Featured Article

Look, we all know that past success in investing doesn’t guarantee future returns. But have you seen some of the results from last year’s World Outlook Financial Conference? I mean c’mon! Take 2 minutes and check out some highlights from 2020. Then you’ll understand why I say you can’t afford to miss our 2021 keynote speakers and industry experts on Friday and Saturday.

If you haven’t purchased your codes there is still plenty of time. And just a reminder that the new online broadcast format means you can log on anytime Friday and Saturday to watch the scheduled presentation (full agenda here) AND be able to watch everything that has been aired up to that point. PLUS every pass includes unlimited access to the on-demand archive – so no matter what your schedule Friday and Saturday everything from the broadcast, including ALL our industry workshops, will be accessible starting Sunday afternoon.

There are speakers I invited because I want to hear their global market and economic forecasts to understand the potential impact to my long-term financial health. There are speakers I invited because I want to hear specific stock recommendations that I could add to my portfolio Monday morning! And there are workshop speakers who will show me opportunities in Precious Metals, Small Cap Stocks, Real Estate, Private Equity and Money Management Services.

The 32nd annual World Outlook Financial Conference broadcast starts at 4:10pm pacific time Friday February 5th, 2021. I hope you’ll be there! (well, not really there – from the comfort of your home, in your favourite chair, in your cozy clothes, with a cold drink and snacks at hand – you get the idea.) CLICK HERE to order your access pass.

All the best.

Mike Campbell

The Reddit forum that helped kick off the frenzy has given way to anxiety, financial bloodshed and infighting

Investors plowed billions of dollars through Robinhood and other online brokerages into GameStop in recent weeks, but the share price has crumbled as traders abandon ship. The beleaguered video game chain peaked last week around $483 and closed on Tuesday at $90, its biggest one-day decline yet.

And as GameStop’s stock price has crumbled, posters have increasingly admonished traders with tough-love reminders that they are just as likely to go broke as strike it rich.

“This is a community of full blown first class … degenerates which take pleasure in posting losses accumulating into the millions every” month, one expletive-filled post read Tuesday. It received more than 50,000 upvotes.

This is not a “Disney ferry ‘One-Wish-comes-true’ show,” said the poster, “SimplyPwned.” “This is the place where one wants to enjoy the sado-masochistic part of the … capitalistic system we are living in. … No sane long-term investor would consider to invest into any of these investments — this is about ‘get rich or die trying!’ ”

Mortgage Investment Funds were created by the Canadian government in 1973 as part of the Residential Mortgage Financing Act to address what was believed to be an imminent housing crisis due to a lack of financing for home ownership and construction. These entities pool funds from investors to finance the purchase and construction of Canadian real estate.

Typically charging higher rates than conventional lenders, the earnings are redistributed back to the investors. But the investors that were candidates to participate back then were likely not attracted to the returns as term deposits at that time already had solid yields.

Lower interest rates have negatively impacted the income investors can earn through GICs and other fixed income products. With the uncertainty and volatility of the stock market, many investors are jittery there, too. Thus, to some people it comes as no surprise that in the past decade, Mortgage Investment Funds surged in popularity. What exactly are these investment entities, and what is drawing so many investors to participate in these opportunities? Click to read full article.

SWIFT Sets Up Joint Venture With China Central Bank Ahead Of Imminent Digital Yuan Launch

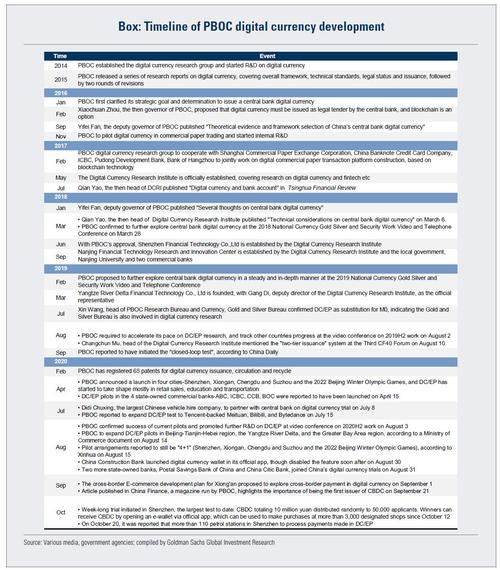

Back in August we reported that China’s Commerce Ministry had released fresh details of a pilot program for the country’s central bank digital currency (CBDC) to be expanded to several metropolitan areas, including Guangdong-Hong Kong-Macao Greater Bay Area, Beijing-Tianjin-Hebei region, and Yangtze River Delta region. This was the inevitable culmination of a process which started back in 2014 when as we reported at the time, “China Readies Digital Currency, IMF Says “Extremely Beneficial“”

Fast forward a few months when China’s preparations to rollout a digital yuan gathered pace, and we reported in October that China was poised to give legal backing to the launch of its own sovereign digital currency, “cementing its trailblazer status in virtual currencies far ahead of other countries, after already recently experimenting with large-scale trials of actual payments by consumers, which was met with mixed results.” Specifically, the South China Morning Post reported that “The People’s Bank of China published a draft law on Friday that would give legal status to the Digital Currency Electronic Payment (DCEP) system, and for the first time the digital yuan has been included and defined as part of the country’s sovereign fiat currency.”

Tesla Inc. co-founder Elon Musk returned from his self-imposed Twitter break to send a series of tweets about joke cryptocurrency Dogecoin.

“No highs, no lows, only Doge,” Musk wrote. He also posted a meme from the Disney movie The Lion King, showing the monkey shaman Rafiki holding up the cub Simba that’s photoshopped to be the billionaire with the Dogecoin logo of a Shiba Inu in his hands.

The digital asset, which was started as a joke in 2013, has risen to about 5 cents in the past 24 hours from 3 cents, according to data from CoinMarketCap. It’s the highest level since last week, when prices briefly spiked after Musk tweeted a picture of “Dogue” — a satire on fashion’s Vogue magazine — featuring a whippet in a red sweater.

Earlier this week, Musk said on social audio app Clubhouse that he doesn’t have a strong view on other cryptocurrencies and that his comments on Dogecoin are meant as jokes, adding “the most ironic outcome would be Dogecoin becomes the currency of Earth in the future.”

He wrote on Tuesday that he was going to be “off Twitter for a while.” Musk sent the Dogecoin tweets along with pictures of space rockets — references to the meme that prices are going to the moon and Space Exploration Technologies Corp. SpaceX, which Musk also founded, saw its test flight of a deep-space vehicle end in an explosive fireball during a failed landing attempt this week.

Musk also said “Dogecoin is the people’s crypto,” along with other posts such as “Sandstorm is a masterpiece,” a possible reference to the 1999 song by Darude. He removed the reference to Bitcoin from his Twitter bio page.

After languishing in relative Internet obscurity, Dogecoin is riding a wave of newfound popularity this year after being promoted by Musk, as well as internet influencers and porn stars. In late January, prices were less than 1 penny.

Dogecoin’s market value now sits at almost $7 billion, making it the 12th biggest among cryptocurrencies, according to CoinMarketCap.