar with the “Parable of the Talents,” but it’s worth a brief retelling. The story, which appears in the gospels of Matthew and Mark, involves a master who entrusts three servants with some of his “talents,” or gold coins, while he’s away on business. Two of the servants take a risk by putting the money to work and end up doubling their master’s wealth. The third servant, however, buries his share to “keep it safe” and so doesn’t generate any returns. (Indeed it likely loses value because of inflation.)

When the master returns, he’s so pleased at how the first two servants grew his wealth that he puts them in charge of “many things” and invites them to share in his own success.

The third servant, though, he calls “wicked and lazy” and says he might as well have deposited the money in a bank while he was away—at least then he would have received a little interest. The servant is punished by having his share of the talents given to the two who faithfully grew their master’s money, leaving him with nothing.

The lesson here should be plainly obvious, and we can express it in a number of different ways: There can be no reward without risk. You must spend money to make money. You reap what you sow. This should resonate with investors, entrepreneurs and any true believer in the power of capitalism.

Jesus’ parable applies not just to individuals but to corporations as well. Companies must grow to keep up with the rising cost of labor and materials and to stay competitive. To do that, they must put their money to work just as the two servants do.

And just as the two servants were invited to share in their master’s success, corporate growth has a multiplier effect—for the company’s employees and their families, shareholders, the local economy, strategic partners, companies up and down the supply chain and much more.

A Bonanza for Precious Metal Royalty Companies as Exploration Budgets Have Declined

I think the business model that best illustrates the meaning of the “Parable of the Talents” is the one practiced by gold and precious metal royalty companies. As much as I write and talk about royalty companies, I still encounter investors who aren’t aware of how significant a role they play in the mining space.

As a refresher, these firms help finance explorers and producers’ operations by buying royalties or rights to a stream. Because miners have had to slash exploration budgets since the decline in metal prices, the kind of financing royalty companies provide has only grown in demand—as evidenced by the mostly positive earnings reports last week.

Chief among them is Franco-Nevada, which had a very strong third quarter, reporting earnings of $55.3 million, or $0.30 a share, up 3.4 percent from the same three-month period last year. The Toronto-based company, having also recently diversified into the oil royalties space, closed its purchase of an oil royalty for C$92.5 million, bringing the number of its oil and gas assets up to 82. Including precious metals and other minerals, the total number of assets Franco-Nevada had in its diverse portfolio as of the end of the quarter stood at 341.

Here’s the multiplier effect: Not only do the miners benefit from the deals, allowing them to continue exploration and other operations, but shareholders are also rewarded handsomely. Since the company went public nearly 10 years ago, it’s raised its dividend each year and its share price has outperformed both gold and relevant gold equity benchmarks. After its earnings announcement last Monday, Franco-Nevada stock closed up more than 6 percent on the New York Stock Exchange (NYSE), its best one-day performance in nearly a year and a half. Shares hit a fresh all-time high last week.

Other royalty companies’ reports were just as impressive and show the rewards of putting your “talents” to work. Sandstorm Gold, reporting higher operating cash flow of $11.9 million, has acquired as many as 10 separate royalties since the end of September on properties in Peru, Botswana and South Africa that collectively cover more than 2.4 million acres.

Osisko Gold Royalties bought a $1.1 billion portfolio of 74 precious mineral royalties, including a 9.6 percent diamond stream. The company reported record quarterly gold equivalent ounces (GEOs) of 16,664, up 65 percent from the same quarter last year, and record quarterly revenues from royalties and streams of $26.1 million, up 48 percent.

Royal Gold also had a strong quarter, reporting operating cash flow of $72 million, an increase of 30 percent from last year, and returned as much as $16 million to shareholders in dividends.

Wheaton Precious Metals, the world’s largest precious metal streaming company, showed a sizeable decline in profits in the third quarter, but it continued to generate strong cash flow and looks poised to meet its end-of-year production guidance.

Although some investors might not realize how important these companies are to the industry, many other investors are opting to place their bets on royalty names, seeing them as having ample exposure to precious metals without some of the risks associated with producers. In its review of the third quarter, the World Gold Council (WGC) reported that global gold demand fell to an eight-year low as investment in gold ETFs slowed to 18.9 metric tons, down from 144.3 metric tons in last year’s September quarter. This could be a consequence of the media’s continued negative coverage of gold, despite its competitive performance against the S&P 500 Index. Whatever the cause, in this environment, there was no lack of love for royalty names, as you can see in the chart above.

A Changing Financial Landscape

We were one of Wheaton Precious Metals’ seed investors in 2004, when it was then known as Silver Wheaton. Because Franco-Nevada wouldn’t be spun off from Newmont Mining for another three years, Wheaton had first-mover advantage. It was something new, something different. This, coupled with what I recognized as a superior business model, gave me the conviction to allocate capital into the fledgling company, a move that turned out to be highly profitable.

Today I have the same conviction in blockchain technology and digital currencies. As of the end of October, the initial coin offering (ICO) market had raised $3 billion so far this year. That’s more than seven times the amount generated in crowdfunding in all of the previous years before 2017. And Bloomberg just reported that Google searches for “buy bitcoin” recently surpassed searches for “buy gold.”

With bitcoin’s market cap having grown past that of Goldman Sachs and Morgan Stanley, cryptocurrencies can no longer be written off as a curiosity. Major financial institutions have become bullish, having filed approximately 2,700 patents in blockchain technology.

Abigail Johnson, the youthful chairman of Fidelity, was quoted as saying, “Blockchain technology isn’t just a more efficient way to settle securities, it will fundamentally change market structures, and maybe even the architecture of the internet itself.” Johnson allegedly has a crypto-mining computer rig in her office, and Fidelity accountholders are now able to see their bitcoin holdings on the brokerage firm’s online platform. USAA, the massive financial firm used by millions of U.S. military personnel and their families worldwide, provides a similar service.

![]()

This all comes as Coinbase, a leading digital currency broker, saw a record number of people opening new accounts on its platform recently, doubling the number of accounts from the beginning of the year. In one 24-hour period, 100,000 new accounts were opened.

Millennials Driving Interest in Blockchain Technology and Cryptocurrencies

A lot of this growth in demand is thanks to millennials, the largest U.S. generation. Forget the stereotype of the “entitled” millennial in the workplace and the misconception that they’re all wasting their money on $10 avocado toast. Consulting firm Deloitte estimates that by 2020, millennials will make up 50 percent of the workforce and control between $19 trillion and $24 trillion. Many are savvy investors and were found to be more likely to be aware of their brokerage account fees than older generations, according to Charles Schwab’s Modern Wealth index.

In some ways, millennials are reshaping our living habits. Many of them choose to rent instead of own to stay mobile. They’re more likely to get their news from Twitter than from TV. Online dating apps have helped foster today’s hookup culture, but while young people now might have more sex partners than before, they’re having less sex overall than their parents or grandparents might have had at their age.

It’s little surprise, then, that millennials are among the earliest and most enthusiastic adopters of blockchain technology, bitcoin and digital currencies in general—none of which existed even 10 years ago. A poll conducted by Blockchain Capital found that large percentages of millennials would prefer $1,000 in bitcoin to $1,000 in other assets. More than a quarter said they would prefer bitcoin to stocks, while nearly a third preferred it to bonds.

What I find especially encouraging is that only 4 percent of those who took the poll owned or had owned bitcoins. I say encouraging because this suggests there’s quite a lot of upside potential for bitcoin ownership, which in turn could raise prices further. As I shared with you recently, Metcalfe’s law states that the bigger the network of users, the greater that network’s value becomes. Consider Facebook. The social media giant has more than 2 billion active users. That’s 2 billion pairs of eyes Facebook is able to charge top dollar for advertisers to reach, helping it deliver record profits in the third quarter.

We could see the same thing happen across the blockchain and cryptocurrency network as more and more businesses and people embrace this new form of exchange.

Ploughing Capital into Blockchain

It should be clear by now that something is changing in financial markets, and this is what inspired me to make a strategic investment in a company with first-mover advantage in the cryptocurrency space, just as we did with Silver Wheaton years ago. As the “Parable of the Talents” teaches us, no reward can come to you without some risk-taking. Doing nothing is not an option.

That company is HIVE Blockchain Technologies, a blockchain infrastructure company involved in the mining of virgin digital currencies. The first company of its kind to sell shares to the public, HIVE began trading on the TSX Venture Exchange on September 18.

I’m very excited about this new chapter in our company’s history. If you weren’t on today’s earnings call, you can download the slide deck here to learn more about our deal with HIVE and what it means for our investors and shareholders.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The index benchmark value was 500.0 at the close of trading on December 20, 2002. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The Modern Wealth Index tracks how well Americans across the wealth spectrum are planning, managing and engaging with their wealth. Developed in partnership with Koski Research and the Schwab Center for Financial Research, the Modern Wealth Index is based on Schwab’s Investing Principles and composed of 60 financial behaviors and attitudes, each assigned a varying amount of points depending on their importance.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Frank Holmes has been appointed non-executive chairman of the Board of Directors of HIVE Blockchain Technologies. Both Mr. Holmes and U.S. Global Investors own shares of HIVE, directly and indirectly.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 09/30/2017: Franco-Nevada Corp., Royal Gold Inc., Osisko Gold Royalties Ltd., Sandstorm Gold Ltd., Wheaton Precious Metals Corp., Newmont Mining Corp.

A “Silver” Lining In The Metals Market

Posted by Avi Gilburt - ElliottwaveTrader.net

on Monday, 13 November 2017 13:19

When I look at the 3 charts that I follow in the metals complex, they seem to be telling a different story today, at least in their micro structures.

When I look at the 3 charts that I follow in the metals complex, they seem to be telling a different story today, at least in their micro structures.

Silver seems to have broken out of its downtrend, and can be viewed as having completed wave i of its (c) wave to the target box above. GLD seems to be stuck in neutral, with the same “potential” structure as silver, but without as much clarity to its micro count as silver has potentially presented.

And, then we are left with the GDX. As long as the GDX remains below the 23.05 level, it still has a smaller degree set up to test the 22 region before a rally may ensue.

So, on Friday (Nov 3), GDX has now dropped down and provided us the lower low I was looking for this past week right into the support region I noted last weekend between 21.95-22.30. Moreover, both gold and silver have now pulled back from their rallies begun this past week, and have still retained a set up to rally in the upcoming week.

Based upon the smaller degree wave counts, it certainly still seems as though the miners and the metals are potentially in different patterns, with the upcoming week set up to provide us further confirmation of this potential.

As I have noted for the last several weeks, silver really seems to be the more telling of the metals charts. I have been following a potential count which suggests that a (c) wave rally within a b-wave of wave ii is taking shape. And, I have noted that as long as we hold over the 16.40-16.50 support region, we can rally back up towards the September highs. This past week, silver broke out of its downtrend channel, and suggested that the (b) wave of the b-wave had completed, and that we also completed wave i of the (c) wave of the b-wave rally. While the micro structure can still support one more small drop before a rally may begin, as long as we hold over 16.65, my expectation is to see us rally back up towards at least the 17.85 region.

However, if silver were to break down below the 16.65 level, it would break its immediate upside set up, and place this pattern into serious question. And, if the market would then continue below the 16.30 level, it certainly opens the door for a much larger decline to be seen in silver. So, please remember that my primary expectation is that any rally we see is likely going to be corrective, which means you must remain quite vigilant, as it is quite possible that the market may not provide us with the larger bounce that I ideally want to see, despite my primary expectation. Along these lines, I have now provided you with the parameters which would suggest the market may be dropping a lot deeper than I had initially expected.

Now, as I have mentioned in the title to the article, I am starting to see a “silver lining” in the market action, and it relates to the miners rather than silver itself. I have warned that GDX could see as much as a 30% decline down to the 17 region once we broke below the upper support in September. And, that was based partly upon my read of the ABX, which is one of the major holdings within the GDX. This past week, ABX has dropped almost to the point where it would complete wave iii of (c), as you can see from the attached chart of the ABX. (Also, please note that I have dropped down our resistance region on the ABX chart). Yet, GDX has not seen a commensurate drop alongside of the ABX. While GDX may certainly catch up in the coming week or two, once ABX begins its wave iv bounce, it will likely pull the GDX up with it. And, should that wave iv begin in the coming week or so, it may suggest that the GDX may not break below the 21 region.

So, while we certainly had a set up to see the GDX drop to much lower levels, the recent relative strength we have seen in the GDX as compared to the ABX may suggest that it may not see as deep a drop for which it had been set up over the last few weeks. And, as I have noted before, the next rally will likely tell the story for the miner’s complex as a whole. As long as we do not see a direct and strong break below the 21.20-21.87 (slightly modified support region), we may see the GDX retain a more immediate bullish stance, which could suggest the yellow count may take shape into the end of the year.

Over the past several months, especially since we broke below the upper support back in September, I have been noting this market has now entered a region of uncertainty. And, I am still of the opinion that we will need to see how the next rally takes shape for us to have a better understanding of which pattern we will need to follow into the end of the year. But, what these patterns have in common is that it still does not look like this market will be ripe for a major rally again until early 2018. And, the probabilities are beginning to increase that the GDX may not see as deep a drop as I had initially expected, and the next few weeks may provide evidence that can make this potential much more likely than not. Stay tuned.

See charts illustrating the wave counts on the GDX, GLD & Silver (YI).

By Avi Gilburt via Elliot Wave Trader

Nov 7, 2017

- The synergistic relationship between gold and economic growth is quite healthy, and poised to become even more healthy in 2018 – 2019.

- Please click here now. Double-click to enlarge this fabulous South Korean stock market ETF chart.

- Big name Western money managers are finally racing to move money into Asian markets, and this is great news for both gold and global stock markets.

- For several years I’ve recommended that the gold community slightly reduce (but not drop) their focus on gold’s Western world fear trade and increase their focus on the Eastern stock markets and the love trade for gold.

- South Korea’s stock market sports 50% earnings growth and a P/E ratio of just 10! Japan’s market is also red hot, and so are the markets of China and India.

- US markets have risen strongly, but with anemic economic growth and nosebleed valuations. Growth is vastly stronger in Asia, but without European and US money manager participation, Asian stock markets have previously languished.

- This situation has changed dramatically in 2017, and 2018 should see an acceleration of this new trend.

- The bottom line: American markets are hot but overvalued. Asian markets are red hot but not overvalued.

- I own ETFs (and some individual stocks) in the “Big Four” Asian markets; India, China, Japan, and Korea. I urge all Western gold bugs to “get with the (good) times”. The fear trade for gold will never disappear, but it’s a new era, and this new era is dominated by Asia.

- Investors should be very comfortable owning Asian stock markets and gold… at the same time. The bottom line: America isn’t out, but Asia is in!

- When times are good (and they are now very good in Asia), Asians buy more gold. Exponentially more. Chinese demand reflects this fact. It’s rising again; demand is up almost 20% over 2016, and poised to rise even more strongly in 2018.

- Please click here now. Next, please click here now. Double-click to enlarge this daily gold chart.

- Technically, gold’s rally ended in early September because of significant resistance at $1362 (the demonetization night high).

- Fundamentally, gold peaked then because of the Modi government’s August 23rd launch of the hideous PMLA program. That launch immediately sent Indian imports plunging towards the zero marker. When Indian gold imports sink, the price of gold sinks. It’s that simple.

- The good news: The government has rescinded PMLA and imports are growing again. Wedding season is beginning and Chinese New Year buy season approaches. As a result, the price is showing firmness, and a gold price rally appears imminent.

- I’ve predicted that Indian GDP growth should hit 10% by 2020. America’s could fall to 1% by then while US inflation starts surging and gold mine production shrinks noticeably. This is an epic win-win situation for gold.

- Sentiment in the gold and hedge fund communities is now generally negative, as it always is when significant rallies begin.

- Please click here now. Double-click to enlarge. There’s a bear wedge in play on this dollar-yen chart now, which is more good news for all gold price enthusiasts. The commercial traders are also adding to their short positions in the dollar against both the yen and the Swiss franc.

- Please click here now. Double-click to enlarge this GDX chart. There’s a modest head and shoulders top pattern in play, and that has a lot of old timer gold bugs nervous.

- Unfortunately, these old timers may be too obsessed with the Western fear trade era of the past, and missing out on the Asian stock markets and gold price synergy that defines the new gold bull era.

- Minor H&S top patterns like this one are irrelevant in the big picture, and this one may be getting technically voided anyways.

- On that note, please click here now. Double-click to enlarge. This is just what the gold bug doctor ordered, to spread some bull era cheer!

- A fabulous bull wedge pattern is destroying the H&S top pattern, which makes sense given the great fundamental action taking place in India and China.

- Owning the “Big Four” stock markets of India, China, Korea, and Japan while engorging on gold, silver, gold stocks (with some bitcoin for extra wealth building fun), is perhaps the greatest “no-brainer” investor play in the history of markets!

Thanks!

Cheers

st

Nov 7, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

Silver’s Sign and USD’s Upcoming Reversal

Posted by Przemyslaw Radomski - Sunshine Profits

on Wednesday, 8 November 2017 13:29

Most of technical analysis that one can read about gold and gold stocks is based on these markets alone. This is quite strange given the multitude of intermarket relationships, but still that’s the case. While it is true that looking at the performance of a given market is the most important thing that one can do when estimating the future performance of a given asset, it doesn’t mean that it’s all there is to it. Conversely, looking at the bigger picture and considering the less known factors can give investors and traders extra insight necessary to gain the Holy Grail of trading – the edge. So, we thought that you might appreciate a discussion of factors that are not as popular as the analysis of the precious metals market on its own, but that is still likely to have an important effect on its price.

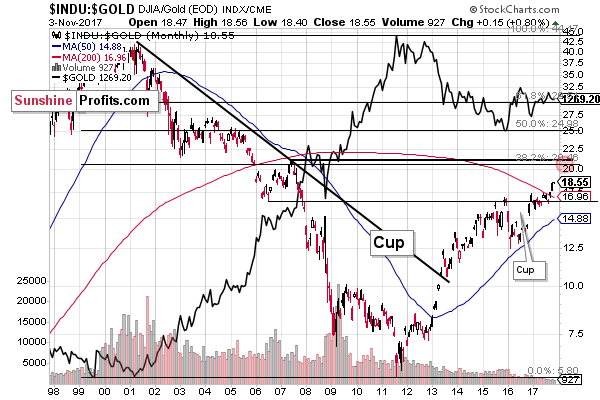

In today’s free analysis, we discuss three such issues: the non-USD silver price (the average of silver prices in terms of currencies other than the U.S. dollar), the Dow to gold ratio and the long-term USD Index picture. The latter is quite often analyzed, but such analyses are generally conducted based on only the most recent data and thus what we discuss should put such comments in proper perspective. In other words, it should make sure that one doesn’t miss the forest for individual trees. Let’s start with the former (chart courtesy of http://stockcharts.com):

Silver’s non-USD performance is something that should be kept in mind and the same goes for the ratio of weekly volumes between silver and the UDN ETF (as that’s how we obtain the non-USD price). The above should not be ignored because silver is an important part of the precious metals sector (and the one that provided biggest gains in the 70s bull market) and the non-USD perspective should not be neglected because, after all, the USD is only one of the major currencies.

It is not the value of the ratio that is currently extraordinary, but the volume (the ratio of volumes, to be precise). Spikes in this ratio indicate extraordinary interest in the price of the white metal and there were many cases in the past when this served as an indication of much lower prices in the following weeks and months. This signal doesn’t say anything about the short term, but the medium-term implications are bearish.

The same kind of implications are provided by the Dow to gold ratio. It moved higher and more than confirmed its breakout above the previous highs. The last time when we saw a major breakout in this ratio was in early 2013 and it meant that gold’s price was about to slide for hundreds of dollars.

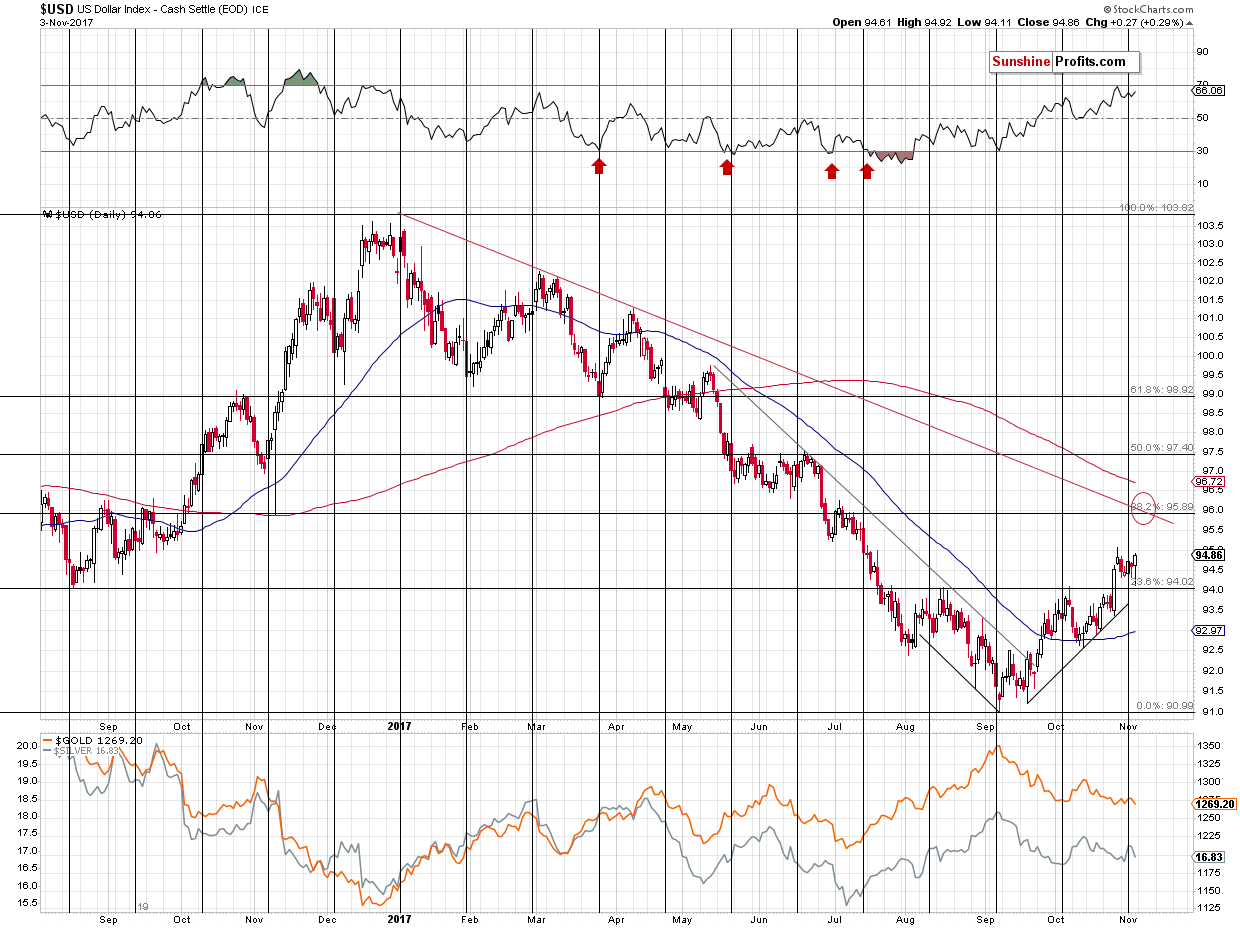

Still as far as the short term is concerned, the USD Index also points to a reversal only after an additional rally.

The breakout above the neck level of the reverse head and shoulders pattern is more than confirmed, so another rally appears very likely to be seen this week. The target at about 96 level (precisely 95.89) is supported by the declining red resistance line and the 38.2% Fibonacci resistance level. Both are based on a clearly visible, medium-term move, so they are important.

Now, let’s consider the follow-up action.

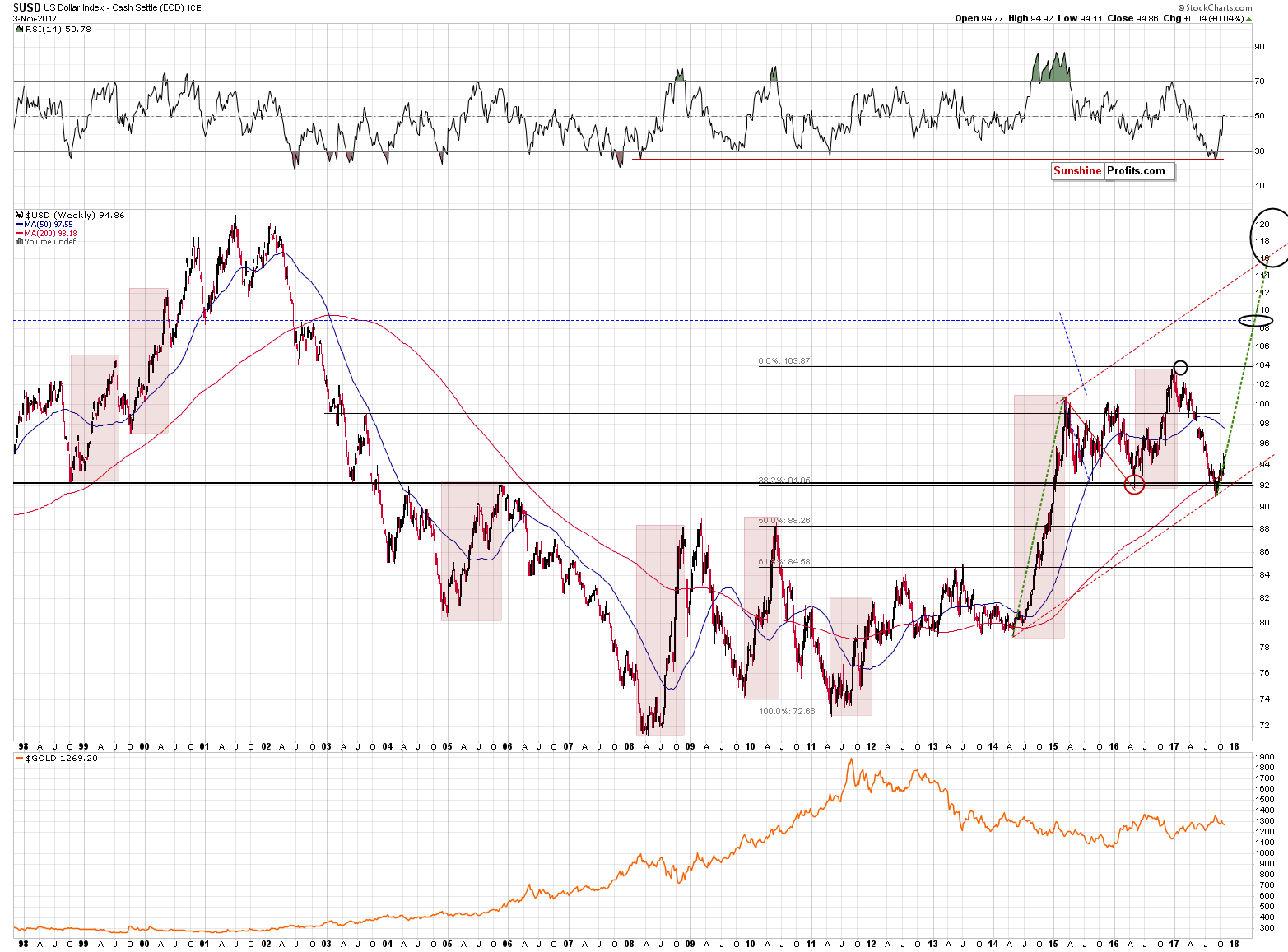

If the USD Index is starting a huge rally, just like it’s likely to based on where we are in the series of interest rate hikes, then it’s a good idea to check how the previous big USD rallies looked like and look for similarities. In this way we could spot trading opportunities (and look for confirmations at particularly important moments / price levels) and even if we don’t, the above should still prepare one for what’s to come and one would not panic in light of an event that would appear a game-changer on a day-to-day basis, but would be normal when looked at from the long-term perspective.

We marked 8 big rallies on the above 20-year chart. They vary in terms of length, size and sharpness, but there are a few similarities between them. The rallies took between (approximately) 30 and 45 weeks, so the current possible rally could end between April and July 2018, but that’s not something that has implications for the nearby days and weeks. However, analyzing the beginnings of the big rallies has such implications.

The first part of 6 out of 8 big rallies was characterized by a rather large pullback. In 1998, 2005, 2008, 2011, 2014 and 2016 the biggest, most stable and bullish part of the rally took place only after an initial correction that erased more than half of the very initial rally.

In the remaining two cases, the correction was still present, but it was not that significant.

So, should we expect the current rally to continue much higher without a bigger correction? No, such a correction would be something rather likely and normal. If the 50% correction is to be the minimum range for the pullback and the USD tops at about 96, then we can expect it to decline to about 93 – 93.5.

That would not be a small move, so adjusting one’s trading positions might be a good idea should it become very likely. The same is the case for the positions in the precious metals market as a bigger correction in the USD would likely translate into a visible correction in metals and miners.

Summing up, even though there are multiple signals pointing to lower precious metals prices in the coming months, it seems likely that after an additional decline from here, the precious metals sector is going to correct to the upside. While we keep the detailed target prices for precious metals and miners for our subscribers, we can say that one of the bigger factors that we will be monitoring for confirmations is the value of the USD Index and it appears likely that the mentioned reversal will take place when the USDX moves close to the 96 level.

We hope you enjoyed today’s analysis, even though it might appear controversial. If you’d like to receive follow-ups, we invite you to subscribe to our Gold & Silver Trading Alerts.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

….also from Sunshine Profits:

Saudi Purge and Gold

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair