Gold & Precious Metals

Chris Vermeullen – Gold Look Strong, but is it Strong Enough?

Posted by Chris Vermeulen - The Gold & Oil Report

on Thursday, 13 April 2017 2:08

Chris Vermeullen, one of the savviest market technicians around, is bullish about gold, but not too bullish this time. He’s seen this pattern many times before. Last week it broke the $1260 resistance point intra-day, only to retreat back before the close. Today, it’s over $1270, but will lose momentum once again? While the long term chart is bullish, he believes that gold will truly shine in the 2nd half of the year.

The stock market is due for a breather and this may very well be the time. Oil is poised to go higher. The VIX while shooting higher will pull back shortly and provide and excellent short. Much more here in this interview. Don’t be fooled by the headlines.

This Will Immediately Signal That Gold Is About To Spike To $1,700

Posted by King World News

on Wednesday, 12 April 2017 14:26

With the gold and silver surging $20 and 40 cents respectively, today King World News is pleased to present an important update on the war in the gold market from Michael Oliver at MSA. Oliver allowed KWN exclusively to share this key report with our global audience.

With the gold and silver surging $20 and 40 cents respectively, today King World News is pleased to present an important update on the war in the gold market from Michael Oliver at MSA. Oliver allowed KWN exclusively to share this key report with our global audience.

Annual momentum turned positive in February 2016 (circled). The post-breakout surge halted at levels that didn’t mean anything to momentum.

…also from KingWorldNews:

We Are Seeing Historic Moves In The Gold Market

Gold & Silver Trading Alert: Gold’s Outperformance and Huge Reversal

Posted by Przemyslaw Radomski

on Wednesday, 12 April 2017 14:03

Several things happened on Friday and the markets reacted to them, so it’s not easy to interpret the final outcome. Was the reversal bearish or was the session bullish as gold didn’t decline substantially even though the USD rallied? Was gold’s reaction adequate, too small or too big?

Let’s start the discussion with a reminder of one of the reasons for Friday’s pre-market rally. In Friday’s Gold Trading Alert, we wrote the following:

The likely direct reason behind today’s overnight spike in the price of gold is a cruise missile strike at a Syrian airbase, most likely the one from which a deadly chemical weapons attack had been launched earlier this week. However, it’s not likely that 59 Tomahawk missiles was enough to ignite a rally alone. The strike had damaged ties between Washington and Moscow, as Russian spokesman Dmitry Peskov described the U.S. action as “aggression against a sovereign nation” on a “made-up pretext”.

We have already mentioned that news-based rallies are likely to be temporary – today let’s focus on the temporary impact that the above was likely to have – it was likely to boost prices of assets that are viewed as safe havens – gold and… the U.S. dollar. Both are being viewed as safe bets and thus it’s no wonder that we saw a temporary increase in prices of both assets. Consequently, the fact that gold didn’t decline is not a reflection of gold’s true strength vs. the US dollar and thus it shouldn’t be viewed as a bullish sign.

The important thing is that whereas the USD rallied further during the session, gold and silver reversed and erased (or more than erased in the case of silver) the entire daily rally before the end of the session. So, even though the initial safe-haven reaction was quite natural, it was also the case that the news-based rally was temporary – it didn’t even take one trading day for the move in precious metals to be reversed.

All in all, it appears that the reversals are the thing to keep in mind, while gold’s supposed strength vs. the USD is not. Let’s take a look at the gold chart (chart courtesy of http://stockcharts.com).

Gold’s reversal was not only sizable, it was also accompanied by huge volume – this is a classic, reliable reversal pattern. Needless to say, the implications are bearish. Moreover, please note that the sell signal from the Stochastic indicator remains in place.

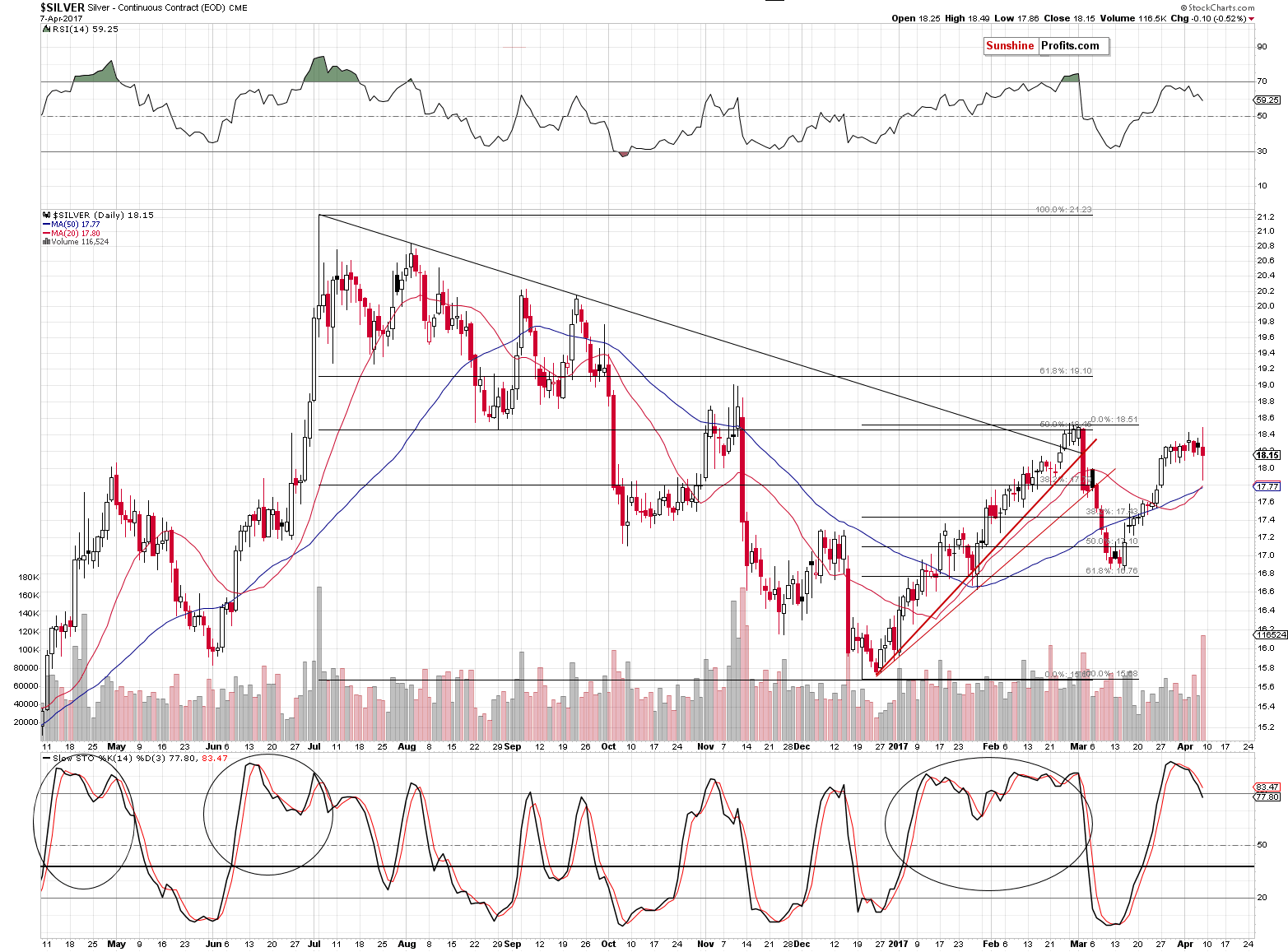

Not only is the reversal in gold significant by itself – it’s also confirmed by analogous action in silver. In fact, silver declined even more than gold (having closed below $18, which is not visible on the above chart) and it’s currently at $17.90. The implications are bearish.

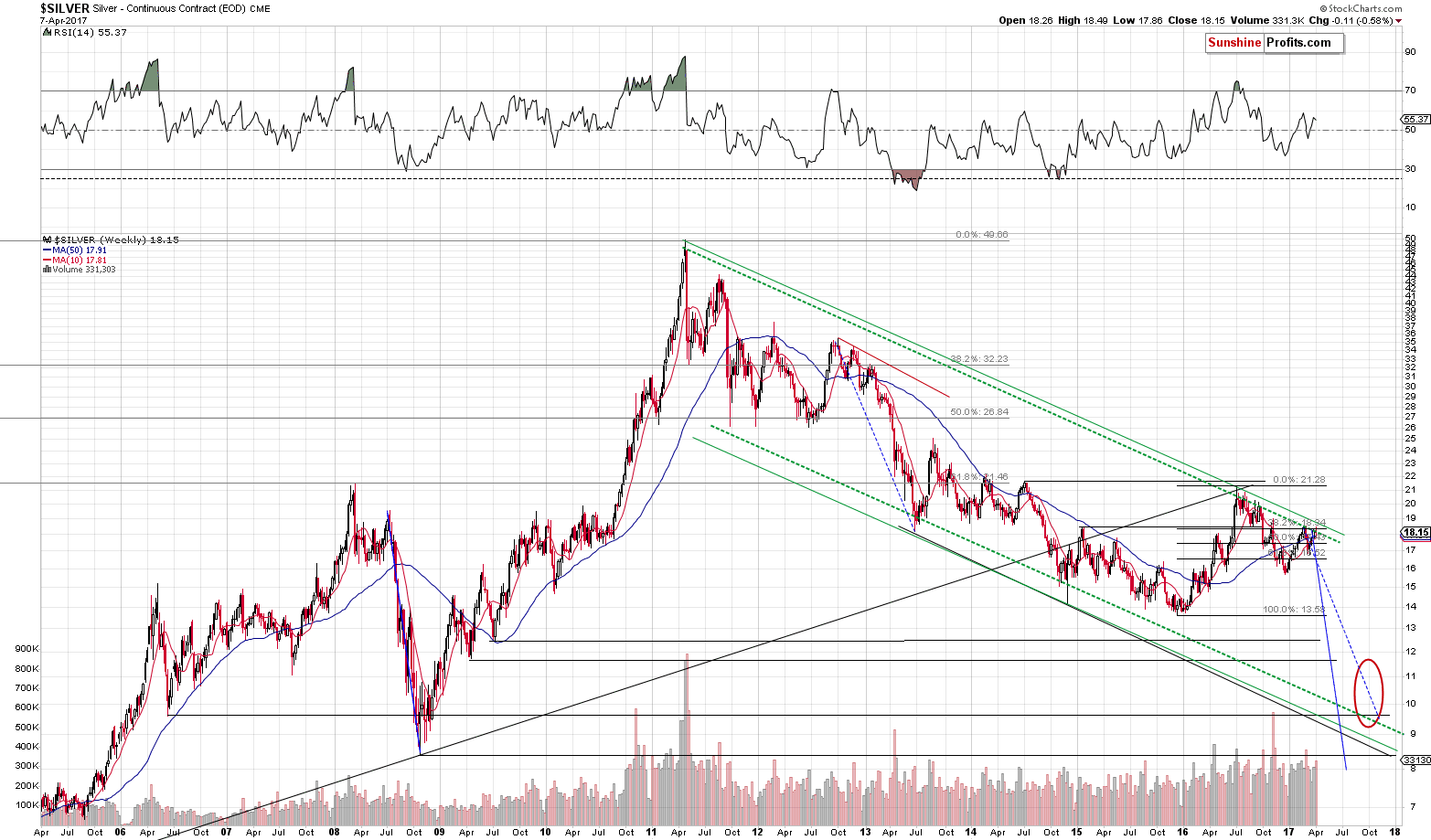

Last week, we wrote the following about the above long-term silver chart:

There are a few things that decide whether a resistance line is strong or not. The more important the tops that it’s based on, the more important the resistance line. The more tops create a given line, the more important the resistance is. Finally, for the line to be very important, the space between the tops that create it should be rather significant (for instance the red line based on 2 late-2012 tops didn’t result in anything in the following months and years).

Moreover, the way a given resistance line is likely to work is based on what created a given line. Therefore, a resistance line based on intra-day tops is likely to stop intra-day moves, a line based on daily closes is likely to stop the moves in terms of daily closing prices (so that the closing price doesn’t break the line even though intra-day moves might) and the line based on weekly closes is likely to stop the moves in terms of weekly closing prices (in analogy to daily closing prices).

After the rather lengthy introduction, let’s move to the point. Silver just moved to the line that is very important (green dashed line based on one extremely important top, one very important top and one less important top) and it did so in terms that were in tune with what the line was based on – silver closed the week at the line that was based on weekly closing prices.

The implications are naturally bearish for the following weeks and months as the above means that even if silver moves a bit higher temporarily, it’s unlikely to move higher substantially or for long. The above alone suggests that we are in the “pennies to the upside and dollars to the downside” territory without considering anything else (including the USD Index). The situation would be different if the silver had broken above this line and confirmed this breakout – but it didn’t, so the implications of moving to it are clearly bearish.

So, a reversal is very likely to occur shortly, if it didn’t occur on Friday.

Silver moved higher very temporarily, reversed before the end of the week and overall it declined last week. The mentioned long-term resistance line seems to have stopped the rally.

Summing up, Friday’s pre-market upswing in the precious metals sector appears to have been just a temporary news-based move that was already invalidated. The resulting reversals are very bearish developments especially that they were seen in both: gold and silver. Naturally, the above could change in the coming days and we’ll keep our subscribers informed, but that’s what appears likely based on the data that we have right now. If you enjoyed reading our analysis, we encourage you to subscribe to our daily Gold & Silver Trading Alerts.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Apr 11, 2017

- Is it last call, for US stock market alcohol? The current price action of gold, the yen, the Indian rupee, and Chindian stock markets suggests that investors who have moved their focus from American stock markets to gold, silver and Chindian stock markets… are doing the right thing.

- America sports one of the worst demographics profiles in the world. The “make the ageing debt-soaked citizens and government great” plan will do little more than create a macabre version of America’s 1950s Happy Days TV show.

- The new Richie Cunningham is 75 years old, works 2 or 3 part-time jobs, and has no real savings. The only way to “make Richie great”… is to let him retire.

- Unfortunately, the US government is eagerly spending trillions of dollars of borrowed money on insane regime change and wars in the Mid-East, while throwing food stamps to its own citizens.

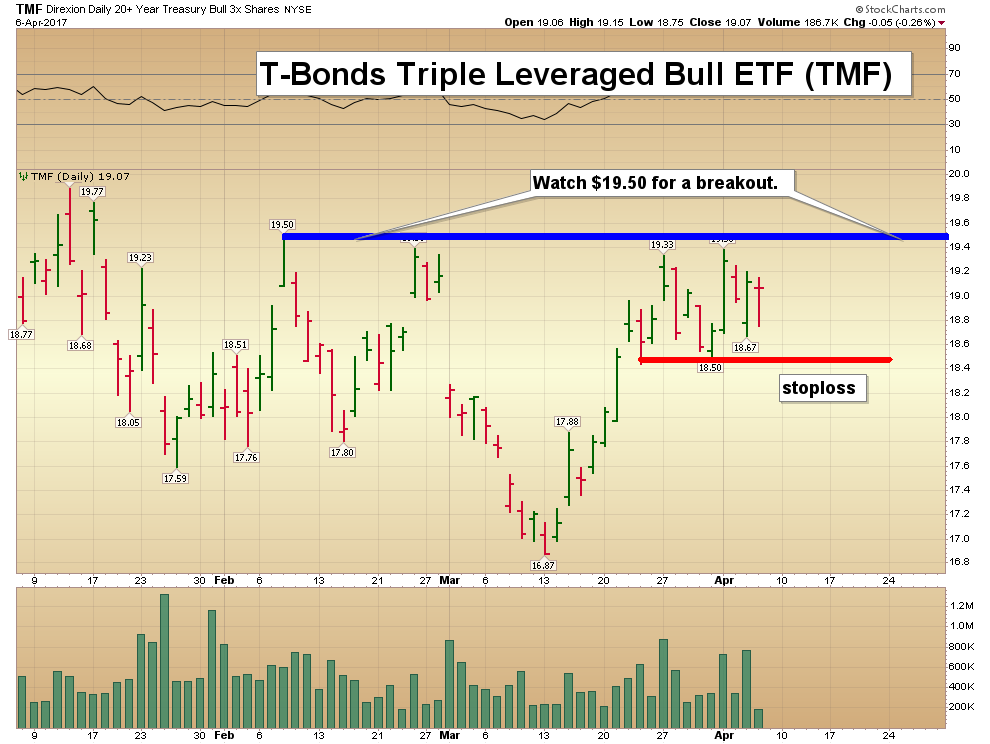

- It’s no surprise that the US stock market is now being carried higher by fewer and fewer stocks. The Fed has barely started its hiking cycle, and it will soon begin “reverse QE” (shrinking its balance sheet). That’s very inflationary, and negative for the US stock and bond markets.

- Also, auto sales are suddenly shrinking. Top Goldman analysts predict it may be the start of a bigger trend that could last for years. As sales drop, car companies will raise prices to make up for lost revenues.

- The bottom line: Stagflation is beginning. The idea that Donald Trump is going to override the peaking US business cycle without eliminating income taxation and capital gains taxation is a ridiculous fantasy.

- Please click here now. Double-click to enlarge this great-looking daily gold chart.

- There’s no question that gold can pull back at any time now, given the extent of the rally, but even a decline to $1225 would only add to the positive look of the chart.

- Please click here now. India sports the greatest citizen demographics in the world, and big name Chinese and Hong Kong stocks are trading near book value.

- Sell some winning stock market positions in America. Buy some positions in Chindia. That’s a sensible strategy.

- Wise Chinese business builders are working with Indians in Dubai now, to turn the Dubai Gold and Commodities Exchange into what I predict will become the undisputed centre of world gold price discovery.

- Western gold bugs may be somewhat over-focused on COT reports for gold/silver, and under-focused on the yen, the rupee, and Chindian growth.

- The COT reports suggest gold can pull back, but only modestly. So, there’s no need for fear. My “Uptrend of Champions” on the daily gold chart looks solid, and gold is marching higher again this morning. Greed is a warning sign, but there is no investor greed now. There is nervousness. That suggests the uptrend is healthy.

- Please click here now. Next, please click here now. Double-click to enlarge. As the dollar disintegrates against the rupee, I’ll dare to suggest it’s likely making a multi-decade top.

- The sun is setting (permanently) on the American empire. For gold, the rupee, the yuan, and Chindian stock markets, the sun is rising. It will likely keep rising for an entire century of time.

- Please click here now. Double-click to enlarge. The dollar looks like a train wreck against both the rupee and the yen. It’s almost impossible for gold to decline in a serious way when those two currencies are beating on the dollar. Here’s why:

- Big bank FOREX traders buy gold as a currency when the dollar tumbles against the yen. That’s in play now.

- A continued rise in the rupee increases the purchasing power of gold-obsessed Indian citizens. If they can buy more gold with their fiat currency, they will do so. In the mind of the Indian gold buyer, a rise in the rupee versus the dollar is the same thing as a fall in the dollar price of gold. It also opens the door for a gold import duty cut because it cuts the government’s current account deficit.

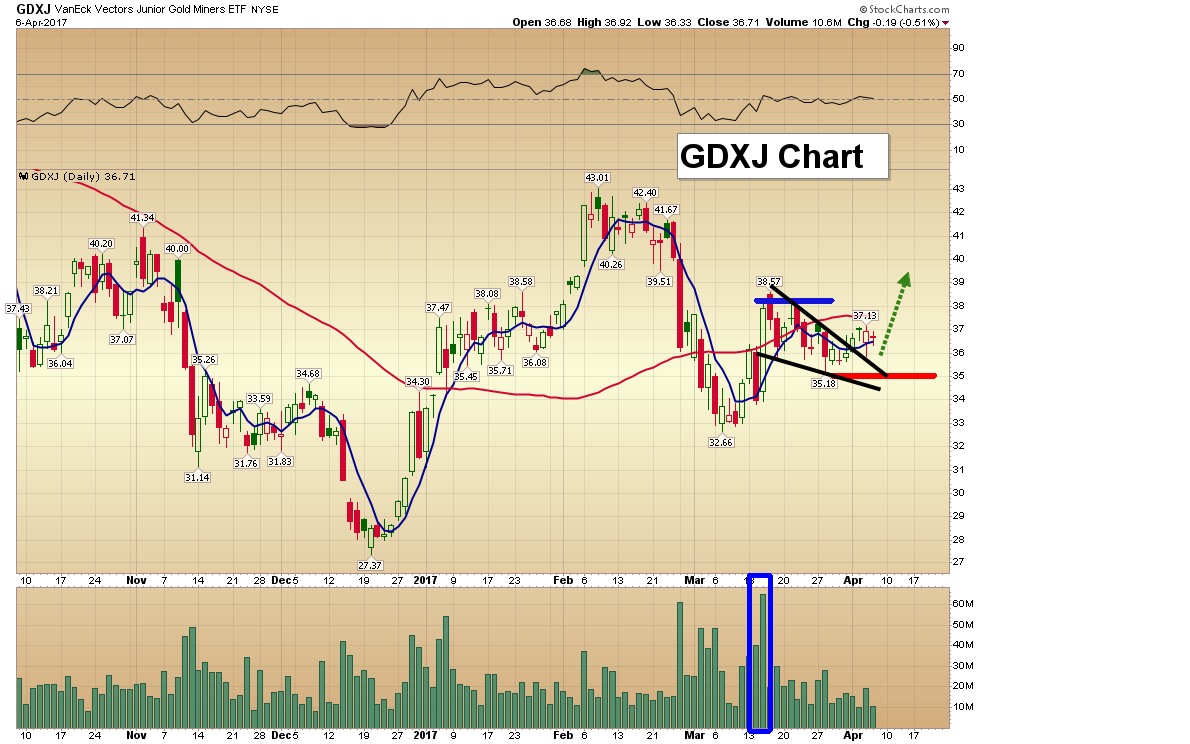

- Regardless, I’ll caution junior gold stock enthusiasts about getting too excited, too soon. It’s a great time (the greatest in history) to accumulate junior gold stocks, but it takes time for inflation to become problematic in the eyes of institutional money managers.

- Until they see problematic inflation right in front of them, these money managers will focus on senior gold stocks. Juniors can still do well, but they won’t stage the kind of “one hundred bagger” action that is possible when inflation begins to get out of control.

- Please click here now. I’ve suggested that oil is making a major low. If RBC’s top oil analyst is correct (I think she is), and oil is headed 20% higher this year, that’s going to usher in a significant ramp-up in institutional concern about inflation. Gold stocks almost always lead bullion in an inflationary environment, and do so in quite a big way.

- Please click here now. Double-click to enlarge this fabulous GDX chart.

- Note the “flat line” event in play on the 14,7,7 series Stochastics oscillator, at the bottom of the chart. A nice upside breakout from a rectangle pattern is also in play. I predicted that Janet’s third rate hike would produce a third major rally in gold stocks, and that’s exactly what is happening. It’s time for Western gold bugs to throw some caution to the wind. Sit back and enjoy the ride… up to my $26 profit-booking target zone for GDX!

Thanks!

Cheers

st

Apr 11, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

Graceland Updates Subscription Service: Note we are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection we don’t see your credit card information. Only PayPal does.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am. The newsletter is attractively priced and the format is a unique numbered point form; giving clarity to each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Gold Stocks: Key Tactics For Investors

Posted by Morris Hubbartt - Super Force Signals

on Friday, 7 April 2017 13:58

Today’s videos and charts (double click to enlarge):

SF Juniors Trading Charts & Video Analysis

SF Juniors Core Position Charts & Video Analysis

SFS Charts & Tactics Video Analysis

SF60 Charts & Tactics Video Analysis

SF Trader Time Charts Video Analysis

Morris

The SuperForce Proprietary SURGE index SIGNALS:

25 Surge Index Buy or 25 Surge Index Sell: Solid Power.

50 Surge Index Buy or 50 Surge Index Sell: Stronger Power.

75 Surge Index Buy or 75 Surge Index Sell: Maximum Power.

100 Surge Index Buy or 100 Surge Index Sell: “Over The Top” Power.

Stay alert for our surge signals, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

SFS Web Services

1170 Bay Street, Suite #143

Toronto, Ontario, M5S 2B4

Canada

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair