Gold & Precious Metals

Gold’s Rally: Key Tactics For Profits

Posted by Morris Hubbartt - Super Force Signals

on Friday, 24 February 2017 16:31

February 24, 2017

Today’s videos and charts (double-click to enlarge):

Gold, Silver, & T-Bonds Key Charts Video Analysis

SFS Key Charts & Tactics Video Analysis

SF Juniors Key Charts & Tactics Video Analysis

SF Trader Time Key Charts Video Analysis

Morris

The SuperForce Proprietary SURGE index SIGNALS:

25 Surge Index Buy or 25 Surge Index Sell: Solid Power.

50 Surge Index Buy or 50 Surge Index Sell: Stronger Power.

75 Surge Index Buy or 75 Surge Index Sell: Maximum Power.

100 Surge Index Buy or 100 Surge Index Sell: “Over The Top” Power.

www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

Investors have a growing appetite for gold in 2017

Posted by Larry Edelson - Money & Markets

on Wednesday, 22 February 2017 13:30

In 2016, two powerful fundamental forces drove the rally in gold prices:

Force #1: Negative real interest rates, as inflation accelerated while bond yields remained near record lows, and …

Force #2: Massive money printing, not by the Fed, but by the European Central Bank and Bank of Japan.

This year, political concerns are Trumping the fundamentals, literally, and pushing gold prices higher amid growing policy uncertainty here in the U.S. and especially in Europe.

Here at home, we have a new president who has outlined some very pro-growth policies, but Trump has been short on the details. And the devil is always in the details. Meanwhile in Europe, Brexit is moving forward as the U.K. prepares for life outside the European Union.

And major elections taking place this year in France and the Netherlands will create even more populist pressure for others to exit the EU, and pronto. Markets are already getting nervous about the growing wave of populism around the world, and that’s keeping a firm bid under gold.

So far this year, gold is pulling off a repeat performance of its trend in 2016. In fact, if you compare the trend in gold over the past six months, to the path it followed last year, the pattern looks eerily similar.

Of course, history never repeats exactly, but it often rhymes. If this pattern holds up — and my own neural net AI forecast charts suggest it will — then I expect gold to enter a mostly sideways trading range, including a correction in the months ahead, which could retest the $1,200 level or a tad lower on the downside.

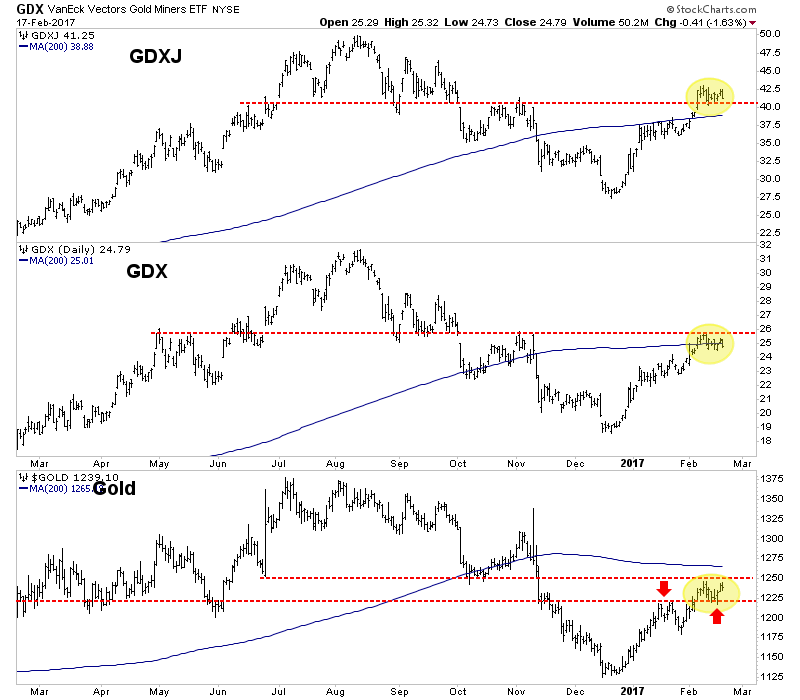

The real story, however, is not in the yellow metal itself, but in the action of gold mining stocks. I expect this is just the beginning of a major move higher for gold and silver stocks — especially the smaller, junior mining shares. Gold and silver stocks should easily outperform precious metals’ prices to the upside in the years ahead, as gold inevitably skyrockets to $5,000 or more.

In fact, the senior mining stocks could outperform by 5- or even 10-to-1 over the price of gold, itself. And select junior mining stocks will really shoot the lights out, easily gaining 20-to-1 or even 50-to1 over the yellow metal.

Right now, investors have already caught on to the outperformance of gold mining stocks, making this a dangerous time to put new money to work in the miners. Let me explain why …

Last year was a good year for gold ETFs, with investors piling into these funds. Record net inflows of $24 billion during 2016 surpassed the previous high of $22 billion in 2009, even after flows reversed briefly post-election, with $8.4 billion of outflows in November and December 2016.

In January alone, another $320 million flowed into ETFs that track the price of gold. And the VanEck Vectors Junior Gold Miners ETF (GDXJ) attracted even more, $650 million of net money flows over the past month.

The trouble is, retail ETF investors are almost always late to the party. And they’re likely piling in now, just before gold enters a corrective phase, as I have forecast.

Bottom line: Expect a better buying opportunity in gold and mining stocks AFTER a near-term correction, which should take place between March and May.

Best wishes,

Larry

related:

Feb 21, 2017

- Hardly a day goes by now without more good news for gold investors appearing, and the pace of this news flow is accelerating.

- Please click here now. Former Fed chairman Alan Greenspan was interviewed by the World Gold Council in the February edition of their influential “Gold Investor” magazine.

- That’s a snapshot of some of the interview. The former head of the Fed gives a magnificent report card to gold as the ultimate asset and currency.

- Please click here now. In India, the restrictions on cash withdrawals from banks are set to end on March 13. That’s just two days ahead of the ultra-important US debt ceiling deadline on March 15.

- March 15 is also the date of the next interest rate decision from the Fed. The bottom line: Gold-obsessed Indians will soon have the ability to purchase significant amounts of gold to bet on ongoing problems for the US government.

- America is the world’s largest debtor nation, and as Alan Greenspan notes, the country desperately needs enormous infrastructure spending, but it can’t afford it. President Trump is almost certainly going to press congress to put even more debt on the backs of ageing American citizens to get that infrastructure spending done.

- That’s going to create significant inflationary pressure, and the US central bank’s rate hikes are going to exacerbate the problem.

- That’s because the bank is in “uncharted waters”; the enormous QE money ball sitting at the Fed has been a huge cause of deflation. It’s put a drag on money velocity by incentivizing banks to hold reserves at the Fed.

- Trump is killing the Dodd-Frank bank reserve requirement rules at roughly the same time as the Fed hikes rates again. That creates a powerful incentive for the banks to move money out of the Fed and put it into the fractional reserve banking system.

- As that happens, money velocity is going to reverse and it could literally “skyrocket”. Back in 2013 I predicted that the Fed was beginning preparations to taper QE to zero, to be followed by a long rate hiking cycle. I also predicted that US real interest rates would go negative as the Fed began raising rates.

- On that note, please click here now. Clearly, that’s exactly what is happening, and I’ll dare to suggest that the gold community’s “inflationary fun” has barely started!

- Please click here now. Double-click to enlarge this gold chart. Short term price enthusiasts can be buyers at my $1220 support zone, and sellers at $1245.

- Gold has “attacked” the $1245 area twice, and another inflationary rate hike from the Fed and/or a hike in the debt ceiling from Trump is almost certainly to be the catalyst that Indians and bank FOREX traders use to bid gold through that resistance zone.

- Please click here now. Double-click to enlarge this GDX chart.

- Gold stocks are drifting sideways in a loose rectangle formation. Technically, the odds of an upside breakout are about 67%, using the classic Edwards & Magee handbook on technical analysis.

- The only way to make an ageing debtor great is to force the debtor to pay what they owe and reduce their debt levels.

- Unfortunately, the Trump administration appears to be under the impression that using strategies designed to work superbly in a low-debt environment will work equally well in a high-debt environment.

- On that key note, please click here now. It’s not just the American government that is embarking on a protectionist agenda. It’s happening in many countries and institutional money managers clearly see that as positive for gold.

- Horrifically, ageing American debtor citizens have used most of their savings for daily living expenses because of low interest rates. Now, surging inflation with only modestly higher interest rates is set to ravage the purchasing power of the remnants of those savings.

- Wave pressures are substantial, but so far corporations have not passed on the wage inflation to consumers in a major way. More rate hikes will end the stock buybacks game for corporations, and put serious pressure on their ability to finance their business operations.

- Businesses will soon respond with significant price increases at the retail level. Please click here now. Double-click to enlarge this Barrick chart.

- When the inflationary grim reaper comes to town, gold stocks and silver are an investor’s best friend. The $19 area represents a convergence of both trend line and horizontal support.

- Note the high volume bar in play last week. Volume tends to spike near the end of a minor trend rally, and the upcoming pullback is likely an ideal entry point for all American inflation enthusiasts!

- The upcoming March 15 debt ceiling and rate hike fireworks show is just one of many reasons to own gold, silver, and high quality gold stocks for both the short and long term. Please click here now. Double-click to enlarge this silver chart. Silver price enthusiasts who want to be on board for a big upside ride as corporations pass on wage inflation to consumers should be eager buyers in the $17.25 area!

Thanks!

Cheers

st

Feb 21, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

Graceland Updates Subscription Service: Note we are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection we don’t see your credit card information. Only PayPal does.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am. The newsletter is attractively priced and the format is a unique numbered point form; giving clarity to each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Gold’s Fundamentals Strengthen

Posted by Jordan Roy-Byrne - The Daily Gold

on Monday, 20 February 2017 15:46

The January headline consumer price index (CPI) came in at 2.5%, which is near a 5-year high. What happened to deflation? As a result, real interest rates declined deeper into negative territory or in the case of the 10-year yield, went from positive to negative. No this isn’t a commodity-driven story. The core CPI (ex food and energy) has been above 2% since the end of 2015 when commodities were in the dumps. Inflation is perking up and couple that with a Fed that pursues rate hikes at a glacial speed and that is very bullish for precious metals.

The chart below is what I refer to as our master fundamental chart for Gold. It plots Gold along with the real fed funds rate and the real 5-year yield. In short, negative and/or declining real interest rates drive bull markets in Gold while rising real rates or strongly positive real rates (like in the 1980s and 1990s) drive bear markets in Gold. Since the middle of 2015 both the real fed funds rate and the real 5-year yield have declined by +2%. The real fed funds rate has declined from a fraction above 0% to now almost -2% (-1.88%). Meanwhile, the real 5-year yield has declined by roughly 2.5% in the past two years from nearly 2% to now -0.60%.

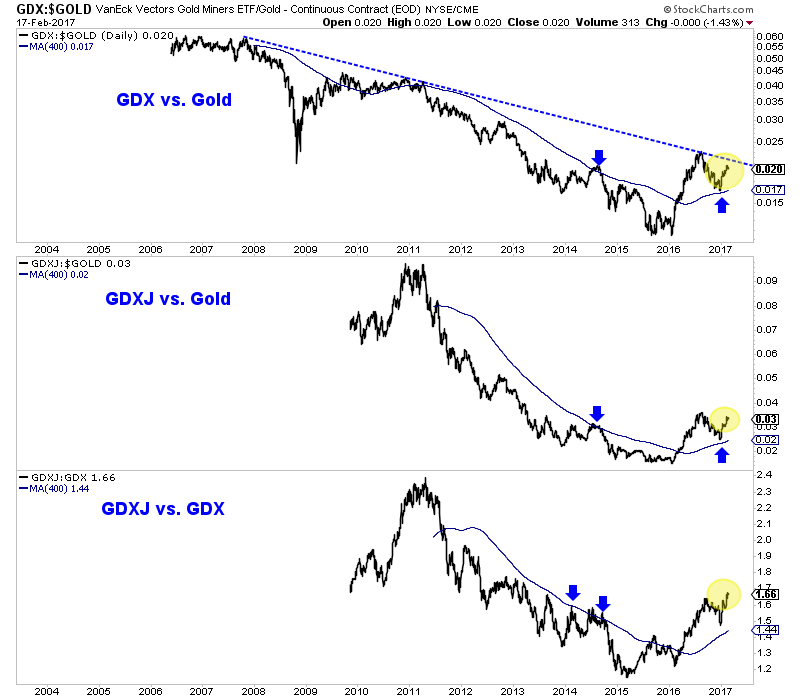

Fundamental analysis can be backward looking and that is why it is so important to verify fundamentals through the lense of technical analysis. While there are numerous charts we could show we want to present a fresh look at some sector relationships which help confirm the strong fundamentals currently supporting the sector.

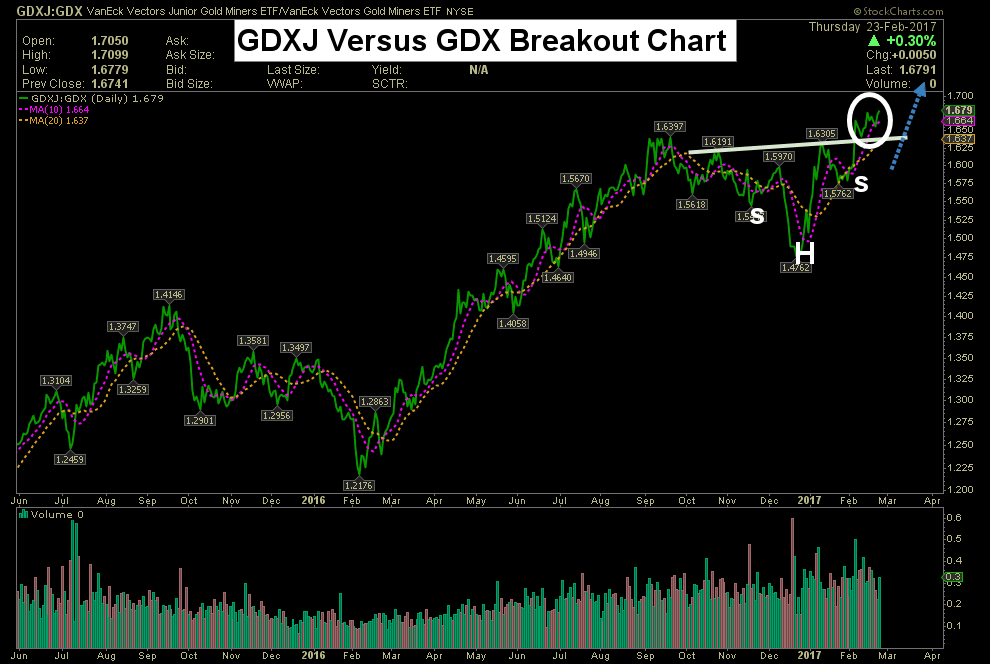

In the chart below we plot the gold stocks (both the seniors and juniors) against Gold and we plot the juniors against the seniors. During a healthy bull market in precious metals, the miners should show strength relative to the metals and secondarily, the riskier and more volatile stocks should also show relative strength. First, we note the GDX to Gold ratio appears poised to break its 10-year downtrend this year. Second, we see that the GDXJ to GDX ratio (juniors versus the seniors) is one month short of a 4-year high.

Ratio Charts

Turning to the short-term, we note that Gold successfully tested its support at $1220/oz while the miners decline on Friday suggests they may need more time to digest recent gains.

With negative real interest rates in place and the gold stocks trading well above their rising 400-day moving averages while showing relative strength against Gold, it is quite clear the gold stocks are in the early stages of a new bull market. It’s also difficult for us to argue that Gold and Silver are not in a bull market. The technical setup is potentially in place for the sector to make an explosive move higher over the next 9 to 18 months. Pullbacks in 2017 need to be bought due to the upside risk over the intermediate term.

Jordan Roy-Byrne CMT, MFTA

Silver: $25 By July?

Posted by The Silver Doctor

on Thursday, 16 February 2017 16:22

Precious metals expert Michael Ballanger ponders the timelessness of Hunter S. Thompson’s “blistering attacks on the status quo” and their applicability to today’s political landscape.

Precious metals expert Michael Ballanger ponders the timelessness of Hunter S. Thompson’s “blistering attacks on the status quo” and their applicability to today’s political landscape.

He also reminds us of the “incredibly bullish” fundamentals for silver and lays out the evidence for why this precious metal is on its way to $25/ounce by mid-year:

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair