Gold & Precious Metals

Sep 12, 2017

- It’s not easy to build wealth in any asset class. It’s even more difficult to retain it.

- On that golden note, please click here now. Double-click to enlarge this short term gold chart.

- Over the past week or two, my wealth building mantra has been, “Book profit now”. From a technical standpoint, the world’s mightiest metal has begun to show signs of “head and shouldering”.

- Head and shoulders top patterns are negative for the price, and it’s normal for them to appear when gold reaches strong resistance.

- Strong resistance is not created out of thin air. It’s created by major fundamental events.

- To view the ramifications of one of those events, please click here now. Double-click to enlarge.

- In November of 2016, many gold market players were buying gold aggressively as it became obvious that gold enthusiast Donald Trump had won the US election.

- The gold price spiked higher as Trump won, and then imploded when the Indian government’s shocking demonetization announcement ruined the party. Conspiracy buffs will find it very suspicious that the Indian demonetization announcement seemed to happen just minutes after Trump had won.

- Regardless, the Trump victory became bitter-sweet for Western gold bugs as they watched the gold price crash.

- From a technical perspective, the tremendous volume that occurred on demonetization night has turned the $1350 price zone into powerful resistance.

- The good news is that compared to the violence of the November sell-off, the current decline is very mild. I’m a light buyer now, and a much bigger buyer at $1308 and $1280, basis December futures.

- It’s important that investors wait for emotional discomfort before rebuying with size. The bottom line is that to build gold market wealth that is sustained, significant patience is required.

- Please click here now. Double-click to enlarge this dollar versus yen chart. The 108 area is the “line in the sand” for the dollar.

- That line in the sand has been severely tested, but so far it has held. When it fails, I expect gold to make a serious charge at major resistance in the $1377 – $1392 price zone.

- The SPDR fund (GLD-nyse) gold holdings have climbed to the 834 tonnes area during this gold price rally. I have suggested that the rise in tonnage is related to a “gold market game changer” mentality amongst a growing number of institutional money managers.

- They are not buying gold because of any particular market event (low real rates, Korea, the dollar index, etc), but because of a newfound respect for the precious metals as an investment asset class.

- Jeff Currie of Goldman Sachs recently suggested that physical gold ownership is a good idea and a key diversifier for equity market investors.

- Please click here now. Bank America is now quoted by Kitco News suggesting that a holding of slightly under 5% is beneficial for an equity portfolio.

- The big picture for gold is fabulous. In the past, a rising equity market was negative for gold. Now, a rising equity market forces money managers to buy more gold to maintain their fixed allocation percentage to it.

- Chinese and Indian money managers recommend higher portfolio allocations to gold than their Western counterparts. As they begin to dominate the market, I predict that the larger Chindian allocations will become “the new normal”.

- Also, Merrill notes that Chinese jewellery demand is soft. That’s normal at this time of year, and my Chinese jewellery stocks are making multi-year highs. These stocks are key lead indicators for Western gold/silver mining stocks, and they are flashing big green lights.

- Please click here now. GDX has had a fabulous summer rally. Given the $1350 gold market resistance and the arrival of GDX itself at my $25 – $26 target zone, a pause in the action is normal.

- Once the consolidation ends, I expect GDX to charge towards $28 – $29. I’m also predicting that the next stage of the rally will be much broader, with many of the more speculative junior stocks joining the upside fun in a much bigger way than they have so far.

- Please click here now. Double-click to enlarge. Silver is also poised for a very big move higher. It’s carving out a beautiful inverse head and shoulders bottom pattern, and an upside breakout should coincide with gold surging above $1392!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Golden C-Bones!” report, highlighting the price action of ten great Canadian gold & silver stocks. I include key entry and exit points for investors!

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Looks Like The COT Report Wins Again, As Gold And Silver Fall Sharply

Posted by John Rubino - DollarCollapse.com

on Tuesday, 12 September 2017 13:02

Eventually physical demand for precious metals will swamp the games being played in the paper (i.e., futures contract) markets. So every time the commitment of traders report (COT), which tracks those paper games, turns bearish while gold and silver continue to rise, the precious metals community watches hopefully for signs that fundamentals are at long last about to ignite a massive bull run.

The past couple of months followed this script (see Lightening-Fast COT Reversal: Now Fairly Bearish For Gold And Silver) as gold and silver kept rising for a while in the face of growing resistance in the paper market.

Here’s a more detailed explanation from Hebba Investments via Seeking Alpha:

The latest Commitment of Traders (COT) report, showed another rise in speculative longs for the EIGHTH straight

week. This two-month streak with the net speculative position of gold traders rising every week, has just tied the record-longest gains streak achieved – in the history of the COT report (going back to 2006) it has never risen for NINE consecutive weeks. History for COT nerds (like myself) could be made next week if gold speculators continue their torrid streak.About the COT Report

The COT report is issued by the CFTC every Friday, to provide market participants a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts – so you may want to take a long position.

There are many ways to read the COT report, and there are many analysts that focus specifically on this report (we are not one of them) so we won’t claim to be the exports on it. What we focus on in this report is the “Managed Money” positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

Moving on, the net position of all gold traders can be seen below:

Source: GoldChartsRUS

The red-line represents the net speculative gold positions of money managers (the biggest category of speculative trader), and as investors can see, we saw the net position of speculative traders increase by 18,000 contracts to 250,000 net speculative long contracts. We are now approaching some of the all-time highs in gross and net speculative positions – so gold investors need to be wary.

As for silver, the action week’s action looked like the following:

Source: GoldChartsRUS

The red line which represents the net speculative positions of money managers showed an increase in the net-long silver speculator position as their total net position increased by around 10,000 contracts from a net speculative short position to a net long position of 62,000. Silver speculators are a bit further away from their all-time highs than gold speculators, but are still moving up strongly.

We have been Extremely Bearish the last few week and have been dead wrong in our short-term call. When that happens, you have to re-evaluate your call and make sure that the logic is still valid to the situation.

Our bearish thesis was primarily based on the fact that speculative positions are extremely bullish levels, while physical demand remains at some of the lowest levels seen in the last few years. Additionally, the Federal Reserve seems to be tightening monetary policy, while some of the risk-on events (North Korea, US Debt Ceiling, etc.) seem to be calming down. None of this has changed.

The above was written yesterday. And today gold and silver are getting whacked.

So, alas, it appears that the paper players will live to manipulate another day, and gold bugs will have to wait for that sustained run to $5,000. Which is okay; the longer it takes the more time there is to stack.

Dollarcollapse.com

Gold Market Update

Posted by Clive Maund

on Monday, 11 September 2017 13:20

Gold continues to build towards its breakout from a massive 4-year long base pattern. This is likely to occur when the dollar breaks down from its topping pattern, and is expected to lead to a bullmarket that will dwarf the last one from 2001 through 2011, and may be given a tailwind when the cryptocurrency Ponzi scheme implodes. In some quarters gold is being described as having broken out already, as are gold stocks, but they haven’t yet, as we will see, and we will also look at evidence that points to the probability of a short to medium-term dollar bounce and a pullback in the Precious Metals sector before the big breakout occurs.

On gold’s 10-year chart we can see its fine giant 4-year long Head-and-Shoulders bottom approaching completion, with the price rising up in recent weeks to the broad band of quite strong resistance at the top of the pattern, partly due to tensions over N Korea. These are expected to ease, which will make a short-term correction back more likely. Before leaving this chart note the volume build on the rally out of the Right Shoulder low of the pattern, and the strength of the volume indicators shown, especially the Accum-Distrib line, which rather amazingly is already at new highs. This certainly bodes well for the longer-term outlook.

Over the near-term, however, various factors indicate that the probability of a reaction back is high. On the 6-month chart we can see that last week the price rose up to the top of its uptrend channel where a prominent “spinning top” candlestick formed on Friday, with the RSI indicator critically overbought, making it likely that gold will react back at least to the lower boundary of this channel. The overbought MACD and sizeable gap with the moving averages also increase the risk of a reaction.

Like gold itself, gold stocks are preparing to break out of a giant 4-year long Head-and-Shoulders bottom. They are still quite a way from having broken out, as we can see on the 10-year chart for GDX shown below, and vulnerable to a near-term reaction on a dollar rebound, that should not see them lose much ground. The big volume on the rally during the 1st half of last year showed that the bottom was in and that a major new bullmarket is in prospect. The formation of the Right Shoulder of this H&S bottom served to correct this strong advance.

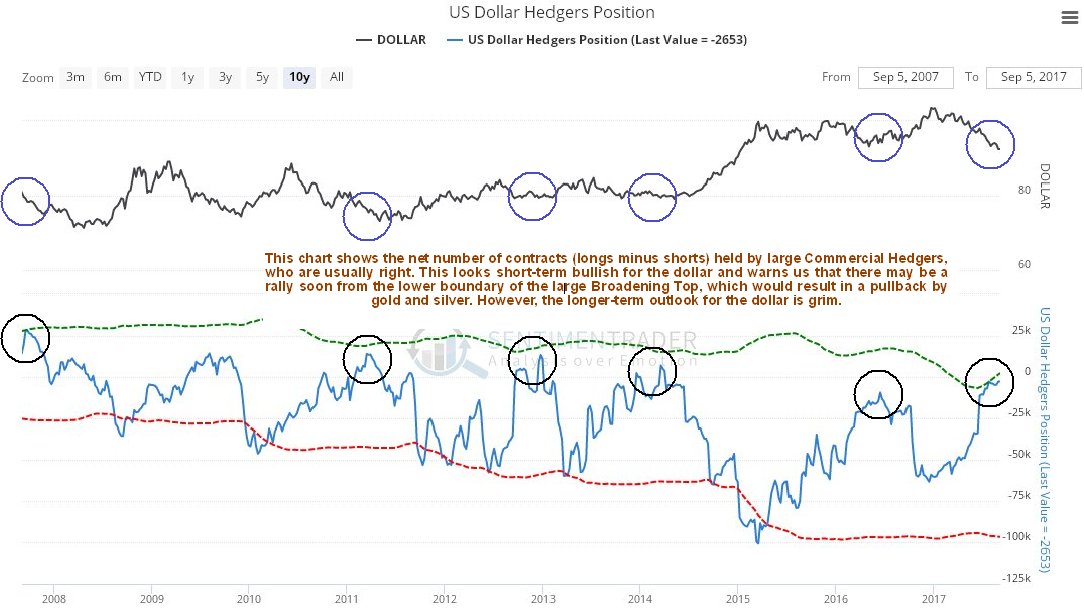

A big reason for gold to react back again soon would a rebound by the dollar, which is made more likely by the fact that a lot of commentators are reading it its “last rites” – it’s not that they are wrong, it’s just that there are a lot of people of one side of the boat now, so they may prove to be wrong short-term but right longer-term. We will now look at some of the big reasons that the dollar could rally soon. On the 8-year chart for the dollar index we can immediately see one of them – the dollar has now arrived at the lower boundary of a large Broadening Top pattern in an oversold state, and while it is believed to be destined to break down from this pattern in due course, it looks likely that it will bounce of its lower boundary over the short to medium-term to correct the oversold condition before going on to break down later.

Another important factor suggesting that the dollar is likely to rally short-term is the latest dollar Hedgers chart, which is now quite strongly bullish. On this chart we see that large Commercial Hedgers, who are almost always right, have cashed in nearly all of their net short positions for a nice fat profit, so that they are now at a very low level, and they would be unlikely to do this if the dollar was set to drop much further. On this chart we also have the benefit of seeing what happened to the dollar soon after they did this on earlier occasions. As we can see it usually rose.

Click on chart to popup a larger, clearer version. Those who think that the dollar will plunge because Nicolas Maduro of Venezuela has announced that his beleaguered country will stop selling in oil in dollars are likely to be disappointed. President Maduro would be well advised to look up what happened to Saddam Hussein after he proposed doing the same, and we must assume that either he doesn’t know his history, or is tired of being President of a failed State and is contriving a way to be forcibly removed from office. We have seen how copper, known as Dr Copper because it tends to lead the economy and lead the metals, has been in the vanguard of the recent metals rally. Thus it is interesting to observe on its 6-month chart below how it suddenly dropped hard on Friday having become overbought, which is thought to presage a dollar rebound and a near-term drop by other metals, like gold and silver.

Conclusion: the long-term outlook for gold couldn’t be better with it looking destined to break out from a giant 4-year long base pattern to enter a bullmarket that promises to dwarf the last one, as the dollar collapses and China (and possibly Russia and other countries) backs its currency with gold, and the cryptocurrency Ponzi scheme implodes, with the liberated funds (or what’s left of them) flowing into gold and silver. Cryptos got a shock late last week when China reportedly revealed that it was set to close local exchanges. From China’s standpoint cryptos are a needless risk to their citizen’s capital, and represent potential competition for their future gold-backed Yuan, albeit not for any intelligent person, and are a nuisance that they can deal with simply by banning them, which as a Command Economy that can ignore criticism, they have the power to do. Near-term gold is looking set to react back as the dollar bounces off support with tensions over N Korea easing as the US has no choice but to accept that N Korea has graduated to the nuclear club, even if it cannot be described as one of its august members.

The tensions centered on the Korean peninsula should soon ease, leading to a rally in the dollar and a (mild) reaction in Precious Metals and other commodities like copper, for reasons that we will consider in this essay.

There can be no denying that what we have previously referred to as “The Empire” is intent on world domination. The evidence is there for all to see in the form of a vast network of military bases spread across the globe, and a history of invasion of various countries by the Empire in recent years in pursuit of its geopolitical objectives. The economic engine that drives the Empire and supports its imperialistic ambitions is the dollar, whose Reserve Currency status means that infinite quantities of it (or proxy derivatives like Treasuries) can be printed up and swapped for goods and services with any and all countries around the world, and it is this dynamic that supports the formidable US military machine. The last Empire that tried to take over the world was Nazi Germany, which recruited Japan to take over the Far East, so that together they became a global axis. As we know this led to an enormous titanic struggle for over 5 years to contain it and defeat it, resulting in immense destruction and loss of life. The reason that Hitler failed was good old fashioned imperial overreach – he didn’t know when to “call it a day” and consolidate his gains, instead he tried to do what has been the undoing of most Empires in the past, take over the entire planet. Actually he got very close to creating a sustainable 3rd Reich, but made several key mistakes. The first was not overrunning Britain while he had the chance, instead he made the fatal mistake of leaving it and starting a war on a second front with Russia, which meant that, in addition to his logistical support being spread too thin, the US was later able to use Britain as an aircraft carrier to bomb Germany back into the Stone Age, which needless to say resulted in its defeat. The second mistake was permitting eastern henchman Japan to bomb Pearl Harbor, and thus bring the US into the war against both Nazi Germany and Japan. Perhaps due to parochial ignorance, Germany and Japan made the catastrophic miscalculation that they could somehow overcome the United States, which at the time was an emerging economic powerhouse. The bombing of Pearl Harbor awoke the sleeping giant and meant the beginning of the end for the Germany – Japan Empire.

Politicians and other megalomaniacs never change of course, and in the power vacuum that arose after the end of the Cold War, the victors decided to press home their advantage and go for world domination, just as you would expect. The absurdly named “War on Terror” was an invention that provided an excuse to invade countries on their “hit list” and strip citizens at home of their rights under the guise of protecting them – witness the daily fiasco of going through airport security in the US.

Right now the three most important countries standing in the way of global hegemony by the Empire are China, Russia and Iran. Since China is a major trading partner of the United States and a powerful economy with a highly developed military deterrent it is “the toughest nut to crack” so they have decided to go after Russia first, but as Russia is also heavily armed with nukes, the assault has been and is largely economic, rather than military. In pursuit of this objective they proceeded to collapse the oil price several years ago in an effort to weaken Russia (and Iran) and largely failed, except for the “windfall” collapse of Venezuela of course. They also demonized Russia in their controlled media, portraying it as an aggressor for invading the Crimea, when all Russia was doing was moving to secure its interests in the region after the Empire instigated a coup against the democratically elected government in the Ukraine to install a pro-Empire puppet government on Russia’s doorstep. The portrayal as Russia as an aggressor provided them with the excuse to impose sanctions on Russia, in a further effort to weaken it. The Europeans, who have a lot to lose by antagonizing Russia, in addition to Gas supplies, foolishly went along with this, and have facilitated further provocation of Russia by allowing NATO to conduct military exercises right up against the Russian border. The Chinese have been watching the Empire’s relentless efforts to damage and take down Russia with interest, because they know that if Russia goes down, they are next, which is why we have seen China and Russia forging strong economic and military ties in the recent past, and why Korea has just come to the fore in this geopolitical chess game. South Korea is the Empire “forward base” in the Far East. Although Japan is a servile US sidekick, it has little appetite for getting involved in conflict with its neighbors and is still pacifist, which is kind of understandable after it got its backside thoroughly kicked and was dragged through the mud at the end of the 2nd World War. China is only too well aware of what the Empire has planned for it, which is why it is not going to permit it to overrun North Korea, and thus gain a foothold on the entire Korean peninsula. North Korea itself is a poor insignificant little country, that has somehow managed to develop a relatively sophisticated nuclear deterrent, a happy coincidence for China. In the Western media Kim Jong Un is portrayed as a dangerous fruitcake, but the truth is that he knows only too well that without such a nuclear deterrent he could end up like Gaddafi or Saddam Hussein, and China has every interest in making sure that the Empire does not overrun North Korea and become an increasing threat to China. It is therefore considered very probable that the huge strides being made by North Korea with respect to a credible nuclear deterrent are thanks to support from China – without China’s help how would this poor little backward State be able to afford it? The fact is that the Empire is being presented with a “fait accompli” – “North Korea now has a credible nuclear deterrent, so what are you going to do about it?” – the answer is nothing, unless they want to start a 3rd World War with China (and Russia). Trump and US Generals can huff and puff about how they are going to come down on North Korea like the proverbial “ton of bricks”, but the reality is that they have been outplayed, and they know it, so this aggressive rhetoric is just face saving posturing for the media, leaving aside the fact that China and Russia have surface hugging supersonic guided missiles that can send US carrier battle groups to the bottom before they even know they are coming. So what now? It looks like the Empire is going to have to accept the fact that North Korea has just joined the nuclear club, even if they don’t have the fancy signed and embossed certificate to hang on the wall, and skulk off to content itself with meddling in Pakistan to try to disrupt China’s grand Silk Road project, and keeping the pot boiling in Afghanistan for the same reason. The tension centered on Korea should therefore ease, the dollar rally from its current oversold position, and the Precious Metals and other metals react back somewhat, although the longer-term outlook for them remains excellent. There are two ways to stop Empires bent on world domination in their tracks. One is brute force as happened in the 2nd World War, and the other is to choke off their economic power, and unfortunately for this Empire, that is relatively easy to do, since its power rests almost entirely on the dollar being the global Reserve Currency. China and Russia and various other States know this, and are moving towards displacing the dollar as the global Reserve Currency, with the first step in this direction being the amassing of a vast quantity of gold, which at some point can be used to back their currencies, whereupon it will be “bye-bye dollar”. This is the point at which Imperial Reach quickly becomes Imperial Overreach. If the dollar loses its Reserve Currency status, the severely debt-wracked and highly leveraged Empire will quickly implode. This is what makes the next several years so dangerous, because the Empire may decide to try to impose its will by force while it still has the chance to do so, leading to catastrophic consequences, and Larry Edelson of Weiss Research has repeatedly pointed out that there is a confluence of war cycles peaking in 2019 – 2020. Looking on the bright side we know the world is grossly overpopulated, which “unintended consequences” may go a long way towards addressing.

To conclude: the tensions centered on Korea should now ease as the Empire is forced to accept the new reality that North Korea has joined the nuclear club, and the dollar rally from oversold – Commercial Hedgers have been slashing their short positions, and the Precious Metals (and metals like copper) react back for a while, opening up another opportunity to accumulate the sector before the expected major bullmarket gets underway.

Gold Breakout & Upside Targets

Posted by Jordan Roy-Byrne - The Daily Gold

on Tuesday, 5 September 2017 13:12

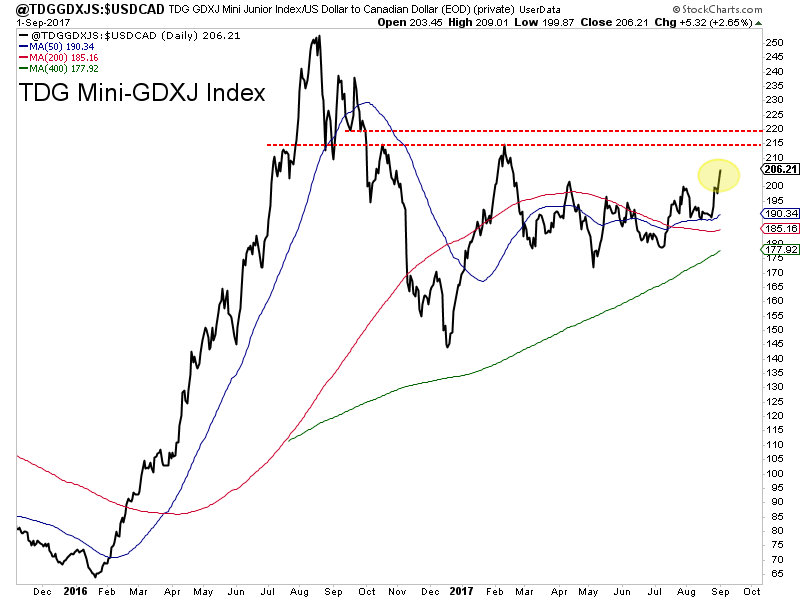

Gold cleared $1300 early in the week and padded its gains on Friday even amid a bullish weekly reversal in the US Dollar. Gold’s breakout was validated by a strong monthly close on Thursday and then a strong weekly close Friday. As predicted, the miners perked up with the breakout in Gold. GDX and GDXJ gained nearly 6% and 7% respectively for the week. Look for the miners to continue to trend higher as Gold attempts to retest its 2016 highs around $1375/oz.

The miners (GDX and GDXJ) have more immediate upside potential. The daily line charts show two levels of resistance. The first level is around $26 for GDX and $38 for GDXJ while the second level is $28 for GDX and $40-$41 for GDXJ.

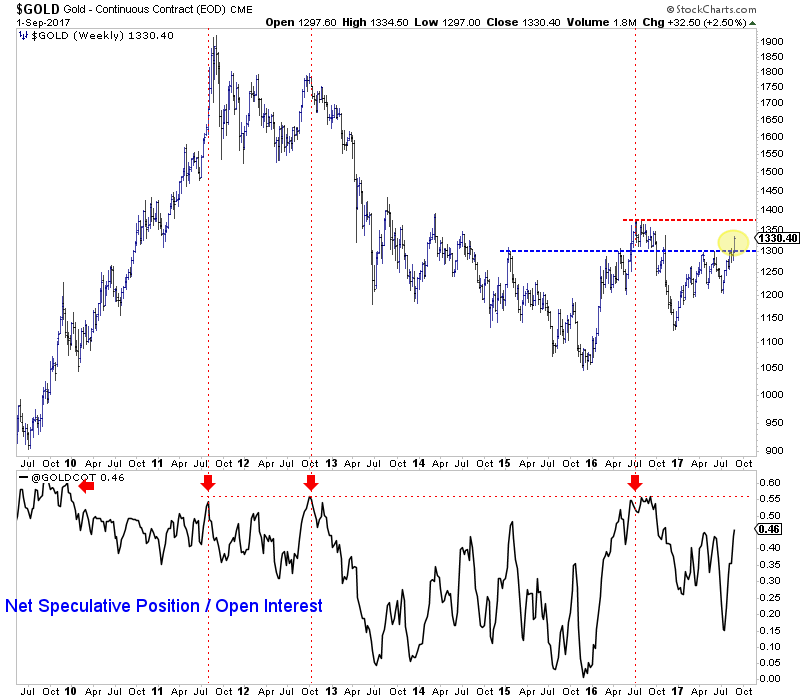

While Gold closed well above $1300 at $1330/oz, it faces resistance at the 2016 highs around $1375/oz. The net speculative position has reached 248K contracts or 46% of open interest. As the chart below shows, the 2016, 2012 and 2011 peaks in Gold all coincided with a net speculative position of 55% of open interest. If current trends continue, the net speculative position could reach 55% as Gold tests $1375/oz.

Circling back to the stocks, we see that our mini-GDXJ index, which consists of 26 stocks and has a median market cap of ~$100 Million closed the week at a +6 month high. The exploration juniors have led the entire sector this year and we expect that to continue. The price action is healthy as the index is trading above its 50-day, 200-day and 400-day moving averages which are all sloping higher. The index closed at 206 and should reach resistance at 215-220. A correction from there (perhaps in October) could setup a push to the 2016 high.

The breakout in Gold through $1300/oz has sparked the miners and juniors and we expect additional gains in the short-term as Gold has room to run. That being said, do note that the net speculative position in Gold is fairly high. It could reach an extreme level if Gold tests major resistance around $1375/oz. To find out the best buys right now and our favorite juniors for 2018 consider learning more about our premium service.

Jordan Roy-Byrne CMT, MFTA

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair