Energy & Commodities

Oil prices could go as high as $100 a barrel next year on the back of “very easy monetary policy” and reflation trade, Amrita Sen, chief oil analyst at Energy Aspects, told Bloomberg in an interview.

“It’s a futures market, we always discount stuff that’s going to happen in the future, now. That’s why prices are rallying right now,” the analyst said on the Bloomberg Surveillance program.

“We’ve always called for $80 plus oil in 2022. Maybe that is $100 now given how much liquidity there is in the system. I wouldn’t rule that out,” Sen noted.

On Monday, Brent Crude prices hit $60 a barrel, rising above that threshold for the first time since the start of the COVID-19 pandemic early last year.

In terms of prompt fundamentals, Energy Aspects’ Sen thinks, like some other analysts, that the market has gotten ahead of itself, “because right now demand is still relatively weak.”

However, the second half of the year does look much, much healthier in terms of demand, the analyst added.

Like other analysts and Torbjörn Törnqvist, chief executive at one of the world’s largest independent oil traders, Gunvor, Sen also sees headwinds to price gains at oil above $60, as U.S. production is set to begin rising.

According to Energy Aspects, U.S. oil output will not go back to pre-COVID levels any time soon, if ever, because producers are more focused on shareholder returns right now.

Last week, Törnqvist told Bloomberg that oil prices were unlikely to soar much above the $60 per barrel mark, considering that this price level would incentivize a lot of oil supply, including from the United States.

“We are at price levels which will look increasingly attractive to producers, so we would expect to see some producer flows coming into the market, which should provide some resistance to prices,” ING strategists Warren Patterson and Wenyu Yao said on Tuesday.

“Looking at the WTI forward curve, while the curve is in backwardation, prices all the way through to the end of 2022 are above US$50/bbl,” they said.

Is Hong Kong a harbinger of what is coming to the US?

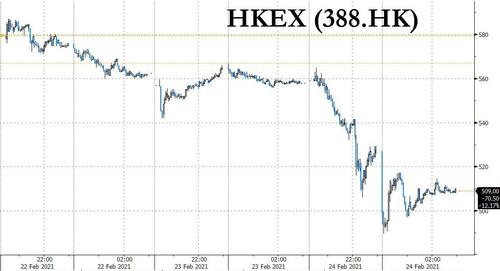

With speculation growing in the US that in the aftermath of the Robinhood scandal, the Biden administration may pass a transaction, or “Tobin Tax” demanded by progressive democrats (according to a 2018 CBO estimate, a 0.1% tax on stock, bond and derivative transactions could raise $777 billion over a decade) and targeting HFTs and other “market makers”, overnight Hong Kong showed how it’s done when in a shock announcement, Hong Kong unveiled its first stamp-duty increase on stock trades since 1993, sparking a furious selloff in the $7.6 trillion market and sending shares of the city’s exchange to their biggest plunge in more than five years.

As Bloomberg reports, the plan for a trading-tax hike to 0.13% from 0.10% is part of a raft of new measures announced in Hong Kong’s budget on Wednesday that included increased spending and cash handouts (in the form of coupons) to help residents weather the pandemic. Even as the city’s economy has plunged over the past year, stock prices and trading have surged amid a global market boom.

The news sent local stocks tumbling, with Hong Kong’s Hang Seng Index closing 3% lower, led by a 8.8% tumble in Hong Kong Exchanges & Clearing.

The plunge was especially awkward as it came after the bourse operator reported record annual earnings on Wednesday. Mainland-based funds sold a record $2.6 billion worth of Hong Kong stocks through exchange links with Shenzhen and Shanghai. That comes after 38 days of net purchases from north of the border.

The news was as shocking to the exchange as it was to everyone else. Calvin Tai, HKEX interim CEO said in an earnings call that the he wasn’t consulted by the government on its decision to hike the stamp duty.

“The impact will be significant,” said Kingston Lin, managing director of the asset management department at Canfield Securities in Hong Kong, ahead of the announcement by the city. “The market is doing very well and, of course, it will bring more revenue to the government. But higher transaction costs will be a concern for the exchange.”

And in a true Robinhood twist, an exchange spokesperson said that “whilst we are disappointed about the government’s decision to raise stamp duty for stock transactions, we recognize that such a levy is an important source of government revenue,” adding that “HKEX looks forward to continue working closely with all its stakeholders to drive the continued success, resiliency, vibrancy and attractiveness of Hong Kong’s capital markets.”

According to local media including Apple Daily and NowTV, the trading tax hike will be launched on Aug. 1 and the government expects it to generate an extra HK$12 billion a year. In the 2019/2020 fiscal year, the duty contributed HK$33.2 billion in revenue.

That said, the move risks damping a trading boom that has gripped the city and propelled earnings at the exchange. The bourse on Wednesday reported that profit rose 23% to a record HK$11.5 billion in 2020, helped by a 60% jump in stock trading. Its shares have surged about 150% from a low last year, making it the world’s biggest by market value.

Analysts at Citigroup Inc. estimated that the increased stamp duty will raise trading costs by 6% to 15%, pressing down trading volumes and crimping the exchange’s earnings per share by 3% to 7%.

Separately, the government announced spending measures of more than HK$120 billion ($15.5 billion) to alleviate economic hardship for city residents struggling after a two-year economic recession.

While Hong Kong has been an outlier when it comes to taxing stock transactions, with major markets such as the U.S. and regional rival Singapore refraining, HK’s action may prompt more politicians into acting to transfer some capital from the financial sector to the people. Indeed, talk of implementing a tax on financial transactions has recently been rekindled by some Democrats in the U.S. after the recent trading frenzy in GameStop Corp. shares.

Saylor: Billions will choose Bitcoin for savings

Saylor was speaking a day after United States Treasury Secretary Janet Yellen described Bitcoin as “inefficient,” comments that accompanied a price dip of over 20% from all-time highs of $58,300.

For him, however, the comments were of little consequence compared with the broader Bitcoin use case quickly encroaching into more and more people’s financial lives.

“The story here that’s not being told is that Bitcoin is egalitarian progressive technology,” he told CNBC’s Squawk Box segment.

“We’re going to see a day when 7 to 8 billion people have a bar of digital gold on their phone, and they’re using it to store their life savings with it.”

Continuing, he cited Bitcoin’s 12-year race to becoming a trillion-dollar asset — two to four times quicker than technology giants such as Amazon, Google and Apple.

“So, the world needs this thing, and I think you can expect that we’ll have a billion people storing their value — in essence, a savings account — on a mobile device within five years, and they’re going to want to use something like Bitcoin,” he added.

“Bitcoin is the dominant digital monetary network.” Full Story

Facebook will restore news to Australian pages in the next few days after the government agreed to change its landmark media bargaining code that would force the social network and Google to pay for displaying news content.

Last week, Facebook blocked all news on its platform in Australia, and inadvertently blocked information and government pages, including health and emergency services.

The ban on news created shockwaves, with the action viewed as a direct message to the rest of the world against embarking on similar regulation of the technology giant.

The historic banning of news on Australian pages came during escalating tensions over legislation that would force the tech giants to negotiate a fair payment with news publishers for using their content.

The treasurer, Josh Frydenberg, and communications minister Paul Fletcher announced on Tuesday a compromise had been reached at the 11th hour as the legislation was being debated in the Senate.

Watching the market’s panicked reaction this morning as the reality of the recent surge in first breakevens then real yields, is finally appreciated by the “cubic zirconium” hands, the momentum chasing algos and the puking CTAs, can’t help but bring a smile to the face of any market cynic who has seen this hilarious market reaction ever so often when markets freak out over a modest if rapid rise in yields (putting the 10Y in perspective, it is at 1.35%, well below any level it traded at prior to the Covid crash of 2020 and financial conditions are still just about the loosest they have ever been).

So, with the world seemingly coming to an end – if only for all those WallStreetBets traders who have never seen a 3% drawdown in their trading careers – here are some very quick words of comfort from Deutsche Bank’s Jim Reid who – unlike so many this morning – gets that there will be no real rise in rates “for the most of our careers.”

Here is Reid:

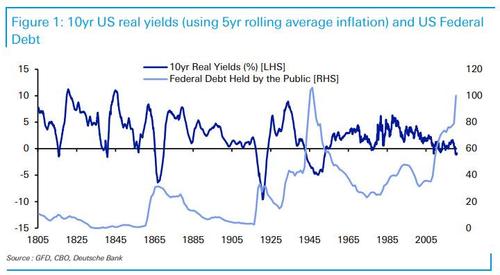

I did a CoTD showing real yields back over 200 years and highlighted that the only time real yields are negative for any period of time are around episodes of high debt. Given today’s debt levels, it’s likely real yields will stay ultra low for as far as the eye can see even if we’re seeing some cyclical pressure now.

And the punchline:

So with debt so high and likely to go notably higher, it is likely that real yields will have to stay artificially low for a very long period of time. Any return to something close to long-term averages would have grave consequences for debt sustainability. The Fed would likely step in well before this point.

Financial repression and QE will likely be alive and well for the rest of most of our careers.

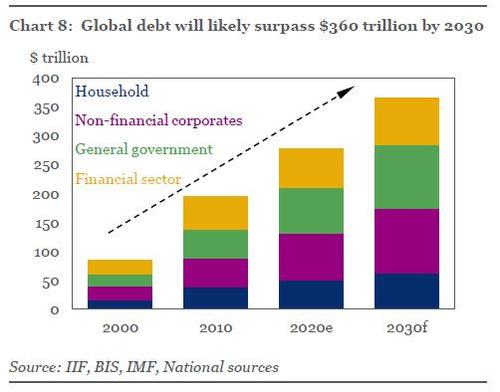

Why this matters? Because as the IIF forecast back in November, “if the global debt pile continues to grow at the average pace of the last 15 years, our back-of-the-envelope estimates suggest that global debt could exceed $360 trillion by 2030—over $85 trillion higher than current levels.”

Needless to say, $360TN in debt will never happen if rates rise from current levels without apocalyptic consequences.

What this means is that the Fed will never again allow rates to go up again or even approach reasonable levels, or else everything – not just stocks – but global economies and society will crash. It also means that the Fed’s nationalization of the bond market which started with purchases of IG bonds and junk ETFs last year alongside the tsunami of liquidity unleashed last March, is about to be complete.

So for everyone panicking about rising rates and liquidating stocks (such as what the CTAs did this morning) over fears of imminent rate hikes… don’t.