Gold & Precious Metals

Newton’s Third Law

Posted by Michael Balllanger for The Gold Report

on Friday, 29 September 2017 13:45

Precious metals expert Michael Ballanger discusses the effects of “Quantitative Tightening” on precious metals markets.

In late August, we decided to anchor our boat out in a place called Indian Harbour, a wonderful “safe haven” for boaters that love northern Georgian Bay, in an effort to make the most of what has been an absolutely dreadful summer for most people in the east-central part of Canada and the U.S. This little harbour is protected by a small sliver of rock and trees that separates it from the ravages of the prevailing westerlies which whip across the prairies gathering momentum until they descent upon the largest contiguous consortment of freshwater lakes in the world (The Great Lakes) and gather moisture and volatility until they ultimately unload their liquid bounty into the most fertile farmland in North America which stretches from Detroit and Soo, Michigan, easterly to Kingston, Ontario.

The storms and winds that pound that little sliver of land are truly violent despite the fact that this past summer was arguably the worst one we have had in recent memory, with temperatures not reaching 30 C once between May and the end of August.

So, there we were in late August, anchored out in Indian Harbour in the hope that the weatherman would finally be wrong—that the temperature would actually NOT dip below 10 C (a tad under 50 F)—and that we might even be able to actually SWIM (which we love to do) as opposed to just do a “quick dip” that is usually reserved for May and early June. The morning after we arrived, I arose at around 6 a.m. (as always) and wandered into the upper part of the boat only to see the thermometer at 3 C. For those not familiar with the metric system, 0 C is “freezing.” Clad in a pair of sweatpants and a t-shirt, it was the coldest summer morning that I can EVER recall.

When we returned to the marina the following Sunday, we listened as many of our boater colleagues were packing up for the year, that is to say, they were emptying their boats and leaving instructions to remove their boats from the water for the season. That night, I made the remark to my partner that it is a statistical anomaly to endure a summer in east-central North America without at least ONE “heat wave” and that I would wager that before the end of September, we would get walloped with at least one serious affliction of Indian Summer. My neighbors all told me to “Dream on” and that Mother Nature is normally not that kind. They were all collectively “hauling their boats out” and as they say, “THAT is THAT.”

Well, the point of this long and very drawn-out story is that as I was driving into the marina last Thursday observing all those yachts up on blocks ready for winter storage, it was like watching the put-call ratio or the Commitment of Traders Report where the mass consensus tilts in one direction or another but where the consensus is ALWAYS wrong. Sure enough, since I returned from the Beaver Creek Annual Precious Metals Summit last Thursday, we have been blessed with the best weather of 2017 as temperatures have exceeded 30 C for the past three days with nary a cloud in the sky. In fact, it was so hot yesterday that my partner, a warm-water lover and a cold-water hater, was in what could only be classed as “cold water,” at least seven times, a record for her even at the best of times. Anchored in the safety of “consensus thinking,” boaters without a boat missed THE best boating weekend of the year; in late 2015, gold investors, anchored in the safety of “consensus thinking,” SOLD all of their positions due to the certainty of lower prices. BOTH were wrong. Dead wrong.

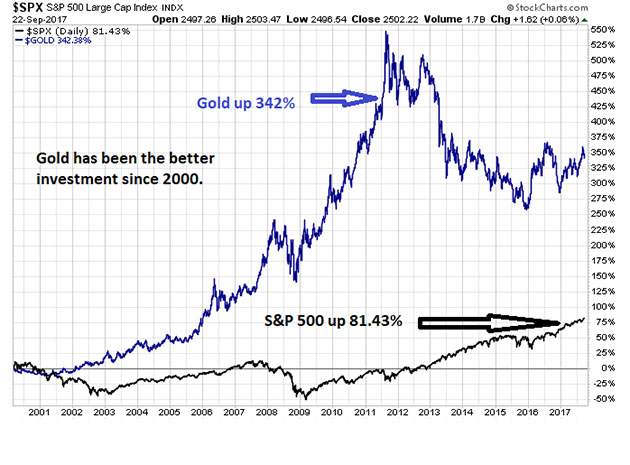

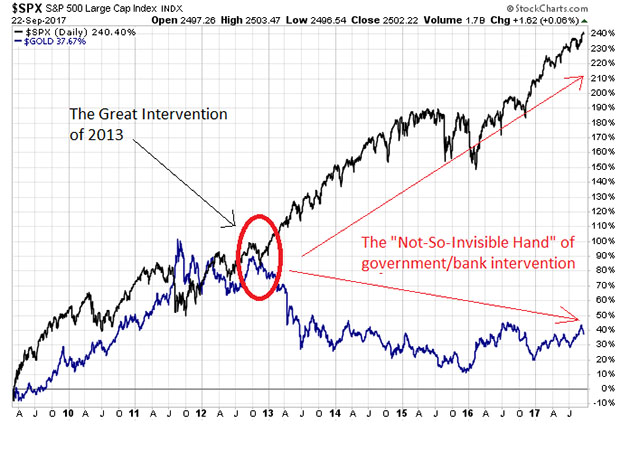

We are now at a crossroads of sorts as it would pertain to the global financial markets in the sense that “consensus thinking” has the masses all buyers of “paper” and sellers of “tangibles,” and given the performance of paper versus tangibles since the bottom in 2009, is there even a basis for debate? One could argue that gold has actually been a better bet since the turn of the century as shown by the chart below.

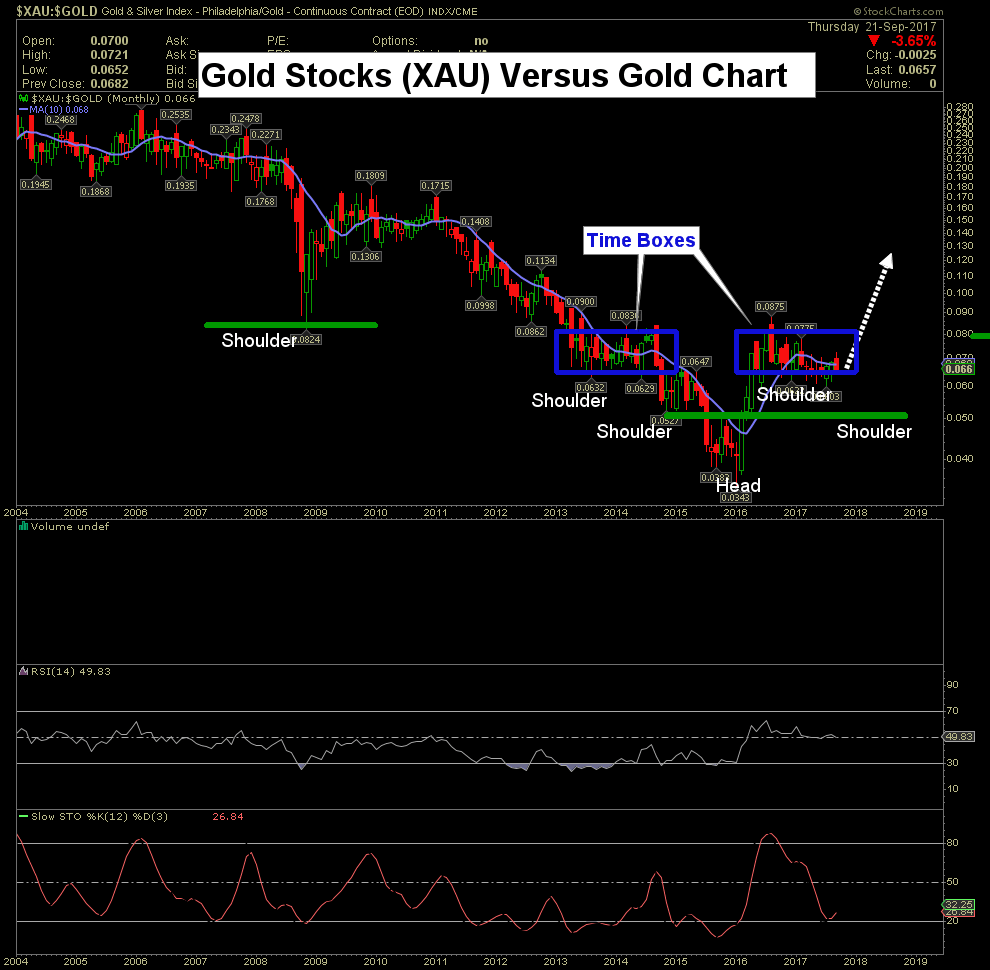

Alas, the chart posted below depicts a far more ominous outcome and a classic example of the dire impacts of institutionalized interventions that have all been “de-myth-ed” after years of denial. The aberrational nature of the interventions of April 2013 can only be described as consequential at least and life-changing at most. The interventions were not only highly anomalous, they were BRAZEN in their execution and designed as yet another tool in the behavioral economics war chest. Since then, stocks have massively outperformed gold and silver with nothing having changed since the U.S. elections in 2016.

Why then should we, as investors, even try to think in a contrarian manner? What good has it done the precious metals enthusiasts since then? Why not just go out and buy a basket of S&P stocks and buy any and all dips right alongside the N.Y. Fed, Bank of Japan, and Swiss National Bank, and ride the wave to financial security?

I will tell you why. Just as dozens of my boater colleagues this past weekend were sitting in sweltering heat, kicking their collective backsides, damning the moment they decided to listen to the climatological consensus, so too will millions of investors find themselves on the wrong side of the consensus trade when the full implications of “balance sheet normalization” is finally recognized. The reason lies squarely within Newton’s Third Law, which is, “For every action, there is an equal and opposite reaction.” In 2008, the banking system was completely cooked; it was buckling under the crippling weight of too much debt. The crisis was TEMPORARILY averted by way of gargantuan purchases of toxic debt by primarily the U.S. Fed, but then quickly aped by central banks around the globe in what has now become an orgy of intervention whose magnitude is now 2.5 times the prior debt level of the 1990’s.

An $800 billion debt bomb ballooned to $2 trillion and now YOUR governments want you ALL to believe that the U.S. Fed can unwind $1,200 billion of purchases with zero “equal and opposite reaction”? How can that much paper be absorbed by the free market without representing the largest draining of “reserves” ever undertaken in the history of world finance? If the initial “action” was intended to inject life back into a mortally wounded toxic cesspool of impaired (if not dead) banks, is not the equal-and-opposite-reaction going to return the banks back to zombie-like status?

My point is that when it comes to all assumptions surrounding the stock, bond and precious metals markets, nobody is taking serious any element of causal damage brought on by the “quantitative TIGHTENING” associated with balance sheet normalization. Stock continue to go to record highs and bonds and precious metals continue to slump into the ecstasy of a rallying USD as the general consensus remains bullish on stocks and neutral-negative on tangible assets. My suspicion is that the stock-binge-buyers are going to be roasting in their backyards while gold and silver owners will soon be floating in the cool waters of a financial oasis as the veracity of Newton’s Third Law exerts itself upon the psyches and wallets of the consensus-following investing public.

As for gold and silver and my beloved miners, I have yet to replace the calls or any of the leveraged positions having exited back on Sept. 3 when RSI for silver topped 78 and gold topped 75. JNUG (Direxion Daily Junior Gold Miners Bull 3X ETF) and SIL (Global X Silver Miners ETF) saw 78 and 69, respectively, but the overwhelming assault by the Commercials leading up to the breakdown sent me racing to the sidelines (for all leveraged and option positions), profits having been squarely booked and average costs reduced.

While I would love to be doing a Khruschevian shoe-pounding in favor of the precious metals tonight, alas, I fear that we have more to come in terms of pain and patience as the Commercials have yet to begin their orgiastic short-covering fire dance while those rocket-scientist Large Speculators have once again with impeccable incompetence been led to yet another pecuniary thrashing. Until these morons are forced by their “technical analyses” to regurgitate all of the gold and silver positions bought on the “breakouts” above $1,310 gold and $17.50 silver, the Commercials will simply slap them around like rented mules until open interest shrinks along with their aggregate short position.

Sir Isaac should be turning over in his grave.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of Michael Ballanger.

Sep 26, 2017

- Today is options expiry day for gold. That’s almost certainly the reason for gold’s pullback today, after it staged a powerful rally yesterday.

- A pause in the price action is normal around these expiry events. The October options contract is expiring, which is recognized by traders as an important one.

- Traders will now focus on December options.

- Please click here now. Double-click to enlarge this short term gold chart.

- For a medium term view of the price action, please click here now. Double-click to enlarge.

- From a technical perspective, all the current price movement in the gold market appears to be “textbook” action. To summarize the recent movement: Gold burst above the $1305 area highs and surged to the “Call-In” day highs in the $1352 area.

- I issued a “book profits now” call as that happened, and the rally promptly died. The pullback took gold back to the breakout zone in the $1305 area.

- Yesterday, gold staged its first rally from that support zone. Gold may soon pull back deeper into that support zone before launching what should be a successful rally above the call-in day resistance zone at $1352 – $1362.

- I’ve laid out two buy zones for investors who want to position themselves to participate in the anticipated breakout above $1362.

- All pullbacks can make investors nervous, and those nervous investors should look at put options for insurance (both emotional and financial).

- Please click here now. That’s a snapshot of the strike price, closing price, change in price, and trading volume for GLD-nyse put options.

- These are December options. Different contract months are available and they can be bought through most stock brokers. Send me an email to stewart@gracelandupdates.com if you want more information about protective put options and I’ll send you a tactical video. Thanks.

- Buying some put options at the same time as buying long positions in gold, silver, and related stocks can help amateur investors to buy serious price weakness, yet still get a good night’s sleep.

- Please click here now. I’ve annotated this Dimitri Speck seasonal action gold chart. In the case of gold price seasonality, history doesn’t always exactly repeat, but it certainly does rhyme. Note the short term peak that often occurs at the end of September.

- October is generally a pullback month ahead of Diwali, but that pullback may have started a bit earlier than usual this year. So, it should end earlier too, probably within about two weeks. There’s an outside chance that it’s already ended, but I wouldn’t bet real money on that idea.

- My $1305 – $1295 and $1285 – $1270 buy zones should be the focus of gold bugs for now.

- Please click here now. The head of the World Gold Council outlines the case for “peak gold”, and he predicts gold will move to $1400 in 2018 and to all-time highs in “the medium term”.

- He may or may not be correct that the world will never produce as much gold as it produces now, but he’s a very influential man.

- So, the question isn’t so much whether “Peak Gold” is real, but whether institutional money managers think it’s real or even partially real, and they do appear to be believers!

- I predict they will move substantially more money into gold stocks in 2018 than they are moving now, based on the view that supply is unlikely to rise much, if at all.

- My personal focus on all price weakness since 2014 has been gold stocks more than bullion. I will also note that gold mining exploration budgets have fallen about 70% since 2012. It takes a long time to put a gold project into production. All the exploration done in the 2012 period doesn’t seem to be bearing much low hanging fruit in terms of viable new projects.

- Please click here now. Double-click to enlarge this interesting GDX chart. GDX has been staging numerous technical breakouts to the upside, and the latest one is from a large symmetrical triangle.

- The apex of that triangle sits in the $22.50 area. Once option expiry day is out of the way, there is still the US jobs report to deal with next week (October 6, 2017). Gold and gold stocks should make a meaningful seasonal low around that rough time frame. From there, I expect gold to begin a trending move higher into 2018, rising up above key resistance at $1392 and steadily rallying towards $1523.

- GDX should easily hit $37 in 2018, with $55 also being a possible target zone if Western money managers continue to allocate money to the SPDR fund as they have in recent months!

Thanks!

Cheers

st

Sep 26, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

The Road Ahead For Gold

Posted by Jordan Roy-Byrne - The Daily Gold

on Monday, 25 September 2017 13:07

In recent weeks both metals and miners have declined somewhat sharply after reaching resistance. Gold peaked just below major resistance near $1375/oz and GDX, the biggest ETF for gold miners peaked at its October 2016 and February 2017 highs. If precious metals can break through this resistance then a major move higher would begin. However, the recent selloff, coupled with a lack of relative strength suggests the road to a breakout could lead well into 2018.

On the daily chart shown below, we can see that Gold has retreated after testing important trendline resistance. Although Gold’s long-term technical structure leans bullish, Gold is currently showing relative weakness. Gold against foreign currencies (Gold/FC) did not make a higher high and Gold/Stocks barely made a higher high. Both ratios may need to hold their blue support lines in order for Gold to remain above $1260/oz.

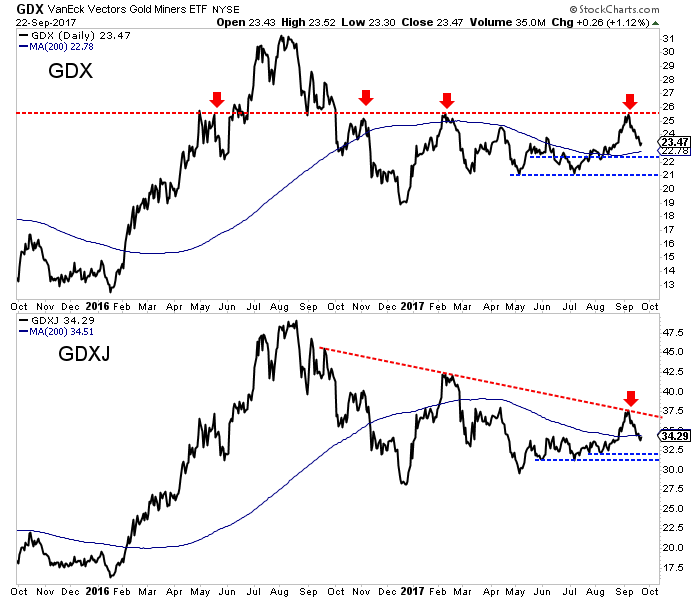

Turning to the stocks, we see that GDX, like Gold was turned back at major resistance. GDX has now tested $25-$26 three times in the past year. On a clean break above that resistance, GDX should retest its 2016 high. It has key support above $22 and at $21. GDXJ will not gain any momentum until it breaks above the September high around $37.50. It has support at $31 and $32.

There are two things that concern us with respect to the medium term outlook. The precious metals complex did not surpass its 2016 highs even though the US Dollar index made a new low. That is a negative divergence. Secondly, both miners and metals have formed a bearish reversal on the monthly charts. That is more significant than a daily or weekly reversal.

While Gold could eventually be headed for a major breakout (potentially in 2018) the road ahead could be difficult. A breakout anytime soon is unlikely. The relative weakness of the sector in the face of a weak US Dollar and the inability to hold gains into the end of the quarter suggests that Gold and gold stocks will remain mired in their long-term bottoming patterns. As we noted several weeks ago, we want to continue to accumulate the best opportunities in juniors on weakness. That is what we have done since last December and it has served us well.

Jordan Roy-Byrne CMT, MFTA

Gold Price Decline: Is It Over?

Posted by Morris Hubbartt - Super Force Signals

on Friday, 22 September 2017 13:18

Here are today’s videos and charts (double click to enlarge):

SF60 Key Charts & Video Update

SF Trader Time Key Charts & Video Analysis

Morris

Fools Gold

Posted by Peter Schiff - Gold-Eagle News

on Wednesday, 20 September 2017 9:01

Recently Jamie Dimon of JP Morgan Chase made headlines by labeling Bitcoin a fraud. Whether those comments played any part in Bitcoin’s recent sell off is hard to say, but the true believers reacted with predictable outrage given that the comments came from the ultimate Wall Street insider whose financial supremacy is supposedly threatened by crypto currencies like Bitcoin.

Recently Jamie Dimon of JP Morgan Chase made headlines by labeling Bitcoin a fraud. Whether those comments played any part in Bitcoin’s recent sell off is hard to say, but the true believers reacted with predictable outrage given that the comments came from the ultimate Wall Street insider whose financial supremacy is supposedly threatened by crypto currencies like Bitcoin.

Although my critical comments on Bitcoin over the years have not received nearly as much attention, they have been just as summarily dismissed by the crypto currency crowd. But I am a well knowlibertarian and follower of the Austrian School of economics. I am not a member of the banking establishment, nor am I a fan of fiat money. I should be one of the good guys. But since I happen to own a company that sells gold, a metal that supposedly Bitcoin will soon make obsolete, the crypto crowd looks at me like a stubborn old buggy whip salesman who refuses to acknowledge that the future resides in horseless transportation.

Well, Bitcoin is not the automobile and gold is not a buggy whip. While Diamond’s comments were not 100% on the money, he is right about Bitcoin’s ultimate demise, just wrong about how it will meet its fate and why. While most fear that government will simply look to make Bitcoin illegal (which could be a possibility if Bitcoin could actually deliver on its promises), it is much more likely to die of natural causes.

The quest to replicate gold is not new. For centuries medieval alchemists tried to turn lead into gold – and now Bitcoin supporters believe they can succeed digitally where the alchemists failed chemically. But their solution will be just as fantastical.

Bitcoin advocates overlook the fact that gold did not become money overnight. It was a valuable commodity long before it became money. A money system based on gold represented a major advancement over the barter system in commerce and finance. It facilitated trade, savings, lending, insurance, and capital formation. Governments often coined gold, collected taxes in gold, and paid their bills in gold. They did this not because they preferred it, but because the people demanded it.

However modern governments have been able to subvert our momentary system by getting the people to accept paper as money rather than gold. This also did not happen overnight. It was a gradual process that began by the issuance of paper currency backed by, and redeemable in gold. Initially few people believed that the paper itself had any value. They knew that its value was derived from the gold that backed it up. However the United States eventually convinced other governments to back their currencies not with gold, but with dollars. Since the dollar was backed by gold, a currency back by dollars was de facto gold backed.

In 1971 President Nixon defaulted on that promise. But by that time, paper money had been in circulation for generations and the majority of people had forgotten that the paper simply represented claims to gold. Since prices, contracts, insurance policies bonds, etc. where already denominated in currency units rather than ounces of gold, the public accepted the switch. Though it was initially followed by substantial price increases, the transition was a success, at least from the government’s perspective.

But this nearly half century experiment in fiat money has been a disaster. Though it has certainly served governments, it has not served the public. It has led to a massive growth of government, pernicious inflation, rolling asset bubbles, booms and bust cycles, weak economic growth, and has transferred purchasing power from the poor and the middle class to financiers and speculators. It is a counterfeit of the gold-based monetary system it supplanted, and its demise now seems certain. Absurdities such as zero or negative interest rates and quantitative easing are sure signs the end is near.

There are many people who now believe that crypto currencies are the next evolution in money. But unlike the switch from gold to fiat, this swap will never take place. Although they have the virtue of arising from the private sector, crypto currencies have no actual value, and like fiat currencies derive their value solely from faith. They have no history of use, or price relationship with other commodities. Although individual crypto currencies like Bitcoin have self-imposed scarcity (which supporters claim is one of the sources of its value), the supply of virtually identical cryptos is limitless. In fact Bitcoin itself recently spun off Bitcoin Cash, which adds to the potentially infinite supply of crypto currencies. If Bitcoin Cash can be spun off, how many more Bitcoin spin off can we expect in the future?

Proponents of crypto currencies incorrectly point out that money need not have any intrinsic value. In fact they make the absurd claim that gold has no intrinsic value either. Every culture values gold for its unique decorative and ornamental value, and that’s not going to change anytime soon. Neither will industrial demand for gold in computers, electronics, airspace, medicine, or dentistry. Add that desirability to gold’s properties of scarcity, divisibility, portability, uniformity, and durability, and you have the perfect commodity for currency use. Bitcoin was created to replicate those properties, but lost is the fact that none of those properties matter without the underlying intrinsic value. Therefore Bitcoin is not digital gold, but digital fool’s gold.

Money must have a value other than its use as a medium of exchange. Like barter, it must transfer real value from one party to another. When gold is exchanged for a chair, one person gets a chair, and the other gets gold. Both parties get something of value independent of a future transaction. The fact that the party receiving gold never uses it as gold, but exchanges it for other goods or services, does not change the nature of the transaction. But if a chair is exchanged for a Bitcoin, the recipient of Bitcoin receives nothing he or anyone else can actually use. The only thing that can be done with Bitcoin is to exchange it for something else.

When gold was used as money, it was still used for other purposes, jewelry in particular. Since it is nearly certain that gold jewelry will always be desired, the owners of gold have little worry that its value will disappear. Gold does not derive its value from faith, confidence, or government decree, but from the market value of gold itself.

Even though fiat currency derives its value entirely from faith, the power of government, legal tender laws, widespread public acceptance, and tradition have provided a real basis for that faith. And since people do not want to go to jail, or have their assets seized, they need to accumulate fiat currency to pay taxes.

But Bitcoin has neither intrinsic value like gold, a history of use and public acceptance like fiat currencies, nor a government requirement that citizens pay taxes in it. There is also no historic precedent for a privately created irredeemable currency ever functioning as money.

To believe that despite these challenges Bitcoin will make the jump from a speculative, intangible financial asset to money is farcical. To do so Bitcoin proponents ignore all laws of money and economics, forget history, suspend common sense, and attack anyone who does not get it as being either biased or a fool. Fueling their arrogance is the fact that many have made paper fortunes based on greater fools making the same mistakes. But like all bubbles this one will end badly, and not only will those betting on its success lose a lot of money, but its failure will ironically make fiat currencies look good, and enhance the government’s ability to further discredit the free market.

But in their enthusiasm for Bitcoin, those looking for a true alternative to fiat currency are overlooking gold. More importantly they are overlooking the modern technology that has greatly improved gold’s utility as money. For example Goldmoney Inc. allows its customers to buy gold, store it in Brinks vaults worldwide, and use their gold as money without ever taking delivery. They can use an app on their cell phones to easily transfer any amount of gold to any third party that maintains a Goldmoney account. Or they can use a free Goldmoney debit card to quickly convert their gold to fiat, and spend the proceeds. All of the problems that Bitcoin proponents claim exist with gold, and which they believe Bitcoin has improved upon, are actually solved by Goldmoney. But the meteoric rise in value in Bitcoin over the past few years has obscured these simple facts in cloud of recently gained wealth. Unfortunately much of that wealth will soon be lost just as quickly.

Bitcoin fans like to suggest that the security and anonymity features of crypto currencies make them superior to gold. But this is a false sense of security. While governments may not be able to hack into Bitcoin’s programming, they can certainly make crypto transactions illegal. It would not be hard for the IRS to determine if a company is conducting business in Bitcoin. Just one vote in Congress could force all crypto currencies into the black market where it will never make a major impact on the broader economy. Bitcoin proponents also claim that gold is less efficient because of the risks and fees associated with third party storage, problems that the cryptos don’t face. But these hurdles are far less onerous than what they would have you believe. Brinks, the storage firm that has contracted with Goldmoney has been storing gold for more than 150 years, and no clients have ever lost a single ounce. The need to safely store gold has never stopped it from functioning as money in the past, and it won’t in the future. But the reason it must be stored is that it has actual value. Bitcoin needs no storage because it has no value to store. Yet try explaining this simple fact to anyone who owns it.

********

Peter Schiff is a best-selling author and CEO of Euro Pacific Capital. See his other commentaries here

Euro Pacific Capital, Inc. archives and reviews outgoing and incoming email. Please click here to read our full email disclosures.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair