Gold & Precious Metals

Gold Stocks Corrections in Bull Markets

Posted by Jordan Roy-Byrne - The Daily Gold

on Friday, 14 October 2016 19:37

The gold stocks are clearly in correction mode. The large caps (HUI, GDX) have corrected 30% while the juniors (GDXJ) have held up well in comparison by correcting the same amount. Given a number of factors (the size of the previous advance, the recent technical damage, stronger US$ index and rising yields) the gold stocks should continue to correct and consolidate in a larger sense. To gauge a potential path forward we present a new analog chart and compare the current correction to those from past markets.

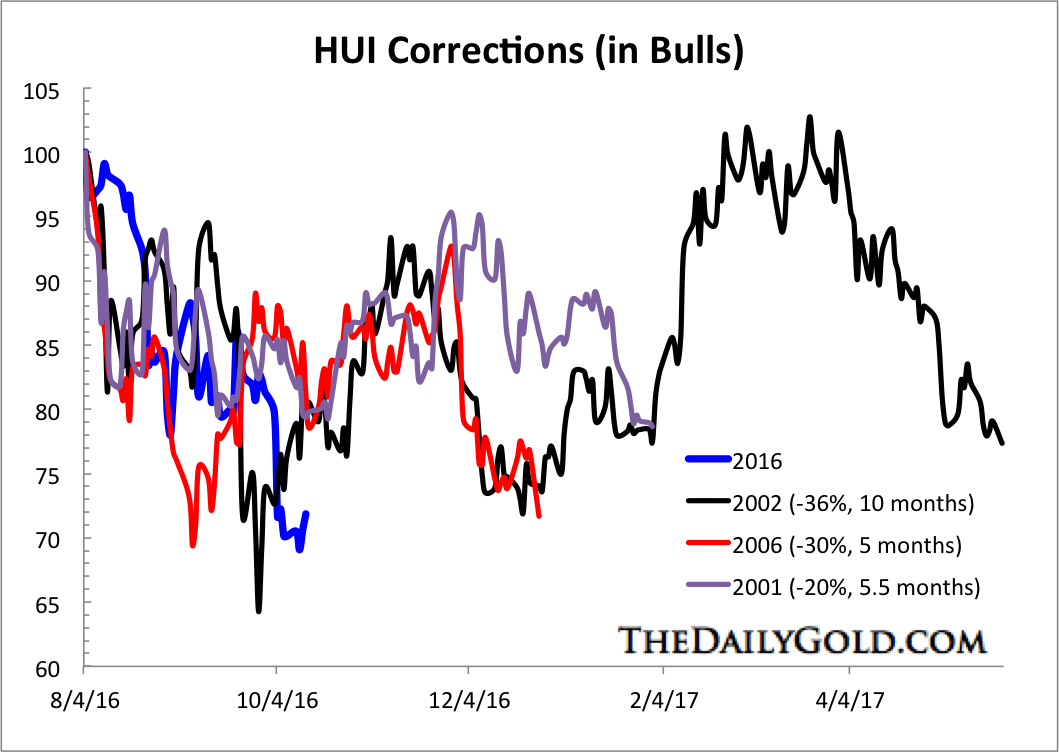

The chart below plots the current correction in the HUI index in comparison to the corrections in 2001, 2002 and 2006. Each correction followed very strong advances. The 2001 and 2002 periods are the best comparison to today. The recent rebound originated from a potential secular low (like 2001) and lasted six to seven months (like 2001). However, the rebound was much stronger than in 2001 and reached an extreme overbought point (like 2002). The HUI has already corrected 31%, which is much closer to the 2002 correction. Only time will tell how long the correction lasts but my view is it is more likely to last around six months than the 10 months seen in 2002.

Gold Stocks Correction Analog

The other important point to mention is every correction formed a typical A-B-C or down-up-down pattern. In other words, each correction served investors two buying opportunities (and three in the case of 2002). While we are likely at a short-term buying opportunity now, probability tells us that another one is coming in the next several months.

A variety of technical indicators (various moving averages, pivot points, Fibonacci retracements) gave us downside targets of GDX $22 and GDXJ $34-$35. That degree of downside is inline with the correction analog chart. While it may take another week for the sector to find a short-term low, the outlook over the next several weeks appears positive. Continue to accumulate on weakness and don’t be afraid to exercise some patience as more buying opportunities will be ahead.

Jordan Roy-Byrne, CMT, MFTA

…related:

How Could Helicopter Money Affect the Gold Market?

Posted by Arkadiusz Sieron

on Friday, 14 October 2016 13:08

Since the NIRP has not yielded the expected results – it could have actually weakened the condition of the banking sector and its ability to expand lending – a hot debate about the use of another weapon in the central banks’ heroic struggle with the deflationary pressure started. We mean of course helicopter money, also called monetary finance or money-financed fiscal programs. Supporters argue that it is a necessary option to revive economic growth and generate inflation, while opponents consider it a fancy name for printing money and monetizing fiscal deficits. Who is right and what does it imply for the gold market?

As we wrote in one edition of the Gold News Monitor, the term ‘helicopter money’ goes back to Milton Friedman who wrote in 1969:

“Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community.”

The idea, although in a different context, was revived in 2002 by Ben Bernanke. What is important is that helicopter money may be understood two ways. Some people interpret the metaphor of helicopter drops quite literally as transferring money from the central bank directly to the citizens, bypassing the financial sector or government. We could dub this version as ‘helicopter money for the people’.

Just imagine that the Fed transfers each month, let’s say, $500 for each American. Would it not be the sweetest monetary policy ever? Well, not necessarily, since this radical or people’s version of helicopter money could generate the highest inflation rate. We know that quantitative easing was also believed to increase inflation (or even cause hyperinflation). However, this time is really different! You see, the problem with the current monetary transmission mechanism is that the central bank affects the amount of banks’ reserves, but it does not control directly the credit expansion, which depends on the banks’ willingness to lend and borrowers’ eagerness to borrow. This is why quantitative easing, contrary to many fears, did not lead to higher prices of consumer goods (although it supported asset prices), because the increase in commercial banks’ reserves did not quickly translate into a dynamic growth in lending addressed to the general public. Indeed, as one can see in the chart below, after the financial crisis burst forth, the total credit to the private non-financial sector started to rise no earlier than in 2011, despite the spike in banks’ reserves in 2008-2009.

Chart 1: Excess reserves of depositary institutions (green line, right axis, millions of $) and total credit to private non-financial sector (red line, left axis, billions of $) from 2006 and 2015.

Now, the idea of people’s helicopter money is to give money directly to consumers. Therefore, helicopter drops could lead to serious inflationary consequences, as newly created funds would end up in the households who would probably spend them largely on consumer goods.

The risk of inflation getting out of control and legal doubts as to whether the central banks are entitled to transferring money to citizens (should not it be the responsibility of fiscal policy undertaken by the elected government?) explain why most economists see helicopter money as financing the expansionary fiscal policy. In this version, helicopter money would be an increase in public spending, or a tax cut financed by a permanent increase in the money supply. What, in practice, would such helicopter drops look like? Well, the central bank could directly credit the government current account or purchase non-interest bearing non-redeemable government assets (like perpetual bonds, but at zero interest rates). Consequently, the budget deficit would be funded by the increase in the monetary base. Governments could then transfer the proceeds directly to citizens, finance tax cuts or increase its spending on goods or services, e.g. for infrastructure projects. Despite important differences between these options, in a sense all would boil down to the helicopter money for people, but with the government as an intermediary. All in all, the household incomes would increase, leading to the rise in consumer prices (assuming that people would not save this money or repay their debts).

It goes without saying that helicopter money would be positive for the gold market. Although the yellow metal is not always a perfect inflation hedge, the introduction of helicopter drops should raise the fears of inflation overshooting and spur safe-haven bids for gold, at least initially. We observed such a pattern both after the Fed’s adoption of quantitative easing and later after the Bank of Japan’s introduction of the NIRP. It is clear as day that investors do not like new monetary tools they are not familiar with. Radical shifts in monetary policies diminish the faith that central banks have everything under control – if that was true, the changes would not be necessary. However, investors should remember that a lot would depend on the details of helicopter drops, such as the specific amount of transfer, the duration of the program, and the adopted constraints. For example, if helicopter money somehow managed to revive economic growth without generating high inflation (perhaps due to a limited amount of monetary drops), the confidence in central banks would increase and the price of gold would go south.

If you enjoyed the above analysis and would you like to know more about the consequences of the unconventional monetary policy for the gold market, we invite you to read the October Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It’s free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

This article looks at factors that will affect gold and silver prices as we go forward. We have to say they are considerable and will lead to our conclusion that while the gold price has fallen through support below $1,300 and now stand at $1,250, we see the fundamentals taking the price back higher and much higher over time. Indeed we do see it rising through its all time peak in the next year and beyond. We will also highlight the fact that such a rise will occur in all currencies as they weaken against the gold price.

This article takes from previous articles featured in the Gold Forecaster weekly issues www.GoldForecaster.com or www.SilverForecaster.com

Gold price structure

Not the balance of demand & supply

Few people realize the structure that lies behind the gold price. Most people believe that it reflects the balance of supply and demand. This is based on the belief that up to 95% of supply and demand is matched by buyer and seller in a ‘normal’, with the un-contracted, unforeseen, final 5% [described as the marginal supply] taken to market in search of buyers, by producers. Likewise buyers have normally contracted 95% of their needs direct from refiners or miners. But the final 5% is bought or sold in the market place when the unexpected need arises.

The market that defines the gold price should be made up of marginal suppliers and buyers. Or is that all? No! Speculators and investors turn to this open market in droves. They are the ones that change the game and stop the market being simply unexpected demand and supply. In most simpler markets speculators and investors make up a far smaller percentage than they do in the very different gold market.

Investors in gold come to the market because;

- The price is going to rise or fall and they want to make a profit longer-term.

- They believe gold is money and buy it to hold for the long term, because of their increasing doubts about the value of national currencies against gold, which is in competition with paper currencies as a store of value. Bear in mind that gold has been such for thousands of years, whereas currencies have only been independent of gold as a back-up since 1971.

Speculators come to the physical gold market usually because they want to hold the metal for a short term profit or sell the metal to buy it back lower down [for profit again]. They are often driven by factors outside the gold market, such as changes in exchange rates in various currencies, or changes and expectations in economic factors, such as interest rate movements, on a global basis. They have little interest in the forces underlying gold any more than they have in any other commodity. Profit in the short term is their goal, and if the gold market or any other market can supply that profit, there they will go.

COMEX

COMEX is not simply a commodity exchange. It is a financial market. The COMEX gold market is not a physical gold market. It is a place where one makes financial bets for cash on contracts, either futures or options.

The only time it becomes a physical gold market is when notice is given by a buyer or seller at the start of a contract that delivery is required or supply will happen at the end of the contract. If no such notice is given then any loss or profit at the end of the contract is paid in cash only. This protects all buyers and sellers and the exchange against having to deliver physical gold.

Remarkably, the physical market is heavily influenced by COMEX and somehow, adjusts prices in line with COMEX. It shouldn’t happen unless there is a link between the use of the physical market with the COMEX ‘financial’ market. This does happen when the banks operate in both markets using them in conjunction to drive prices, causing other investors to react to their actions.

For example, speculators [high frequency traders included] will take short or long positions on COMEX then enter the physical market [in London usually] to deal in physical OTC in such a way as to make their COMEX positions profitable. If they are short [as we saw on last Tuesday] they sell enough gold to depress the price. On quiet days, such as when the Chinese market was closed last week, it was a good time to sell using both markets [when buyers, in size, were absent] to manufacture short-term profits.

We also saw major operations like that in 2013 when COMEX short positions were taken in huge amounts then massive amounts of physical gold [400 tonnes+] was dumped in the physical market. This triggered stop losses and brought another 600+ extra tonnes onto the market from investors reacting to price falls. This sent the physical market plunging nearly a third to hit $1,150. What a profitable operation for the big U.S. banks! Of course the positions can be both ways, where ever the speculators want the price to go.

Since 2013 this has held prices at low levels. During this time China and Russia have been able to acquire huge tonnages for their central banks for and through the Shanghai Gold Exchange.

But it has also served to keep gold prices low and prevent them competing with currencies as an alternative to currencies. Prices north of $2,000 would represent competition to the dollar and other currencies and reflect a loss of confidence in them.

Sum Total

Take the above shape of the market and add all these ingredients together and what do we have?

- Net demand and supply do not affect the gold price that much. Where marginal supply and demand comes to the market their influence should rule prices if the market was isolated to them.

- Speculators in the physical markets can overwhelm this marginal supply and demand. It comes usually from the big banks and their clients who focus on short term profit.

- COMEX paper gold is really froth or surf on the real waves in the market, but somehow this being full of sound and fury is credited with controlling gold prices. This can only happen when major banks and central banks use both London and COMEX to rule prices.

- In the last few years China has taken huge amounts of physical gold to itself and now Shanghai is the global, physical, gold hub. Once it has liberalized its currency and financial markets, we believe it will control the pricing power over gold. It’s inevitable. This will undermine the power of COMEX as physical dealing in both London and New York will see the presence of Chinese demand and supply in its markets. Being far larger than either, the Chinese will overwhelm the western gold market. With the Chinese bank ICBC/Standard a gold market maker in London controlling warehousing for around 3,500 tonnes there, they can buy/sell large amounts to ensure the global price of gold is at levels they want to see!

Monetary Influence

The absolute proof of the value of gold as money is the fact that central banks continue to be the major holders of gold. It is held as an important reserve asset and acts as a counter to national currencies in reserves.

Only once gold had been sidelined in the U.S. during the 41 years to 1974 could the dollar act as the only currency in the country. Over the generations since 1933, the globe got used to the dollar as the only global money. Eventually, after a considerable campaign against gold from 1975 until 2009 by western central banks and the I.M.F. was gold recognized as a valuable reserve asset. From 1999 until 2009 the Central Bank Gold Agreement stated exactly that.

But the reality is that central banks have never discarded gold as back-up money as is evidenced by the huge tonnages that continue in their reserves.

Indeed, an ex-head of the Bundesbank, Weber, stated that gold is ‘a counter to the gold price’.

Gold is not measured by currency values, gold measures currency values.

We have often written about the dollar succeeded when it became the sole global reserve currency, with the backing of oil [when one could only buy oil using the U.S. Dollar] but that time has begun to wane as a host of nations from European to Russian to Chinese currencies are now chipping away at the dollar’s influence.

De-globalization and Exchange/Capital Controls

Exchange and Capital Controls are often misread as being confined to emergency protection of a currency. They have wider uses and can be used to interfere with specific flows of funds and to control national commercial situations. They include, withholding taxes, duties both imports and exports in specific instances as well as overall financial flows through a country.

They can be extremely effective in boosting a nation’s economy.

Oil and the Dollar

Here is a potential scene that may happen for political as well as economic reasons. A threat is being posed by divisions between Saudi Arabia and the U.S. as the U.S. policy in the Middle East still does not accept that the battle is between Shi’ite and Sunni Muslims not individual nations.

On top of this it is clear that increasing U.S. oil supplies through fracking as well as other sources may well obviate the need for imported oil. As we see Russia and Saudi Arabia appearing to cooperate on freezing or reducing the price of oil, we see not only the price of oil, but the future of fracking lying directly under the control of these two nations. The future will likely see the oil price ‘war’ heat up tremendously to the extent that the U.S. may well want to protect its own oil industry, as well as ensuring it becomes self-sufficient in oil supply. The imposition of duties on imported oil will protect the future profitability of U.S. oil producers [through higher prices] as well as remove the control of U.S. oil prices from outside producers such as Russia and Saudi Arabia. This will also remove the need to guarantee the security of the Persian Gulf.

The boost to inflation through higher prices will also assist in the economic growth levels of the U.S.A.

In turn the lessening of the need for imported [Saudi] oil may well lead Saudi Arabia to accept all currencies for its oil, removing the hold the dollar has had for generations over the oil world.

Once this happens the dollar will remain a leading global currency but lose its role as the sole global reserve currency, while preparing it for its future role in a multi-currency monetary system, whose arrival is inevitable.

The rise of the Middle Kingdom

With the arrival of the Yuan as one of the currencies that make up the Special Drawing Right of the I.M.F. the Yuan has become a global ‘hard’ currency. Its use from now on will accelerate globally, taking from the role the dollar has played until now.

We have no doubt that China will be the largest economy in the world and the wealthiest simply through its population and capabilities. It will be the manufacturer to the world. It will have the financial power to dominate the global economy. Alongside this the Yuan will challenge the dollar to the point that there will be a distinct division of east and west in the global economy.

As an example, imagine China becoming willing to pay Yuan for all imports and demanding Yuan for its exports. Of course, this won’t happen quickly, but gradually so as to minimize any progress in China’s global power.

But at some point there will be international friction in the monetary world. This will lead to currency turmoil and a loss of confidence in most currencies.

Gold in a multi-currency world

Only gold will bring the soothing qualities to the monetary world needed to make it function properly while major changes take place.

As we have written many times before gold will become the fulcrum [or the lubricant] on which the currency world continues to function well. That’s why central banks continue to hold gold in the west and to acquire it in the east!

Looking at the big picture of gold we see the investment/speculative role of gold and the monetary world of gold. As we move to a multi-currency monetary system we see the two sides of the gold world rushing on a headlong path towards a major collision. But, at the moment, they are apart.

Once they collide we will see a rocketing gold price.

At that point nation after nation will see the need for governments to control gold itself and the price just as the U.S. did in 1933. But this time, gold will continue to be dealt freely outside nations that take their citizen’s gold.

At that point nation’s opposition to gold, competing with their currencies, will go the way the U.S. did in the past and harness gold in support of their currencies. But then they will not allow gold to compete against their currencies at institutional or retail levels within their borders. They will ban gold dealing and will appropriate gold within their jurisdictions preventing citizens from holding all but small amounts of gold.

With nations whose currencies are losing the confidence of their trading partners, the use of gold as a back-up asset to repair that confidence will grow. We saw that in the Sovereign Debt crisis in the E.U. gold/currency swaps ‘policed’ by the Bank of International Settlements, which blazed the trail for what we expect to see in the future.

A word to gold investors – Simply holding gold overseas will not be enough. We are happy to send you a guide on just how to hold your gold effectively out of the reach of the authorities in your Jurisdiction.

It will be the gold investor that ensures he is outside the reach of confiscating authorities that will retain his gold and ensure he profits from those rocketing prices.

….related:

- The world is undergoing a major economic transition from deflation to inflation. Sadly, very few retail investors are correctly positioned to benefit from this exciting change.

-

In the big picture, the transition means that gold stocks will outperform gold bullion, and bonds will stagnate.

-

Chinese and Indian stock markets could boom. Western stock markets could also get dragged higher, but investors there have a lot more risk than Chindia investors.

-

To understand the fundamentals of the transition, please click here now. I predicted that Janet Yellen’s first actions as Fed chair would be to begin to transition a deflationary world to an inflationary one.

-

I said she would do that, ironically, by tapering QE to zero and raising interest rates, and that’s exactly what she is doing. Now, the world’s top institutional economists are beginning to adopt the same view that I had years ago, which is that QE is inflationary for Wall Street, and deflationary for Main Street.

-

Rising oil prices are already putting pressure on the yield curve and the ten-year bond. That’s likely to accelerate in 2017.

-

Please click here now. Top economists at JP Morgan, Merrill Lynch, and other major financial institutions are all turning negative on bonds, and becoming very positive about commodities.

-

These institutional money managers move truly gargantuan amounts of liquidity, and the early 2016 rally in gold stocks was the canary that sang loudly in the “inflation is coming” coal mine.

-

This transition is not going to benefit day traders. It’s going to benefit Western gold community investors with a long term horizon, and make them richer than they can possibly imagine.

-

It’s multi-year process, not an overnight event.

-

Please click here now. Western real estate can initially continue to do well as rates rise.

-

That’s mainly because Chinese markets are opening up wider, and citizens there are maniacal savers, sitting on about $25 trillion (USD) in savings. That money will continue to pour into Western real estate even as rates rise, because inflation will rise faster.

-

Please click here now. Top analysts at Barron’s believe peak liquidity and peak bond prices are here.

-

The bottom line is that with the exception of China, governments around the world have done nothing for Main Street while central banks have provided gargantuan stimulus to financial assets. That’s about to change, and the change is incredibly inflationary.

-

Please click here now. Double-click to enlarge. That’s a look at the Indian small caps market, which I cover in my https://gracelandjuniors.com

-

That market is up about 65% from the 2016 lows, and poised to blast out of a massive inverse head and shoulders bottom pattern. When inflation appears, small caps tend to outperform large caps in a major way.

-

India could potentially achieve 10% GDP growth very soon, and 8% seems like a “walk in the park”. As that growth continues relentlessly, commodities like oil (and especially uranium) are poised to benefit.

-

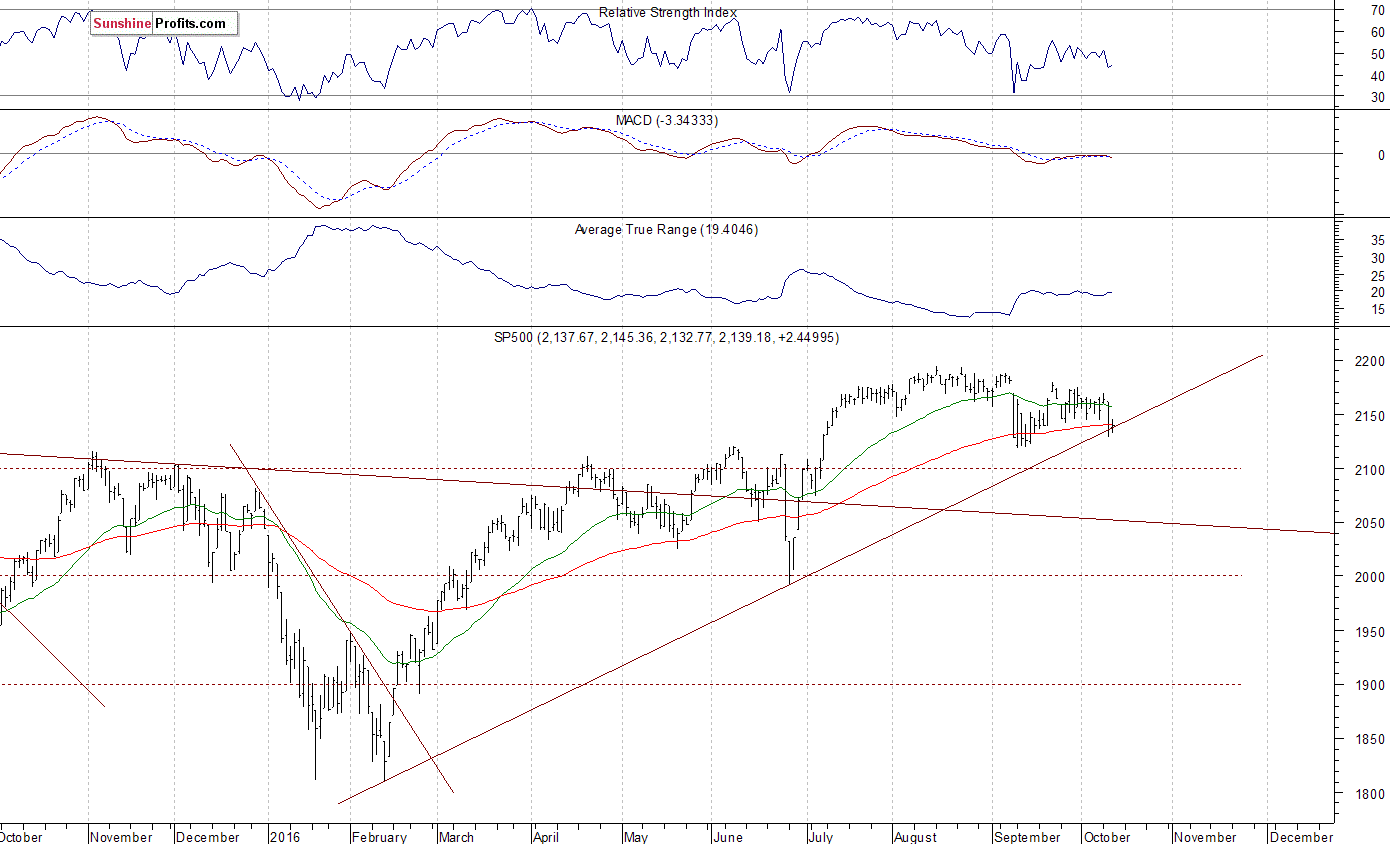

Please click here now. Double-click to enlarge. That’s the daily gold chart. I’ve outlined a bit of a grind for gold in the next few weeks.

-

From a fundamental perspective, gold needs another rate hike from Janet to move higher. In late 1979, rate hikes were negative for gold, but for most of the 1970s, gold went higher alongside rates, because inflation grew faster than interest rates.

-

In the current situation, interest rate hikes are incredibly positive for gold, because of the existence of the huge QE “money ball” that sits at the Fed and other central banks. Rate hikes incentivize banks to move that money out of the Fed and into the fractional reserve banking system.

-

Janet is unlikely to hike again until December, so gold is likely to grind sideways until then. If gold investors look closely at that gold chart, it’s clear that gold really has made little upside progress since it became clear in mid-February that Janet was going to delay further rate hikes.

-

To understand the potential for gold to grind sideways from a technical perspective, please click here now. Double-click to enlarge this monthly bars gold chart. Gold must grind sideways now, to form the right shoulders of a huge inverse head and shoulders bottom pattern.

-

I don’t expect the grind on the right shouldering process to take anywhere near as long to form as the left side did, which is good news for all gold price enthusiasts!

-

Please click here now. Double-click to enlarge this daily bars GDX chart. Gold stocks are also likely to grind sideways for now, and then begin an enormous rally in 2017. Gold stock investors should focus on the $22 and $18 price zones for fresh buying. What’s coming in 2017 is not a “bull market”. It’s the start of a wondrous bull era!

Thanks!

Cheers

St

published Oct 11th @ 7am

….related: Former Soros Associate Says Fed Responsible For Gold & Silver Smash

How was that for a forecast?!

Posted by Larry Edelson - Money & Markets

on Wednesday, 5 October 2016 16:25

Please don’t take this as boasting, but for months now I’ve been using my cycle analysis and AI software to warn everyone I could that gold and silver and miners were headed lower, not higher.

And I gave a date. I stated they were headed lower into today, October 5. I made that forecast as many as seven or eight months ago.

Since then, we’ve seen gold plunge from as high as $1,377 to yesterday’s low of roughly $1,266 — a $111 drop, or just over 8.0%. The loss in silver has been similar.

I got my share of hate mail for that forecast, especially from those following the trading analysts out there who keep calling for the death of the dollar and who use every piece of news they can find to make an excuse for higher metals prices.

Unfortunately, they don’t understand the precious metals market. They can’t possibly understand it because most of them have never traded it. Most of them are unaware of the history of gold and most of them are simply fear-mongerers.

Not me. I tell it like it is, with my Artificial Intelligence Model and the waves, or cycles, I follow. My sole mission is two-fold …

- Keep you out of trouble, like I just did.

- Make you money, scientific profits and make it easy, with my very accurate forecasting models and more.

Right now, due to the severity of the selling, I cannot claim the low is in and the next leg up is about to start.

So we have to wait a few days to watch the action, which I will do for you.

Meanwhile, stay alert, the markets are really heating up.

Best,

Larry

Editor’s Note: Due to Hurricane Matthew, you may not hear from us for a brief time. We will resume our normal schedule as soon as the storm passes.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair