Gold & Precious Metals

Gold’s Next Leg Down Targets $1156

Posted by Rick Ackerman - Rick's Picks

on Wednesday, 15 March 2017 13:41

Our downside target for the near-term is 1156.60, a ‘midpoint’ Hidden Pivot that comes from the weekly chart.

April Gold had a chance to rally out of the hole this week from a bouncy-looking pivot at 1195.40. Instead, the futures popped for a few measly points before falling back to the support. This is pretty feeble price action, especially considering the rally had round-number support at 1200.00 going for it as well. Under the circumstances, we should expect the futures to continue lower, eventually turning 1200.00 into resistance.

I’d return reluctantly to the bullish case, at least for the near term, if this vehicle were to leap above 1214.50 in the next day or two. That would generate a bullish impulse leg on the hourly chart — one that presumably would be tradable. Click here for two weeks’ free access to Rick’s Picks

…also: Silver Market Poised For Big Reversal When Institutional Investors Move In

Mar 14, 2017

- After Janet Yellen first hiked rates in late 2015, the precious metals market rallied in a big way in the first half of 2016. Please click here now. Double-click to enlarge this GDX daily chart.

- In late 2016 the Fed hiked again, but the metals market rally in 2017 has been more subdued. Why?

- For the main answer to that question, please click here now. Double-click to enlarge this dollar versus yen chart.

- The bottom line is that the gold price has tremendous correlation to the price action of the dollar versus the yen. In 2016, the dollar collapsed against the yen. In 2017, the dollar has declined against the yen again, but only moderately.

- Hence, the rally in gold and gold stocks has been less exciting than it was in 2016.

- Please click here now. That’s a shorter term look at the dollar versus the yen. A loose rectangle is in play, and the next big move will almost certainly be determined by key fundamental news being reported this week.

- On Wednesday, the Fed decides whether to raise rates, and the debt ceiling (which I call a floor) comes back into focus. There’s also a major election in the Netherlands. A populist win there could rock major markets. On Thursday, the Bank of Japan meets to decide its next major policy move.

- Fundamentally, gold is well-supported, and the news this week is likely to be quite positive for gold and associated assets.

- Please click here now. I’ve suggested quite emphatically that in a rising interest rate environment, both gold and the dollar can rally together, and top economists at CITI are now taking note of this fact.

- That means their institutional clients are taking note of it, which adds more support to gold. Gold bugs clearly have nothing to fear from a higher dollar, and the dollar is floundering against the yen and the Swiss franc.

- It may also be set to tumble against another key currency. Please click here now. Double-click to enlarge. After breaking a key uptrend line, the dollar seems poised to break down from a substantial double top pattern against the Indian rupee.

- That would be good news for India’s current account, and increase the already-enormous gold buying power of Indian citizens. That’s because a surge in the rupee would chop the cost of gold in rupees, and Indians are obsessed with buying more gold when the price drops.

- Please click here now. Next, please click here now. I’ve been adamant that investors need to fade the US stock market a bit (except for bank stocks which benefit from higher rates), and buy Chindian markets.

- In a nutshell, the American empire is ending, and the Chindian empire is beginning. In the short term, the US business cycle is long in the tooth, and that’s when bank stocks and gold stocks are an investor’s best friend.

- Rising rates will eventually crush the US stock market. India’s central bank chief appears to be little more than a government-appointed “yes man”. So, he’s unlikely to raise rates, even as the US hikes aggressively.

- That’s going to create substantial institutional liquidity flows out of the US stock market and into India.

- On that note, please click here now. Double-click to enlarge this spectacular Indian stock market ETF chart for INDA-NYSE.

- It’s blasting upside from a huge inverse head and shoulders bottom pattern. It’s a nice fantasy to believe that Donald Trump can cheerlead the US nation to “world leader forever” status. Horrifically, the reality of the US situation is far different from that wonderful fantasy.

- Cheerleading works in a limited way when interest rates are low. When they rise and the yield curve inverts significantly, cheerleading doesn’t work at all.

- That’s because institutional money managers don’t care what the top government cheerleader says or does when the yield curve inverts as rates soar. They just sell US stocks, and they do so… as a stampeding herd.

- If Trump doesn’t renew Janet Yellen’s mandate to lead the Fed and appoints a government “yes man” in her place who leaves rates low, the banks will just keep their money at the Fed and the US economy will enter a state of significant deflation.

- Trump is also beginning to pressure Japan to push the dollar lower against the yen. It’s likely a question of when, not if, Abe orders his central bank to kill the Japanese QE program. When that happens, the dollar could stage a dramatic collapse against the yen. If the dollar collapses against the yen, it will collapse in an even bigger way against gold.

- The end of QE in Japan would create enormous liquidity flows out of government bonds and into the banking system. Inflation would surge, and Japanese citizens would be strong gold buyers and exporters of significant inflation to America.

- Please click here now. Double-click to enlarge this important gold chart. The news events this week could easily send gold to my $1180 buy zone, and then to $1220 or even $1245. I’m a very happy gold stock buyer here in the $1200 area. It represents great value for enthusiastic gold market investors!

Thanks!

Cheers

st

Mar 14, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

…related: SWOT Analysis: How Will Gold React to the Next Rate Hike?

SWOT Analysis: How Will Gold React to the Next Rate Hike?

Posted by Frank Holmes - US Global Investors

on Monday, 13 March 2017 14:56

Strengths

- The best performing precious metal for the week was gold, down 2.43 percent, but still leading its precious metals peers. Gold imports by India are said to have risen nearly three-fold in February from a year earlier, reports Bloomberg, jumping 175 percent. Jewelers are restocking for the upcoming festival and wedding period that starts next month.

- The U.S. saw its largest trade deficit since March of 2012, reports Bloomberg, as a jump in merchandise imports in January exceeded a smaller gain in shipments overseas. “The wider deficit indicates trade, which subtracted 1.7 percent from fourth-quarter growth, will weigh on the economy in early 2017,” the article continues. A stronger dollar has made exports less competitive and could be hindrance to boosting manufacturing jobs in the U.S. as President Trump promised.

- Joni Teves, strategist at UBS, writes that the research group expects underlying positive sentiment toward gold to remain broadly intact as uncertainty lingers. In its Global Precious Metals Comment, Teves outlines that despite the recent increase in positioning, gold market length remains relatively subdued with net positions in Comex accounting for about 50 percent of the record. Similarly, UBS writes “there really isn’t much expectation of an aggressive selloff in gold – this has been a common theme among our conversations with market participants in different regions.”

Weaknesses

- The worst performing precious metal for the week was platinum, down 5.72 percent. Silver was not far behind with a loss of 5.22 percent.

- According to a weekly Bloomberg survey, nearly half of gold traders and analysts are bearish on gold as the dollar strengthens amid expectations of a Fed rate hike next week. Overseas, the People’s Bank of China reports gold holdings unchanged for a fourth-straight month, coming in at 59.24 million ounces by the end of February. Similarly, Bullionvault’s Gold Investor Index, which measures the balance of client buyers against sellers, fell to the lowest level since July.

- Gold fell below $1,200 an ounce this week, the longest losing streak since October, on better-than-expected U.S. private jobs data – adding to positive economic talk that boosted the dollar. “Three weeks ago the possibility of a rate hike in March was very small, but now it’s 100 percent,” said Bob Takai, CEO and president of Sumitomo Corp. So where exactly does the Fed see rates headed? The chart below gives a quick comparison between the Fed Funds Target versus where the Taylor Rule Estimate, estimating close to 4 percent. The sudden shift to raise rates in March may reflect that the Fed is behind the curve again.

Opportunities

- Hedge funds are bracing themselves for tough times ahead this year, reports Bloomberg. Managers have stopped loading up on bullish positioning, becoming less reliant on U.S. stocks and selling economically sensitive bank shares and materials like copper, the article continues. Now they are buying gold. Quants from UBS and Goldman Sachs are also seeing opportunity for the yellow metal, using different modeling techniques they conclude that the dollar is perhaps 30 percent overvalued. And despite gold being under pressure leading up to the next rate hike, Bank of America still sees prices rallying by around $200 by the end of the year.

- Mike McGlone, a BI Commodity Strategist, writes this week that commodities often prevail in tightening cycles, perhaps now more than ever. For example, bullion gained 52 percent in the June 2004 to June 2006 tightening cycle and 5 percent from the June 1999 to May 2000 tightening cycle. “The Fed is only tightening when they are concerned about inflation,” McGlone said. “That is good for gold.” In fact, the yellow metal bottomed a day after the past two tightenings and rallied thereafter.

- After four years of restraint, Bloomberg reports that mining investment bankers say deal-making is starting to flow again. Paul Knight of Barclays Plc says this is the busiest it’s been in his four years with the company. “If our experience here is any indication of what’s happening around the street, you may well see more M&A activity at the end of this year than we’ve seen in the last three or four years,” Knight commented. China Gold, the nation’s largest government-owned gold producer is even back on the acquisition hunt after bulking up mines, reports Bloomberg.

Threats

- Morgan Stanley points out that a revised draft of South Africa’s mining charter could still contain very disadvantageous requirements for mining companies that are not reflected in the share prices. One of the key concerns around the potential draft includes the fact that the once empowered, always empowered rule no longer applies and companies have to empower back to 26 percent if they are below the threshold.

- Steven Mnuchin’s picks for the top ranks of the U.S. Treasury are being stalled due to resistance from the White House, reports Bloomberg. More specifically, questions about loyalty to Trump have played a role in at least two cases – including one recruit whose Twitter account was scrutinized for potential criticism of the president. On the flip side, David Nason, who is a leading candidate to be named the Fed’s bank supervision chief, told the White House he is no longer interested in the job. Nason plans to pursue opportunities at GE instead. And if you thought Russian hacking in the U.S. has pulled back since the election, you would be wrong. Liberal think tanks, critical of President Trump, around the U.S. are finding that their firewalls have been breached by Cozy Bear and they are being asked to pay ransoms in bitcoin to prevent sensitive data from potentially being leaked.

- According to a study by consultant Roland Berger GmbH, the proposed U.S. border tax would make most automakers unprofitable, reports Bloomberg, along with strain consumers and lead to job losses rather than gains. “The planned charge would increase the average cost of a car by $3,300, prompting a drop in demand and forcing manufacturers to react by shrinking their U.S. workforce,” the firm said in a presentation on Wednesday.

Eric Coffin SPECIAL $7 OFFER

Posted by MoneyTalks Editor

on Friday, 10 March 2017 23:31

Being first has its advantages. And subscribers to Eric Coffin’s Hard Rock Advisory have enjoyed those advantages to the fullest, particularly over the last 18 months. Consider just the takeouts alone listed here. And the recommendations go on – Silvercrest Metals, Vendetta Mining, Almadex Minerals, GMV Minerals. Eric’s remarkable string of stock picks in the junior mining space in 2016 suggests more is yet to come in 2017.

AS A MONEYTALKS ONLY SPECIAL – we are able to offer our listeners and subscribers a chance to try HRA for a ridiculous price of only $7! That isn’t a typo. $7.00. No strings attached.

CLICK HERE to subscribe and start reading Eric’s picks right now.

~ Editor

Silver Market Poised For Big Reversal When Institutional Investors Move In

Posted by Steve St. Angelo - SRSrocco Report

on Friday, 10 March 2017 14:09

The Silver Market is going to experience a big reversal when the Hedge Funds and Institutional investors rotate out of highly inflated stocks and into precious metals investments. This is not a matter of if, it’s a matter of when. And the when, could be much sooner than we expect due to the huge problems with the U.S. debt ceiling deadline on March 15, 2017.

As I mentioned in my previous article, POWERFUL GOLD & SILVER COILED SPRINGS: Important Charts You Have To See, I posted this chart of the 2,000 point drop in the Dow Jones early in 2016 versus a huge spike up in gold and silver:

At the beginning of 2016, the Dow Jones Index fell to a low at 15,600 level, 5,000+ points lower than what it is trading currently,while the gold and silver price surged higher. The fundamentals of the Dow Jones Index is more rotten than ever. Wolf Richter wrote about this in his article, Dow Companies Report Worst Revenues since 2010, Dow Rises To 20,000 (LOL).

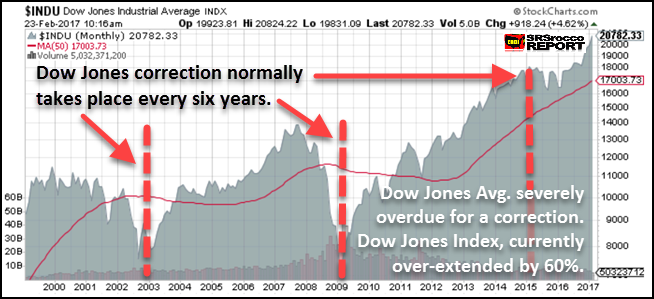

Furthermore, the Dow Jones Index is seriously overdue for a correction:

According to the economic contraction cycle that occurs about every six years, the Dow Jones Index is severely overdue for a good ‘ole fashion beating. If we assume that a normal correction for the Dow Jones would be for it to fall to about 8,000 points, the index is overvalued by at least 60%. And that is just for starters.

So, when the Dow Jones Index and the broader stock markets finally crack, we are going to finally see Hedge Funds and Institutional investors rotate out of the majority of highly inflated stocks and into the precious metals and mining sector. This will have a profound impact on the price of gold and silver as well as their mining companies share prices.

To get an idea how this will impact the Primary Silver Mining sector, I compared it to the largest U.S. oil company in country, ExxonMobil. ExxonMobil is listed on the Dow Jones Index as one of 30 industrial stocks and has the highest market cap of all the energy companies in the United States.

What Will The Impact Be When Hedge Funds & Institutional Investors Move Into The Silver Market?

According to Michael Belkin of the Belkin Report, he put out a buy signal on his top Primary Silver mining companies during an interview on King World News last month. Now, Michael was one of the few who made a call back at the end of 2015 advising his clients (and those who subscribe to his new gold stock newsletter) to get into the gold mining sector. And at the beginning of the year, the price of gold and the gold shares shot up considerably. Then a month later, he made a call advising his clients to get into his group of Primary Silver mining stocks. Over the next several months, the Dow Jones Index crashed while the price of silver and the silver stocks surged higher.

Belkin, who has large institutional clients is now advising them to get out of the most of the broader market stocks and into other assets such as the precious metals, especially the silver stocks. He is one of the few analysts that I respect as he does not get paid by the mining companies to promote their stocks. He suggests certain stocks through his own analysis and models. Belkin believes the broader markets are going to finally correct BIG TIME this year and that one of the few sectors to move into will be the precious metals.

If we look at the market cap of ExxonMobil versus the ten top primary silver mining companies in the world, we can plainly see how much potential there is in the primary silver mining sector:

ExxonMobil has a market cap of $344 billion (at the time when the chart was created) compared to $27 billion for the top ten primary silver mining companies. These top ten primary silver miners include, Fresnillo PLC, Pan American Silver, Tahoe Resources, Hecla, Coeur, First Majestic, Silver Standard, Fortuna, Endeavour Silver, and SilverCorp Metals.

Actually, half of the total market cap of the group was from Fresnillo PLC which is $13 billion. This means, ExxonMobil’s market cap is nearly 13 times greater than the total of the top primary silver mining companies in the world.

NOTE: There are other large silver producing companies in the world such as Hochschild out of Peru. However, I wanted to focus on the largest (Fresnillo) and those mainly trading on the U.S. exchanges.

Next, lets compare the total outstanding shares between ExxonMobil and these top primary silver miners:

Currently, ExxonMobil has 4.15 billion outstanding shares versus a total of 2.5 billion for the top ten primary silver miners. Thus, the largest oil and gas company in the U.S. and on the Dow Jones Index has two-thirds more outstanding shares then the top 10 primary silver miners put together.

So, how do the stock prices of these two compare to each other? When I put together these charts last week, ExxonMobil’s share price was $82.90 versus an average $10.90 a share for the top ten primary silver miners:

With the oil and silver price lower this week, these figures shown above are lower, but still reflect about the same ratio. Regardless, the top primary silver miners average share price for the group is about eight times less than ExxonMobil. However, the interesting thing to understand is that any significant amount of funds flowing into the primary silver miners will cause their share prices to move up a lot higher and faster than ExxonMobil.

If the market cap of each doubled, this would be the result on their share prices:

It would take $344 billion to double the market cap of ExxonMobil to $688 versus just $27 billion (to $54 billion) for the top ten primary silver miners. Which means, it wouldn’t take much in the way of funds moving into the primary silver mining sector to double its market cap, and share price compared to ExxonMobil. While it is impossible to know how much money or trading volume would be needed to double the market caps of the two listed above, logic suggests that the primary silver miners will experience a much higher surge in share price with much less in the way of total funds versus ExxonMobil.

Furthermore, a weakening economy and falling Dow Jones Index would likely result in lower oil prices. This will be bad news for ExxonMobil and the energy sector shares.

Now, one of the most fascinating comparisons between ExxonMobil and the top ten primary silver miners is their percentage on total production in their various industries. ExxonMobil produced approximately 2.5% of total global liquid oil production in 2016, compared to the top primary silver miners producing 18% of total world silver supply:

As we can see in the chart above, ExxonMobil’s portion of total world liquid oil production is that tiny sliver of white at the bottom of the bar graph. However, these top 10 primary silver mining companies produced 18% of total global silver mine supply last year.

Yes, it is true that the value of liquid petroleum that ExxonMobil produced last year was much higher than the total value of silver produced by these top ten primary silver mines… but guess what??? All that oil has been either burned or consumed by the market, while a good portion of that silver was acquired by investors or is used as jewelry or silverware that could be brought back into the market as a high quality STORE OF VALUE.

While oil is strategically important to our modern society, it is nothing more than a mere commodity, burned and consumed. Gone forever. On the other hand, while silver does act as a commodity due to its industrial uses, a large portion of its demand is based on investment demand. Which means, silver still functions as a store of wealth… just like it did 2,000+ years ago.

When the markets finally crack and the Dow Jones Index falls off a cliff, Hedge Funds and Institutional investors will move into the precious metals with even more leverage and a greater amount of funds than what took place during the beginning of 2016. Of course, the Fed and Central Banks could postpone the market correction for a while, but the longer they do so, the harder and faster the inevitable decline.

I believe Michael Belkin’s analysis is correct that there will be few decent stocks or sectors to move into when the highly inflated markets finally tank. Thus, when BIG MONEY moves in the silver market, it will cause the silver price and the silver mining shares to surge. How high will be anyone’s guess.

Lastly, I wanted to compare some of the top U.S. oil and gas producers market cap versus the same ten primary silver mining companies:

These top ten U.S. oil companies market cap was $855 billion compared to the top ten primary silver miners at $27 billion. The combined market cap of the top U.S. oil and gas producers is nearly 32 times higher than the top primary silver miners.

In the future when demand for physical silver overwhelms supply, investors will move into the next best thing.. the primary silver mining shares. Because there are so few primary silver miners, any significant amount of funds moving into this sector could reach insane levels never imagined today.

IMPORTANT NOTE: I appreciate everyone’s patience during our new site upgrade. My webmaster Peter has finally upgraded the site and it should be now seen by most across the world. It could take a bit longer for some as the propagation is complete.

You all will notice that the site is not much different than the old site, but there are some small changes and additions. However, the most important upgrade was the LOAD TIME. My site has been suffering problems in the past (including many different ERROR codes) that impacted its load time. A few months ago, it would take upwards 15 or more seconds to load. Now, it loads very quickly in 3-4 seconds.

I would enjoy hearing and comments or replies on what you all think of the new site.

best regards,

steve

Check back for new articles and updates at the SRSrocco Report.

….related: 13 Stunning Visualizations of Silver Put Global Debt Into Perspective

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair