Gold & Precious Metals

Diamonds in the Precious Metals Miners…

Posted by Rambus Chartology

on Tuesday, 25 October 2016 13:52

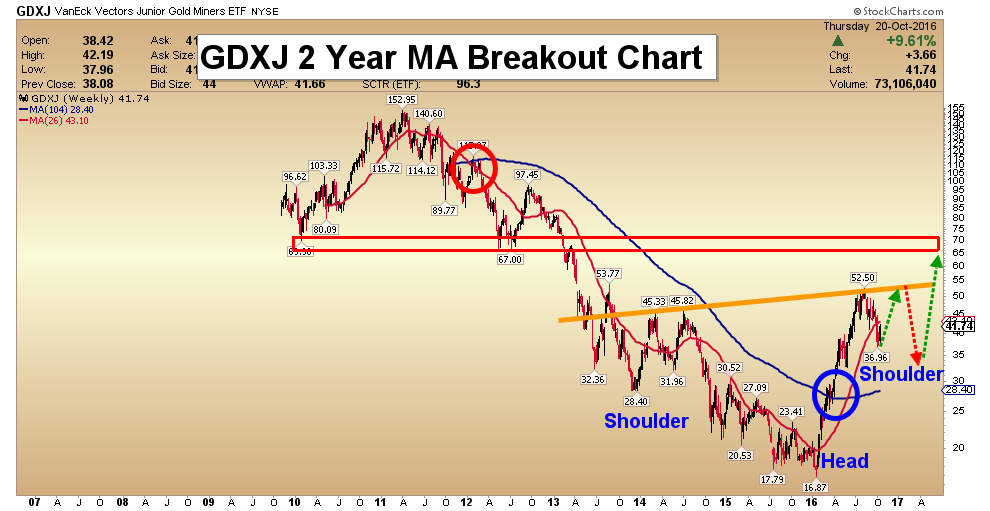

Back in September we looked at a possible morphing Diamond on the GDXJ in which the dashed trendlines were showing the original Diamond. When it started to morph into the bigger Diamond I added the two red circles that showed the false breakouts from the original dashed Diamond. As you can see the last two weeks produced a rally that so far has failed below the apex of the morphing Diamond. From a Chartology perspective the Diamond is a reversal pattern as it has five reversal points.

Below is a longer term daily line chart for the GDXJ which shows how it is situated at the top of the big impulse move up out of the January low. The brown shaded support and resistance zone comes in between 29.75 and 32.50. It may be possible that the Diamond could be the reversal pattern at the first reversal point in a much bigger consolidation pattern.

In the very big picture the neckline symmetry line comes in around the 33.75 area on the long term monthly chart, which would be in the ball park of the brown shaded support and resistance zone. Symmetry suggests the right shoulder still needs a lot more work compared to the left shoulder.

Below is a daily chart for the GOEX, which is the old GLDX gold explores etf, which shows a Diamond reversal pattern in place with a small expanding rising wedge forming as a possible halfway pattern. The price objective for the expanding rising wedge comes in around the 29.56 area. The 50% retrace of the first impulse leg is at 30.15.

As you can see the indicators below the chart all have a positive cross. If the expanding falling wedge plays out to the downside it would be nice to see a positive divergence on the RSI at the top of the chart.

The breakout below the bottom rail of the Diamond consolidation pattern only took about four days or so to reach the low. If we see a similar move down to the price objective, that will shake many PM investors to the core. This looks like a good time to raise a little cash if one is a shorter term trader. For the intermediate to longer term investors sitting tight still looks like the best approach. Once we get the first reversal point in place, at the bottom of the new trading range, that will suggest the low for the rest of the bull market is in place. Surviving this first reaction low will test your mental fortitude if it plays out.

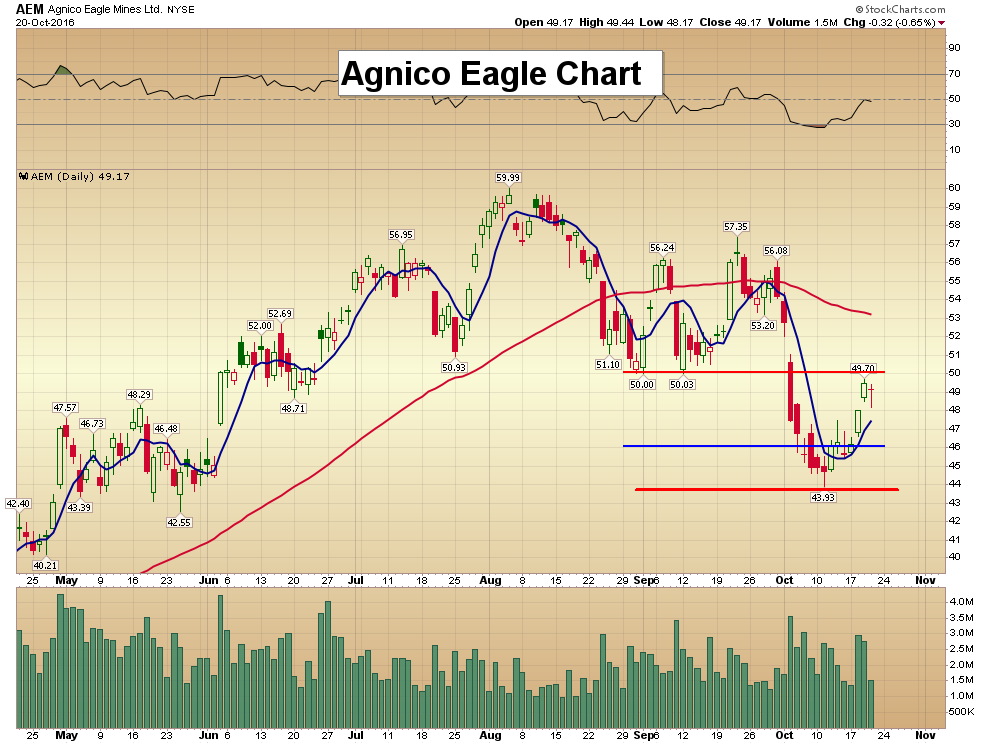

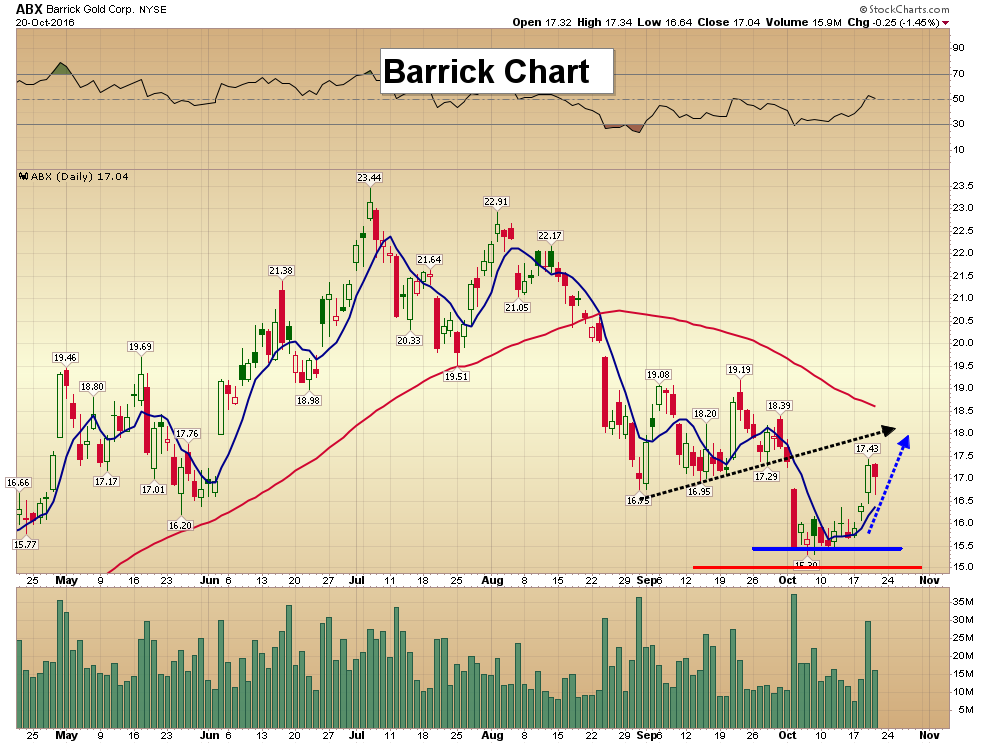

Precious Metals: Right Shoulder Action Now

Posted by Morris Hubbartt - Super Force Signals

on Friday, 21 October 2016 13:48

Today’s videos and charts (double click to enlarge):

Gold & Silver Bullion Video Analysis

Bonds, Currency, and Stock Markets Video Analysis

Precious Metal ETFs Video Analysis

SF60 Key Charts Video Analysis

SF Trader Time Key Charts Video Analysis

Morris

The SuperForce Proprietary SURGE index SIGNALS:

25 Surge Index Buy or 25 Surge Index Sell: Solid Power.

50 Surge Index Buy or 50 Surge Index Sell: Stronger Power.

75 Surge Index Buy or 75 Surge Index Sell: Maximum Power.

100 Surge Index Buy or 100 Surge Index Sell: “Over The Top” Power.

Stay alert for our surge signals, sent by email to subscribers, for both the daily charts on Super Force Signals at www.superforcesignals.com and for the 60 minute charts at www.superforce60.com

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

Frank Johnson: Executive Editor, Macro Risk Manager.

Morris Hubbartt: Chief Market Analyst, Trading Risk Specialist.

website: www.superforcesignals.com

email: trading@superforcesignals.com

email: trading@superforce60.com

Speculators Close Gold Positions

Posted by Arkadiusz Sieron

on Thursday, 20 October 2016 16:11

The latest Commitment of Traders report shows that speculative positions decreased. What does it mean for the gold market?

In the April edition of the Market Overview, we wrote that the Commitments of Traders Report is one of the most important publications on the gold market, as it breaks down the open interest number into categories of traders, showing the trade positions of market participant groups in the gold market. Let’s analyze the recent changes in traders’ positions.

Chart 1: The price of gold (yellow line, right axis, London P.M. fixing), the net position of money managers (green line, left axis) and the net position of producers (red line, left axis) over the last 12 months.

As one can see in the chart above, money managers (green line) tended to follow gold prices, while producers (red line) moved in the opposite direction to gold prices. The 2016 rally in gold was partially caused by the fast rise in net long positions of speculative traders. The chart also shows that these investors really tend to be most bullish just prior to significant price tops (and most bearish before the significant price bottoms).

What is crucial here is that money managers decreased their position from over 255,000 to about 149,000 net long contracts over the last two weeks. Although further declines are clearly possible, speculative positions are now at much more healthier levels.

The take-home message is that speculative traders (money managers) significantly reduced their net long position. The end of speculative fever may be good news for the gold market in the long-term. However, it is rather too early to call the bottom, as we should see some stabilization in net long positions first. We have to wait for Friday’s release of the Commitment of Traders report – but investors should always remember that there is a three day lag between the report and the actual positioning of traders (the report is issued on Friday, but contains Tuesday’s data).

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor

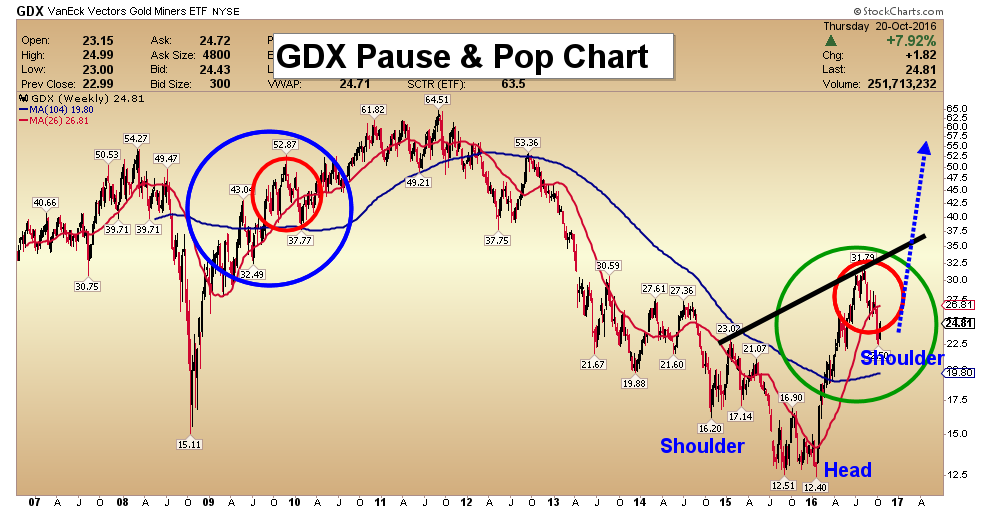

….related: Chart of the Day – GDX

Chart of the Day – GDX

Posted by Gary Savage - Smartmoneytracker

on Wednesday, 19 October 2016 13:49

GDX has now completed a weekly swing barring a complete reversal the rest of the week. This deep into an intermediate decline a swing stacks the odds heavily in favor of the correction being over. The metals should now rally for the next 3-4 months.

Oct 18, 2016

- The SPDR fund tonnage increased again yesterday, and now sits at 967 tons. This is obviously good news for all higher gold price enthusiasts.

- Please click here now. Double-click to enlarge. Gold is attempting to stage a nice upside breakout from a small symmetrical triangle pattern.

- In the short term, whether a rally happens or not probably depends on what happens with the bond market. Please click here now. Double-click to enlarge this short term T-bond chart.

- Since the Brexit vote occurred, both gold and T-bonds have been drifting lower. Sometimes gold leads the bond market. Sometimes it’s the other way around, but it will be difficult for gold to stage a major rally now without a bond market rally.

- In the big picture, inflationary pressures are rising significantly, and in 2017 a divergence in the gold-bonds relationship may start to manifest itself.

- Please click here now. Double-click to enlarge this long term gold stocks versus gold chart.

- Gold stocks have been in a long twenty-year bear cycle against gold bullion, and the cycle won’t be over until money velocity and bank loan profits end their own twenty-year bear cycles.

- I’ve suggested that 2017 is the year that happens. When it does, gold stocks should enter a multi-decade bull cycle that I would argue is better termed a “bull era”.

- Please click here now. CNBC commentator Rick Santelli recently flew into a rage when hearing the news that Janet Yellen may try to seek congressional approval to buy stocks.

- The average working class person in the Western world can’t afford to live normally anymore, even when working multiple jobs. Janet’s latest solution, horrifically, is to try to pump up the stock market even more than her predecessor already did with his crazed QE programs, and leave Main Street to rot.

- Some gold analysts may cheer for more useless QE and other silly central bank schemes, but these programs are highly deflationary for Main Street. From a demographics standpoint, the West is an ageing society, so by definition QE cannot fix anything.

- Attention gold stock enthusiasts: Inflating Wall Street and deflating Main Street does not create a bull cycle in gold stocks. It prolongs the twenty-year bear cycle. The bottom line is that QE is the disease, and rate hikes are the cure. Rate hikes end the madness of forcing an ageing society to move savings out of banks and into speculative investments to “promote growth”.

- QE destroys the standard of living of the Western world’s working and middle classes. It makes housing an investment rather than a place to live. It encourages crazed government bureaucrats to borrow even more money than they already have done. That money is then promptly wasted on ludicrous regime change and entitlement schemes.

- I have to wonder if the next program to “help” most of the Western world’s citizens will be for central banks to buy food commodities. That would make food an investment and completely annihilate the financial state of most citizens. Would Janet Yellen call that, “good news for inflation”? I don’t know. I would call it an act of lunacy.

- The only things that QE has inflated are houses and government bonds, and that is opening the door to an “endgame” type of scenario.

- Janet Yellen is going to have to face the fact that rate hikes are desperately needed to save Main Street from the government monster that is enveloping almost everyone, including the central bank. She’s also going to have to face the fact that the rate hikes are going to be followed by more PBOC devaluation of the yuan. The latest yuan devaluation is already in play now, in advance of an anticipated US rate hike in December.

- There’s not going to be any “making America great again”. The demographics of America are the demographics of a dying empire, regardless of who is sitting in the big White House chair.

- At some point, Janet Yellen and the rest of the Western world are going to have to accept that the West is out, and Chindia is in, in terms of empire leadership “action”.

- Rising rates fit well with an ageing society. It’s just common sense. Rising rates stop real estate speculation and lower rents. Also, many senior citizens can’t afford the higher property taxes that are now in play in this “healthy” real estate market.

- Going forwards, it’s madness to believe that roughly 350 million Americans can compete against 2.5 billion hungry Chindians. In a nutshell, it’s time for the West to retire from the empire leadership game, and enjoy that retirement.

- The government bond market Ponzi scheme must end, and the diabolical attack on America’s elderly savers must end. Cowards attack the elderly, and Janet Yellen should think very hard about that fact at her upcoming rate policy meeting in December. I think Janet will do the right thing, not just in December, but throughout 2017.

- I’m predicting that she is ready to begin raising rates more consistently, which is what she should have been doing from the start of the 2015 calendar year.

- Please click here now. Double-click to enlarge this key GDX chart. Like gold bullion, gold stocks appear to be “ripe for a rally”. Note the position of my 14,7,7 Stochastics series oscillator, at the bottom of the chart, but please click here now. If Janet Yellen doesn’t get away from promoting government borrowing and crushing savers, money velocity and bank loan profits are not going to recover, and gold stocks are going to go right back down to multi-decade lows against both gold and the dollar.

- Janet pulled the plug on QE, as I predicted she would. Now it’s time for her to stop doing the bidding of a debt-soaked government. It’s not time to make America great. It’s time to make it normal, by raising rates in December, and consistently in 2017. If she does that, gold stocks, money velocity, and bank loan profits will all soar while an out of control government gets taken to the woodshed, where it belongs!

Thanks!

Cheers

st

Oct 18, 2016

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com

email for questions: stewart@gracelandupdates.com

email to request the free reports: freereports@gracelandupdates.com

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair