Currency

In response to institutional investors’ concerns about the risks of trading in a new asset class, TMX Group, Canada’s major stock market operator, has revealed plans to launch its first-ever crypto futures product.

While speaking to Reuters, TMX Group’s John McKenzie said that the firm plans to release the product on the Montreal Exchange later this year. According to Mackenzie, “more institutional investors and dealers are […] holding more crypto assets within their portfolios or for their clients or in ETFs,” adding they are working on how to mitigate risk due to crypto’s huge volatility.

Cointelegraph reached out to TMX Group for more details regarding this development. This article will be updated pending new information.

Cryptocurrency assets have suffered significant drops in recent months as investors sought safer investments amid expectations of interest rate hikes by central banks. They’ve made progress in recovering some of their losses in recent weeks, with Bitcoin (BTC) regaining past the $42K mark and the price of Ether (ETH) pulling back to retest $3,000 support levels…read more.

Canada’s population growth over the the past half decade has been largely driven by immigration, according to 2021 census data.

Statistics Canada captured the Canadian population on May 11, 2021, five years after its previous census in 2016.

The newly-released findings reveal Canada grew about twice as fast as other G7 countries, which include France, Germany, Italy, Japan, U.K. and U.S. Even in 2020 when the pandemic halted Canada’s population growth, it continued to be the fastest-growing in the G7. The main reason for the slowdown was the border restrictions Canada put in place to curb the spread of COVID-19.

Canada is now home to nearly 37 million people. Immigration, not fertility, drove Canada’s population growth. Four out of five of the 1.8 million people added to the population were either temporary residents or immigrants with permanent status. The remaining population growth was due to natural increase (the difference between births subtracted by deaths)…read more.

- Joe Rogan said he’s not leaving for Spotify for Rumble and its looser content moderation rules.

- The site, favored by the right, offered him $100 million to leave the streamer.

- After a standup set Wednesday, Rogen said “Spotify has hung in with me, inexplicably.”

Joe Rogan has no plans to leave Spotify any time soon.

During a fan Q&A after an intimate standup set in Austin, Texas, on Tuesday night, Rogan said his controversial podcast would remain on the streaming platform, according to The Hollywood Reporter.

“No, Spotify has hung in with me, inexplicably, let’s see what happens,” Rogan reportedly said Tuesday night in response to fan questions about potentially taking his show elsewhere.

Rogan did not immediately respond to a request for comment.

As other artists left Spotify in protest of the company allowing his show to remain, the conservative-leaning video site Rumble offered Joe Rogan $100 million to host his podcast there…read more.

Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 30 energy, energy service and pipeline & infrastructure companies with regular updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

EIA Weekly Oil Data: Overall, the EIA data of Wednesday February 9th was moderately bearish for energy prices as US Commercial Crude Stocks fell 4.8Mb (the forecast was for a build of 0.4Mb). The main reason for this difference is that Net Imports fell 1.42Mb/d or 9.94MB on the week. One large component of this difference was that Exports rose 724Kb/d or 5.1Mb on the week lowering US Commercial inventories. Motor Gasoline Inventories fell 1.6Mb while Distillate Fuel Oil Inventories fell 0.9Mb. Refinery Utilization was at 88.2%, up 1.5% from the prior week’s 86.7%. US Crude Production rose 100Kb/d to 11.6Mb as production recovered from last week’s weather disruptions.

Total Demand rose 470Kb/d to 21.88Mb/d as Motor Gasoline demand rose 900Kb/d to 9.13Mb/d. Distillate Fuel demand fell 373Kb/d to 4.30Mb/d. Jet Fuel Consumption fell by 62 Kb/d to 1.41Mb/d. Cushing Crude Inventories fell 2.8Mb to 27.7Mb.

Overall we would rate this week’s data as modestly negative for energy prices. The main focus of the markets remains potential supply disruptions in Europe if Russia invades Ukraine after the Beijing Winter Olympics end on February 20th. Russia does not want to disturb the growing political and economic alliance with China. The invasion, if it does occur, is likely to commence when the ground is still firm enough for tanks and other heavy weapons to maneuver but after the Olympics are over.

EIA Weekly Natural Gas Data: Weekly withdrawals are rising as the on and off cold weeks of winter are here. Last week’s data showed a large withdrawal of 268 Bcf (the largest so far this winter), lowering storage to 2.323 Tcf. The biggest US draws were in the South Central (101 Bcf), the Midwest (85 Bcf) and the East (68 Bcf). By contrast, the largest US draw ever occurred in early January of 2018 at 359 Bcf and the largest draw in 2021 occurred in mid-February with a draw of 338 Bcf. We have now had three weeks of winter draws over 200 Bcf.

The five-year average for last week was a withdrawal of 187 Bcf and in 2021 was 192 Bcf due to mild weather. Storage is now 5.8% below the five-year average of 2.466 Tcf. Today NYMEX is US$3.99/mcf due to the recent milder weather that may last for a week or so. AECO spot today is trading at $4.15/mcf due to the milder weather in western Canada. February (being the key winter month for natural gas demand), is still likely to see price moves to the upside on very cold days. Spikes over $6/mcf could occur in the remaining weeks of this month.

After winter is over natural gas prices typically retreat and if the general stock market decline unfolds as we expect, a great buying window should develop at much lower levels for natural gas stocks in Q3/22.

Baker Hughes Rig Data: The data for the week ending February 4th showed the US rig count rose by three rigs (up six rigs the prior week) to 613 rigs last week. Of the total working last week, 497 were drilling for oil and the rest were focused on natural gas activity. The overall US rig count is up 56% from 392 rigs working a year ago. The US oil rig count is up 66% from 299 rigs last year at this time. The natural gas rig count is up a more modest 26% from last year’s 92 rigs, now at 116 rigs.

Canada had an increase of one rig (up five rigs last week) to 218 rigs. Canadian activity is up 27% from 171 rigs last year. There was one more oil rig working last week and the count is now 136 oil rigs working, up from 95 last year. There are 82 rigs working on natural gas projects now, up from 76 rigs working last year.

The overall increase in rig activity from a year ago in both the US and Canada should translate into rising liquids and natural gas volumes over the coming months. The data from many companies’ plans for 2022 support this rising production profile expectation. We expect to see US crude oil production reaching 12.0Mb/d in the coming months. Companies are taking advantage of attractive drilling and completion costs and want to lock up experienced rigs, frack units and their crews as staffing issues are difficult for the sector. We expect US production to reach 12.5Mb/d during 2H/22.

Conclusion:

Bearish pressure on crude prices:

- Omicron Covid-19 caseloads have not gone away and deaths are rising for the unvaccinated. Deaths in the US have reached 906K (up 19K over the last week) and worldwide has reached 5.75M. It seems we are getting used to Covid and are now seeing many areas of the world reopening once hospital bed usage declines. Political pressure by anti-vaxxers and other protestors are calling for countries to reopen. Those that do not are facing trucker blockades as we see in Canada. The Ambassador Bridge at Windsor crossing to Detroit is blocked and is an economic problem for Canada as 25% of our trade with the US crosses this bridge. The longer the blockade lasts the more disruptive this will be to the key Provinces of Ontario and Quebec.

- Some European countries like Germany and France are not inclined to follow the US’s lead to aggressively sanction Russia if it invades eastern Ukraine. They have strong reciprocal economic interests with Russia. An overall invasion to take over the whole country may be a different situation for them. Berlin has not sent any weapons to Ukraine compared to other countries. They have only sent medical support and helmets so far. If there is an invasion and Germany and France do not go along with President Biden’s move to sanction energy exports from Russia, then crude prices will lose their war premium. The US has sent troops to neighboring Poland and Romania in case the Russian invasion spreads further than just Ukraine and also to aid in the resettlement of large numbers of refugees from Ukraine. The US fears that there may be up to 5M refugees looking for new homes in western Europe if Russia grabs all of Ukraine. We see this as a low probability event.

- The Iran nuclear negotiations are working towards getting sanctions removed so that they can sell their oil around the world. Negotiations appear to be making a breakthrough with a target timeline of the end of February now that President Biden has agreed to full economic sanctions being removed if a deal is reached. If so Iran could increase production by over 1.5Mb/d almost immediately. In addition, Iran has over 200Mb in storage around the world near its buyers, so those volumes could also alleviate the current tight market. The US seems to be moving forward with this even though Iran is close to having a nuclear weapon. They are going this way as they see no way to stop a nuclear Iran. Having Iran abide by UN inspections appears to be acceptable to the US. The US sees this as Iran alleviating the tight oil market with the world gaining significant new oil supplies.

Bullish pressure on crude prices:

- Russia provides over 26% of western Europe’s crude oil needs and around 41% of its natural gas needs. Any sanctions on these sales would not be easily met by other producers. This effectively is a two-edged sword. The US is sending over more cargoes of LNG and has asked Qatar to do the same. The Nord Stream 1 pipeline is operational and with gas flowing into Germany. The second pipeline is part of the potential sanction regime by President Biden who will not let this line open if there is an invasion. Germany may accede to this but has not done so publicly as they desperately need the natural gas.

- OPEC increased production in December by only 166 Kb/d and not the authorized 400Kb/d. OPEC+ held their February meeting and agreed to an increase of 400Kb/d in their official target for March 2022. Once again we see this as an unlikely target to reach as they have failed to reach this target in prior months. Many of the members have not spent to keep fields maintained and some have significant infrastructure problems.

- Russia has threatened increased cyber attacks against the US if President Biden escalates pressure on Russia. Cyberwarfare against Ukraine’s infrastructure and military control systems may be the prelude to the invasion. Such action has already started.

- Ukraine’s President Zelensky on February 2nd said “this is not going to be a war between Ukraine and Russia. This is going to be a European war, a fully fledged war.” Prior to this he has downplayed the situation. This is getting closer to a precipice. After the Olympics are over the countdown begins.

CONCLUSION:

The growing concern about an invasion/annexation of eastern Ukraine continues to spike crude oil prices higher. WTI rose to over US$93/b last week. WTI today is at US$89.88/b.

If there is no invasion or if a ‘minor incursion’ does not set up sanctions against Russian energy exports as the winter weather subsides, the price of WTI crude could retreat quickly towards US$62-65/b, especially if Iran sanctions to sell oil are removed in March. If the Russian invasion is for all of Ukraine (not very likely in our view), then the price of crude could spike up over US$100/b up to US$120/b. How long it stays up is unknown but the repercussions would likely increase the potential for a severe world-wide recession. A recession would knock off demand for energy around much of the world and crude oil prices would collapse as they did in 2008-2009 and 2020.

Energy Stock Market: The S&P/TSX Energy Index currently trades at 196 (down three points over the last week) as the war event window closes in.

I presented my annual keynote energy presentation at the two day World Outlook Financial Conference (WOFC) on February 4 & 5. Post conference access passes are now available. Please go to their website to get your tickets to this excellent and informative event. It was another great success and there were quite a few very interesting sessions that are worth listening to especially if you have a very diversified portfolio.

Our February Interim Report comes out tomorrow afternoon and covers the latest signs of internal deterioration in the general stock market and increased weakness in key world economies. Energy usually lags big market moves with the general market breaking down first. We go over this in detail in our report. Big overall stock market downside is ahead and investors should be prepared. The MEME stocks have been massacred and a few of the FAANG and related have been severely eroded in value (Meta-FB and Netflix are just two examples) Remember how you felt in the later stages of bear markets as were seen in 1987, 2000, 2008, and 2020? Prepare yourselves for this impairment risk to your assets. Our report covers this potential painful market situation.

Our next quarterly SER webinar will be held on Thursday February 24th at 7PM MT. If you want to join/register for this event or access our Interim Report to come out tomorrow you will need to become a subscriber to our full product. Go to https://bit.ly/34iKcRt to subscribe.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

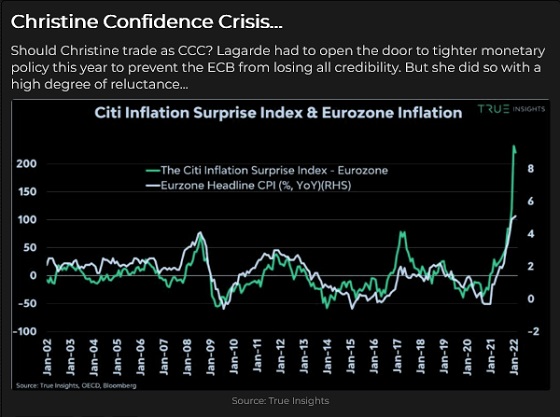

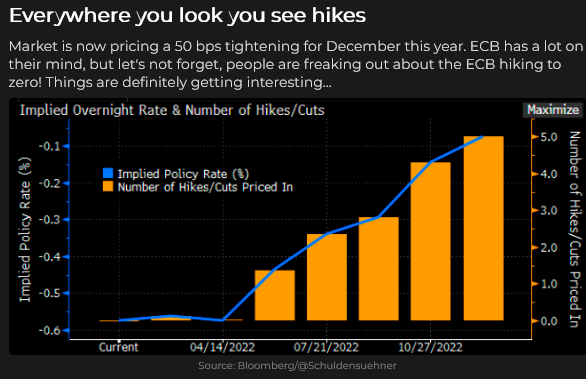

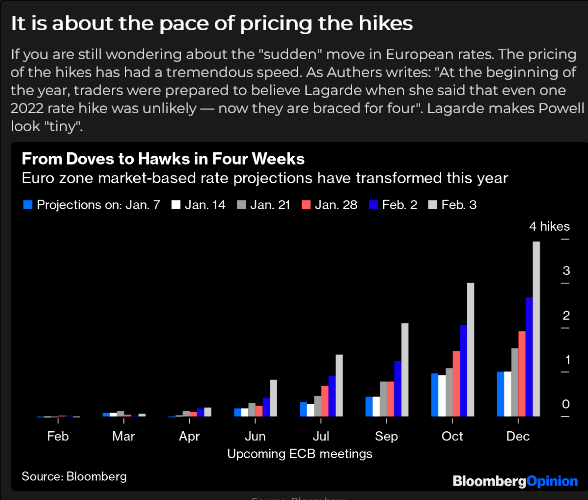

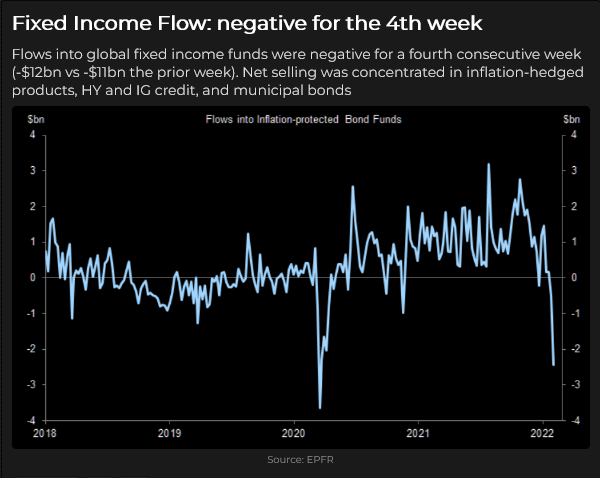

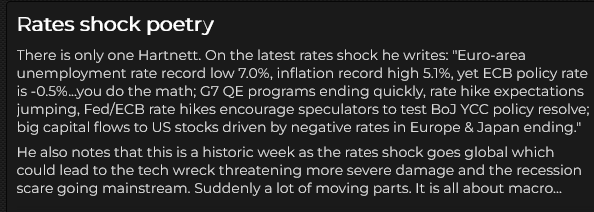

Interest rates surge higher everywhere

Christine Lagarde surprised markets Thursday by opening the door to higher interest rates this year from the ECB. On Friday, markets were stunned by an unexpected (and suspect, given the massive “seasonal adjustments”) US Employment report. The net result? Interest rates everywhere surged higher this week.

Think of Euribor as the EUR equivalent of the Eurodollar interest rate contract. This dramatic tumble has a HUGE “rate of change.”

The Eurodollar futures trade at a discount to par (zero yields.) A 9835 figure implies a ~1.65% interest rate come December 2022.

US 10 year Treasury yield now above 1.90%.

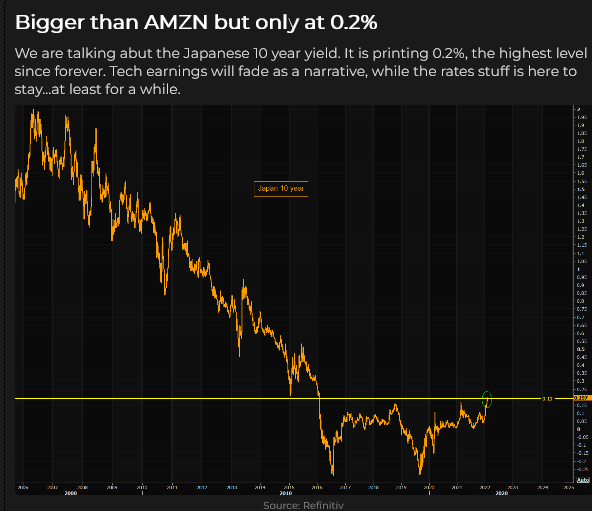

Even Japanese bond yields traded to 5-year highs. (Remember the “widow-maker” trade? For years, traders made big bets on Japanese yields rising – but they got “carried out” fighting the BoJ.)

Markets are currently pricing at least 2 x 25bps bumps from the ECB this year. German bond yields are back above zero for the first time in 3 – 4 years. All European sovereign yields have spiked higher, and spreads against Germany have widened. On Thursday, the Bank of England raised s/t rates 25bps, but the ECB stole the show.

The shocking “rate-of-change” is probably more important than the net change. On January 15th, I asked if the surge in rates following the Fed meeting was Peak Fed Hawkishness or A Minsky Moment. I defined a Minsky moment as a “sea-change at the Fed, and you ain’t seen nothing yet!”

Right now, it looks like the Minsky horse is ahead by 20 lengths.

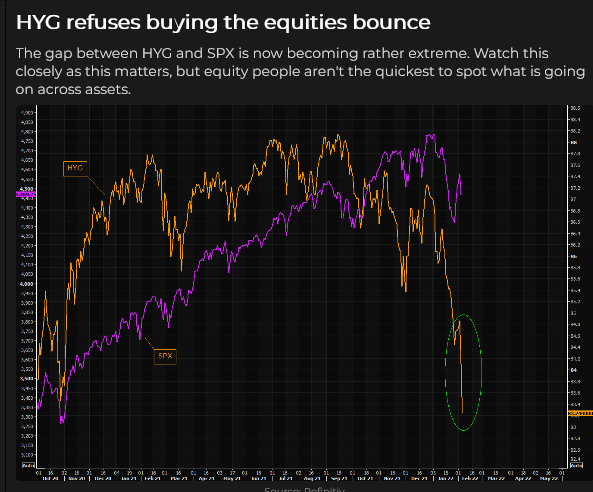

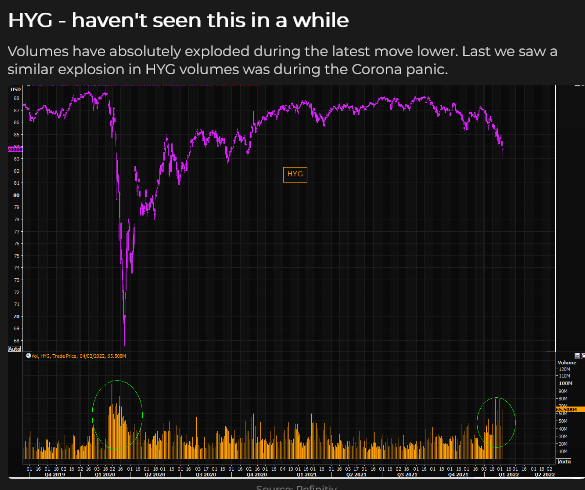

Not only are interest rates everywhere rising, but credit spreads are widening – weaker credits will have to pay much more to borrow money.

Positioning: It looks like everybody is already short of the US Treasury bond market.

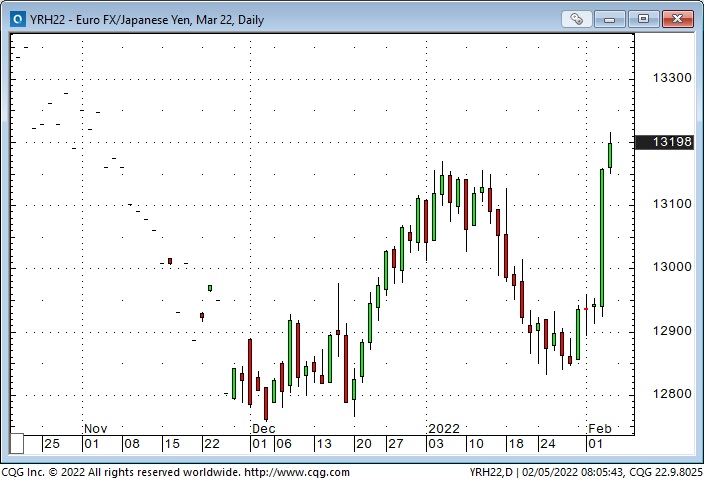

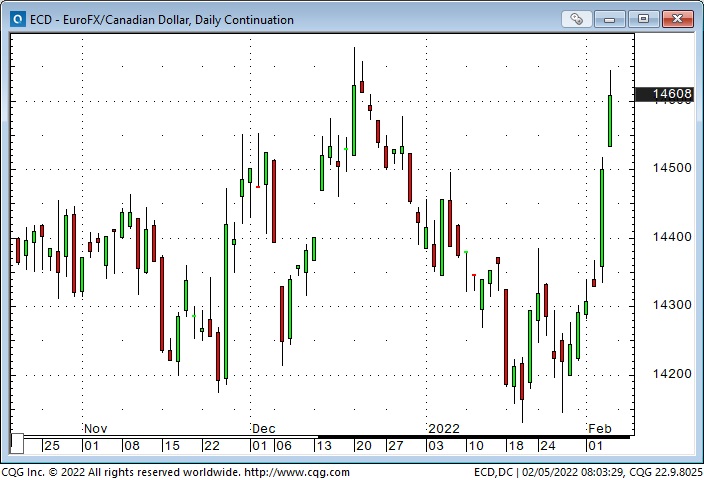

Currency markets reacted swiftly

The surprise move by Lagarde and the subsequent surge in Eurozone interest rates saw the Euro currency rally hard against all other currencies.

The Euro against the USD.

The US Dollar Index hit an 18-month high last week as markets expected Fed policy would maintain a substantial interest rate premium over other countries. That changed Thursday when ECB surprised markets, and the EUR had its biggest one-day gain in years.

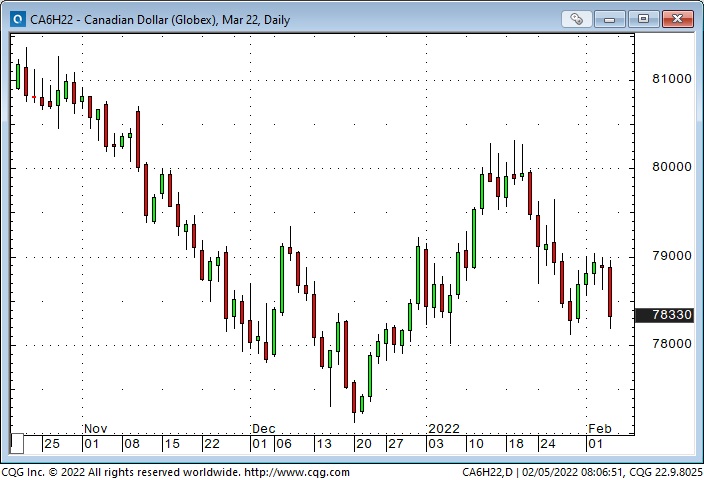

The Canadian Dollar has been surprisingly weak the past couple of weeks – given the strength in crude oil (Western Canada Select in nearly CAD$100 BBL) and the recent weakness in the USD. Perhaps the CAD is struggling in a “risk-off” environment.

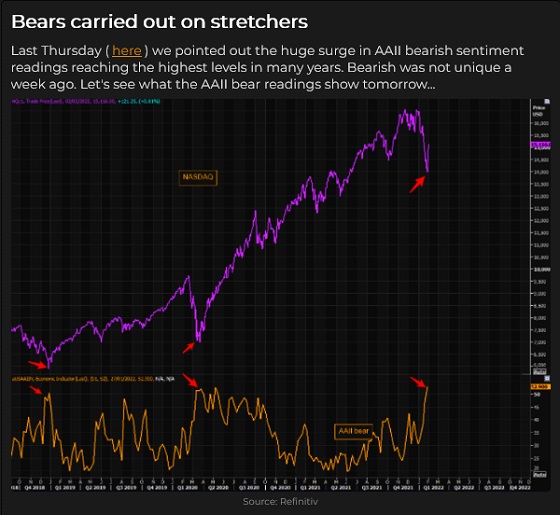

Stock indices rallied hard early this week, then reversed

The wild intra-day and inter-day swings that we saw in January continued this week, with the DJIA swinging >2,500 points from last week’s low to this week’s high. The DJIA closed ~360 points above last week’s close at the end of the week. And, ICYMI, Facebook had a bad week.

Facebook reported after the close Wednesday. By Thursday, the stock was down ~27% for a market cap loss of ~$230Billion.

This chart was dated Wednesday when the DJIA was up ~2,400 points from last week’s lows.

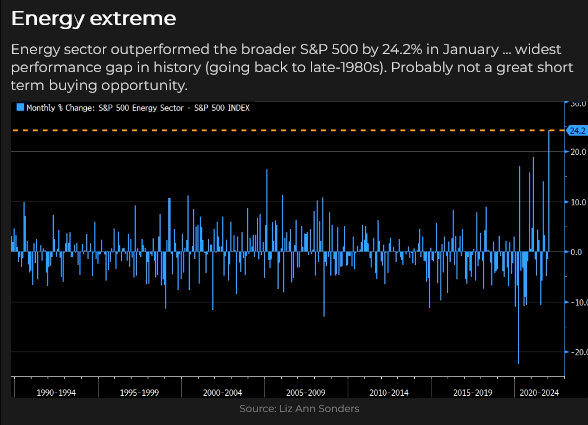

Energy markets are hot

WTI crude oil traded above $93 this week – an 8-year high – up ~50% from the beginning of December. Prices have climbed for seven consecutive weeks. Energy share indices outperformed the S+P by ~24% in January – the widest monthly gap in over 40 years.

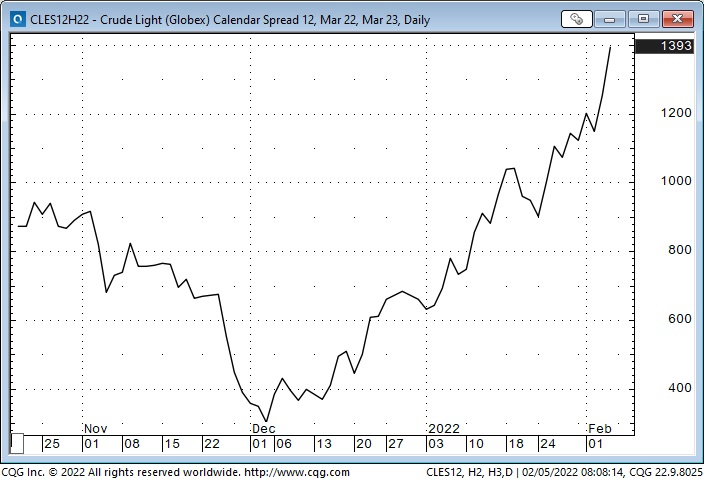

The forward WTI curve is exceptionally steep, with front-month March 2022 ~$13.90 premium over March 2023. (The $10 increase since early December is “stunningly HUGE!!”)

Rising geopolitical tensions are contributing some “fear” premium to the crude oil price, but the ESG inspired “Consequences of Procrastination,” which have created self-destructive energy policies in much of the Western World, are the real driving force behind the energy rally.

China hosts the Olympics from February 4th to 20th. Geopolitical stress may increase after the Olympics are over. Remember, Russia annexed Crimea immediately following the Sochi Olympics in February 2014.

Covid has disappeared from the market’s rear-view mirror

Covid had a HUGE impact over the past two years, spurring massive monetary and fiscal stimulus, lockdowns, social tensions, supply chain disruptions, and HUGE gains in the leading stock indices. But markets are looking ahead.

The Bullish case: The pandemic policies that have crippled the economy will soon be over, and the re-opening economy will be robust. Interest rates rising 1 – 2% will not be a headwind. Inflation has peaked, and the recent correction has been healthy. The indices will rebound as capital “rotates” to stocks that prosper in the new economic environment. There are trillions of dollars on the sidelines (that could come into the market), potentially massive corporate buybacks, and passive flows (now more than 50% of total flows) will continue – where else can capital go? TINA.

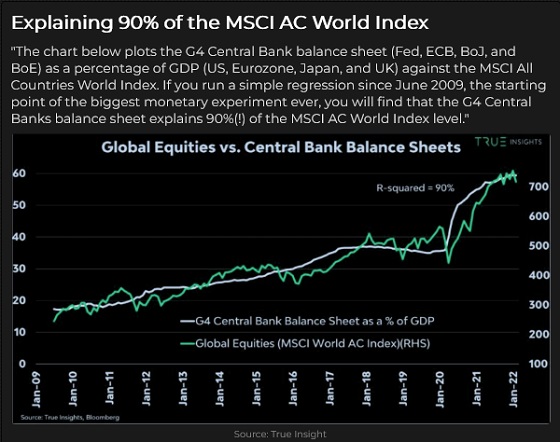

The Bearish case: The HUGE gains in 2021 were an anomaly. The bubble has already popped. The perpetual motion machine finally ran out of gas, and speculators are exhausted. For the past several months, the indices have trended higher on the back of Big Cap stocks while breadth deteriorated. ARKK, an example of speculative excess and poor risk management, has fallen 50% in the past three months. The sea-change in Fed policies in late 2021 marks the top of a 12-year bull market that went parabolic on easy money, TINA, FOMO, corporate buybacks and Passive inflows. The Fed will be tightening into a slowdown; it will not cool inflation, and stagflation will result. Emerging markets have been in a bear trend for months.

My short term trading

I bought the S+P mid-day Friday of last week, and, with the market surging higher into the close, I stayed long over the weekend. The market was strong early Monday, and I sold the position to gain ~80 points.

I frittered away about 30 points Tuesday, Wednesday and Friday, taking quick losses on short positions. At the end of the week, I was flat, and my P+L had a net gain of ~0.50%.

This week, I had several real-world “distractions” and never got “in sync” with the market action. That’s life, but I was whimpering to myself that I need to be more disciplined – I need to get my priorities straight and not allow real-world events to distract me from trading. Fat chance of that happening. Luckily, a good friend reminded me, yet again, that there’s a rumour going around that markets will be open again next week.

On my radar

I expect dramatic rotation within the market. A ton of money is trapped in stocks that suffered HUGE declines, and it is now “dead money.” The indices fell 10 -15% from the January highs and have bounced back ~50% of that break. I expect the bounce to run out of steam and roll over before reaching the January highs. If a bear market has begun, I expect to see nasty bear market rallies ahead. As Richard Russell used to say, “Everybody loses money in a bear market.”

Thoughts on trading

One of the best things about writing this blog is that I get fantastic emails from people I’ve never met. Here’s a brief quote from a subscriber:

“One Comment that really had an impact on my trading came from an extremely successful trader from Europe who spent ten years at a brokerage before trading his own account. He said, “After watching thousands of you guys make tens of thousands of trades over ten years, there’s one thing that jumped out at me: You LOVE to pick tops and bottoms! Whereas the guys with the multi-million-dollar accounts wait until the trend is so obvious they just have to pick up the money.”

I like that quote because it reminds me of something I used to say – something that I learned from being in the brokerage business for over forty years. My quote:

“Over the years, I’ve watched 100s and 100s of clients lose millions and millions of dollars. One of the things they all had in common was that, sooner or later, they decided to let a losing trade have “a little more time.”

Keep the time frames of your analysis and trading/investing in sync. It is SO easy to develop a multi-year macro investment idea, put on a trade, have it go against you, and then you have to wait years for your vision to materialize. Be patient. Focus on “when” to put on a trade, not “why.”

Quotes from the notebook

“FOMO leads to chasing – be patient; if you don’t have a good setup, don’t trade.” Tyler Bollhorn at the World Outlook Financial Conference, February 2022. Tyler was responding to Mike Campbell, the conference host, asking the closing panel for advice on avoiding losses / managing the risks of trading or investing.

My Comment: I agree 100%! Tyler and I kicked the idea around later, off-camera, and we both decided that it’s SO easy to see something developing – and you “have” to get on board even if it means not having a good setup – and then when the market starts going the wrong way you’re playing defence short-handed!

“Wait for your setup, and then pull the trigger. Don’t chase it if you don’t take the trade when you should. You MUST learn to stay on the sidelines in that case. There will always be another trade.”

“Fear of losing causes you to not trade when you know you should (the hard trade.) FOMO causes you to chase. Fear of having made a bad entry by chasing leaves you at risk of being shaken out early.” Peter Brandt RealVision September 2019

My Comment: Peter and I both worked at ContiCommodity in the late 1970s, but I never met him back then. In 1981 he started working for Commodity Corp, a prop trading firm. A few years later, he went out on his own and has made his living ever since by trading his own accounts. (He tried managing money for friends one year and hated the fear of losing other people’s money, so he stopped.)

Peter and I swapped many emails the last few years and finally had a wonderful face-to-face visit in Tucson in 2019.

I think it’s perfect that Tyler and Peter both offer essentially the same advice. It’s worth listening to people who have learned their lessons the hard way.

The Barney report

The “Barns” is getting bigger and stronger – and more imaginative. He’s just a week short of five months old. We make a point of getting him out for at least two walks a day, regardless of the weather. He has well and truly upset my previous daily routines, but I love the little guy! (This abandoned railroad near our house makes a terrific off-leash track.)

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.