Gold & Precious Metals

Precious Metals Bull Candlesticks

Posted by Morris Hubbartt - Super Force Signals

on Friday, 11 August 2017 14:15

Here are today’s videos and charts (double click to enlarge):

SFS Key Charts & Video Update

SF60 Key Charts & Video Update

SF Juniors Key Charts & Video Analysis

SF Trader Time Key Charts & Video Analysis

Morris

Aug 8, 2017

- Gold is consolidating the recent rally. That rally (basis December futures) moved the price from the $1210 area up to about $1280.

- Please click here now. Double click to enlarge this short term gold chart.

- There’s a small head & shoulders top pattern in play, and commercial traders have been selling gold and shorting in that top area.

- Please click here now. When commercial traders add short positions into a gold price rally, a pause in the upside action often follows.

- Please click here now. Double click to enlarge this daily gold chart.

- Note the 14,7,7 Stochastics series crossover sell signal on the chart. A few weeks of consolidation would bring down this overbought oscillator.

- That would put gold in a nice technical position just as Diwali buying gets underway. Indians are always eager buyers into gold price weakness, and so are Western commercial traders. If a gold “price sale” happens at the same time as an event like Diwali, commercial traders tend to be very aggressive buyers.

- With the consolidation now apparently underway, gold bugs can nibble at the price in the $1245 – $1260 area. My suggestion is not to predict that the price goes there, but to be prepared to do some light buying if it happens. My own focus for fresh buys in the consolidation zone is GDX, the gold stocks ETF.

- On that note, please click here now. Double-click to enlarge. I’m quite an aggressive GDX buyer in the $22 – $18 area, and a seller (of some) in the $23 area.

- Please click here now. This is another important COT report. It’s for the Japanese yen versus the US dollar.

- As expected, the commercial traders are shorting the yen into the rally. What is much more interesting is the overall size of the long position they hold. It’s truly enormous.

- This is important because the yen is a key “risk-off” currency like gold. The US debt ceiling is becoming a concern. If congress refuses to raise the ceiling, it could create a financial earthquake in the US government bond market.

- In turn, that would create an epic risk-off event, sending both the yen and gold higher. If that happened, the commercial traders would likely sell a big portion of their huge long yen position at a fat profit.

- Also, Japan may be poised to finally raise interest rates in 2018. That’s another event that could send both gold and the yen soaring against the dollar.

- In addition, I think most analysts are seriously underestimating the commitment of Donald Trump to lowering the value of the dollar. He’s doing it to make American debt more manageable.

- The bottom line is that there’s a global currency war going on, Trump is winning it, and the dollar faces tremendous headwinds from all directions.

- Some investors have asked me if a fall in the bond market would trigger a stock market “melt-up”. The answer is that just as gold sometimes rallies and sometimes declines when rates are hiked, the US stock market can rally or decline when rates rise.

- The current pace of rate hikes has done no harm to the stock market. If it continues, the stock market can theoretically keep rallying. If something goes wrong (perhaps quantitative tightening), and the bond market crashed, the stock market would almost certainly crash too, even though it’s not a bubble market.

- Please click here now. Double-click to enlarge this fabulous bitcoin chart. I’m adamant that investors should be well-diversified in their quest to build wealth and retain it.

- I view blockchain currency as the hottest sub-sector of the precious metals asset class. At www.gublockchain.com I cover the intense price action for bitcoin and many other blockchain currencies.

- In the case of bitcoin, it just blasted out of a beautiful inverse head and shoulders bottom pattern. It appears to be making a beeline to my $4000 price target for that pattern. Eager wealth builders can be modest sellers in the $3800 – $4200 area.

- Please click here now. Double-click to enlarge. On August 1, 2017 bitoin investors received free “bitcoin cash” currency, the result of a “hard fork” in bitcoin.

- I view the bitcoin cash spinoff as a gargantuan dividend, and it just surged about 100% higher… in less than 48 hours.

- While blockchain is the current star of the upside action show, gold bullion, silver bullion, and the yen may be poised to join the fun in the key September and October months that I refer to as “US stock market crash season”!

Thanks!

Cheers

st

Aug 8, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

“Inflate or Die,” Peak Silver & Golds Coming Breakout

Posted by Gary Christenson - The Deviant Investor

on Monday, 7 August 2017 13:55

Inflate or die” was Richard Russell’s characterization of our economic system and the central bank response to most problems during the past three decades.

INFLATE THE CURRENCY SUPPLY! Examine the currency supply as measured by M3 and reported by the St. Louis Fed.

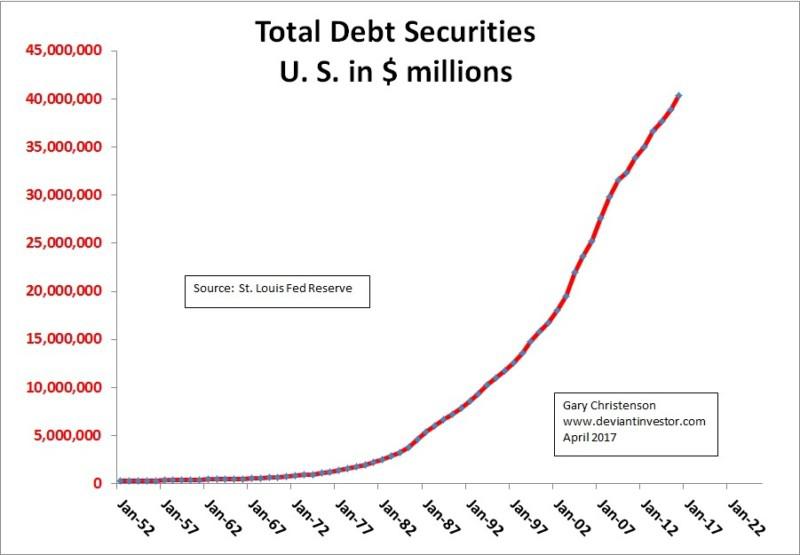

Fiat currencies are created as debt. Inflating currency supply means increasing total debt. Global debt exceeds $200 trillion. Per the St. Louis Federal Reserve, total debt securities in the U.S. exceed $40 trillion.

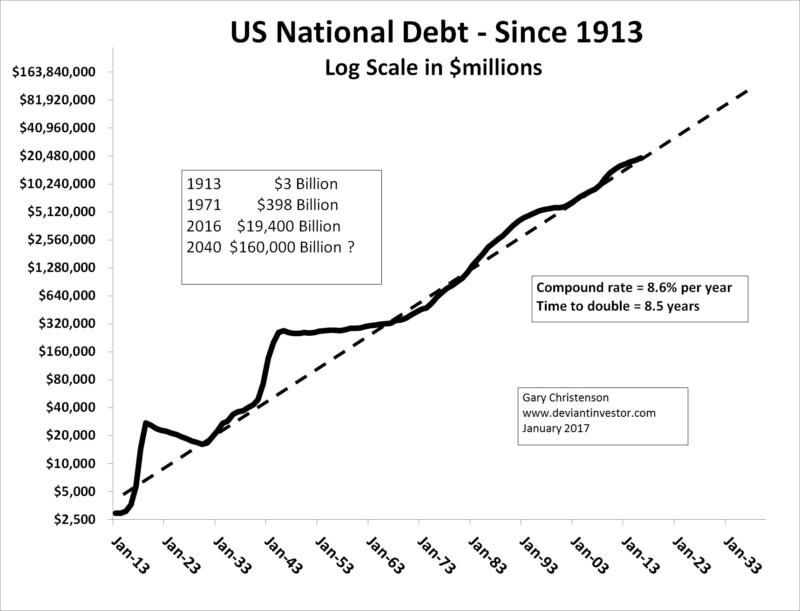

Official U.S. government debt is $20 trillion and has increased exponentially for over a century. Unfunded liabilities are 5 – 10 times higher.

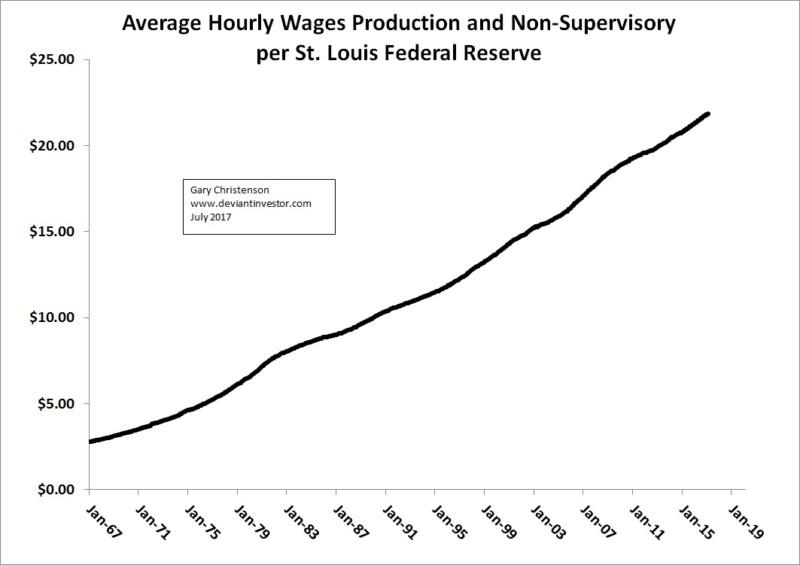

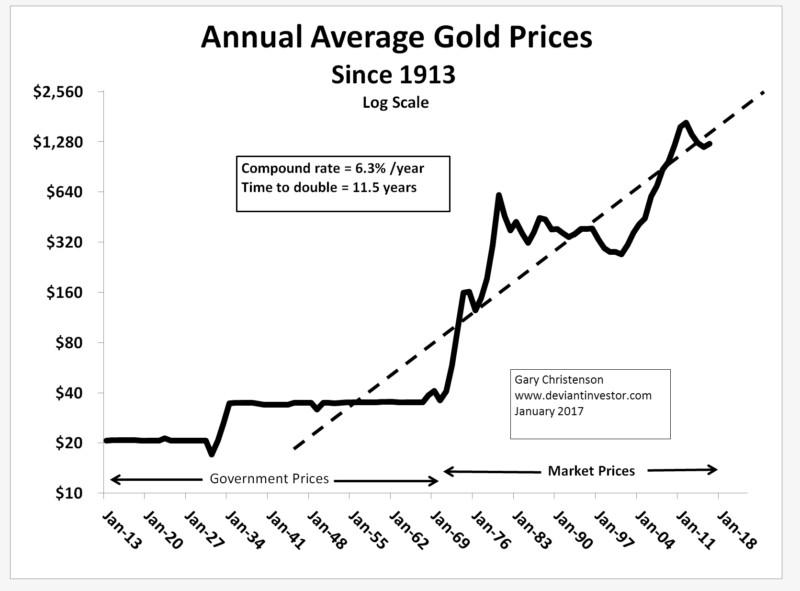

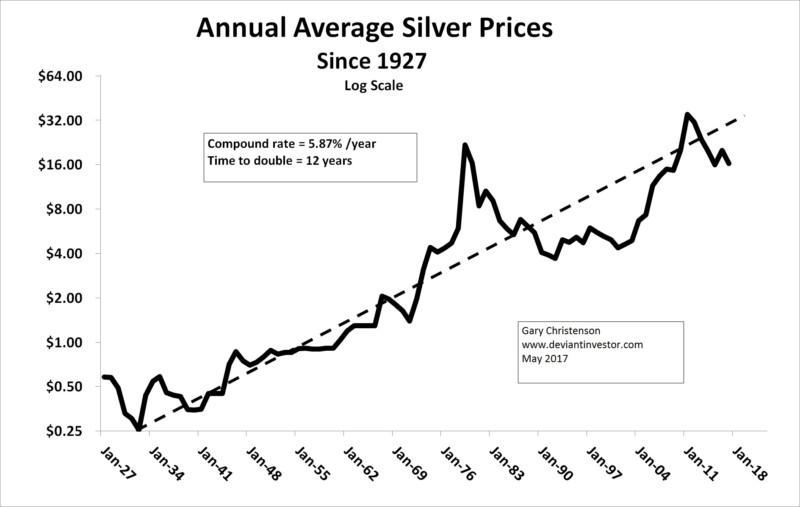

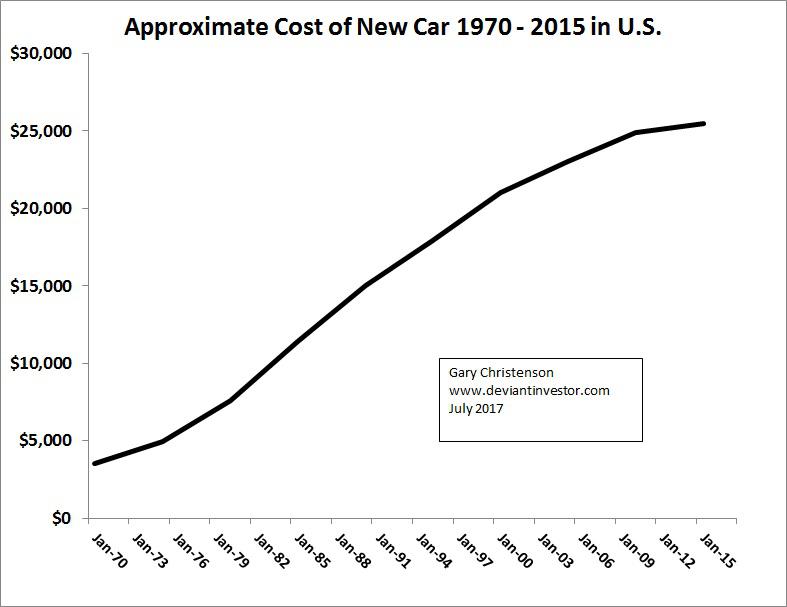

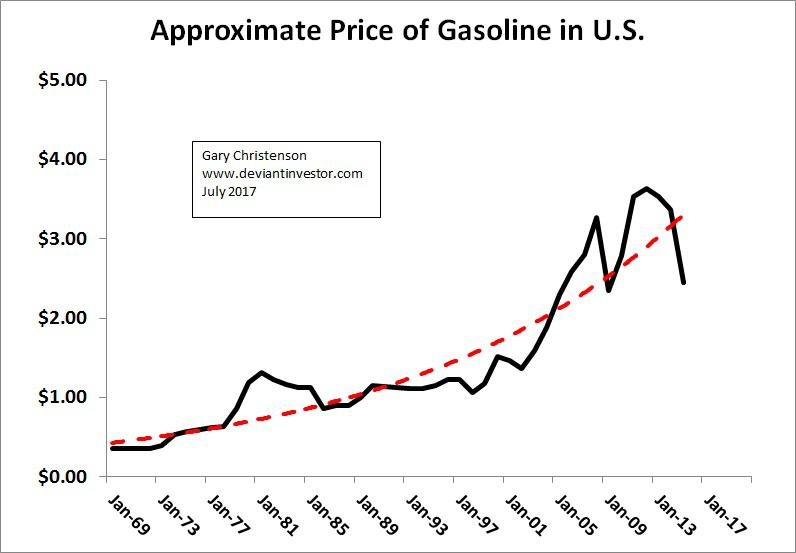

Debt and M3 rapidly increase, while the economy and population slowly increase. The currency supply is continually inflated. The result is much higher prices for most goods and services, including wages, food stamps, gold, cigarettes, cars, gasoline, medical care, college tuition and many more.

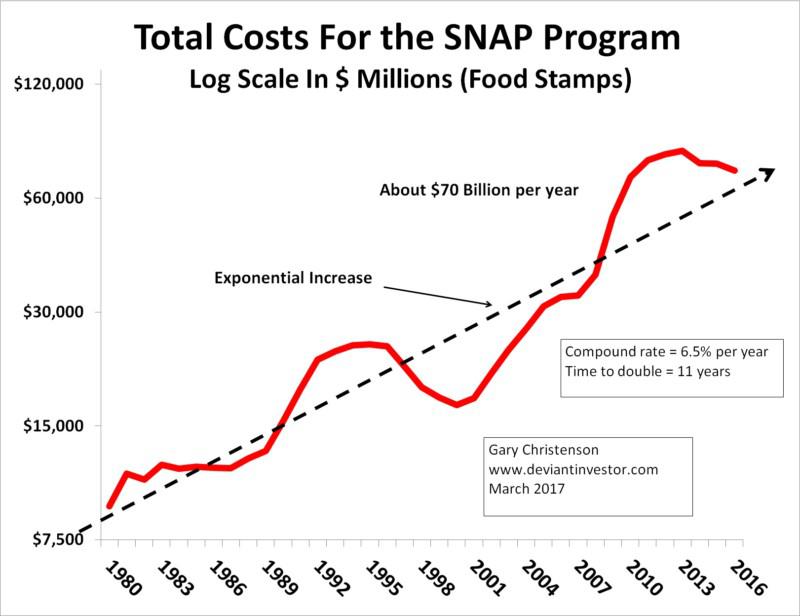

“Food Stamps” program costs have exponentially increased for 35 years.

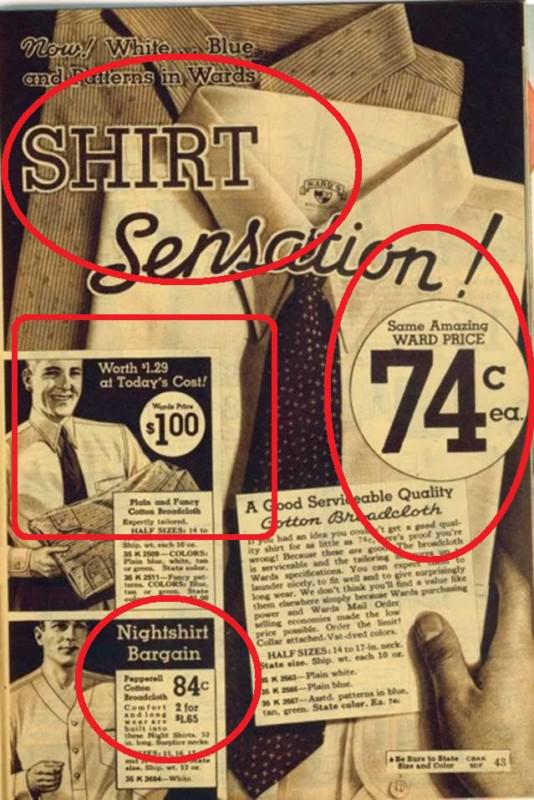

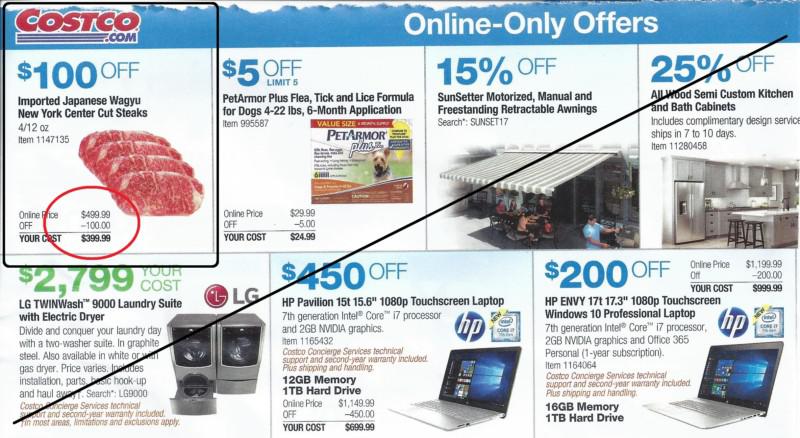

This is an ad for clothing from the 1930s. Prices are much higher today because the dollar has been devalued by more than 90% since the 1930s.

By contrast, consider this ad from a recent Costco flyer.

Premier beef from Japan is on sale at three pounds for $399.00. Yes, over $100 per pound, but very special. Ordinary grocery store meat is cheaper, but far more expensive than when President Nixon severed the last link between the dollar and gold in 1971, thereby escalating the inflation of the currency supply. Dollars devalue and prices increase, regardless of official statistics that show practically no consumer price inflation.

OBSERVATIONS

-

The wars in Afghanistan and Iraq continue. It benefits the military-industrial complex, lobbyists, and congress-persons to prolong these wars for decades. If a war is fought to be prolonged, not won, we usually dislike the results. Vietnam, Iraq, Afghanistan, and Syria come to mind.

-

The U.S. may expand military adventures in Syria.

-

New wars with Russia, China, Iran, and North Korea are possible.

-

Wars are expensive. Since government expenses have exceeded revenues for decades, new and expanded wars will require larger increases in debt and currency in circulation. Consumer prices will rise even more.

Option One – Reductions, Depression, Crashes And Dreams:

Reduce Federal government expenditures, reduce the number of Federal employees, cut military programs, cap expenditures for Medicare and Medicaid, and …DREAM ON!

Option Two – More of the Same:

Continue “borrow and spend” policies, maintain and expand wars, forget cut-backs in government programs, accept occasional market crashes and expect national debt to increase at 8 – 11% per year “forever.” Watch gold and silver prices increase!

Note: Consumer prices for food, energy, clothing, housing and transportation will increase. Are you prepared with an adequate quantity of gold and silver bullion?

QUESTIONS:

National debt, currently $20 trillion, has doubled every 8 to 9 years for a century. If it doubles as it has historically, national debt could reach $160 trillion in 24 – 27 years.

-

Can the U.S. economy support $160 trillion in debt?

-

How much dollar devaluation will be required to enable this level of debt?

-

What will a house, loaf of bread, or an ounce of gold cost when the national debt reaches $160 trillion? Ten times more than today? One hundred times more than today?

-

Do you believe that Social Security payments and private pension plan payments will increase as rapidly as your cost-of-living increases?

If interest rates average 3% and national debt grows to $160 trillion, then ANNUAL interest expense in the 2040 decade will be approximately $5 trillion.

-

Is this plausible?

-

At 6%, the annual interest expense will be $10 trillion.

-

Can interest rates ever be raised to “normal?”

-

What are the ugly consequences of rapidly rising debt along with rising interest rates?

If you are digging yourself into a dangerous hole, should you stop digging, or dig faster?

Does the “borrow and spend” policy appear sustainable? New and expanded wars accelerate debt increases and dollar devaluations which increases consumer prices and economic instability. Is another “2008 Crisis” on the horizon?

Do the actions and policies of our central bankers and political leaders inspire you to consider self-protection, gold bullion and silver bullion?

Extreme measures may be used to extend the “borrow and spend” paradigm as tax revenues stagnate, and confidence in fiat currencies sinks toward the current level of confidence in congress. How much time will the following buy?

-

Negative interest rates

-

Retirement funds appropriation

-

War on Cash

-

More QE and “printing”

-

More wars and martial law

-

Other “extreme measures” that may be used.

GOLD AND SILVER!

Read: Why have western vaults shipped 1,000 to 2,000 metric tons of gold bars each year to Asia?

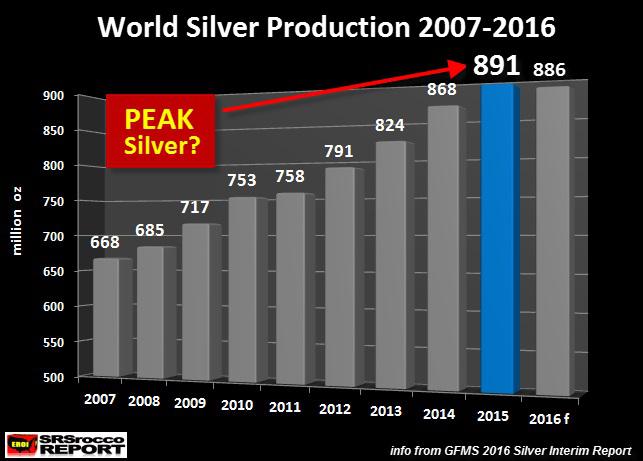

Did the world reach “Peak Silver” in 2015? Read “Chile’s Silver Production Down a Stunning 32%”

Gold 12 Year Wedge Pattern Will Soon Resolve – Probably Upward! Expect higher prices.

Read: Gold Erases Flash-Crash Losses As Dollar Slides

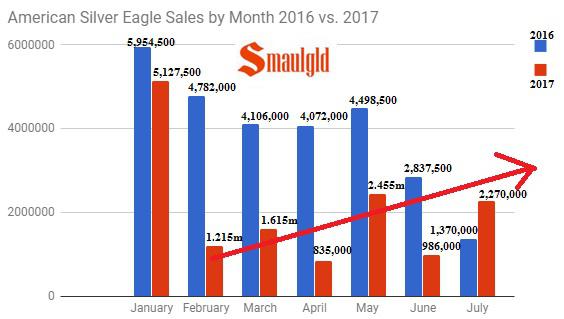

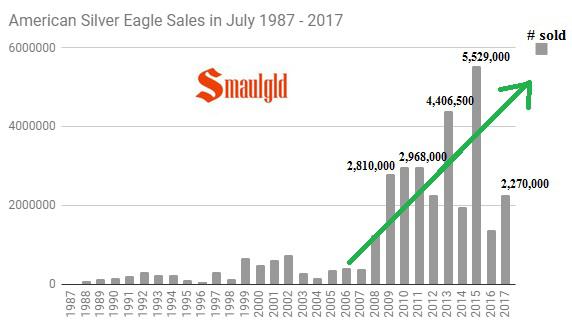

Silver Eagle Sales in July were stronger than in 2016.

Huge sales of Eagles since the 2008 crisis! Many people (not enough) sought protection via Silver Eagles.

CONCLUSIONS

-

Inflate or Die!

-

Bankers, politicians, Wall Street, lobbyists, government employees, corporations, and most people will choose inflation.

-

Consumer prices will increase as debt and currency in circulation rise.

-

Official statistics show almost no consumer price inflation. Believe the statistics at your own risk.

-

Wars will continue and expand, which will require additional inflation of currency in circulation and the devaluation of fiat dollars.

-

Change will eventually be necessary. Reset, a new currency, rise of the IMF Special Drawing Rights (SDR), horrible depression, responsible congress or …?

-

Governments and central bankers are digging us into a dangerous economic hole by massively increasing debt. They could stop making the debt hole deeper… but will they?

-

Gold and silver bullion and coins will protect purchasing power better than most other alternatives.

-

Gold and silver stocks and cryptocurrencies, though volatile, will expand your purchasing power if bought correctly.

We believe precious metals are bottoming and about to break out following the summer doldrums. August and September are typically two of the strongest months and we have 3 highly prospective junior gold stocks in our sights.

Gary Christenson

The Deviant Investor

Silver Investment: Outperformed Gold In This Major Sector

Posted by Steve St. Angelo - SRSrocco Report

on Thursday, 3 August 2017 15:00

Precious metals investors may not be aware, but silver investment has seriously outperformed gold in this major market sector. Even though precious metals sentiment and sales are currently lower than they were over the past several years, this is only temporary pause before the market surges as the highly inflated stock market finally cracks and plunges lower.

When we start to witness a huge correction or crash in the broader stock markets, there only be a few physical assets worth owning to protect wealth. Investors moving into the precious metals at this time, will see their asset values increase significantly. However, silver will likely out perform gold as investors and speculators move into the more undervalued precious metal.

Actually, we have already witnessed this as physical silver investment versus jewelry demand has outperformed gold in the same market. Let me explain. While industrial demand is the largest consumer of silver in the market, silver jewelry demand has ranked second for quite some time. But, this all changed after the 2008 U.S. Banking Industry and Housing Market collapse.

For example, global silver jewelry demand in 2007 was 182 million oz (Moz) versus 62 Moz in silver bar and coin demand. Thus, physical silver bar and coin demand was only 34% of world silver jewelry demand:

However, during the U.S. market meltdown in 2008, physical silver bar and coin investment surged more than three times to 197 Moz, while silver jewelry demand stayed flat at 178 Moz. In just one year (2007 to 2008), physical silver investment accounted for 110% of global silver jewelry demand.

While silver investment demand fluctuated over the next seven years, it hit a record high of 291 Moz in 2015 as investors took advantage of low prices not seen since 2009. As physical silver bar and coin demand reached a new record in 2015, accounting for 128% of global jewelry demand that year.

Even though physical silver demand declined in 2016, it was still neck and neck with jewelry demand of 207 Moz each. Now, if we compare physical silver investment to jewelry demand versus gold, we can plainly see how silver has outperformed gold in this market.

Before the 2008 market meltdown, global gold physical investment of 14.4 Moz accounted for 18% of world gold jewelry demand of 79.5 Moz:

Even though physical gold bar and coin demand more than doubled in 2008 to 30.1 Moz, it still only represented 40% of global gold jewelry demand of 75.7 Moz. If we go back to the silver chart above, physical silver demand increased more than three times in 2008 (versus 2007) and accounted for 110% of global silver jewelry demand.

Yes, it’s true that in “Dollar terms”, investors bought more physical gold than silver, but as I have stated before…. it’s a matter of focusing on “how many ounces” you own, not “how much in Dollars.”

Regardless, physical gold investment reached a record 37.3 Moz in 2015 versus 77 Moz in gold jewelry demand. However, gold bar and coin demand in 2015 only accounted for 48% of gold jewelry demand compared to physical silver investment which represented 128% of silver jewelry demand during the same year.

What does this mean? It shows us that investors are buying a larger percentage of the silver supply than gold in relation to jewelry demand. Furthermore, physical silver bar and coin demand (291 Moz) in 2015 increased nearly five times the amount (62 Moz) in 2007, versus physical gold investment that only increased 2 1/2 times, from 14.4 Moz to 37.3 Moz during the same time period.

While many precious metals investors have become disillusioned by market fundamentals because they don’t believe they matter in a manipulated market, patience will reward those who remain committed. The reason I believe this has to do with my understanding of the Energy Market. Without my in-depth knowledge of the disintegrating global oil industry, I would also believe that the Fed and Central Banks can continue manipulating the markets for decades. However, time is not on their side.

This is why I try to educate precious metals investors about energy. If you understand the dire energy predicament we are facing, you would realize there are few assets to own in the future to protect wealth. I will be publishing an article shortly on the BIG 3 U.S. OIL COMPANIES latest financial results…. which continue to disappoint.

Aug 1, 2017

- Gold has rallied more than $60 per ounce in the last few weeks. In the short term a new catalyst is needed to continue the rally, but the big picture looks fabulous.

- Please click here now. India has a population of about 1.3 billion people, with the World Gold Council (WGC) noting that about 60% of them are under the age of 25.

- The WGC appears to be significantly underestimating the pace of recovery of the nation’s jewellery market. Indian demand in the first half of 2017 has already exceeded demand for the entire 2016 calendar year.

- Chinese demand is solid, and Turkey is becoming a potential third force of significant love trade demand.

- Having said that, it could be the fear trade in the West that pushes gold over $1300. I refer to the US debt ceiling as a floor, and President Trump has wondered out loud if a government shut down is needed to stop congress from passing the buck.

- Unfortunately, Trump’s Treasury Secretary is in favour of passing the buck once again, but Trump has shown himself to be willing to stand up to anyone he feels is an obstacle to his agenda.

- Trump’s next statement regarding the debt floor will be a key indicator as to whether fear trade investors can help gold retake the $1335 price area that was hit on the night of Trump’s election.

- That rally was violently destroyed by the Indian government’s demonetization announcement. Conspiracy buffs will note that the demonetization announcement came just as it was clear that Trump had won the election.

- Perhaps it was coincidence, and perhaps not. Regardless, the good news for gold bugs is that the news about gold coming out of India is now quite positive.

- With a supportive love trade from India, China, and now Turkey, any US debt floor shock could create significant fear trade buying on the COMEX. That would almost certainly push gold to $1335 or higher.

- Please click here now. Double-click to enlarge this daily gold chart.

- Note the position of my 14,7,7 Stochastics series oscillator at the bottom of the chart. In the short term, gold is overbought.

- The lead line of the oscillator is at the 90 level. Gold bugs should cheer that the oscillator has a “flat line” event, and the rally continues.

- Regardless, some profit should be booked into this price strength. Please click here now. Investors who place heavy bets against the commercial traders generally don’t fare very well.

- It’s clear that these powerful commercial traders are selling and shorting gold with some size now.

- That makes sense after a $60 rally. Gold bugs should book some profit while cheering for further gains. This is a simple approach, and a winning one!

- The US dollar index gets a lot of coverage from gold analysts. Bank FOREX traders tend to focus more on the dollar versus the yen, and rightly so.

- Please click here now. Double-click to enlarge.

- This weekly chart paints a picture of a weak dollar against the yen. Further weakness appears imminent. That’s good for gold.

- Please click here now. Double-click to enlarge this interesting gold versus dollar index chart.

- Arguably, there’s a huge double-bottom pattern in play, with a neckline at the 14.44 price zone. The target of the pattern is the resistance in the 17 area. That would correspond with a gold price of about $1400.

- Many gold mining companies have significant cost cutting programs in play. Many are in advanced stages, and that means that even a modest rise in the gold price can turn these companies into highly profitable “cash flow cows”.

- Please click here now. Double-click to enlarge this GDX chart. It has a solid feel to it, and the current “steady as she goes” rally looks better than the previous ones. Profit needs to be booked on this price strength, but very lightly!

- A major upside breakout above $26 is likely to coincide with a key breakout above 14.44 on the USDX versus gold chart. Donald “The Golden Trumpster” Trump could be the catalyst that makes the breakout happen if he soon says “no” to any more US government debt ceiling expansion drugs!

Thanks!

Cheers

st

Aug 1, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair