Gold & Precious Metals

Gold Gains on Uncertainty

Posted by Frank Holmes - US Global Investors

on Wednesday, 15 February 2017 13:05

Last year, central bank policy and negative real interest rates drove the gold rally. This year, it seems to be uncertainty over Trump and other antiestablishment leaders, which is convincing the smart money to make wagers on the yellow metal, often seen as a safe haven during shaky times. So far in 2017, it’s up close to 7 percent, compared to the S&P 500’s 2.6 percent. In fact, if you compare this year’s price action to last year’s, they look remarkably the same, with a dip in December before the Federal Reserve raised rates. Although past performance is no guarantee of future results, gold could gain another $100 an ounce this year if it continues to follow the same trajectory.

Among those who are bullish on the yellow metal is Stanley Druckenmiller, the legendary hedge fund manager who dumped his gold the same day he learned Trump had been elected. Before that, it was the number one holding in his family office account. Now he’s back, telling Bloomberg he “wanted to own some currency and no country wants its currency to strengthen. Gold was down a lot, so I bought it.”

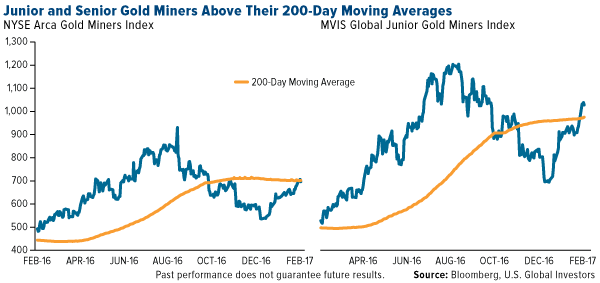

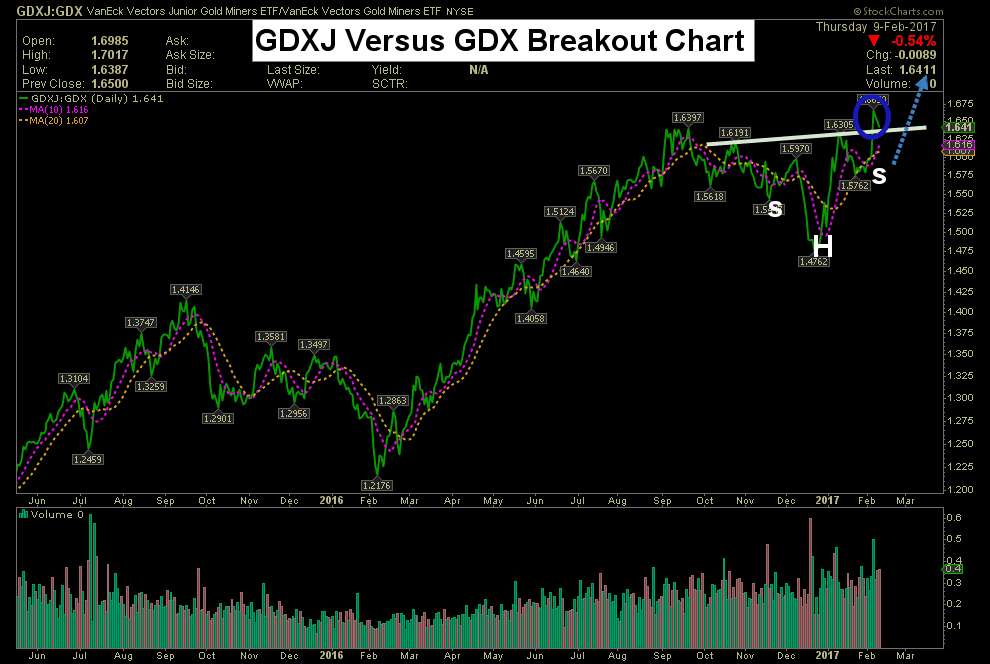

Higher demand has been good for both junior and senior gold miners, which recently crossed above their 200-day moving averages.

The NYSE Arca Gold Miners Index was up for an incredible seven straight days ended Monday, while the MVIS Global Junior Gold Miners has made positive gains in eight of the nine previous days.

Germany Brings Home More of Its Gold

Hedge fund managers aren’t the only ones whose demand for gold is strong. For the sixth straight year, central banks continued to be net importers of the metal in 2016, with China, Russia and Kazakhstan leading world consumption.

Although it might not have purchased any gold in 2016, the Deutsche Bundesbank, Germany’s central bank, ramped up its repatriation program, bringing home some 216 metric tons from vaults in New York, according to the Wall Street Journal. In 2011, former Fed Chair Ben Bernanke said central banks held gold simply because it’s tradition. I think the reason goes much deeper than that. Gold is money—it has been ever since the first gold currency appeared in China more than 3,000 years ago—and Germany’s efforts are proof of that.

Feb 14, 2017

- The world’s ultimate asset, gold bullion, continues to act superbly. That’s because fundamental, cyclical, and technical price drivers are very positive and are in play at the same time.

- Please click here now. Double-click to enlarge this gold chart.

- Gold is poised to burst upside from a small bull wedge pattern, after recoiling from $1250 area resistance.

- Support sits at $1222, and testimony from Janet Yellen today along with key US retail data tomorrow could be the fundamental catalysts that launch gold’s next assault on that $1250 zone.

- Experienced technicians understand that their charts only work when fundamentals are creating the technical picture they see on their charts.

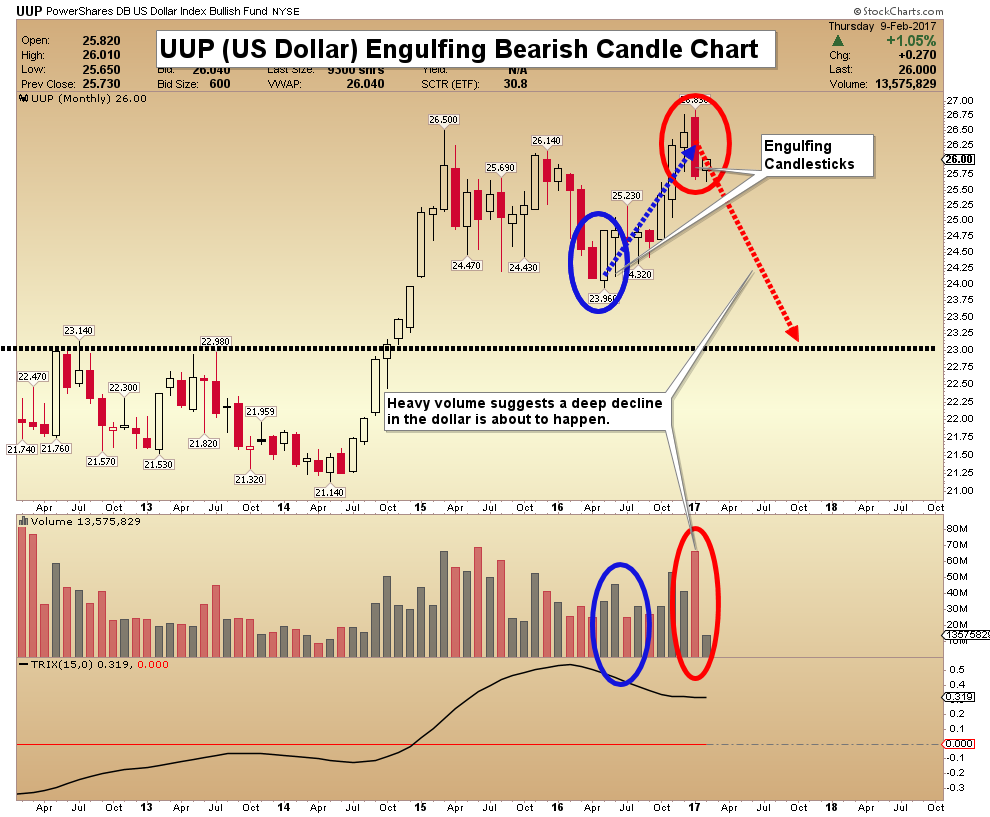

- In the case of the US dollar, most amateur technicians were very bullish on the dollar at the start of the year. They’ve essentially been crushed by “Trumpamentals”.

- The bottom line: The fundamentals of the Trump administration are changing institutional liquidity flows from a safe haven orientation to a US economy risk-on orientation.

- That’s very positive for gold, as a pick-up in Main Street (small business) business activity can be very inflationary. That’s because money velocity tends to accelerate quite dramatically when the pick-up gets underway.

- Please click here now. Double-click to enlarge this dollar versus franc chart.

- The dollar has broken down from a head and shoulders top pattern. A textbook rally back towards the neckline is now in play.

- Once that rally is completed, the dollar is likely to retest the recent lows, helping gold surge through the resistance at $1250.

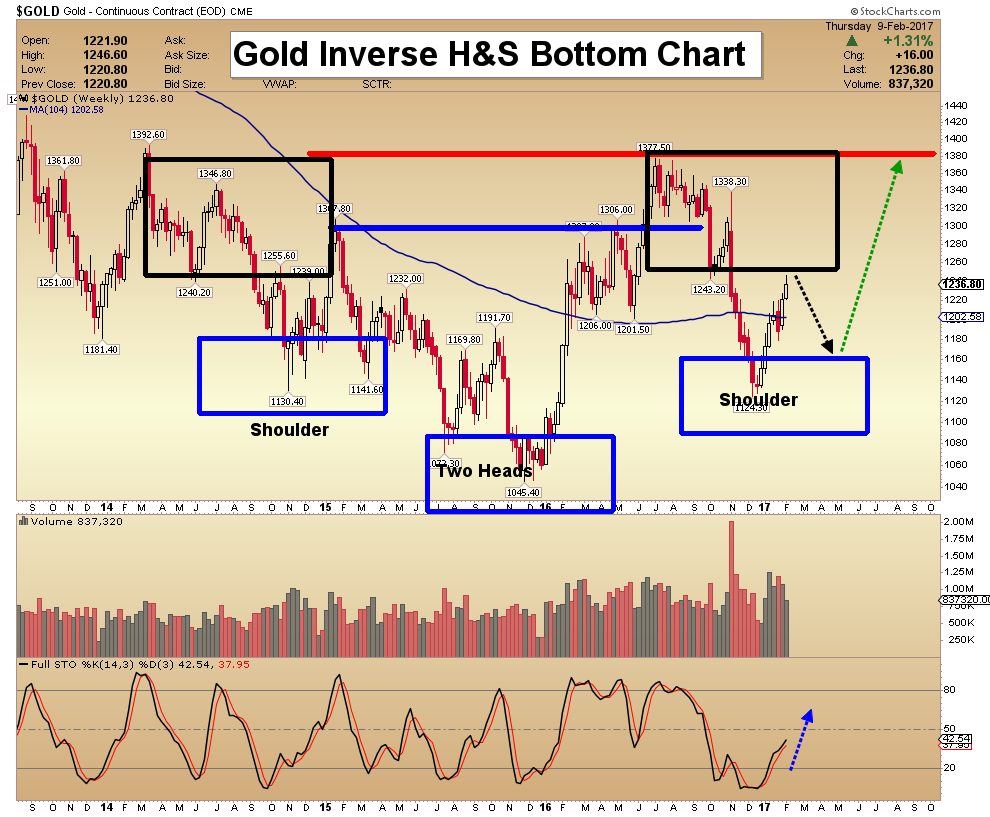

- Please click here now. Double-click to enlarge this weekly gold chart.

- While $1250 is acting as short to intermediate term resistance, gold seems poised to move even higher in the big picture, likely to about $1300.

- Two key trend lines of resistance converge in the $1300 area, making that the next likely upside stop for gold above $1250.

- Please click here now. Double-click to enlarge.

- That’s another look at the weekly chart for gold. Both the RSI and Stochastics oscillators are crossing above the 50 area. That tends to happen when upside momentum is increasing.

- Also, note the highs in the $1306 – $1307 area. They are also likely to offer a profit booking opportunity for happy gold bugs soon!

- It turns out that I’m not alone in my view that gold can rally to $1300. Please click here now. Dominic Schnider is a heavyweight economist at monster bank UBS, and he sees gold making a beeline for $1300 too!

- Institutional money managers gain extra confidence when top economists recommend an asset class, and having Schnider “on side” with higher prices will certainly build that confidence.

- Please click here now. Double-click to enlarge. Silver bugs should also feel confident right now.

- That’s because silver is beginning to act with less volatility, and more like a slightly “jacked” version of gold! On rallies, silver is outperforming gold against the dollar, but not excessively so.

- Modest outperformance by silver against gold tends to occur during long term uptrends. Wild outperformance tends to occur when the precious metal sector is ending a big uptrend. The current action in the silver market is ideal for investors.

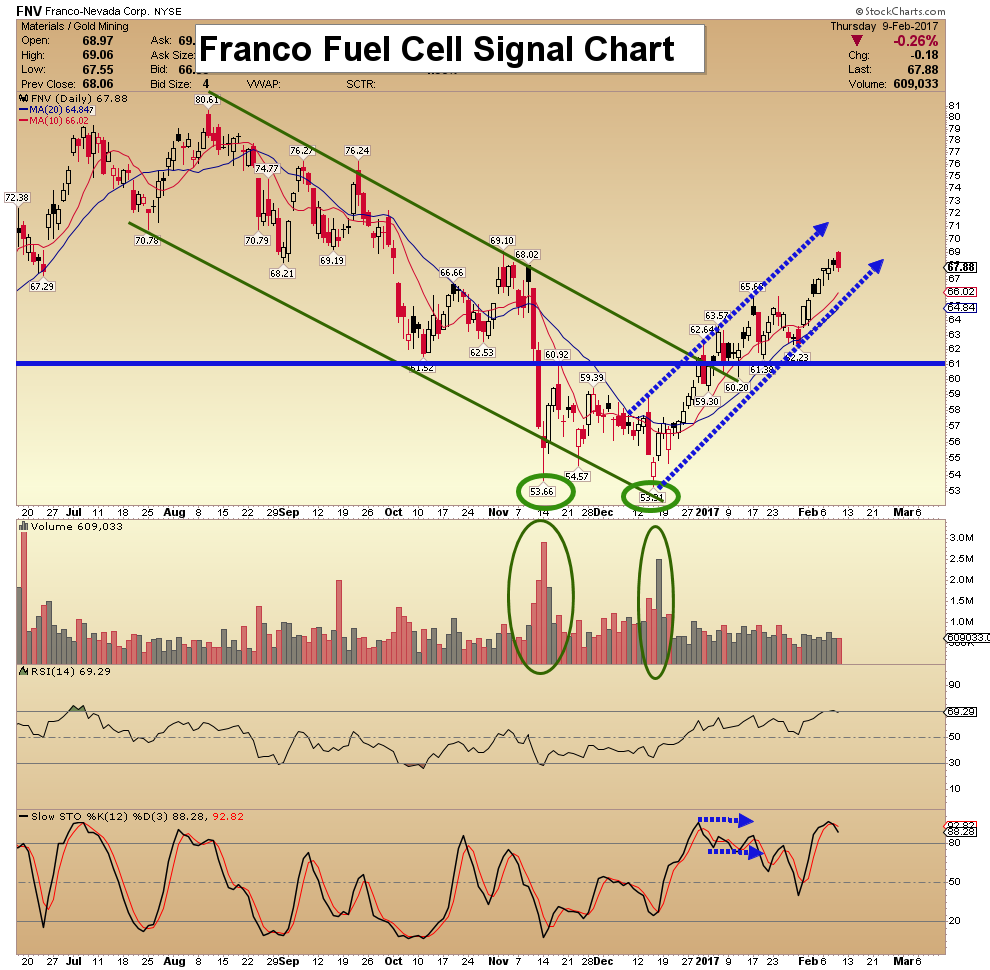

- As good as gold and silver bullion look, the stocks that mine these mighty metals look even better, as they typically do when economic growth and inflation come into synergistic play.

- Please click here now. Double-click to enlarge this GDX chart. Happy gold stock investors should wait for my $26 – $27.50 target zone before booking any more profits. That target may be achieved this week. Valentine’s Day is today, and may I suggest as a gift… something golden!

Thanks!

Cheers

st

Feb 14, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

Is the Gold Silver Ratio Predictive?

Posted by Bob Loukas - The Financial Tap

on Monday, 13 February 2017 17:11

One aspect of the precious metals market today that I like is the Gold Silver Ratio. It appears to have topped, right along with the 2016 gold bottom, and for all gold bull followers out there this is certainly a welcomed development. Precious metals bear markets always hit silver hard, while bull markets always see Silver outperform gold. As a result, the Gold Silver Ratio rises during bear markets and then falls during bull markets.

On the chart below, the long rising channel represents the precious metals bear market when gold/silver were both sold aggressively. Each peak in the ratio, as seen with the red arrows, correspond with major Cycle price lows. Meaning that as gold sold and collapsed into each yearly low, Silver as a ratio was hammered further.

But that trend has reversed, and silver has for the first time in five years outperformed gold. The chart shows the Gold Silver Ratio has turned lower, meaning that with the last big gold selloff, Silver actually outperformed gold, on a relative basis. It’s not proof of a bear market low, but we do know that every precious metals bull market saw silver dramatically outperform gold. In every case, the Gold Silver ratio turn lower as the entire metals complex went higher. From my perspective, it would appear that the ratio has broken lower and that a new downtrend has been established.

Wall Street Pouring Money Back Into Oil And Gas

Posted by Nick Cunningham - OilPrice.com

on Friday, 10 February 2017 15:20

Despite the near record increase in U.S. oil inventories last week – an increase of 13.8 million barrels – oil prices traded up on February 8 and 9 as traders pinned their hopes on a surprise drawdown in gasoline stocks, which provided some evidence of stronger-than-expected demand.

Despite the near record increase in U.S. oil inventories last week – an increase of 13.8 million barrels – oil prices traded up on February 8 and 9 as traders pinned their hopes on a surprise drawdown in gasoline stocks, which provided some evidence of stronger-than-expected demand.

The abnormal crude stock increase took inventories close to 80-year record levels at 508 million barrels, and is another bit of damming evidence that should worry oil bulls. But the oil markets were not deterred. In fact, that has been a defining characteristic of the market in recent weeks – optimism even in the face of some pretty worrying signals about the trajectory of the market “adjustment” process.

More signs of optimism abound.

….related:

Light Pullback For Gold: Key Tactics

Posted by Morris Hubbartt - Super Force Signals

on Friday, 10 February 2017 13:57

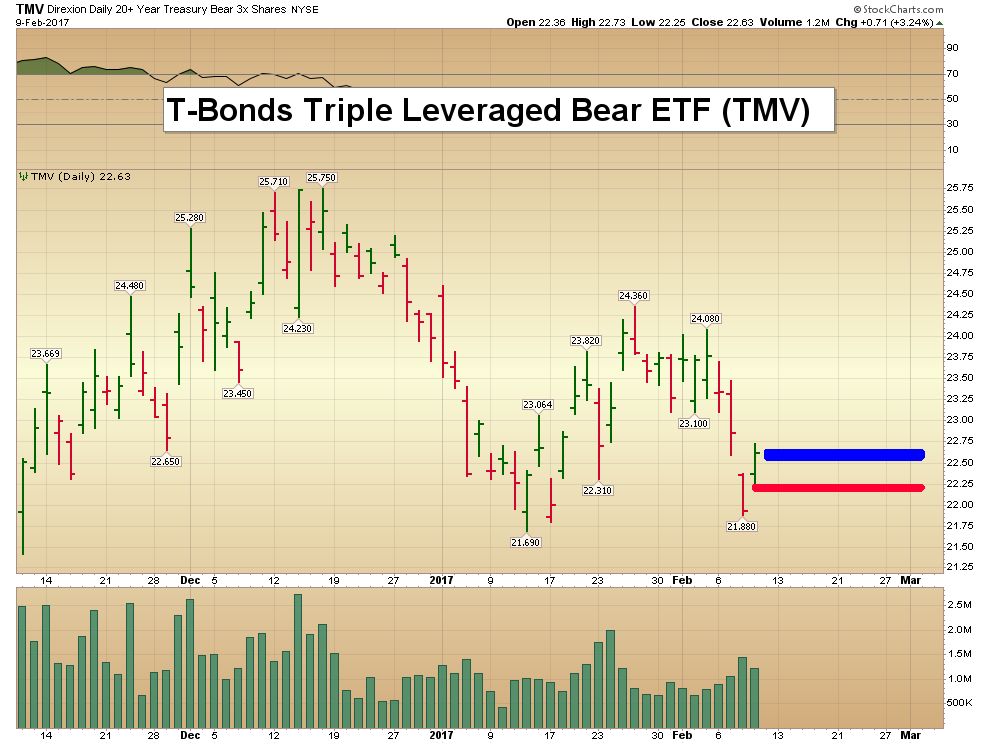

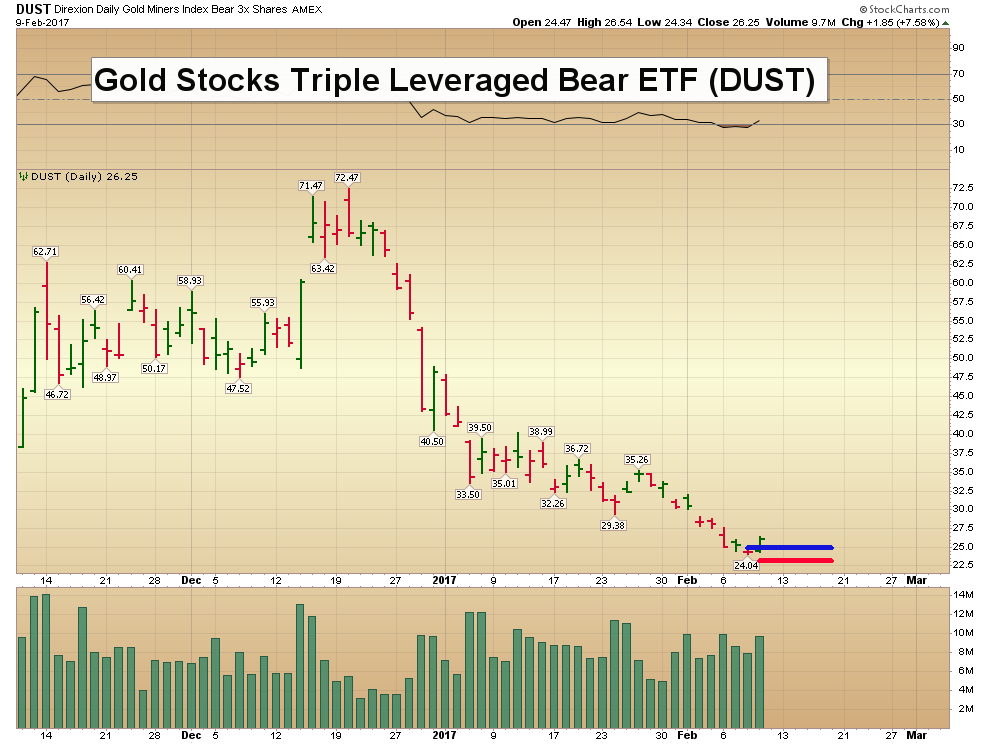

Here are today’s videos and charts (double click to enlarge):

Gold, Silver, & T-Bonds Key Charts Video Analysis

SFS Key Charts & Tactics Video Analysis

SF Juniors Key Charts & Tactics Video Analysis

SF Trader Time Key Charts Video Analysis

Morris

The SuperForce Proprietary SURGE index SIGNALS:

25 Surge Index Buy or 25 Surge Index Sell: Solid Power.

50 Surge Index Buy or 50 Surge Index Sell: Stronger Power.

75 Surge Index Buy or 75 Surge Index Sell: Maximum Power.

100 Surge Index Buy or 100 Surge Index Sell: “Over The Top” Power.

Stay alert for our surge signals, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

SFS Web Services

1170 Bay Street, Suite #143

Toronto, Ontario, M5S 2B4

Canada

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair