Gold & Precious Metals

Keep it simple!

– Two Trends That Will Force The Fed To Start Buying StocksSnowballs have a short life expectancy in Death Valley.

– Fiat currencies, backed by credit and debt, survive longer than snowballs in Death Valley, but history shows all fiat currencies are inflated into worthlessness and eventually die.

– “U.S. dollars have value only to the extent that they are strictly limited in supply.” Ben Bernanke on November 21, 2002. But we know the supply of dollars has grown rapidly since 1971, and especially after the 2008 crisis while Bernanke was Chairman of the Fed.

– The U.S. government is officially $20 trillion in debt. Unfunded liabilities are far larger.

– Official national debt has doubled every eight to nine years for decades. Debt in 2017 is $20 trillion and accelerating higher, and in 24 – 27 years it could be eight times higher – at $160 trillion. Can this fiat currency Ponzi scheme survive that long?

– If the Fed “prints” another $140 trillion, will that destroy the purchasing power of the dollar?

– Note to congress: “If you don’t raise the debt limit you will collapse the fiatcurrency bubble. But if you raise the limit and continue with ever-increasing debt you only delay a larger collapse.”

– If something can’t continue, it will stop. What specifically might stop? Economic insanity, exponentially increasing debt creation, FederalReserve credibility, the dollar as the Reserve Currency, purchasing power of the fiat dollar, euro, pound, yen …and others come to mind.

– Federal Reserve Notes are debts of the central bank and have value because they are strictly limited in supply. But the supply of dollars is huge and rising rapidly. That begs the question, “What will preserve the value of the dollar?”

– Gold has been valuable money for thousands of years. Which will retain their value longer?

Gold coins,

or

Fiat dollars created in ever-increasing quantity?

Snowballs in Death Valley tell us most of what we need to know about debt based fiat currencies – and their chances for survival.

Gary Christenson

The Deviant Investor

Mar 28, 2017

- I’ve referred to the price action of gold in 2017 as the “Uptrend of Champions”.

- Please click here now. Double-click to enlarge.

- A short term pause here in the $1255 – $1270 area is likely. A pullback would only add to the already-positive look of the chart, and open the door for a powerful rally to $1315.

- To understand why a pullback would only add to the solid technical set-up, please click here now. Double-click to enlarge.

- A pullback from the current price area would create a nice inverse bull head and shoulders continuation pattern within the uptrend channel. That pattern would mathematically target the $1343 area highs where gold traded on the night of Donald Trump’s election.

- The Western gold community’s initial celebration of the “Golden Trumpster” that evening was turned into a gold price nightmare by the horrific demonetization announcement in India.

- The good news: With bank restrictions gone, Indians are now free to withdraw unlimited amounts of cash. Most of the world top bank FOREX traders are very negative on the dollar versus the yen, euro, and the franc. The bottom line is that gold is now ready to retake all the ground it lost from the $1343 area highs.

- I’ve suggested that the world is on the cusp of a Chindia-oriented “gold bull era”, but initially themed more on a period of dollar devaluation in America. That’s because there is no solution to the Western world’s debt problems other than default or dollar devaluation against gold.

- China’s government has serious debt, but there are still about 300 million rural citizens poised to enter the urban workforce. China’s citizens are maniacal savers, and the country can grow its way out of its debt problems, much like America did in the 1950s.

- Unfortunately, the America of today (and most of the Western world) is demographically the opposite of what it was in the 1950’s. There will be no growing out of debt for Western governments or citizens.

- There will only be fiat devaluation and a very long term decline in the standard of living of the citizens.

- Please click here now. Double-click to enlarge. Oil is beginning to look interesting at the current support zone.

- Oil stocks may comprise more than 20% of Russian and Chinese stock markets. That’s a high number compared to other big markets. A more positive outlook for the price of oil could usher in substantial institutional investment in the stock markets of both Russia and China.

- Please click here now . Double-click to enlarge this quarterly bars long term oil chart.

- Note the 14,5,5 Stochastics series oscillator at the bottom of the chart. It’s massively oversold, and now flashing a huge crossover buy signal. There’s also a loose inverse H&S bottom pattern in play. That pattern tends to signal that a major price advance is imminent.

- Oil is by far the biggest component in most commodity indexes, and institutional money managers tend to buy gold when those indexes rise. That’s partly because gold is also a commodity index component, but mainly because they view gold as the ultimate currency hedge against inflation.

- A major rally in oil would be extremely good news for gold and silver investors around the world.

- Please click here now. Double-click to enlarge. Janet Yellen has (so far) been successful in raising short term rates while keeping long term rates in check.

- This T-bond chart suggests bonds could pause, and then stage an upside breakout. That fits with the inverse H&S bull continuation pattern scenario I’ve laid out on the gold chart.

- Please click here now. Double-click to enlarge this spectacular chart of the euro versus the US dollar. Gold has quite a lot of positive price drivers right now, and the euro is one of the bigger ones. A major upside breakout has either just occurred, or is imminent.

- Please click here now. Double-click to enlarge this silver stocks ETF chart. The only thing that gold stock price enthusiasts have to “fear”… is that silver stocks may perform even better than gold stocks.

- My suggestion: Own both silver and gold stocks. All investor eyes should be on the $36.74 price marker for SIL. Today is options expiry day for COMEX gold and silver options, and an upside breakout for SIL is likely to follow that expiration.

- Please click here now. Double-click to enlarge this GDX chart. Note the immense bullish volume bar that occurred as the Fed hiked rates, creating a dramatic rally in most gold stocks. GDX is nicely poised in a rectangle formation now, ready to begin a fresh surge higher.

- Because of the fabulous technical, cyclical, and fundamentals in the precious metals sector, investors can expect solid gains over the next 36 months, with most stocks and bullion likely to move to all-time highs. Quite simply, from both a real risk and potential reward perspective, it’s the greatest time in history to own the entire precious metals sector!

Thanks!

Cheers

st

Mar 28, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

email for questions: stewart@gracelandupdates.com

email to request the free reports: freereports@gracelandupdates.com

Graceland Updates Subscription Service: Note we are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection we don’t see your credit card information. Only PayPal does.

| Subscribe via major credit cards at Graceland Updates – or make checks payable to: “Stewart Thomson” Mail to: Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 / Canada |

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am. The newsletter is attractively priced and the format is a unique numbered point form; giving clarity to each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Technicals for Gold Miners Remain Weak

Posted by Jordan Roy-Byrne - The Daily Gold

on Monday, 27 March 2017 13:17

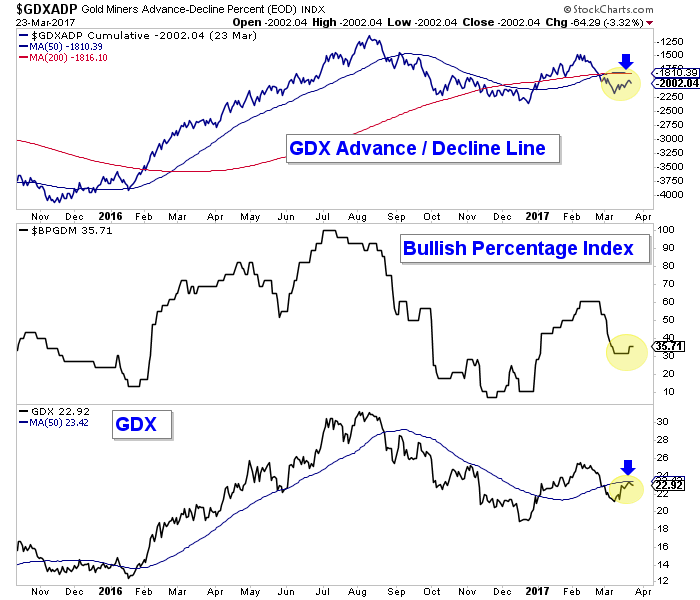

Last week we wrote that precious metals should see upside follow through but to be wary of the 200-day moving averages and February highs before becoming excited. The metals did follow through as Gold gained 1.5% and Silver gained 1.9% (for the week) but the miners disappointed. GDX gained only 1.1% while GDXJ finished in the red as did junior silver companies (SILJ). As spring beckons, the gold stocks are showing relative and internal weakness.

Two signs of weakness in the miners are visible in the weekly candle charts below. First, while Gold has already rallied back to its high the first week of February, GDX and GDXJ are down 11% and 15% respectively. The miners and the metals will not always be perfectly aligned but that is a rather stark divergence. Secondly, although Gold closed at the highs of the week in each of the past two weeks the miners failed to hold their gains. This is not exactly the type of price action that inspires more gains in the short term.

Gold, GDXJ, GDX Weekly Candles

Gold stocks are also showing some internal weakness. In the chart below we plot the advance/decline (A/D) line for GDX and its bullish percentage index (BPI). Both are breadth indicators. The A/D line is the holy grail of leading indicators while I have found the BPI to be more of a confirmation or overbought/oversold indicator. At present, the A/D line is below both its 50 and 200-day moving averages which are flattening and soon to slope lower. That is ominous if the A/D line can’t regain those moving averages. Meanwhile, the BPI is only at 36%. This means it has room to move up but it also shows weakness as it has barely changed despite gains in recent weeks.

x

xPart of the cause of weakness in the gold stocks (and relative strength in Gold) is the weakness in the stock market which is actually a welcome and positive development for precious metals. As we discussed in a recent video, precious metals are currently setup to benefit from weakness in the stock market as they were in the 1970s and early 2000s. Patience is needed though as stock market weakness is not necessarily an instant or immediate catalyst for the gold stocks.

The current weak technical action in the gold stocks is further evidence that precious metals are unlikely to see a blast off anytime soon. Gold could continue to rally on the back of stock market weakness but don’t expect that to pull miners much higher. I reiterate that at present it’s not wise to chase strength in the miners. Instead, traders and investors should be patient and wait for (presumably) lower prices and a better entry point. We continue to look for high quality juniors that we can buy on weakness and hold into 2018.

Jordan Roy-Byrne, CMT, MFTA

A Grinding Gold Market: Key Trades

Posted by Morris Hubbartt - Super Force Signals

on Friday, 24 March 2017 13:25

Here are today’s videos and charts (double click to enlarge):

Big Macro Picture Key Charts & Video Analysis

SFS Key Charts & Tactics Video Analysis

SF Juniors Key Charts & Video Analysis

SF60 Key Charts & Tactics Video Analysis

SF Trader Time Key Charts Video Analysis

Morris

The SuperForce Proprietary SURGE index SIGNALS:

25 Surge Index Buy or 25 Surge Index Sell: Solid Power.

50 Surge Index Buy or 50 Surge Index Sell: Stronger Power.

75 Surge Index Buy or 75 Surge Index Sell: Maximum Power.

100 Surge Index Buy or 100 Surge Index Sell: “Over The Top” Power.

Stay alert for our surge signals, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

SFS Web Services

1170 Bay Street, Suite #143

Toronto, Ontario, M5S 2B4

Canada

February CPI and Gold

Posted by Arkadiusz Sieron

on Wednesday, 22 March 2017 14:16

Last week, several U.S. economic reports were released. What do they imply for the gold market?

The FOMC meeting and parliamentary election in the Netherlands prevented us from covering recent economic data coming out from the U.S. Let’s catch up. First of all, inflation continued to strengthen. Consumer prices increased 0.1 percent last month, according to the Bureau of Labor Statistics. It was the smallest rise since last summer and much below a 0.6 percent surge in January. Core CPI, which excludes the volatile energy and food categories, increased 0.2 percent, only slightly faster. However, overall CPI rose 2.7 percent on an annual basis, the highest level since early 2012. Core CPI jumped 2.2 percent over the last 12 months.

As one can see in the chart below, the overall consumer inflation rate significantly accelerated over the last several months. The inflation rate rose from 0 percent in September 2015 to almost 3 percent currently. It strengthens the hawks’ camp in the U.S. central bank, which is generally bad news for gold bulls. However, until the Fed remains behind the curve, gold may gain due to lower real interest rates.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from February 2012 to February 2017.

When it comes to other data, retail sales rose just 0.1 percent in February, following a 0.6 percent jump in January. Weak sales – despite unseasonably warm weather, are a negative surprise, which does not bode well for economic growth. As a reminder, the Atlanta Fed’s GDPNow model forecasts real GDP growth in the first quarter of 2017 at only 0.9 percent.

National industrial production was flat in February, but regional manufacturing indices, such as Philly Fed and Empire State remained at high levels in March (although they corrected a bit). Permits to build new homes dropped 6.2 percent, but housing starts climbed 3 percent in February. And the sentiment among home builders also surged, as the National Association of Home Builders’ confidence index jumped 6 points to 71 in March, the highest level since June 2005.

The bottom line is that retail sales were weak in February, but inflation accelerated on an annual basis. However, given a big drop in oil prices, inflation may soften in the months ahead. Anyway, the recent data on inflation does not affect significantly the prospects of the Fed hikes. A hawkish Fed is rather negative for the yellow metal, although two more hikes in 2017 have been probably already priced in. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair