Gold & Precious Metals

Gold Crash Coming?

Posted by Larry Edelson - Money & Markets

on Friday, 12 August 2016 16:02

Despite all the bullishness about gold and silver and the mining industry, I’ve maintained for quite some time the view that this first leg up will be dramatically retraced with a crash heading into October.

To say I’ve become unpopular because of my view would be an understatement. Every gold bug and analyst I know is more bullish than ever.

And according to the Commitment of Traders (COT) reports from the Commodity Futures Trading Commission (CFTC) — bullish sentiment in the precious metals is at record highs. That typically means that the slightest fright could set off an avalanche of selling in the gold and silver markets.

Thus far, gold’s traded in a range from $1,320 to roughly $1,365. On Friday, gold was pushing above my weekly buy signal at $1,363.50.

Friday morning’s strong employment data, however, sent the dollar soaring, the euro plunging and gold down more than $26 for the day. Silver down more than $0.71 for the day, a whopping 3.53% decline.

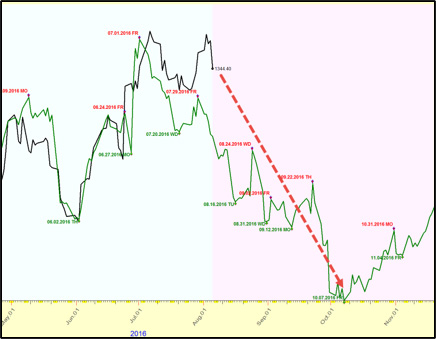

Here’s the artificial intelligence chart for gold, showing you gold’s probable path heading into October (silver’s is similar) …

The fact that gold — despite many attempts — has been unable to close above $1,363.50 on a weekly closing basis indicates that’s the roof and support still lives at the $1,320 level.

More importantly, gold is following the AI models to the tee.

Look, I am as bullish long-term as anyone is. But no bull market goes straight up. Strong long-term bull markets stair-step higher, taking one step up — then pulling back 50-65% — then taking another step higher. This is what you want to see.

It’s also why I’ve been steadfast and refused to jump on a wave with the majority of bullish gold and silver surfers who are about to be thrown off the wave’s crest and even worse, get smashed amongst the coral or the rocks below.

There is a time to buy, there is a time to sell, and there is a time to be on the sidelines like a tiger stalking its prey.

Stalking the precious metals is what I have recommended, and I’m convinced it is the right strategy — because even some of my most loyal followers have wanted my head over the last several weeks …

Proving to me that the majority are going to get caught as the wave turns down and lose or give back a majority of their “lucky” gains as they typically do.

Same for the mining sector. It had its first leg up and now it needs to pull back and refresh.

So keep your eyes on gold and silver. As long as gold is unable to close above $1,363.50 on a Friday closing basis — October futures contract — then gold should follow the path seen in the AI forecast chart above into a low in early October. That low should come in around $1,250 – $1,275.

So keep your eyes on gold and silver. As long as gold is unable to close above $1,363.50 on a Friday closing basis — October futures contract — then gold should follow the path seen in the AI forecast chart above into a low in early October. That low should come in around $1,250 – $1,275.

Assuming that’s the course of action and major support holds, I’ll be screaming from the rooftops to buy gold, silver and select mining companies.

So what should you do if you haven’t listened to me or if you followed one of the hundreds of analysts who refused to do anything but be bullish and promote precious metals and miners with reckless abandon?

If it were me, I would hedge my holdings with inverse ETFs. For gold I would consider ProShares UltraShort Gold, symbol GLL. For silver I would consider ProShares UltraShort Silver ETF, symbol ZSL. Careful though, this is a double-leveraged ETF, seeking to deliver twice (2x or 200%) the inverse (or opposite) return of the daily performance of silver bullion in U.S. dollars.

And for mining shares, I would consider Direxion Daily Gold Miners Index Bear 3x Shares ETF, symbol DUST. Carefully here too, as DUST is a triple-leveraged ETF, seeking to deliver three-times (or 300%) the inverse (or opposite) return of the daily performance of the NYSE Arca Gold Miners Index in U.S. dollars.

Meanwhile, the U.S. stock markets continue to struggle, with the majority of stocks deep in the red for the year and with only a handful keeping the Dow Industrials and the S&P 500 at record highs. It won’t last.

Yes, long term, the stock market is headed to Dow 31,000. But that does not mean — like gold and silver — that a sharp, sudden decline can’t occur. It will.

If you’re loaded up with stocks and it were me, I would consider hedging with an inverse ETF such as ProShares Short S&P500 ETF, symbol SH.

These are mere suggestions. Members of my newsletter and trading services of course get specific recommendations, timing, buy prices and sell prices.

Lastly, keep your eye on crude oil. There should be one more decline before its new bull market really starts to take off.

Stay tuned and stay safe!

Best wishes,

Larry

Larry Edelson, one of the world’s foremost experts on gold and precious metals, is the editor of Real Wealth Report and Supercycle Trader.

Larry has called the ups and downs in the gold market time and again. As a result, he is often called upon by the media for his investing views. Larry has been featured on Bloomberg, Reuters and CNBC as well as The New York Times and New York Sun.

How to Profit from the Current Gold Bull Market

Posted by Chen Lin for The Gold Report

on Friday, 12 August 2016 2:27

After five years of a brutal bear market, gold and gold miners are finally having a huge rebound, and investor Chen Lin, writer of the popular newsletter What is Chen Buying? What is Chen Selling?, sees the parallels to 2009. He highlights nearly a dozen mining companies that have weathered the downturn and are in position to ride the wave higher.

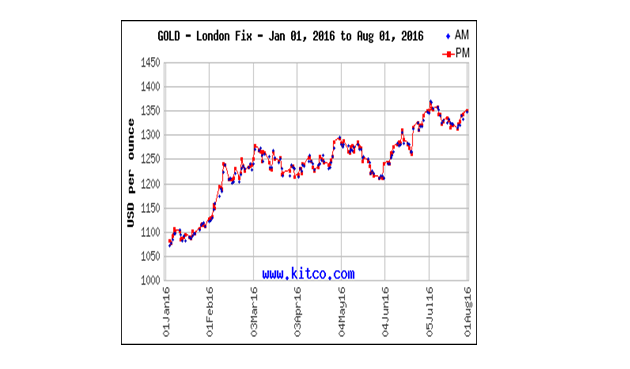

Gold and gold miners are finally having a huge rebound after five years of a brutal bear market, and we are having a spectacular year so far. Recently gold and silver are shaking off the potential summer weakness. We have been seeing very weak physical demand from China and India in the past few months due to high prices: Chinese demand was down 30–40% and India’s was down 70–80% in Q2 versus the same period last year. In the meantime we have some Federal Reserve officials signaling that more interest rate hikes are

However, gold and silver are still looking very strong in the shoulder month of August. This year’s gold and silver rebound tracks the strong rebound of 2009, the period when gold and silver rebounded off the brutal 2008 crash. Following the 2009 playbook, we should have a good second half if gold and silver continue to follow in the footsteps of 2009. As you can see from the charts, gold started to take off big time after the summer consolidation in 2009, first at the end of August and early September, exploded parabolically, and peaked in early December. If you look at the monthly gains of 2009, two-thirds of the annual gains happened during the three-month period of September, October and November!

Seasonally, gold and silver usually bottom around August. When the summer ends, jewelry shops are busy buying precious metal for the holiday seasons, starting with the Indian wedding season into Jewish Hanukkah into the Christmas holidays into the New Year and finally the Chinese New Year. Even the recent report of weak physical demand for gold from China and India may indicate that jewelry shop precious metal inventory there is low. They may have to play catch-up in the second half to restock the inventory, and that can drive the gold price even higher.

As traders, now we need to prepare for a similar move of gold and silver in the next three to four months. This type of opportunity happens only once or twice in a decade and I don’t wish to miss it. We want to build up our positions in the month of August in case a similar move of gold and silver happens again later this year.

How to trade? If you are not very familiar with the gold mining industry, I strongly suggest you stick with exchange-traded funds (ETFs): SPDR Gold Trust (GLD) for gold, iShares Silver Trust (SLV) for silver, plus Market Vectors Gold Miners ETF (GDX) and Market Vectors Junior Gold Miners ETF (GDXJ) for gold miners. There are other physical-metal-backed ETFs for long-term holding. You can also try the leveraged ETFs, futures and options if you can tolerate the risks. Gold and silver miners are extremely difficult to analyze, and they fool even the seasoned experts all the time. Don’t take any unnecessary risks.

For people like me who have been in the industry for a long time, there are actually a lot of opportunities. The recent rebound of mining stocks has been very uneven. There are many very good value stocks if you look around.

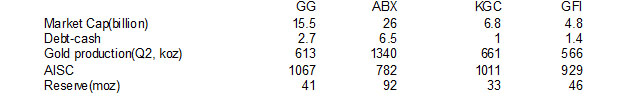

Here is a rough comparison of four of the ten largest gold miners in the world. You can see a huge valuation gap between Goldcorp Inc. (G:TSX; GG:NYSE)/Barrick Gold Corp. (ABX:TSX; ABX:NYSE)and Kinross Gold Corp. (K:TSX; KGC:NYSE)/Gold Fields Ltd. (GFI:NYSE). I understand Goldcorp is one of the best-run gold miners and Barrick is a darling of the funds, but does that justify the huge 100–200% valuation gap? If you believe this gold rally is for real, then I see these stocks converging in the next year or two when investors start to put valuations into their calculations. Here are the ten-year charts for these four stocks versus GDX. I see them converging, which means Kinross and Gold Fields could have 100% upside in addition to any appreciation of GDX.

If you go down the food chain to the midtiers and juniors, I wish to remind everyone that this sector broke a lot of investors in the past downturn. Personally I saw friends who were almost completely wiped out. Did the industry change its behavior to be more friendly to shareholders? The honest answer, unfortunately, is no! You don’t have to ask me, you can ask Rob McEwen, former Goldcorp chairman, and other honest industry insiders about it. I was following the industry carefully during the downturn; sadly most companies still didn’t want shareholders’ input, only their money.

Insider ownership has been very low compared to other industries, thus there is little motivation to help existing shareholders to even recoup their original investment. I have seen shareholder revolts, but these revolts seldom succeeded. One of the few exceptions is Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT); shareholders successfully went to court, fired the management team, and Klondex became one of the very few successful stories during the past downturn. But stories like Klondex are very rare, as many juniors wiped out most of their investors. Fortunately I saw the downturn of gold coming and led my subscribers to underweight gold and gold miners in 2012 and avoided a lot of this carnage.

Insider ownership has been very low compared to other industries, thus there is little motivation to help existing shareholders to even recoup their original investment. I have seen shareholder revolts, but these revolts seldom succeeded. One of the few exceptions is Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT); shareholders successfully went to court, fired the management team, and Klondex became one of the very few successful stories during the past downturn. But stories like Klondex are very rare, as many juniors wiped out most of their investors. Fortunately I saw the downturn of gold coming and led my subscribers to underweight gold and gold miners in 2012 and avoided a lot of this carnage.

Going forward, I really like gold and silver miners who successfully delivered new mines during the downturn. The midtier companies I own are OceanaGold Corp. (OGC:TSX; OGC:ASX) and B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX). Both successfully built mines in this recent downturn, on time and on budget. Both underpromised and overdelivered, they are extremely rare cases in the recent downturn. If you remember the long list of bankruptcies, like Allied Nevada’s, that wiped out shareholders completely, the old memory is too painful to recall. The reason to continue investing in these companies is that they have an experienced in-house team that can deliver and a management team that at least really cares about shareholder value.

I also own companies that were building new mines during the downturn and are now finishing them or are close to finishing them, companies that include Pretium Resources Inc. (PVG:TSX; PVG:NYSE), K92 Mining Inc. (KNT:TSX.V) and Maya Gold & Silver Inc. (MYA:TSX.V). Now everyone wants to build the next new gold mine. But during the downturn, only the best deposits were put into production. Pretium is finishing up a world-class mine in north British Columbia. It should start pouring gold next year, 500,000 oz/year (500 Koz) at costs well below $500/oz.

K92 should be in production this month or next. The company is quiet about its production guidance because it wants to underpromise and overdeliver. We should see it starting with 40–50 Koz at very low cost and going higher from there.

Maya is ramping up its production as we speak. The new Zgounder mine (85% owned) is targeting 1.4 million oz (1.4 Moz) of silver per year at total costs just over $10/oz and cash costs just over $6/oz. We didn’t see many silver mines starting up when silver was around $15/oz. This mine, when fully ramped up, likely beyond 1.4 Moz/year, will be one of the great new pure silver mines built in the past few years.

Finally I wish to emphasize that these mines that have been built during the down times are truly world class. They are targeting sub-$1,000 gold and sub-$15 silver prices. When they are fully up and running, they will be some of the lowest cost mines in the world.

I also like exploration companies that carefully navigated the downturn, keeping costs and dilution down. A couple of these companies I own are Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE), GoldQuest Mining Corp. (GQC:TSX.V) and Paramount Gold and Silver Corp. (PZG:NYSE.MKT; PZG:TSX). Gold Standard Ventures has been a spectacular stock during this downturn. The management team put their heads down and consolidated the whole district. Gold Standard gained the support of Goldcorp and OceanaGold, the two most successful companies during this downturn, at premium to its share price. It also made a strategic investment in Battle Mountain Gold Inc., which was dead for many years because of its very high royalty rate. The company bought down the royalty to a reasonable level and is now ready to explore.

GoldQuest’s management was able to raise money and shore up its balance sheet in the good times, and kept their heads down and did exploration and a preliminary feasibility study at minimum dilution in the downturn. Now the share price has rebounded and the company is ready to go to the next phase.

Paramount hasn’t moved much like other exploration companies, likely due to the fact that it just completed a merger. It is a spinoff of the old Paramount, which was sold to Coeur Mining Inc. (CDE:NYSE) during the bear market. It is one of the few winners of mines in the past few years. Now the company picked up another property during the downturn. It has two sizable gold projects, one in Nevada and one in Oregon, both in preliminary economic assessment (PEA) stage. Paramount has a total of over 5 Moz of Measured and Indicated resources, and a market cap of about $35 million. It is one of the few U.S. listed and U.S.-based exploration companies with proven management that is still quite cheap.

In summary, the rebound of gold has striking similarities to 2009, the year after the 2008 crash. If history repeats itself, we should see the most appreciation of the gold price starting in September, the beginning of the annual gold run. I am excited about it.

As always, when to book profits is the most important question for any investment, but especially in the volatile gold and gold mining industry. I was fortunate that I sold silver at $49–50/oz back in 2011 and led my subscribers to underweight gold and gold miners in 2012. I will be certainly watching the gold market very closely and hopefully will navigate through this gold bull market as successfully as the last time.

Charts courtesy of Chen Lin

related: Gold Investment Demand Reaches Record In First Half 2016 On “Perfect Storm”

Chen Lin manages a family fund and writes about it in the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors, Inc. While a doctoral candidate in aeronautical engineering at Princeton, Lin found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Read what other experts are saying about:

Disclosure:

1) The following companies mentioned in the article are sponsors of Streetwise Reports: Klondex Mines Ltd., Pretium Resources Inc. and Gold Standard Ventures Corp. The companies mentioned in this article were not involved in any aspect of the article preparation or editing so the expert could write independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Chen Lin: I or my family own shares of the following companies mentioned in this article: Kinross Gold Corp., Gold Fields Ltd., OceanaGold Corp., B2Gold Corp., Pretium Resources Inc., Maya Gold and Silver Inc., K92 Mining Inc., Gold Standard Ventures Corp., Paramount Gold and Silver Mining Corp. and GoldQuest Mining Corp. I personally am or my family is paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

Gold Investment Demand Reaches Record In First Half 2016 On “Perfect Storm”

Posted by GoldCore

on Thursday, 11 August 2016 14:09

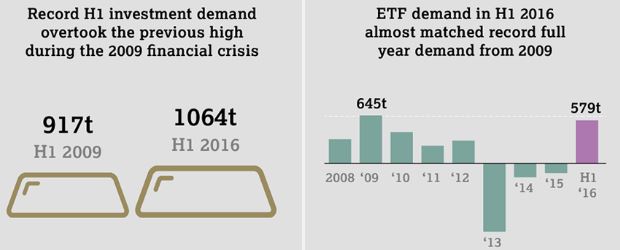

Gold investment demand surged to a record in the first half of 2016 and overtook the previous high seen during the 2009 financial crisis on a “perfect storm” for gold according to the ‘Gold Demand Trends Q2 2016’ report which was released by the World Gold Council today.

….related:

Goldman Sachs analyst Eugene King estimates we have only “20 years of known mineable reserves of gold.” The last known gold deposit

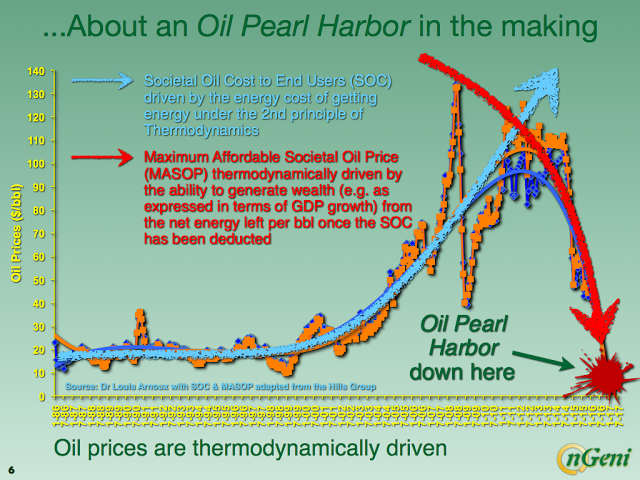

THE COMING BREAKDOWN OF U.S. & GLOBAL MARKETS EXPLAINED… What Most Analysts Miss

Posted by Steve St. Angelo - SRSrocco Report

on Wednesday, 10 August 2016 14:06

The U.S. and world are heading toward an accelerated breakdown of their economic and financial markets. Unfortunately, the overwhelming majority of analysts fail to understand the root cause of this impending calamity. This is also true for the majority of precious metals analysts.

The U.S. and world are heading toward an accelerated breakdown of their economic and financial markets. Unfortunately, the overwhelming majority of analysts fail to understand the root cause of this impending calamity. This is also true for the majority of precious metals analysts.

The reason for this upcoming systemic collapse of the U.S. and Global markets is quite simple when you understand the information and are able to CONNECT THE DOTS. While it has taken me years of research to be able to finally put it all together, new information really put it all into perspective.

Gold: Exceptional Bullishness – Correction Imminent

Posted by Clive P. Maund

on Tuesday, 9 August 2016 15:20

“The vast majority of investors are now bullish on the PM sector, with a current 89% bullish reading, after 100% at the start of July, as revealed by the Gold Miners Bullish % Index shown below. Although it has eased somewhat, the current reading is still very high and increases the risk of a significant correction soon. Holders of PM stocks at this point can either take some profits here, or buy on a dip to the lower channel boundary, with a close stop beneath it, and take profits in a more serious manner if the clearly defined uptrend fails.”

“We’ll start by looking at gold’s latest charts beginning with the 3-month. On this chart we see that gold made only very limited gains following its Brexit vote surge, and it has just failed at resistance at its early July high, with a sizeable down day on Friday, so that it is now stuck in a rectangular trading range, which could be either a continuation pattern or an intermediate top.”

….view all charts and analysis HERE

…related: A clear, concise and gripping interview with the highly regarded Greg Weldon who has been so right on Precious Metals –

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair