Gold & Precious Metals

Jim Rogers: Gold Prices Will Be ‘Explosive,’ Just Wait and See

Posted by JIm Rogers via Kitco

on Monday, 31 July 2017 14:32

Jim Rogers Has a Forecast And It’s Ugly:

Is it time for the market to crash? Legendary investor Jim Rogers joins Kitco News for an interview to discuss his predictions for the biggest financial crisis we’ll see in our lifetimes, and how he’ll be protecting himself. “Gold is going to be explosive in the next few years,” Rogers said, as he gave his insight on gold, the U.S. dollar, and the crypto-craze. Click on the image or HERE for the 6 minute interview.

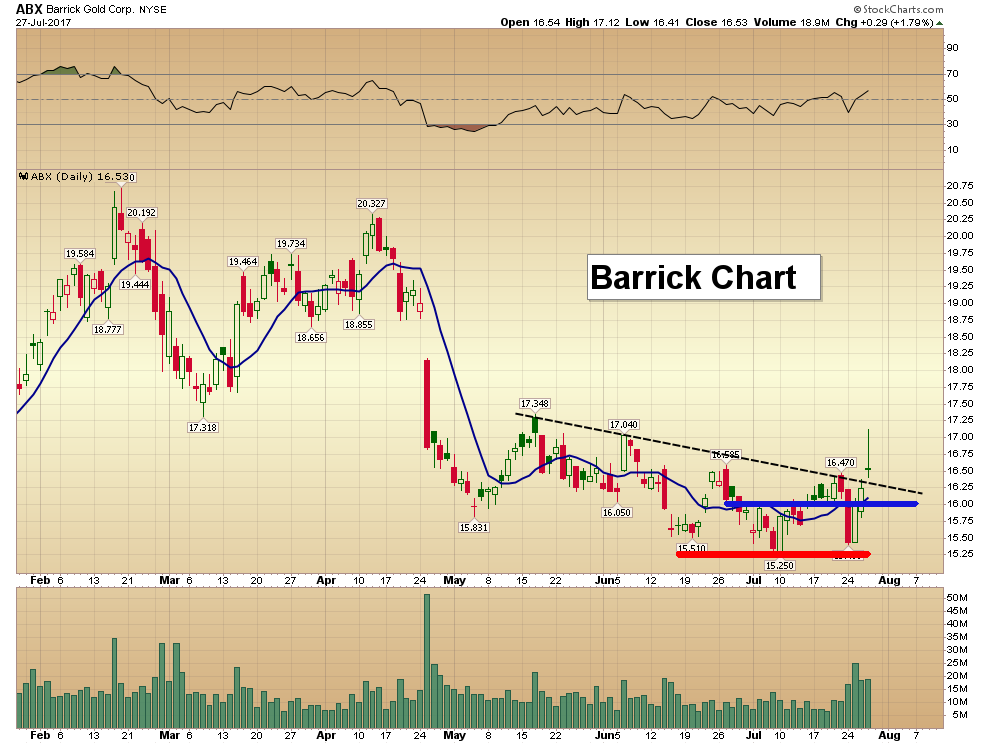

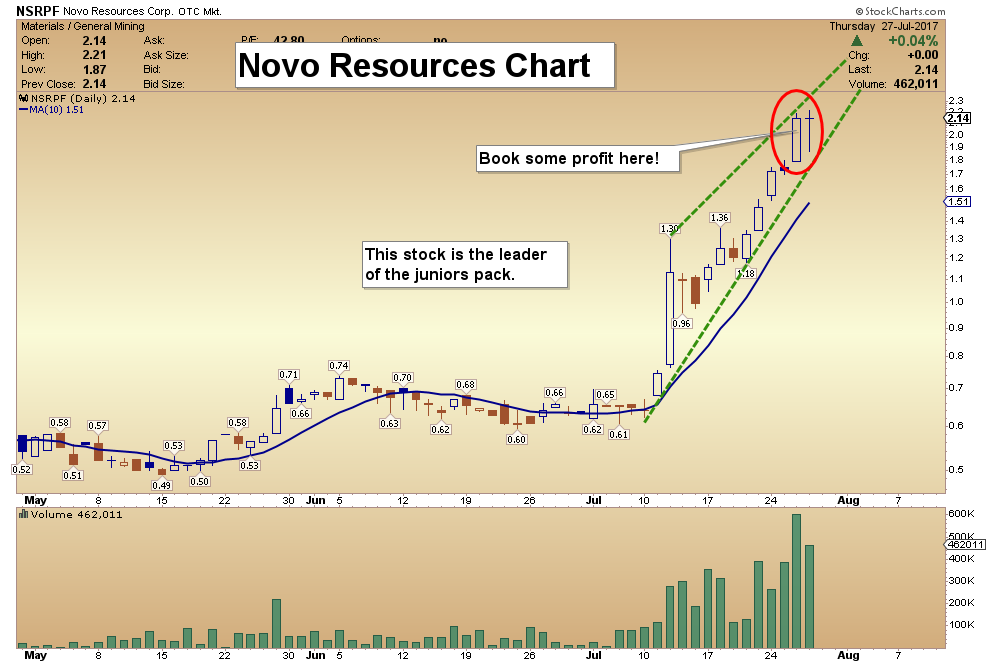

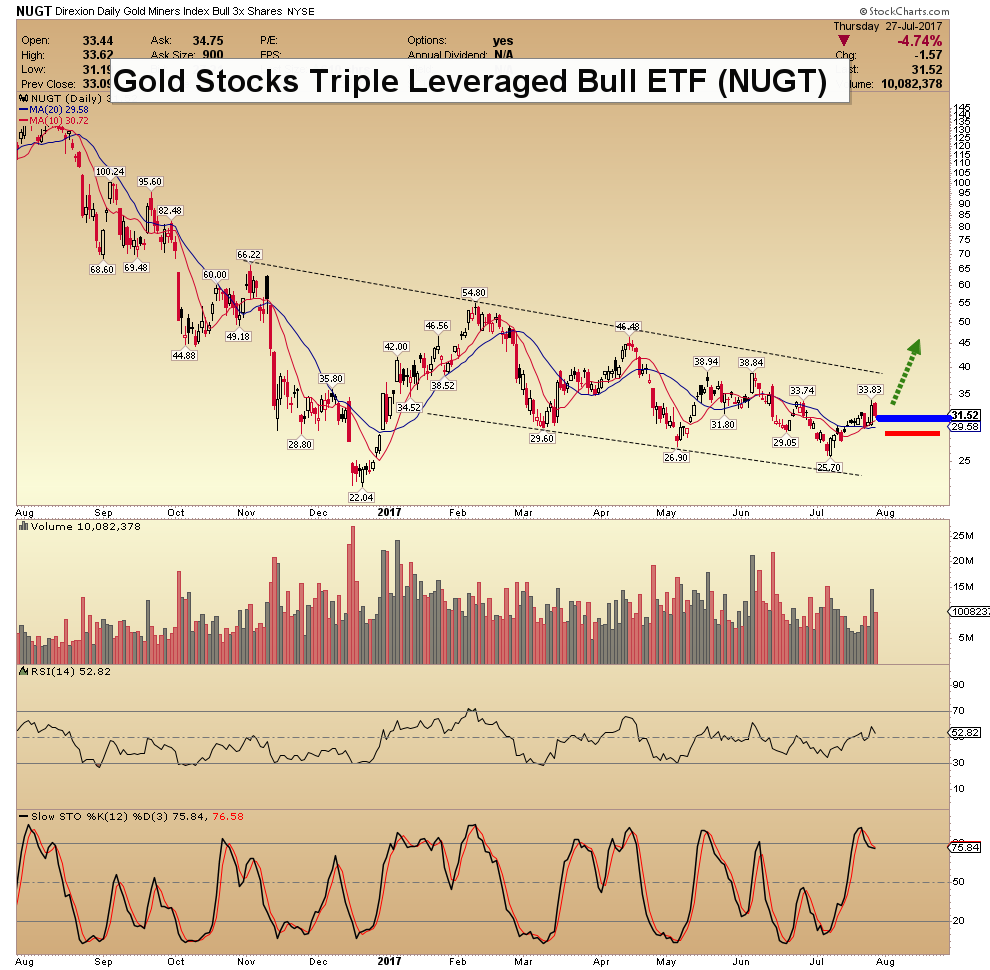

Key Gold Market Candlesticks

Posted by Morris Hubbartt - Super Force Signals

on Friday, 28 July 2017 18:52

Here are today’s videos and charts (double click to enlarge):

SFS Key Tactics & Video Update

SF60 Key Tactics & Video Update

SF Juniors Key Tactics & Video Analysis

SF Trader Time Key Tactics & Video Analysis

Morris

Investment Potential of Platinum and Palladium

Posted by Arkadiusz Sieron

on Friday, 28 July 2017 13:22

In the previous sections of this edition of the Market Overview, we presented the demand and supply outlook for platinum and palladium. In that part, we would like to analyze the potential benefits of adding these precious metals into investment portfolio.

On the surface, platinum and palladium behave similarly to the yellow metal. Indeed, as the chart below shows, there is an important positive correlation between prices of these metals and gold. It should not be surprising as all four main precious metals – gold, silver, platinum, and palladium – are considered as currency, with an appropriate ISO 4217 code.

Chart 1: The price of gold (yellow line, Comex future price, weekly average), the price of silver (red line, right axis, Comex future price, weekly average), the price of platinum (blue line, Nymex future price, weekly average), and the price of palladium (green line, Nymex future price, weekly average).

Based on the 1977 – 2016 data, the correlation coefficient for gold and platinum is 0.87, while for the yellow metal and palladium it is 0.75 (for silver these coefficients are, respectively, 0.81 and 0.65). It implies a strong relationship between both these metals and gold. Interestingly, it’s stronger than the link between them, as the correlation coefficient for platinum and palladium is 0.72 (we use weekly averages here due to availability of consistent and comparable data, but the coefficients are similar for daily prices). Why should we add them to the gold portfolio, if they are not negatively correlated with the yellow metal?

First of all, since both platinum and palladium are industrial commodities – which are sensitive to the level of business activity (auto sales) and industrial demand – they can play an important and beneficial role in portfolio diversification (their prices are more correlated with the U.S. industrial production than gold). In particular, thanks to its industrial use, both white metals serve as a long-run inflation hedge. In good times, they should outperform gold, which behaves like a safe haven, shining during periods of uncertainty and turmoil. And it’s worth pointing out that the correlation between these two platinum-group metals and gold are still smaller than between gold and silver, which is above 0.9, hence investors could consider replacing part of their silver holdings with platinum-group metals. Indeed, it turns out that silver has significantly lower risk-adjusted return than platinum and especially palladium.

Moreover, both white metals are more volatile than gold, as has been perfectly seen in 2008 when platinum reached its peak, only to drop like a stone a few months later. Their relatively high volatility is the other side of the ability to diversify portfolios. However, investors should remember that one of the reasons of unpredictability is lower liquidity of white metals compared to gold.

To make it clear, we do not recommend abandoning gold and investing money in platinum and palladium instead. Quite to the contrary, we believe that the majority of precious metals portfolio should be allocated to gold – especially by investors who would like to minimize risk, as it was found in this paper – as gold is the best hedge against the stock market (according to this paper, platinum can help diversify a stock portfolio in the long-term, but not as well as gold, while palladium does not show such hedging ability). However, small additions of the platinum-group metals as portfolio diversifierscould enhance expected returns, being a smart move. There is no agreement what “small additions” exactly means, but most analysts would agree that platinum and palladium should never be more than 5 percent of one’s investment portfolio, while gold should be at least 10 percent.

Indeed, when we analyzed the weekly returns (based on the prices presented on the chart above), it turned out that gold has the lowest volatility measured by the standard deviation. Platinum (and silver) has similar expected return (about 0.15 percent per week), while being significantly more volatile. Meanwhile, palladium yields higher gains (about 0.24 percent per week), but at the expense of greater risk (the standard deviation of 4.70 percent against 4.44 percent in the case of silver, 3.56 percent in the case of platinum and 2.72 percent in the case of gold). Thus, risk-adjusted returns for both gold and palladium, are almost the same, while platinum loses in this respect (and silver looks even worse). Still, let’s keep in mind that the data period that we analyzed starts at 1977 – if we take into account the current bull market only (starting at 2001), we see that silver outperformed both: platinum and palladium.

Moreover, palladium has a weaker correlation with gold. It suggests that investors debating about platinum versus palladium should prefer the latter metal – financial analysis confirms our previous conclusions on the fundamentals of both white metals. Given the retreat of diesel technology in the automotive sector, palladium should outperform platinum in the long-run. Surely diesel will not disappear, but its dusk is very likely after the Volkswagen scandal and given that burning diesel produces nitrogen dioxide, the main cause of smog – this is why more and more cities in the world (Paris is the great example) are implementing measures against diesel vehicles. Therefore, taking all this into consideration, the investment potential of palladium seems to be greater than in case of platinum, although the current level of prices may limit it.

Finally, please note that the above does not take into account the possible (and likely) impact of the growth of electric cars in the future, including the use thereof in self-driving cars. The above could disrupt the demand for both platinum and palladium. That’s not something that’s going to happen this month or next, but it is something that one needs to keep in mind.

Thank you.

Arkadiusz Sieron

If you enjoyed the above analysis and would you like to know more about the fundamental outlook for precious metals, we invite you to read the July Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It’s free and you can unsubscribe anytime.

Legend Connected In China At The Highest Levels Says Price Of Gold Will Skyrocket 75% Within 18 Months!

Posted by King World News

on Thursday, 27 July 2017 15:59

Eight years after the global financial crash and despite fears of tightening, stock markets are near historic records.

Eight years after the global financial crash and despite fears of tightening, stock markets are near historic records.

So much liquidity was pumped into the market that investors faced with too much money and not enough opportunities, frantically chased any investment that might produce a return.

Markets are addicted to cheap money. However, the Trump bump has turned into the Trump slump as hopes fade for Trump economic stimulus in the wake of his healthcare reform failure. Investors face a darkening picture, particularly when the world’s largest borrower faces another debt-ceiling fight this fall…

SWOT Analysis: Silver In the Spotlight

Posted by Frank Holmes - US Global Investors

on Tuesday, 25 July 2017 14:18

Strengths

- The best performing precious metal for the week was silver, up 3.34 percent as investors loaded up on ETFs that purchase the physical metal, perhaps speculating that silver would outperform gold if the latter rallied. Gold traders and analysts remained bullish this week, for the fifth week, as the European Central Bank keeps its stimulus going, reports Bloomberg. In addition, as the dollar slumps amid an investigation into President Trump, gold heads for the first back-to-back weekly advance since early June, another Bloomberg article reads.

- Gold bulls are keeping their faith in the metal, reports Bloomberg, as the equity rally pares the yellow metal’s gains. Gold bulls have pointed to slow inflation and Fed concerns that asset prices look “somewhat rich.” Similarly, a Bank of America Merrill Lynch survey shows fund managers are growing hesitant to buy U.S. equities. Jason Mayer of Sprott Asset Management says that the non-stop bull market has led to a lot of complacency where managers aren’t hedging. “Once that tide turns, that could prove to be bullish for gold and precious metals,” Mayer said.

- After President Trump’s economic revitalization agenda once again faltered, the U.S. dollar fell to an 11-month low this week, reports Bloomberg. Opposition to Trump’s health-care reform bill, along with European shares dropping amid earnings disappointments, sent gold to its highest level this month.

Weaknesses

- The only negatively performing precious metal for the week was palladium, off 1.62 percent. Hedge funds and money managers seem to be losing their faith in gold, along with other precious metals, reports Bloomberg. Before posting its first weekly gain in six weeks, the net-long position in gold fell to the lowest in 17 months for the week ended July 11. Money managers are hitting the exit as they brace for monetary tightening in the U.S. and Western Europe, the article continues, and aren’t waiting around for signs that the Fed may change its rate trajectory.

- U.K. Royal Mint sales dropped in the second quarter by 62 percent compared with the previous three months, reports Bloomberg. Sales are down 41 percent from a year earlier. And according to data on the Swiss Federal Customs Administration’s website, Swiss gold exports declined 169.5 tons in May. Month-over-month exports to India also fell, but exports to China and Hong Kong both rose.

- Jaguar Mining previously had seen its 2017 gold production output at 100,000 ounces, but the company cut its forecast to 95,000-105,000 ounces, reports Bloomberg. Positive news, however, came after its decision to leave Turmalina at Level 9 and commence development and mining of Level 10 in Orebody A. Turmalina saw significantly stronger production in June versus April following this decision, the article continues.

Opportunities

- Scotia Mining Sales notes that as silver has gotten cheap again, particularly when looking at the widening gold-silver ratio, investors have been piling into silver ETFs (while dropping out of gold ETFs). Interestingly enough, there seems to be a bearish outlook in the futures market, where hedge funds are now holding the first net short silver position seen in two years, the group writes. The risk of higher U.S. interest rates should drive silver prices lower, is the reasoning behind this. However, if the Fed “blinks” and silver prices rebound, they will rebound quickly and violently, Scotia continues.

- Klondex Mines reported record, second-quarter operating results for its Nevada and Canadian operations this week, producing 66,629 gold equivalent ounces (GEOs), an increase of 94 percent from the first quarter. In the press release, the company also stated that it remains on track to meet its annual production guidance of 210,000 to 225,000 GEOs, up 36 percent from 2016. “As expected, the operating results for the second quarter were the best in the company’s history,” President and CEO Paul Huet said.

- Roxgold Inc. announced an updated mineral resource estimate (MRE) and complete drilling results from its first half Infill and Extension drilling program at the Bagassi South deposit. The Bagassi South deposit is located less than two kilometers from Roxgold’s flagship underground gold mine at the 55 Zone. According to a press release, highlights of the estimate are as follows: 1) Indicated MRE of 352,000 tonnes at 16.6 grams of gold per tonne (g/t Au) for 188,000 ounces and 2) Inferred MRE of 130,000 tonnes at 16.6 g/t Au for approximately 69,000 ounces of gold. In other company news, Columbus Gold Corp. announced its intention to spin out its mineral projects in the U.S. into a separate publicly traded company to be named Allegiant Gold Ltd. The plan of arrangement would see shareholders of Columbus receive one share of Allegiant for every five shares of Columbus. This should unlock the value for their North American assets.

Threats

- As Global Mining Research points out in a note this week, over the last few years there have been a number of companies that haven’t mined to their Life of Mine (LOM) plans. In particular, stripping requirements haven’t been met. One of the most well-known examples of this recently is Detour Gold, the research group points out, but clarifies that it certainly not the only one. Deferring the waste removal puts the company at risk for greater waste removal requirements in the future, which is obviously not a source of revenue.

- Due to Goldcorp’s failure to properly consult with affected indigenous peoples on its proposed Coffee Gold project, the Yukon Socio-Economic Assessment Board decided to stop its assessment of the project, reports Seeking Alpha. This means the project’s timeline could be in jeopardy, along with costs associated with the project. This decision points to deeper troubles at Goldcorp in relation to the company’s Canadian operations, the article continues.

- Special Counsel Robert Mueller is taking a wide-angle approach to his probe regarding President Donald Trump’s campaign and Russia in last year’s election. He is now looking into other Trump business transactions, despite the President’s caution not to do so. “The roots of Mueller’s follow-the-money investigation lie in a wide-ranging money laundering probe launched by then-Manhattan U.S. Attorney Preet Bharara last year,” the Bloomberg article reads.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair