Economic Outlook

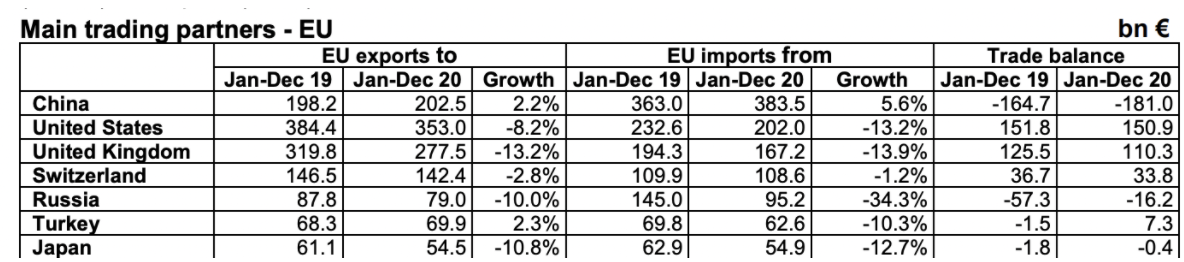

For the first time, China has officially become the European Union’s top trading partner, trumping the United States, which has long held that status.

According to the EU’s statistics office, Eurostat, last year, mostly impacted by the coronavirus pandemic but also due to the Trump Administration’s economic policies, EU-China trade grew while imports and exports to the United States dropped compared with 2019.

Export of EU goods to China grew by 2.2% and China exports to the EU grew by 5.6% in 2020.

At the same time, EU exports to the US fell by 8.2% and EU imports from the US fell by 13.2%.

Source: Eurostat

China’s trade volume in goods with the EU reached $710 billion in 2020, according to the data.

Both the EU’s exports to and imports from China grew last year, with exports valued at $245 billion and imports worth $465 billion. The trade deficit the EU has with China also rose 9.9%, ballooning from 4200 billion in 2019 to $220 billion last year.

According to Eurostat, the EU bought a large number of pharmaceuticals, medical equipment and medical supplies from China last year.

Ostensibly offsetting that, large-scale public investment in infrastructure fueled demand for European manufacturing goods.

For the past few years, the EU has been trying to intensify its economic ties with China by concluding a bilateral investment pact, also known as Joint Comprehensive Agreement on Investment.

Last December, after seven years of negotiations, the EU and China agreed to sign an investment deal that will give their companies greater access to each other’s markets. The deal is still pending ratification by the European Parliament but once completed, should boost trade even further.

Essentially, the deal would give European companies greater access to Chinese markets. China has committed to being transparent on subsidies for state-owned firms and forced technology transfers.

The deal also makes it easier for European firms to navigate the Chinese paperwork bureaucracy and gain some leverage with the authorities. Previously, EU companies were locked out of many industries in China, where they were forced to partner with Chinese firms or stymied by unfair competition from state-owned enterprises.

There is strong opposition to the deal, with EU lawmakers and human rights activists rallying against it. They believe that the agreement is lacking in enforcement mechanisms, and they criticize the Chinese authorities for their policies toward labor and minorities. Some also believe that the deal could jeopardize relations with the United States.

Even though the trade shift was perhaps ultimately caused by the pandemic, the Trump Administration’s open economic warfare with many countries, the EU included, is leaving a mark on these developments.

Since President Trump started his mandate in January 2017, the US and EU have been at odds over several issues, not the least of which was Trump’s imposition of tariffs on several EU products, prompting the EU to retaliate with its own.

On January 20th, Brussels did little to hide its happiness over Joe Biden’s inauguration and ambitions for the new administration.

Ursula von der Leyen, president of the European Commission, said that “the United States is back and Europe stands ready to reconnect with an old and trusted partner.”

Even though Biden promised to ‘reunite’ with US allies, such as the EU, experts insist the change will not come overnight and certainly won’t undo China’s newfound status as the bloc’s biggest new trading partner.

I had to do a double-take recently when reading a CNBC headline that stated: “The only reason to be bearish is there’s no reason to be bearish.”

It is indeed hard to argue the point. As the article explained:

“A majority of investors finally agree the V-shaped recovery is at play,” according to the Bank of America Global Fund Manager Survey. Plus, a record percentage of money managers believe that global growth is at an all-time high.”

When “everyone is in the pool,” it is an excellent time to remember a basic premise of investing from our post on trading rules:

“Opportunities are made up far easier than lost capital.” – Todd Harris

On this week’s show Justin Smith of Hawkeye Wealth shares with Michael some of the reasons investors might consider adding mortgage funds to their portfolio. Justin also presented a workshop on the topic at the 2021 World Outlook Financial Conference – providing more detail and analysis on this new type of asset class, and why it is becoming so popular in this low interest rate environment.

As a special bonus for our MoneyTalks audience, we’ve pulled Justin’s full presentation out from behind the paywall and are able to offer you free access. CLICK to Watch

With so much computing hardware in use around the globe, it is only prudent to use all that hardware in the most efficient way possible, after all, the gear is not free and it all requires space and maintenance, also not free. One way to increase hardware efficiency is to use Virtual Machine (VM) technology, and in a nutshell VM is a way to run a virtual computer within an actual computer.

Virtual Machine(s) are typically files, often called images, that run separately from everything else on the computer. The VM’s can have their own operating system, can be used for beta testing new applications, can be used to inspect and test infected code, and any other operation that benefits from being on its own. VM’s can be “sandboxed” in the host computer, meaning that they cannot interact in any way with any other part of the computer, so there is no code / instruction that can escape to, or tamper with, the host hardware.

It is possible to run several VM’s inside the same computer as long as the hardware is robust enough. For servers, VM’s can run multiple operating systems side-by-side typically using “hypervisor” software to manage them. Desktop computers would typically use the host operating system to run the VM operating system in a program window. Each VM provides its own “virtual” hardware, such as CPU, memory, hard drives, network interfaces etc, and the virtual devices are mapped to the real hardware when it is safe and/or advantageous to do so.

VM’s can provide a safe environment for testing and development, trying things out that could be dangerous on an actual, non-sandboxed computer. A good way to perceive development on a VM is “what happens in the sandbox can be kept in the sandbox”. But there are more uses for VM that have significant benefits in the production environments of many businesses. Not everything in a VM has to be confined to the VM if pathways to business operations are developed and implemented carefully.

An example of using VM technology to achieve higher efficiency in computer operations is to dedicate VM’s to specific business operations, such as EMAIL, WEBSITE, and ACCOUNTING. If each of these business functions normally has a dedicated server, there may be unused capacity in each server dedicated to each function. Using VM technology, each of these business functions can be given its own protected space in the available servers, and by dynamically adjusting that space, computing resources can be more efficiently utilized. A certain amount of “intelligence” is built into the VM and host environments to ensure the most efficient deployment of all computing resources.

With VM technology, companies may be able to significantly reduce costs, by having fewer servers and/or desktop machines to get all the work done.

There are several companies making great progress in VM technology, and this market space is poised to experience large growth within the next 12-24 months. We just sent our Trend Disruptors Premium subscribers a new recommendation in the VM space and are offering that recommendation to Money Talks subscribers (see below).

The Trend Disruptors team is currently monitoring another 20+ stocks for potential inclusion in the TD Premium portfolio. The performance of the Trend Disruptors Premium portfolio has been excellent, averaging a 28% gain on all closed positions.

New Recommendation: VMWare Inc (VMW.NYSE)

VMware, Inc. provides software in the areas of hybrid cloud, multi-cloud, modern applications, networking and security, and digital workspaces in the United States and internationally. It offers compute products, including VMware vSphere, a data center platform, which enables users to deploy hypervisor, a layer of software that resides between the operating system and system hardware to enable compute virtualization; and cloud management products for businesses with automated operation, programmable provisioning, and application monitoring solutions. It also provides networking and security products and services that enable customers to connect and operate their network; and storage and availability products, including data storage and protection options. In addition, it offers VMware Cloud Foundation, a platform that combines its compute, storage, and networking technologies with cloud management into an integrated stack and delivers enterprise-ready cloud infrastructure for private and public clouds. Further, it provides hybrid cloud computing solutions, such as VMware Cloud Provider Program, VMware Cloud Foundation, and VMware Cloud Services; computing solutions, such as Workspace ONE that delivers and manages any application on any device by integrating access control, application management, and multi-platform endpoint management; pivotal cloud foundry, pivotal labs, and heptio, as well as pivotal application and pivotal container services; and VMware Carbon Black Cloud platform, AppDefense, and VMware Workspace ONE platform. The company sells its products through distributors, resellers, system vendors, and systems integrators. VMware, Inc. has strategic alliances with Amazon Web Services to build and deliver an integrated hybrid solution; and SNC-Lavalin to provide digital collaboration platform for project delivery. The company was incorporated in 1998 and is headquartered in Palo Alto, California. VMware, Inc. is a subsidiary of Dell Technologies Inc.

The stock of VMWare has been stagnant since December 2018 and the main reason for that stagnation is that Dell Technologies owns over 80% of the company. But come September, we expect Dell to sell its share of VMWare and we want to own shares now because, once the spin-off is announced, we expect the value in VMware to finally be unlocked.

Wall Street projects VMware will grow sales by 8–10% over the next four years. And it has above average gross margins of about 82%. We believe VMWare will surpass Wall Street’s sales and free cash flow estimates.

ACTION: BUY Stop for VMWare (VMW.NYSE) at 145.20 meaning only buy VMW if it trades at 145.20 or higher. If BUY Stop triggered, initial SELL Stop at 131.50.00. Buy up to 152.00

Trend Disruptors is offering Money Talks subscribers a special rate of $399.95 for a 1 year subscription to the TD Premium service, a $200 savings. Click here to take advantage of this offer.

For more information on Trend Disruptors click here.

Yesterday marked the end of the Perseverance rover’s 300m mile journey to Mars and the start of a 687-day mission to better understand whether the planet would make for a nice place to live.

Costs for development and operation of the rover will likely total $2.4B…

… But the benefits on Earth are likely worth far more

Since the 1960s, NASA’s Mars programs have led to countless innovations, including materials for heart surgeries, methane-leak detectors, and — importantly — carbonating beer.

With Perseverance, it’s no different:

- Honeybee Robotics developed drill bits for the rover’s robotic arm that were also commercialized for use with standard drills

- Tempo Automation simulated designs for NASA’s circuit boards and then discovered the technology’s utility in the broader circuit manufacturing process

- Tech in Photon Systems’ spectroscopy tool for Perseverance is being tested for use in pharmaceuticals, food processing, and wastewater management

More and more companies are building for space

For Perseverance, Maxar Technologies built a robotic arm to scoop samples, Northrop Grumman built navigational sensors, and drone company AeroVironment helped build the rover’s onboard helicopter.

Just this week, Axiom Space raised $130m to build the first commercial space station, while SpaceX raised $850m to fund future missions.

As space travel and exploration have become more popular, other companies have specialized in building anything from wrenches for astronauts to zero-gravity espresso machines for the ISS.

But most money is in the ‘space-for-earth’ business

Known as the space-for-earth economy, goods and services sent to space for use on Earth — including for telecommunications, Earth observation, and national security — made up 95% of the $366B in 2019 space sector revenues.

But as costs decrease and successful missions attract new entrants, expect both the space-for-earth and space-for-space economies to scale up.

For now, the Perseverance rover’s clearest immediate impact on Earth is, without a doubt, limited edition Krispy Kreme Mars doughnuts.