Gold & Precious Metals

Rising Interest Rates Could Present A Problem For Risk Assets

Posted by The Felder Report

on Monday, 10 July 2017 14:50

Exactly one year ago I wrote, “long bonds enter the blowoff stage” (and “a few more thoughts on the long bond blowoff“). Since then the 30-year treasury yield has risen 40% and the 10-year treasury yield has risen 75%. This is an important development for investors to take note of because when interest rates have risen this rapidly in the past it has typically led to some stormy weather for risk assets.

The Reason Why Gold And Silver Have Frustrated Investors Since 2011

Posted by Steve St. Angelo - SRSrocco Report

on Friday, 7 July 2017 13:52

The biggest frustration to many precious metals investors, is why have the gold and silver prices under-performed the market since 2011? Actually, for gold it was since 2012. Even though gold hit a new record high of $1,900 in September 2011, its average annual price was higher in 2012 at $1,669 compared to $1,571 the prior year.

Regardless, the precious metals analysts back in 2012 were forecasting the market was going to experience even higher gold and silver prices, especially after the Fed announced QE 3 at the end of 2012. However, the precious metals community was taken by surprise as the gold and silver prices were hammered at the end of 2012 and into the beginning of 2013:

During this period, the gold price fell 30% and the silver price declined nearly 50%. Did something fundamental change in the markets for investors to suddenly ditch precious metals? Actually, something really big happened….. THE MARKETS BROKE. Of course, many in the alternative media believe the financial market died in 2008, but when we look at another indicator… it clearly shows that the markets drastically changed even further in 2012.

The following charts (below) from the article, Deutsche: The Market Broke In 2012, “This Is What Everyone Is Talking About”, show that the market is totally under-pricing RISK by orders of magnitude never seen before. Now, when I say “under-pricing risk”, all that means is that the market has no idea of the dangers ahead. It is similar to someone driving a car that doesn’t realize the engine is burning up and the brakes don’t work because the WARNING LIGHTS aren’t functioning. So, the poor slob continues to speed down the road, without out a care in the world… until the car blows up or he heads over a cliff.

In the Deutsche Bank article linked above, analyst Aleksandar Kocic providing actual evidence that the WARNING LIGHTS in the market are no longer working:

Regular readers are familiar with the Economic Policy Uncertainty (EPU) index which is constructed by counting the frequency of articles in ten leading US newspapers that contain three of the target terms: economy, uncertainty; and one or more of Congress, deficit, Federal Reserve, legislation, regulation or White House. These numbers are then properly normalized by their means and standard deviations of occurrence and combined into an aggregate index. As such, EPU is completely market independent (in the same way the mechanics of a coin toss is relative to any particular gamble).

Okay… the description of the indicator above may be a bit difficult to understand, so I will simplify it. The BLUE LINE represents the “Economic Uncertainty Policy” (EPU index) shown by the frequency of articles in the MainStream media. The BLACK LINE is the VIX index, the volatility index (S&P 500). Basically, economic uncertainty printed in articles in the Mainstream Media should correspond with the volatility indicator of the markets (the VIX).

And… this is precisely what took place from 1996 to 2011. The blue and black lines moved up and down in tandem. However, after 2011, something changed. According to Kocic:

Intuitively, when VIX is in tune with EPU, the market is acknowledging the levels of risk through the prices. However, when VIX is low and EPU high, markets are complacent – they are underpricing risk.

After 2011, the two measures of risk decouple with VIX consistently low despite growing uncertainty. The breakdown is structural, and it is visible across all market sectors, not only equities.

What Kocic is saying is that the market has become highly complacent and is seriously underpricing risk. In the next two charts, Kocic takes the difference between EPU Index and the VIX to get the second chart at the bottom. As we can see, something changed after 2011, and especially after 2016

This chart is showing the level of COMPLACENCY in the market. From 1996 to 2011, the market complacency level fluctuated around the base line. However, after 2011, market complacency is now trended much higher.

According to the article:

This is where things get even more interesting, because by this measure, “it appears that the markets have made a structural shift towards higher levels of complacency in the last six years.” Here, Kocic reverts back to his old, cautious self, warning that this decoupling will end in tears. This is how he frames it:

Current levels of complacency are alarming. This is what everyone is talking about. Despite growing uncertainties and tensions, the market volatility refuses to rise. Persistence of low volatility is increasing the penalty for potential dissent and reinforces one sided positioning. As a consequence, the risk of disorderly unwind is growing.

Because market volatility is so low, investors have been brainwashed to believe EVERYTHING IS OKAY. Unfortunately, the situation is quite dire because the market’s “Warning Lights” have been turned off.

I decided to take that chart above and show at what point the gold price peaked:

This chart is showing the level of COMPLACENCY in the market. From 1996 to 2011, the market complacency level fluctuated around the base line. However, after 2011, market complacency is now trended much higher. According to the article: This is where things get even more interesting, because by this measure, “it appears that the markets have made a structural shift towards higher levels of complacency in the last six years.” Here, Kocic reverts back to his old, cautious self, warning that this decoupling will end in tears. This is how he frames it: Current levels of complacency are alarming. This is what everyone is talking about. Despite growing uncertainties and tensions, the market volatility refuses to rise. Persistence of low volatility is increasing the penalty for potential dissent and reinforces one sided positioning. As a consequence, the risk of disorderly unwind is growing. Because market volatility is so low, investors have been brainwashed to believe EVERYTHING IS OKAY. Unfortunately, the situation is quite dire because the market’s “Warning Lights” have been turned off. I decided to take that chart above and show at what point the gold price peaked:

There’s no coincidence that the gold price peaked at the same time the EPU – Economic Policy Uncertainty index decoupled from the VIX, shown at the end of 2011. The market has been deluded to believe that GOLD DOESN’T MATTER anymore. This is shown in VIX index, as it continues to trend lower to the same level in 2007… before all hell broke lose in the markets:

Again, the EPU Index just shows how much “Uncertainty” is taking place in the markets via articles on the MainStream media. According to Kocic, the EPU Index below, has been at a record high level since 2016:

However, the VIX Index (volatility) is now at the same level it was in 2007. Which means, the market is totally disregarding ALL THE BAD NEWS coming out of the Mainstream Financial Media. Again, it is just like a speeding car heading down the road with an engine ready to blow and with no brakes, but the driver doesn’t know anything is wrong because the warning lights aren’t working.

So, for all the frustrated precious metals investors out there who continue to BELLY-ACHE and COMPLAIN that the “Analysts Got It Wrong” about gold and silver since 2011… have also been BAMBOOZLED, like the rest of the market, that EVERYTHING IS FINE. Well, it isn’t.

Lastly, the question I receive the most in my INBOX is “WHEN will the markets collapse?” Before I answer that, I want to say the following. The amount of contact email I receive now from my website is off the charts. I used to be able to reply to everyone within a few days, but now it has become impossible as the amount of requests for information have now become a part-time job. I apologize for not being able to respond to everyone over the past few weeks (month)…. but it has been a very busy time for me.

Furthermore, the SRSrocco Report site is a ONE MAN SHOW. Those who run their own websites understand what I am talking about because there is a great deal of work and logistics just to keep the site running. Many of the alternative media sites have more staff to deal with maintaining the site and etc, so they are free to spend most of their time on research, writing and doing interviews. Unfortunately, I don’t have that luxury, which is keeping me from writing even more articles and publishing new Reports.

That being said, I want to thank all the individuals who have been very generous in sending donations to the site. These donations have allowed me to maintain and upgrade the site. Gosh, last year before my excellent webmaster, Peter, upgraded the site, it was very slow and at times generated site errors which kept some visitors from being able to access it. Some followers let me know that it was taking upwards of 15-20 seconds to load.

Now, the site loads exceptionally fast as we have upgraded to a Virtual Private Server. Also, my webmaster has done a lot of additional programming to make the site even more efficient and fast. I can tell there is a big difference in the performance of the site now when I visit some of the other alternative media sites that take a long time to load. Unfortunately, it is hard to find a good webmaster, but I was very lucky to come across Peter.

When I first started the site, I decided not to do a subscription service because I wanted to make sure the information got out to the public. However, I have received several emails from followers who have suggested that I should start up a PATREON site, like Sean at SGT Report and James Kunstler and Kunster.com. While the site will still be open to the public, this is a service that allows people to become a PATREON contributor to the site.

So, I will be working with my webmaster over the next week to consider implementing this option. Again, I appreciate the generous support by many of you all as I try to put out original information that is not found elsewhere on the internet.

Okay… so, WHEN does COLLAPSE happen?? If I had that answer, I would be able to pick the winning numbers on the lottery ticket. However, the indicators, like the ones shown in this article, point out that the situation in the markets are deteriorated much quicker than before. The Central Banks asset purchases of $1.5 trillion in the first five months of 2017, are more than double the annual trend since 2011.

The U.S. and Global Oil Industry is being GUTTED from the inside out due to the current low oil price. As Chris Martenson stated during my interview with him, the global oil and gas industry’s total debt is now closer to $3 trillion versus $1 trillion in 2006. These energy companies have to pay a lot of INTEREST EXPENSE just to service their massive debt. Once the energy industry starts to really disintegrate, then it will take down the entire market.

My gut tells me that this will likely start to occur within the next 6 months to 2 years. It could happen sooner, or it could take a bit longer. However, there is no way to TIME THIS EVENT. So, don’t try to. It would be prudent to own some physical precious metals before the market cracks, or it may be difficult to access any…. or if so, only at much higher prices.

For those who continue to be frustrated by the low precious metals price, silver is down another 20 cents as I write this article, take a GOOD LOOK at the charts in this article. The market WARNING LIGHTS are no longer working, so when the CRASH happens, it will be a complete surprise.

Check back for new articles and updates at the SRSrocco Report.

So, for all the frustrated precious metals investors out there who continue to BELLY-ACHE and COMPLAIN that the “Analysts Got It Wrong” about gold and silver since 2011… have also been BAMBOOZLED, like the rest of the market, that EVERYTHING IS FINE. Well, it isn’t.

Lastly, the question I receive the most in my INBOX is “WHEN will the markets collapse?” Before I answer that, I want to say the following. The amount of contact email I receive now from my website is off the charts. I used to be able to reply to everyone within a few days, but now it has become impossible as the amount of requests for information have now become a part-time job. I apologize for not being able to respond to everyone over the past few weeks (month)…. but it has been a very busy time for me.

Furthermore, the SRSrocco Report site is a ONE MAN SHOW. Those who run their own websites understand what I am talking about because there is a great deal of work and logistics just to keep the site running. Many of the alternative media sites have more staff to deal with maintaining the site and etc, so they are free to spend most of their time on research, writing and doing interviews. Unfortunately, I don’t have that luxury, which is keeping me from writing even more articles and publishing new Reports.

That being said, I want to thank all the individuals who have been very generous in sending donations to the site. These donations have allowed me to maintain and upgrade the site. Gosh, last year before my excellent webmaster, Peter, upgraded the site, it was very slow and at times generated site errors which kept some visitors from being able to access it. Some followers let me know that it was taking upwards of 15-20 seconds to load. Now, the site loads exceptionally fast as we have upgraded to a Virtual Private Server.

Also, my webmaster has done a lot of additional programming to make the site even more efficient and fast. I can tell there is a big difference in the performance of the site now when I visit some of the other alternative media sites that take a long time to load.

Unfortunately, it is hard to find a good webmaster, but I was very lucky to come across Peter. When I first started the site, I decided not to do a subscription service because I wanted to make sure the information got out to the public. However, I have received several emails from followers who have suggested that I should start up a PATREON site, like Sean at SGT Report and James Kunstler and Kunster.com. While the site will still be open to the public, this is a service that allows people to become a PATREON contributor to the site.

So, I will be working with my webmaster over the next week to consider implementing this option. Again, I appreciate the generous support by many of you all as I try to put out original information that is not found elsewhere on the internet. Okay… so, WHEN does COLLAPSE happen?? If I had that answer, I would be able to pick the winning numbers on the lottery ticket.

However, the indicators, like the ones shown in this article, point out that the situation in the markets are deteriorated much quicker than before. The Central Banks asset purchases of $1.5 trillion in the first five months of 2017, are more than double the annual trend since 2011.

The U.S. and Global Oil Industry is being GUTTED from the inside out due to the current low oil price. As Chris Martenson stated during my interview with him, the global oil and gas industry’s total debt is now closer to $3 trillion versus $1 trillion in 2006. These energy companies have to pay a lot of INTEREST EXPENSE just to service their massive debt. Once the energy industry starts to really disintegrate, then it will take down the entire market.

My gut tells me that this will likely start to occur within the next 6 months to 2 years. It could happen sooner, or it could take a bit longer. However, there is no way to TIME THIS EVENT. So, don’t try to. It would be prudent to own some physical precious metals before the market cracks, or it may be difficult to access any…. or if so, only at much higher prices. For those who continue to be frustrated by the low precious metals price, silver is down another 20 cents as I write this article, take a GOOD LOOK at the charts in this article. The market WARNING LIGHTS are no longer working, so when the CRASH happens, it will be a complete surprise. Check back for new articles and updates at the SRSrocco Report.

Pause vs. Reversal

Posted by Paul Rejczak - Sunshine Profits

on Thursday, 6 July 2017 13:28

Briefly: In our opinion, full (100% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Gold and silver didn’t continue Monday’s plunge, but they didn’t erase it either. Have we just seen a reversal or just a normal, healthy pause after a sharp move?

The former seems more likely and the price levels that were reached (and those that were not) provide the details. Let’s move right to the charts (chart courtesy of http://stockcharts.com).

Gold

Gold moved back up on an intra-day basis, but finally ended the session without significant changes. At the moment of writing these words, gold is trading at about $1,223, so the situation didn’t change much overnight either. Please note that the volume that accompanied yesterday’s back and forth movement was significant, but the same was the case on June 14th – back then it was only a pause within the decline. Consequently, it doesn’t seem that the sizable volume is a bullish sign at this time.

The RSI indicator is close to 30, however, the comeback of the regular gold-USD link and the situation in the USD and Euro Indices seems to be much more important. After all, if gold is to move below the 2015 low this winter, then it’s about time it started a bigger decline, and during bigger moves, the daily RSI can stay below 30 for prolonged periods (November and December 2016 serve as examples).

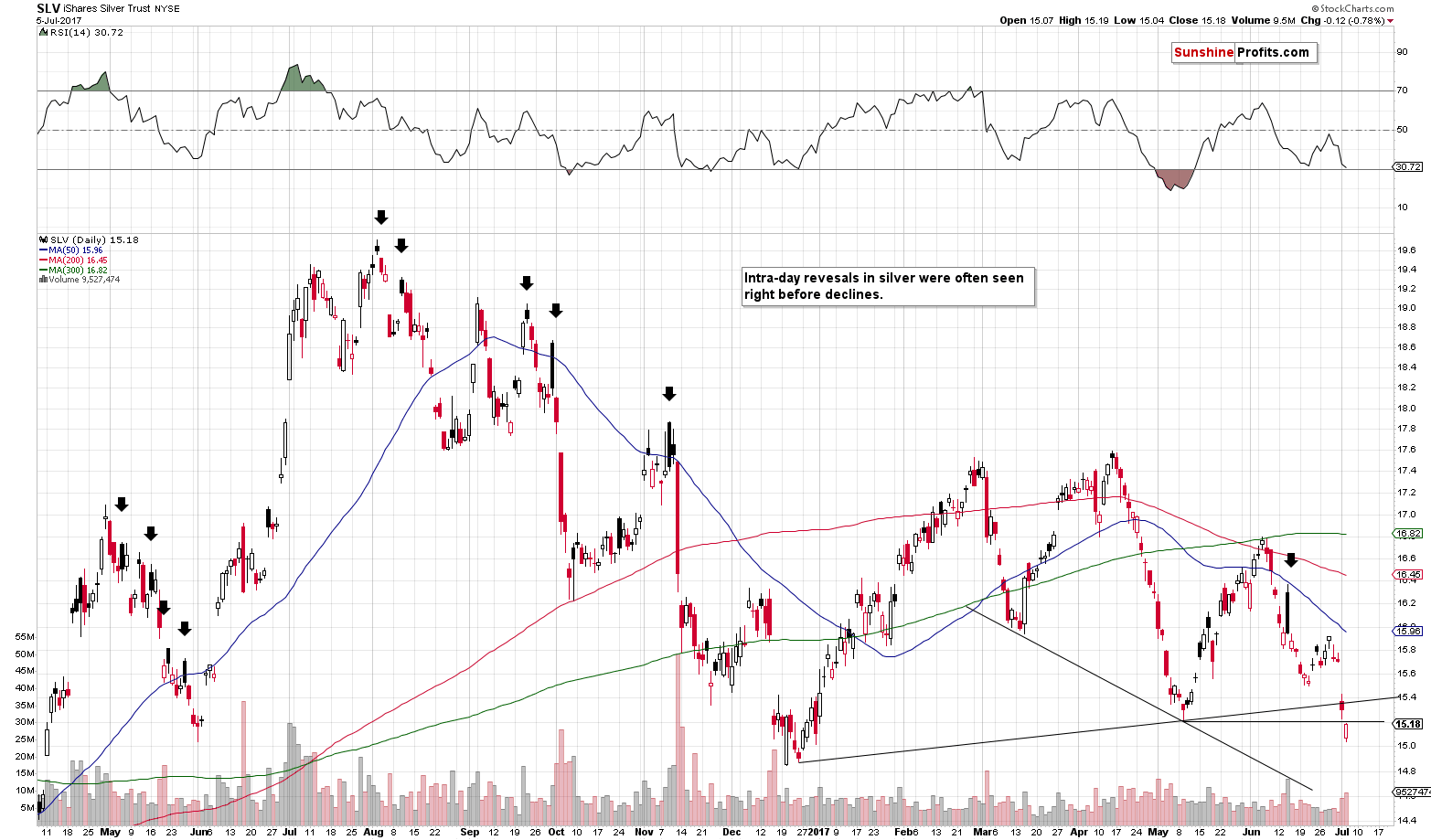

Silver

The SLV ETF chart shows that silver moved a bit higher, but not above any important support/resistance line that it had previously broken. It remains below the May low and below the rising resistance line. Consequently, it doesn’t seem that anything changed based on yesterday’s session.

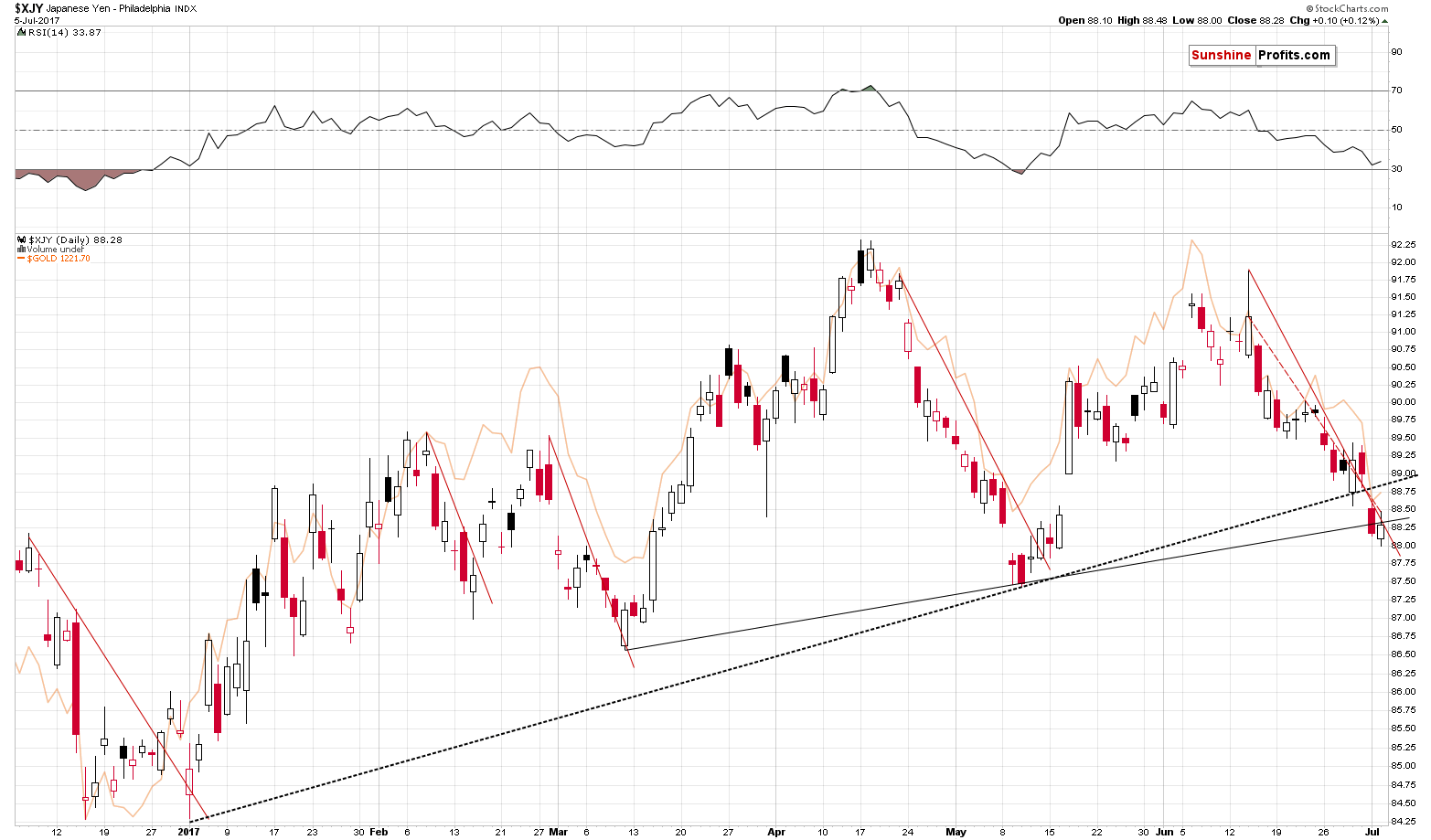

Yen

In yesterday’s alert, we wrote the following on the Japanese yen:

The yen did something unlikely – even though it had moved to support levels and broke above the resistance line (and it still seems that taking profits from the trading position in this currency pair was justified), it declined sharply on Monday, breaking through (and closing below) 3 support lines: the short-term one based on the recent tops and 2 medium-term ones based on previous lows. The short-term outlook for the Japanese yen has just deteriorated substantially.

(…) the change in the short-term outlook implies that the 2017 corrective upswing is over and that the yen can now move substantially lower (below the 2016 low and quite possibly below the 2015 low as well). Given the strong gold-yen link, the above has profoundly bearish implications for the precious metals market.

During yesterday’s session, the yen moved somewhat higher, but not above any important resistance level. Consequently, nothing changed from the technical point of view and the outlook for the yen – and for gold – remains bearish.

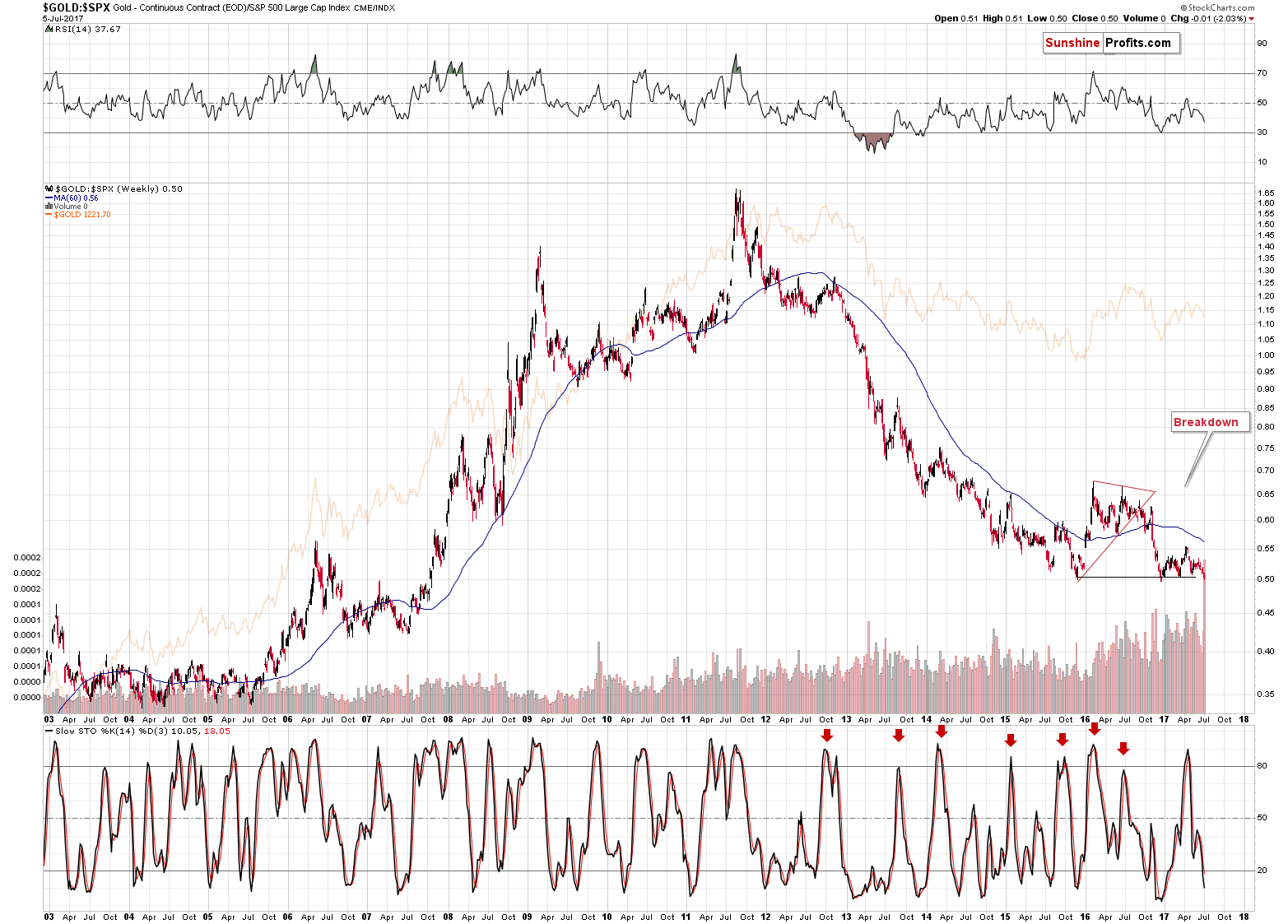

Gold to S&P Ratio

Finally, we would like to remind you of a very specific situation in the ratio between gold and the broad stock market. This ratio moves along with gold and visible divergences can tell a lot about gold’s next big move.

In early 2011, the ratio was reluctant to break above the previous high and it only did so by an insignificant amount – this divergence heralded declines and we have indeed seen a major top.

In the second half of 2012, the ratio barely moved higher even though gold moved quite close to its 2011 top. This major divergence indicated trouble ahead and that’s exactly what the gold market got – the yellow metal declined very substantially in the following months.

We are currently once again in a situation in which the ratio moved lower and it appears ready to break to much lower levels. Will gold follow? That’s exactly what happened in the previous cases, so why should this time be any different?

The ratio formed a very specific price pattern (actually two patterns) and it’s about to complete them. The ratio formed a head-and-shoulders pattern (this year’s performance) as a right shoulder of a bigger head-and-shoulders pattern (the second half of 2015 being the left shoulder and the 2016 performance being the head). Once gold moves lower while stocks rally, the ratio is likely to plunge further and based on the mentioned patterns, the move is not likely to be minor. The target based on the size of the head suggests a repeat of the 2016 decline in the ratio – or a bigger decline, which could correspond to a move to the ratio’s 2003-2005 lows. What could the gold price do? It could repeat what happened during the previous big slide of the ratio – the 2013 decline. This methodology would imply gold at about $900, which is in tune with our downside target for gold based on other techniques.

Summing up, it seems that yesterday’s price move was a natural pause after a sharp decline and not a major reversal. The short-term outlook remains bearish.

Most importantly, however, please keep in mind that the biggest buying opportunity for the precious metals is likely just months (not years) away.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (100% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,317; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $44.57

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JNUG ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we’ll keep you – our subscribers – updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

UBS Says Investors “Should Be Buying Gold Near $1,200”

Posted by Investing News Network

on Wednesday, 5 July 2017 12:10

The Swiss banking giant is recommending that investors buy the yellow metal for insurance.

The Swiss banking giant is recommending that investors buy the yellow metal for insurance.

UBS Group’s (NYSE:UBS) wealth management unit says gold will probably trade between $1,200 and $1,300 an ounce in the short-term, and is recommending that investors buy the yellow metal for insurance.

“We’re not saying we have a bullish bias; we’re not saying we have a bearish bias,” Wayne Gordon, the firm’s executive director for commodities and foreign exchange, told Bloomberg.

“We’re saying that tactically, people should be buying it somewhere near $1,200 and selling it again somewhere near $1,300, and it’s because we have a view that real rates go sideways. So the pickup in nominal rates will be equally matched by the pickup in inflation,” Gordon added.

If US unemployment keeps falling, and the US Federal Reserve keeps raising interest rates no matter what inflation data shows, that will be negative for gold in the short term, he said.

Other analysts agree with this short-term forecast. In fact, after last week’s hawkish comments from the world’s biggest banks, it seems most central banks will follow the US and tighten policy measures, which could hurt gold.

“We still have two rate hikes factored in for the [US Federal Reserve] in the second half of the year, and we expect some reduction of the balance sheet,” Capital Economics analyst Simona Gambarini said.

“At the same time, in the UK and Europe, although policy will remain loose for some time, it will start to turn the other way,” she added. “So all in all, it doesn’t bode so well for gold prices.”

But according to UBS, if the US economic slowdown seen at the start of 2017 is not as temporary as the Fed believes, or if global growth slows, policymakers will have to review their tightening path. “We like the insurance qualities for gold just from an unknown perspective at these sorts of levels,” Gordon explained.

The gold price was trading at $1,223 on Tuesday (July 4), after rallying somewhat from an eight-week low reached on Monday (July 3). Geopolitical worries turned investors to safe-haven assets, as North Korea announced the successful launch of an intercontinental ballistic missile that could reach Alaska. The announcement was made on North Korean state television on Tuesday afternoon in the early hours of Independence Day in the US.

“Although the current market anxiety and flight to safety has the ability to support gold, the sharp $23 depreciation observed on Monday will be difficult for bulls to claw back. Short term bears remain in control with gold at risk of depreciating further if the Greenback continues to stabilise,” said Lukman Otunuga, a research analyst at FXTM.

“Buy Gold Stocks Now”

Posted by Stewart Thomson - Graceland Updates

on Tuesday, 4 July 2017 17:26

Jul 4, 2017

The latest gold price action is a near-perfect reflection of the current market fundamentals.

The latest gold price action is a near-perfect reflection of the current market fundamentals.- Please click chart now. Double-click to enlarge.

- Gold has arrived at my $1220 – $1200 conservative investor buy zone.

- The market is seasonally soft in the summer months, but two key price drivers are poised to create the next rally.

- The first is the US jobs report. It’s scheduled for release on Friday at 8:30AM. Market participants are going to be looking at wage price inflation as much as they are looking at the total number of jobs created.

- Gold has a rough general tendency to soften ahead of this report, and then rally strongly following its release.

- The $1220 – $1200 support zone is an ideal price area for gold bugs to buy in anticipation of a post jobs report rally!

- Please click here now. Double-click to enlarge this seasonal spot gold chart, courtesy of Dimitri Speck.

- This chart should be used by all gold bugs as a key reference chart to understand gold’s seasonality.

- In a nutshell, the summer is the best time to accumulate gold, and February is a great time to book some profits.

- The current price softness is seasonally normal, and it’s exacerbated by the decision of bullion banks to halt imports into India.

- They decided to halt imports until they got clarification about applying the new GST regime to the gold market. It appears that June imports were only about five tons.

- It’s almost impossible for gold to rally with Indian bullion banks importing no gold, but there is some great news.

- To view that news, please click here now. Imports are set to resume next week, and that resumption will coincide with upside pressure on the gold price that typically follows the US jobs report release.

- “I personally feel India is poised for double-digit growth, GST is an aid to it, even without GST we would have reached there. If you ask my personal judgment, post 2019-2020 we are poised for double digit growth.” – Rakesh Jhunjhunwala, one of India’s top investors, July 4, 2017.

- Gold demand in India is in a basing zone, and I expect the country’s gold market infrastructure to become as good as China’s in just the next three years.

- A floor of double digit GDP growth in India is going to create a “bull era” in gold demand growth. Simply put, it’s the greatest time in history to be an investor in the precious metals asset class.

- Please click here now. In any business cycle, growth generally peaks as the cycle peaks.

- The current US business cycle is about eight years old, and growth is quite strong, relatively speaking. This strength should now begin to create wage inflation, which is good news for gold stock enthusiasts.

- To understand why I use the phrase “relatively speaking”, please click here now. Germany and China have the biggest current account surpluses in the world. The US has the biggest deficit.

- It’s a “no brainer” to see why Europe’s most powerful nation (Germany) is joining forces with China. A current account surplus “cartel” is essentially being created. This is going to put enormous pressure on the Trump administration to devalue the dollar against other fiat currencies, and perhaps directly against gold.

- While gold is seasonally weak, investors should not let this distract them from the fact that gold is fundamentally and technically in a key buying area now. It’s poised to see very solid appreciation in the years ahead.

- Please click here now. Double-click to enlarge this GDX chart. In a deflationary crisis, gold and silver bullion are the best performers. Gold stocks tend to look like wet noodles, and silver stocks can look even worse. As the winds of inflation begin to pick up against a background of possible dollar devaluation, the mining stocks will be the leaders.

- I view the $23 – $18 area for GDX as one of the most important accumulation price zones in the history of markets. Investors who take action here are poised to be rewarded with gains that are not just big, but here to stay!

Thanks!

Cheers

st

Jul 4, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair