Gold & Precious Metals

Oct 17, 2017

- Gold’s recent rally from the $1268 area lows has stalled, and the reasons for that are both fundamental and technical.

- Please click here now. Double-click to enlarge this daily gold chart. Gold fell about $100 from the $1362 area highs as seasonally soft Chinese buying was accompanied by a collapse in Indian demand.

- That collapse was caused by the “Know Your Client” rule imposed by the government on gold jewellery purchases.

- The price decline was exacerbated by the “Golden Week” holiday in China. Also, the Chinese government chopped commercial bank reserve requirements. That created a huge “risk-on” mentality in global stock markets during what is normally a weak period.

- As the Golden Week holiday ended, the US jobs report was released, and the Indian government killed the “Know Your Client” rule.

- Gold surged about $40 higher from the $1268 area Fibonacci line to the neckline of the head and shoulders top pattern.

- Please click here now. Unfortunately, there isn’t enough demand to sustain the rally, and the short term target of $1215 is still a probable one.

- Put options are a nervous gold bug’s best friend, as I’ve repeatedly noted since gold traded above $1330.

- Please click here now. Double-click to enlarge this long term gold chart. In the big technical picture, the short term weakness is healthy.

- There are several huge bullish price patterns in play on the weekly gold price charts, including the bull wedge pattern I show here. A pullback to the trend line is normal after a major breakout.

- That pullback is in play now, and it is targeted to end at about $1215, which is also the target of the head and shoulders top pattern.

- Please click here now. Double-click to enlarge. That’s another look at the weekly chart.

- In addition to the huge bull wedge, there’s an enormous inverse head and shoulders bottom pattern in play.

- The target of that pattern is at least $1650.

- Please click here now. I consider Jeff Christian to be the Western world’s top gold market fundamentalist.

- He sees the growing institutional investor loss of respect for the Fed as a theme that will continue. That’s good news for gold.

- Jeff and I differ in our short term outlook (I see $1215 as probable and he sees $1340+), but we both are focused on a decent acceleration in upside price action to occur over the next 12 – 18 months.

- That acceleration should begin as gold moves above $1392. January – February 2018 (Chinese New Year gold buy season) is the most likely time frame for that move above $1392 to happen.

- Please click here now. Double-click to enlarge this dollar versus yen chart.

- The dollar looks like a train wreck in slow motion. Clearly, the Fed’s rate hikes have been dollar-negative. To make America “great” again, a modern version of the homestead program would be required.

- Going forwards, America would need at least a billion new immigrants with an incredible work ethic to stop China and India from economically leaving it in the dust. That’s not happening now, and it’s not going to happen. The dollar will continue to decline, albeit very slowly.

- More rate hikes will only cause problems for a debt-soaked government that can barely finance itself now. That’s dollar-negative and gold-positive.

- Please click here now. Double-click to enlarge this GDX weekly chart. I’ve suggested that nervous investors can use put options to manage that nervousness.

- Those who are flush with cash or new to the gold stocks asset class should have an aggressive buy program in the $23 – $18 price area, in preparation for a sustained uptrend to my $31 and $37 target zones. Keep an eye on Chinese New Year as the time frame to nail the first target at $31!

Thanks!

Cheers

st

Oct 17, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

SWOT Analysis: Gold In Focus After Climbing Above Key Threshold Level

Posted by Frank Holmes - US Global Investors

on Monday, 16 October 2017 13:31

Strengths

- The best performing precious metal for the week was palladium, up 7.28 percent as money managers raised their net-long positions on continued expectations that the shift from diesel to gasoline powered cars will continue.

- Gold traders and analysts surveyed by Bloomberg are bullish for the first time in five weeks, reports Bloomberg. Following the release of the Fed minutes which showed rising concern about low inflation, the yellow metal climbed to a two-week high. A fresh flare-up in tensions with North Korea pushed gold higher this week, writes Bloomberg, along with a U.S.-Turkey diplomatic spat regarding visitor visas was supportive.

- The Indian government withdrew an order that brought the gold industry under anti money-laundering legislation, reports Bloomberg. Jewelers were included in the Prevention of Money-Laundering Act in August that increased compliance requirements. In response to the rule reversal, shares of jewelers climbed in the country. This move comes just as gold buying improves before the Hindu festival of Diwali, the peak season for demand, the article continues.

Weaknesses

- The worst performing precious metal for the week surprisingly was gold, up more than 2 percent, despite grabbing most of the precious metals headlines.

- According to the People’s Bank of China website, gold reserves in China came in at 59.24m fine troy ounces in September, unchanged again from the previous month, which unfortunately is beginning to become a trend. Chinese markets had been closed the prior week to mark National Day.

- Oddly, the B2Gold share price underperformed for the week as it reported a production beat for the third quarter as well as its first gold pour at Fekola. SSR Mining also reported a minor shortfall in quarterly production which did hit the share price as well.

Opportunities

- The odds of an interest rate increase by year-end fell to 73 percent on Friday, from 77 percent on Thursday, weakening the dollar, according to fed funds futures data compiled by Bloomberg. Gold climbed above $1,300 on the dovish news and this has heads turning somewhat back to gold versus the bulk miners as the following report illustrates. S&P Global Market Intelligence released a note this week showing that miners planned to spend nearly $8 billion looking for new deposits in 2017, about 14 percent more than last year, reports Bloomberg. Gold exploration budgets in particular rose 22 percent to $4.1 billion in 2017, the article continues. That’s the biggest increase among nonferrous metals.

6

6

- Another report this week comes from UBS, saying that gold is poised for a recovery. “Following the past three Fed rate hikes, gold typically performed well in the months that followed, while the dollar, rates and equities tended to come off. Gold has rallied each January since 2014 and we think there is reasonable potential for this trend to continue,” the report reads.

- Miners could be spared a proposed royalty increase in Western Australia, reports Bloomberg, after the government’s opposition party said it would block the motion in parliament. Western Australia hosts four of the nation’s biggest gold mines. Leader of the opposition Liberal party Mike Nahan said on Tuesday that Liberal party members of parliament will vote with other minor and cross-benchers to overturn the royalty increase.

Threats

- Despite gold surpassing $1,300 this week, Goldman Sachs sees further technical weakness for the yellow metal, with the potential for prices to fall 14 percent from current levels, reports Bloomberg. The bank has been fairly bearish on gold, maintaining its outlook in a September report that gold prices will end the year at $1,250 an ounce.

- Foreign Relations Committee Chairman Bob Corker and President Donald Trump ratcheted up a feud this week over Twitter. Corker called the White House an “adult day care center” and warned that Trump could set the U.S. “on the path to World War III,” reports Bloomberg.

- Following reports that Secretary of State Rex Tillerson called President Donald Trump a moron, the president fired back defending his intelligence, reports Bloomberg. “I think it’s fake news, but if he did that, I guess we’ll have to compare IQ tests,” Trump said in a Forbes interview. “And I can tell you who is going to win.”

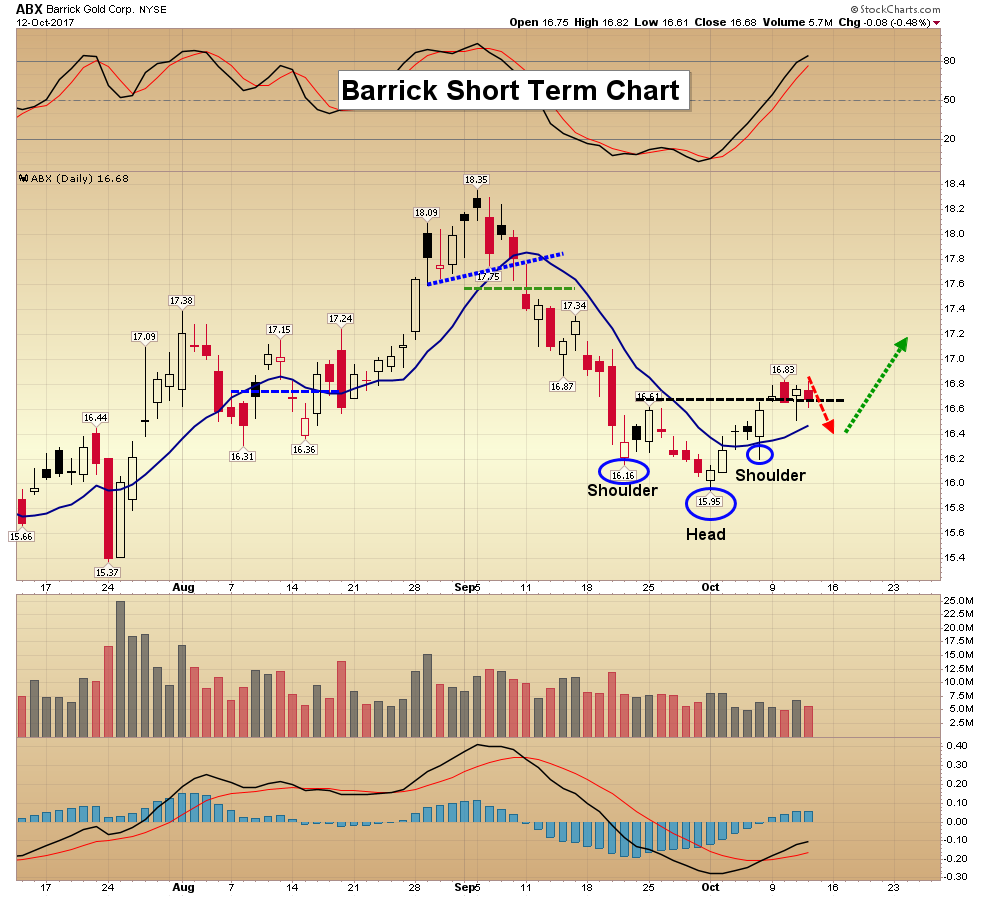

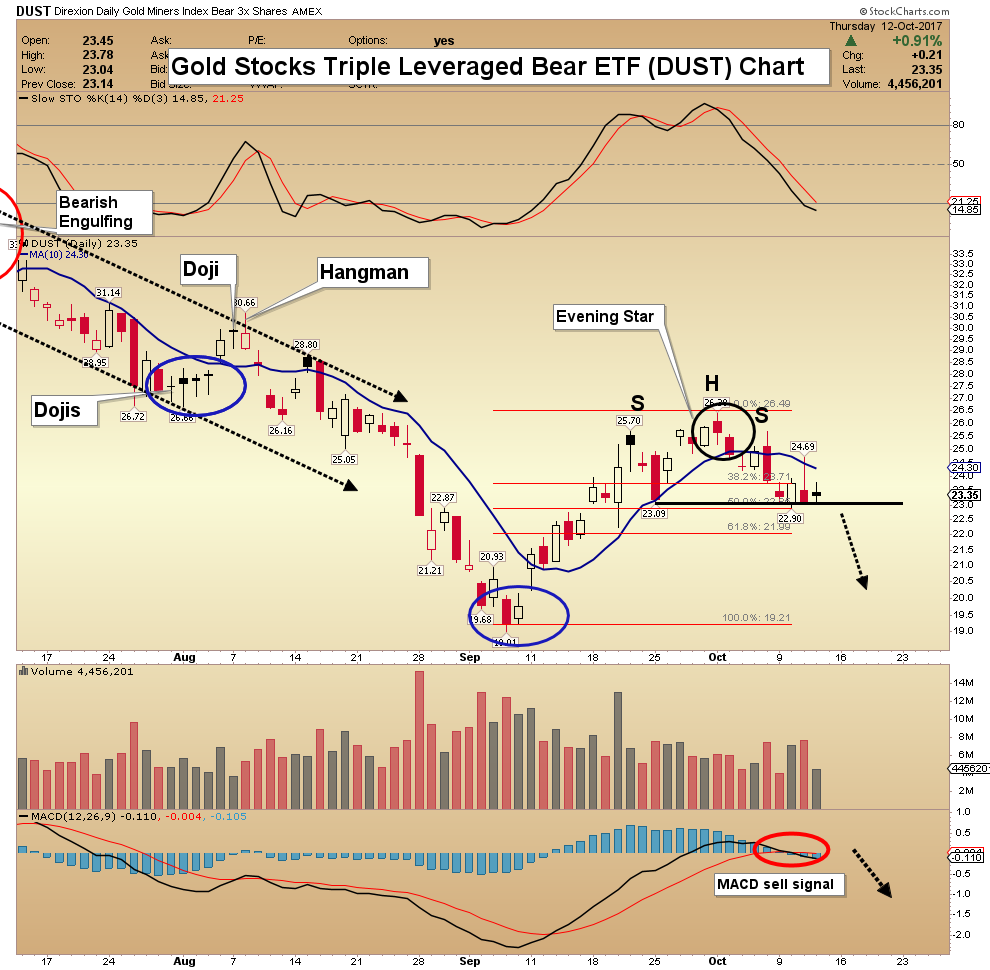

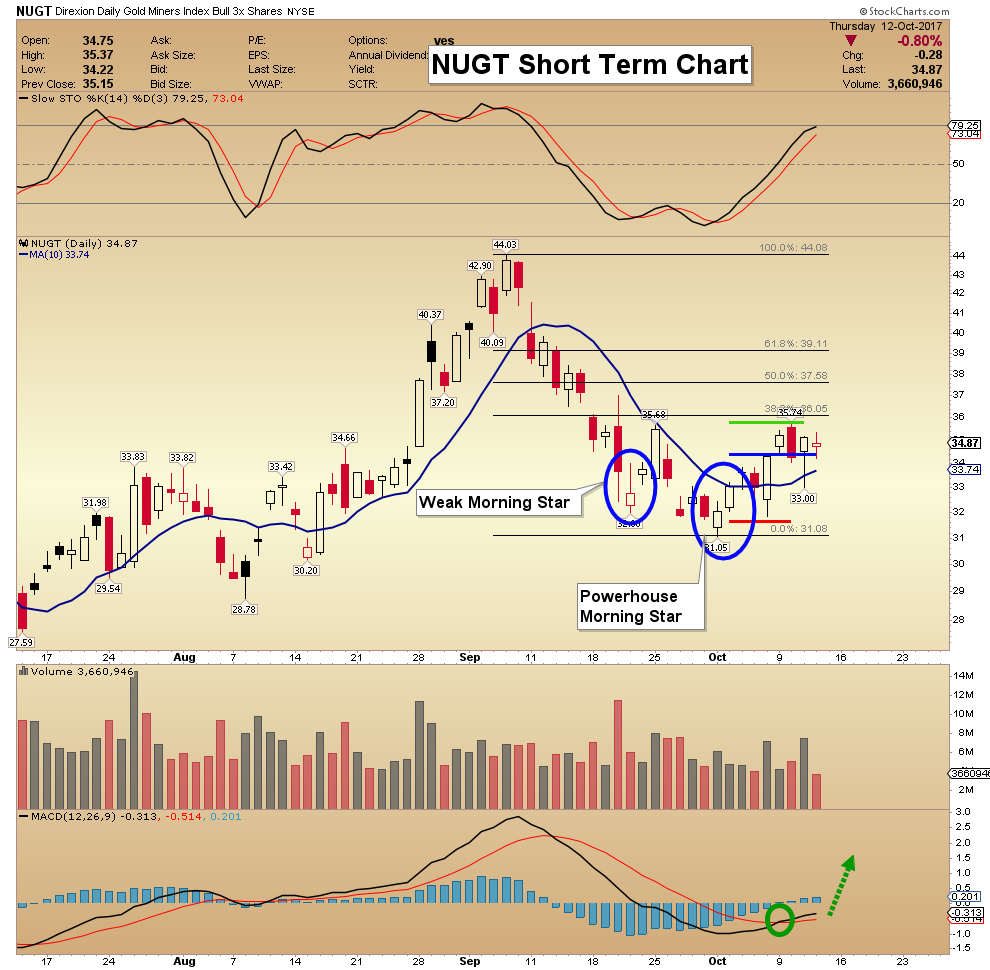

Gold Bulls Have Slight Technical Edge

Posted by Morris Hubbartt - Super Force Signals

on Friday, 13 October 2017 13:26

Today’s videos and charts (double click to enlarge):

SFS Key Charts & Video Update

SF60 Key Charts & Video Update

SF Juniors Key Charts & Video Analysis

SF Trader Time Key Charts & Video Analysis

Morris

| Friday, Oct 13th 2017 Send an email to trading@superforcesignals.com |

Germans Have Quietly Become the World’s Biggest Buyers of Gold

Posted by Frank Holmes - US Global Investors

on Thursday, 12 October 2017 13:51

When I talk about Indians’ well-known affinity for gold, I tend to focus on Diwali and the wedding season late in the year. Giving gifts of beautiful gold jewelry during these festivals is considered auspicious in India, and historically we’ve been able to count on prices being supported by increased demand.

When I talk about Indians’ well-known affinity for gold, I tend to focus on Diwali and the wedding season late in the year. Giving gifts of beautiful gold jewelry during these festivals is considered auspicious in India, and historically we’ve been able to count on prices being supported by increased demand.

Another holiday that triggers gold’s Love Trade is Dussehra, which fell on September 30 this year. Thanks to Dussehra, India’s gold imports rose an incredible 31 percent in September compared to the same month last year, according to GFMS data. The country brought in 48 metric tons, equivalent to $2 billion at today’s prices.

As I’ve shared with you many times before, Indians have long valued gold not only for its beauty and durability but also as financial security. Indian households have the largest private gold holdings in the world, standing at an estimated 24,000 metric tons. That figure surpasses the combined official gold reserves of the United States, Germany, Italy, France, China and Russia.

A New Global Leader in Gold Investing?

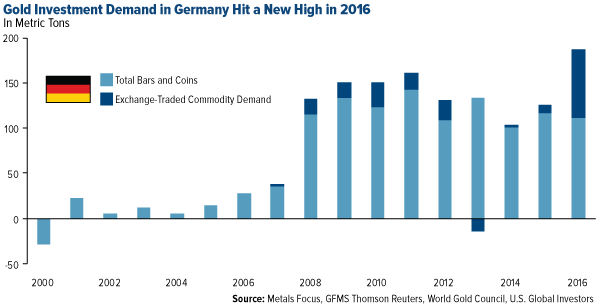

But as attracted to gold as Indians are, they weren’t the world’s biggest investors in the yellow metal last year, and neither were the Chinese. According to a new report from the World Gold Council (WGC), that title shifted hands to Germany in 2016, with investors there ploughing as much as $8 billion into gold coins, bars and exchange-traded commodities (ETCs). This set a new annual record for the European country.

Germany’s rise to become the world leader in gold investing is a compelling story that’s quietly been developing for the past 10 years. Before 2008, Germans’ investment in physical gold barely registered on anyone’s radar, with average annual demand at 17 metrics tons. The country’s first gold-backed ETC didn’t even appear on the market until 2007.

But then the financial crisis struck, setting off a series of events that ultimately pushed many Germans into seeking a more reliable store of value.

“While the world fretted about Lehman Brothers, German investors worried about the state of their own banking system,” the WGC writes. “Landesbanks, the previously stable banking partners of corporate Germany, looked wobbly. People feared for their savings.”

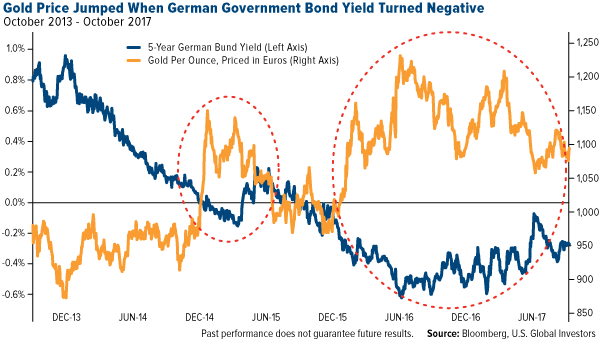

To stanch the bleeding, the European Central Bank (ECB) slashed interest rates. Banks began charging customers to hold their cash, and yields on German bunds dropped into negative territory.

All of this had the effect of rekindling German investors’ interest in gold. As I’ve explained before, gold prices have historically surged in that country’s currency when real government bond yields turned subzero. What we saw in Germany was no exception.

Weakening Faith in Paper

As the WGC points out, Germans are acutely aware that fiat currencies can become unstable and lose massive amounts of value. In the 1920s, the German mark dipped so low, a wheelbarrow overflowing with marks wasn’t enough to buy a single loaf of bread. In the past 100 years, the country has gone through eight separate currencies.

It’s little wonder, then, that a 2016 survey found that 42 percent of Germans trust gold more than they do traditional money.

This is where Germans and Indians agree. The latter group’s faith in the banking system has similarly been eroded over the years by regime changes and corruption, and gold has been seen as real money.

It’s not just individual German investors who harbor a strong faith in gold. The Deutsche Bundesbank, Germany’s central bank, spent the past four years repatriating 674 metric tons of Cold War-era gold from New York and Paris. The operation, one of the largest and most expensive of its kind, concluded in August. Today the central bank has the second largest gold reserves in the world, following the Federal Reserve.

Room for Further Growth

With Germans’ demand for gold investment products having already reached epic proportions, what can we expect next? Will interest continue to grow, or will it recede?

Analysts with the WGC believe there is room for further growth, citing a survey that shows latent demand in Germany holding strong. Impressively, 59 percent agreed that “gold will never lose its value in the long-term.” That’s a huge number.

Regardless of whether or not investment expands in Germany, this episode shows that gold is still seen as an exceptional store of value, and trusted even more so than traditional fiat money. For gold investors, that’s good news going forward.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Silver Market Update

Posted by Clive Maund

on Wednesday, 11 October 2017 13:28

The last Silver Market update almost a month ago called the intermediate top within a day, as you may recall, and it has back to the extent predicted in that update.There was more evidence of a turn in silver than gold on Friday, when a more obvious reversal candle appeared on its chart. On the 6-month chart we can see that a long-tailed candle occurred that approximates to a bull hammer where the price closed not far off the day’s highs on the biggest volume for over a month. After its recent reaction this certainly looks like a reversal, especially as the downtrend channel has been converging. The earlier overbought condition has more than fully unwound and the price has dropped back into a zone of support.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair