Gold & Precious Metals

Mar 7, 2017

- A week ago I talked about the “need to bleed” for gold stocks. Since then, it could be said that the blood has flowed with gusto.

- Until the March 15 FOMC meeting is out of the way, gold and associated investments will be vulnerable against the dollar.

- Please click here now. Double-click to enlarge this GDX chart.

- As Chinese new year celebrations waned in February, GDX began trading in a modest broadening formation. Broadening formations tend to be resolved in a somewhat violent manner.

- In this case, the breakdown from that formation created a droopy right shoulder of an inverse head and shoulders bottom pattern. The shoulder is droopy because there is considerable market concern about the upcoming FOMC meeting next Wednesday.

- There is good news for gold stock enthusiasts, though. To view it, please click here now. Double-click to enlarge. The Fed’s first rate hike created an enormous rally in gold, silver, and associated stocks.

- That’s because rate hikes incentivize banks to move money out of government bonds, and into the fractional reserve banking system, where it can be loaned out aggressively.

- The result is a boost in money velocity and inflation. Gold stocks mount sustained rallies in that environment.

- In late 2016, Janet Yellen suggested an aggressive pace of rate hikes in 2017 would be her play, but most analysts didn’t believe her. After all, back in late 2015 she promised that there would be four rate hikes in 2016, and there was only one.

- Gold stocks swooned in mid-2016 when it became apparent that the rate hikes needed to boost money velocity would not be happening.

- A rate hike next week should quickly produce “Rate Hike Rally #3” for gold stocks. Also, I should note that the inverse H&S bottom pattern for GDX could become a double bottom pattern.

- Double bottom patterns create substantial fear amongst investors, more so than any other technical market pattern. For a double bottom pattern to be valid, volume needs to be less on the second bottom, and so far that’s the case with GDX.

- Tactics? I covered off some GDX short positions in the $23 area, and have started buying GDX in small size. Until the FOMC meeting is done, I’ll use my unique pyramid generator to systematically buy any further price weakness in GDX.

- Please click here now. Double click to enlarge. Gold bullion has not fallen much since arriving at my last selling area of $1265.

- It appears that gold will make a low somewhere between $1220 and $1200 by the FOMC meeting, and a rally will begin from there.

- It’s important to buy gold stocks and silver stocks around support zones for gold bullion. The buy size should reflect the size of the support. The $1220 and $1200 support zones are modest in size, so buy size should also be modest.

- For gold stocks to have the kind of sustained bull cycle that gets most gold bugs really excited, it’s going to take many more rate hikes and a reversal in money velocity.

- That has yet to happen, but Rome, and substantial inflation, are not built in a day!

- To view the rate hike oriented inflation building process in action, please click here now. When I first predicted that the Fed would taper QE to zero and begin a hiking cycle, I suggested that bank stocks would massively outperform the rest of the US stock market, and that would be followed, slowly, by a key reversal in money velocity.

- All is playing out according to my prediction, but gold stock investors need to understand that two rate hikes in two years are not going to produce a key reversal in money velocity. More hikes are required, and the good news is that more are coming!

- Please click here now. Double-click to enlarge. This chart of the BKX bank stocks index versus the S&P500 shows bank stocks have delivered the massive outperformance I predicted, and that’s after just two rate hikes.

- All gold stock enthusiasts should also be bank stock enthusiasts. Here’s why: In a market meltdown, banks tend to get gargantuan free money handouts from governments, albeit at the expense of working class taxpayers. They get food stamps, bowls of soup, and cracker crumbs.

- This makes the ability of banks to survive market downturns truly remarkable. The potential upside reward for bank and gold stock shareholders during a long term hiking cycle is fabulous.

- Gold stocks and bank stocks are like lovebirds. As the Fed steps up the pace of nominal hikes in 2017 and 2018, that hiking will make real rates (inflation minus the nominal rate) drop further. Money velocity should reverse by late summer, just in time for gold’s strong season!

Thanks!

Cheers

Stewart Thomson

website: www.gracelandupdates.com

Gold Market Correction Tactics

Posted by Morris Hubbartt - Super Force Signals

on Friday, 3 March 2017 17:39

posted Mar 3, 2017

Today’s videos and charts (double click to enlarge):

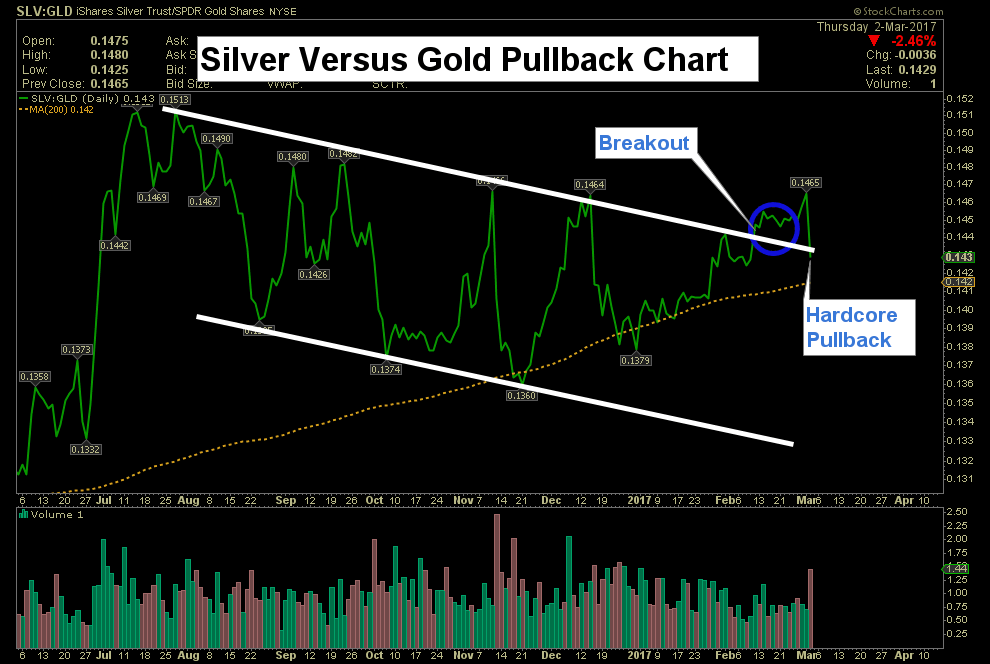

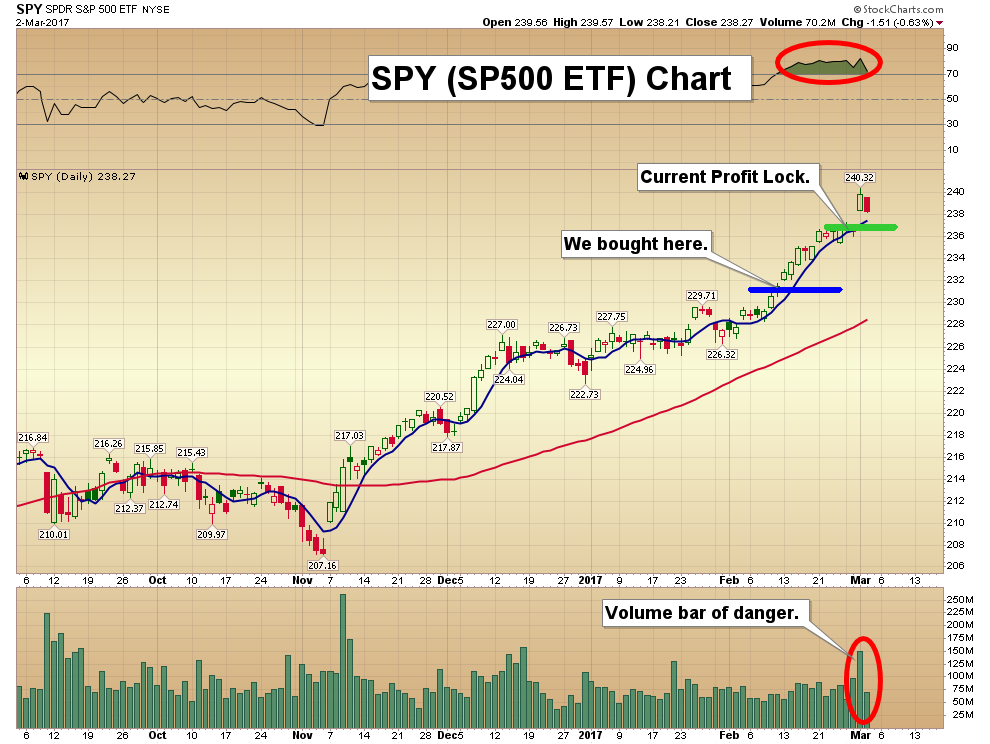

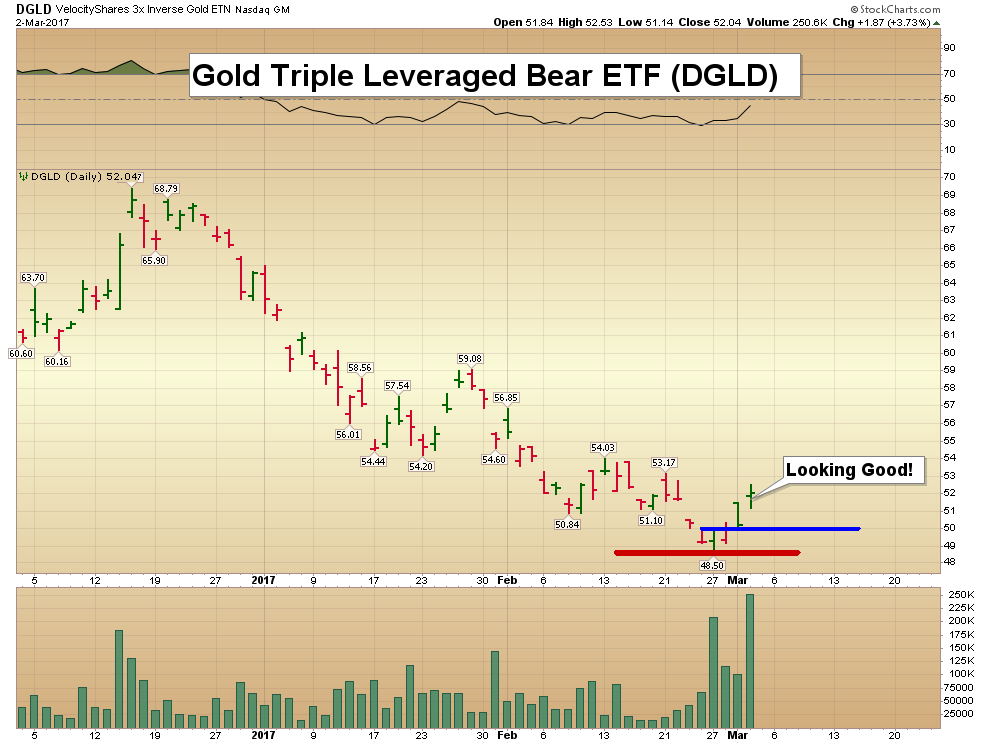

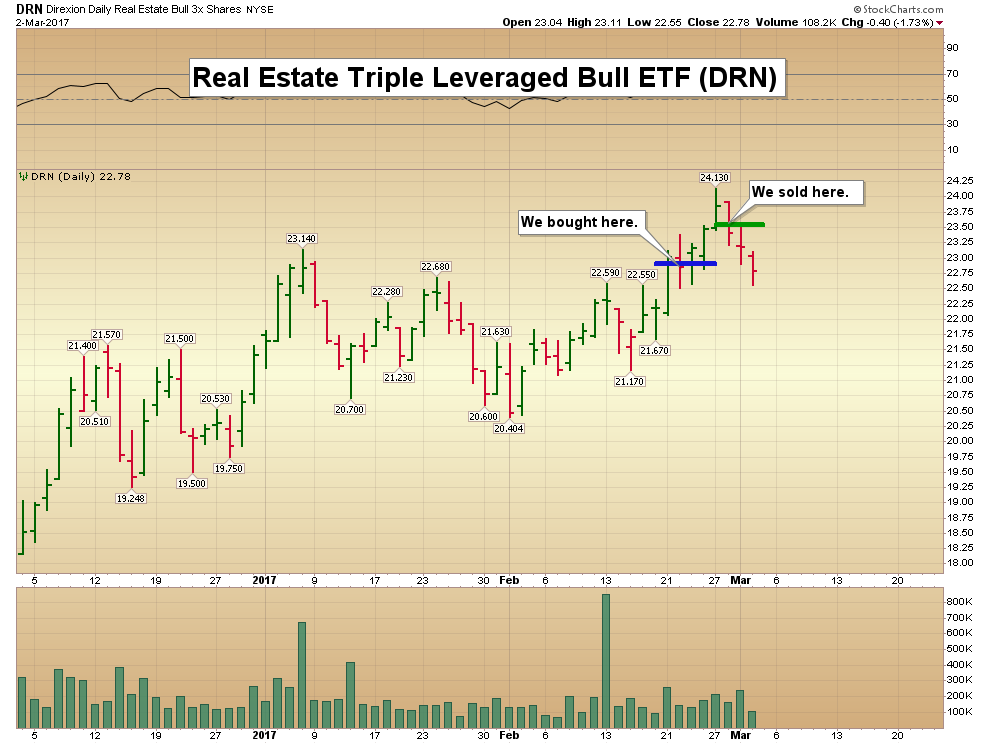

Silver Versus Gold Video Analysis

SFS Key Charts & Tactics Video Analysis

SF60 Key Charts & Tactics Video Analysis

SF Trader Time Key Charts Video Analysis

Morris

Gold Stocks’ Enormous Daily Slide

Posted by Przemyslaw Radomski - Sunshine Profits

on Wednesday, 1 March 2017 21:18

Feb 27th was just another period of back-and-forth movement for gold, silver, the USD Index and even the general stock market – but not for precious metals mining stocks. Gold stocks and silver stocks plunged very visibly – there are very important implications of this move and they are not bullish.

Let’s take a closer look at the charts (charts courtesy of http://stockcharts.com), starting with the GDX ETF (proxy for both gold and silver stocks).

Precious metals mining stocks declined on huge volume and the fact that this happened without the metals’ lead is profound. Miners were a leading indicator in the recent past as well as in the previous years – including the time before THE plunge of 2013. We discussed that in greater detail in yesterday’s gold trading alert, while describing the situation in gold stocks (using the HUI Index as a proxy):

The HUI Index declined by 8 index points (almost 4%) [last week] despite having very strong reasons to move higher. Not only gold rallied, but we also saw higher prices of stocks in general (highest weekly close ever in case of S&P and DJIA) – miners should have rallied strongly and they weren’t just responding weakly – they declined, which is rather extreme. We saw something similar in 2012 and 2013, before the huge plunge in gold.

The above chart features something less visible but still very important. The size of the decline that followed the 2011 top and the size of the subsequent rebound (in the second half of 2012) is practically identical to the decline that we saw in the second half of 2016 and the current rebound. Back in 2012 gold stocks formed a local top after retracing about 50% of the previous decline and it appears that exactly the same thing happened also this time.

But the question remains if the top in metals was just formed or not. The upswing in gold and volume in GLD makes it quite likely.

Interestingly, while the HUI declined by almost 4% last week, it’s already down by more than 5% this week, even though gold is flat. The bearish implications described above clearly remain in place.

We already featured the GDX ETF chart that includes silver stocks, but let’s take a look specifically at them, to make sure that they confirm the observations made while analyzing gold stocks.

During yesterday’s session alone silver stocks declined about as much as they did from the February top to Friday – the size of the decline just doubled. The volume was huge. Both factors (size and volume) serve as good confirmations of the bearish signals that we discussed earlier.

Summing up, the bearish outlook for the precious metals sector remains in place. While the daily price changes are not particularly meaningful (except the miners’ underperformance – its implications are meaningful and bearish), the long- and medium-term signals that are very important (being highly effective in the past) continue to paint a very bearish picture for the precious metals sector for the upcoming weeks and months. It seems that the following weeks will be more than exciting and we encourage you to stay up-to-date with developments in gold and silver.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Feb 28, 2017

- In terms of technical analysis, gold stocks recently reached what I call a “Need to Bleed” price area.

- Please click here now. Double-click to enlarge this important GDX daily chart.

- A very large inverse head and shoulders bottom pattern is in the late stages of forming, and this is great news for gold stock enthusiasts around the world.

- Most technical chart patterns are quite small and they tend to fail. This one is bigger, and it has a very aesthetic look.

- The price target of this impressive pattern is the $30 – $32 area. That represents a substantial percentage gain for investors, if it plays out.

- I’m a GDX buyer this morning, both for myself and for the funds I manage.

- Please click here now. Gold bullion is displaying very solid price action. Following a likely pullback to $1245, my next technical upside target is $1275.

- Should gold experience a deeper pullback ahead of the US debt ceiling deadline and FOMC meeting on March 15, investors should be eager buyers at $1220.

- Gold is the world’s ultimate asset. It continues to be very well supported by the price action of the “risk-on” US dollar against other key fiat currencies.

- Please click here now. Double-click to enlarge.

- After breaking down from a large head and shoulders top formation against the Swiss franc, the US dollar has formed a bear wedge.

- It’s now on the verge of breaking down from that wedge. When the dollar fails against the franc, it tends to also fail badly against gold.

- In time, I think the dollar will re-test the lows all the way down at the .9550 area, which means that gold will likely soon trade at $1338.

- Please click here now. Double-click to enlarge this dollar versus yen chart.

- The 112.50 support zone for the dollar has been repeatedly tested, and it is barely holding. A meltdown under 112.50 that occurs while the dollar tumbles against the franc would be extremely good news for gold.

- Please click here now. Double-click to enlarge. That’s another key dollar versus yen chart.

- The dollar broke down from a double top pattern at the same time as it broke down from the H&S top pattern against the franc. As that happened, the dollar was crushed by gold.

- The dollar could now be said to be trading sideways against the yen in a very bearish symmetrical triangle formation. These types of triangles tend to consolidate the existing trend, which is now down for the dollar.

- Is the technical situation for the world’s dollar bugs becoming perilous? I think so. The dollar looks to be targeting 107.50 against the yen, which also corresponds with $1338 for gold.

- Most dollar bugs are also heavily invested in the US stock market. I think many elderly Americans are hoping that America can relive the glory days of the 1950s, when the US dollar and stock market were almost invincible.

- Unfortunately, America’s debt levels (personal, corporate, and government) make this a wishful fantasy at best.

- To understand the reality of sustainable wealth building in the twenty first century, please click here now. Is Donald Trump going to make the American nation great by restricting the arrival of highly educated Indian engineers into the United States?

- No, but he’s going to make American inflation great for gold stock investors! Deportation is inflationary because it reduces the US work force by about 3% – 7% in size. The time is very near when US corporations will pass on these new wage inflation pressures to their customers.

- China and India are going to develop a much closer trade and working relationship. It’s going to happen very quickly, while America descends into a stagflationary nightmare, blasting gold stocks higher for many years into the future!

Thanks!

Cheers

st

Feb 28, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

Underperformance in Gold Stocks Argues for Interim Peak

Posted by Jordan Roy-Byrne - The Daily Gold

on Monday, 27 February 2017 16:00

The early stages of Gold bull markets (this one included) are characterized by strong outperformance from the miners. They will lead the metals and turning points and register strong outperformance. We saw that in the early 2000s, late 2008 to early 2009 and we have seen it again over the past year. During the recent rebound, the miners rallied back to the “Trump” resistance while Gold is not yet close to doing so. However, unfortunately for bulls, while Gold is now pushing higher above key levels, the gold stocks are lagging. This new and recent underperformance suggests the gold stocks have made an interim peak and will remain entrenched in a correction or consolidation.

In the daily bar chart below we plot Gold, GDX and GDXJ. Gold closed the week up 1.6% and through resistance at $1250/oz while both GDX and GDXJ closed down over 2.5%. That is a strong negative divergence. Gold also eclipsed its early February high while miners did not. Do note that the miners already reached their early November peak (GDXJ exceeded it) while Gold remains some $40/oz below that peak. Buying in the miners reached an exhaustion point.

Gold, GDX, GDXJ

So if the gold stocks are correcting, how much downside potential is there? Upon first glance, we see 8% downside for GDX and 10% to 12% downside for GDXJ and TheDailyGold junior index. Note that the miners have already corrected roughly 6% to 9%. Keep an eye on GDX $22 because it is a confluence of strong support. It includes the 400-day exponential moving average which has provided support during many bull market corrections. The same can be said for the 350-day exponential moving average for TheDailyGold junior index. The secondary downside target for GDX and GDXJ would be the 400-day moving averages which are currently at $20 and $30 and rising.

TDG Junior Index, GDXJ, GDX

TDG Junior Index, GDXJ, GDX

After a roughly 40% to 50% rebound in only two months it should be no surprise that the mining sector has begun to soften around important resistance. Therefore, the recent underperformance in the shares relative to the metals (Silver included) rather than a surprise is confirmation that a correction in the shares has begun. We expect the metals to follow suit soon enough. Investors and traders are advised to accumulate their favorite names as the mining sector nears our downside targets.

Jordan Roy-Byrne, CMT, MFTA

Jordan@TheDailyGold.com – For professional guidance in riding this new bull market, consider learning more about our premium service including our current favorite junior miners.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair