Timing & trends

As long time readers know I’m a big fan of $VIX (Volatility Index) technical structures and compression patterns. Often dismissed as non chartable I think we’ve successfully to put that argument to bed a long time ago.

Recently in “Key Charts” I again outlined the $VIX as one of the key charts to watch and it’s been interesting to say the least hence I wanted to outline an update as a pattern is forming that suggests a major $VIX uprising may be in the cards this fall.

Yes, $VIX again came under pressure into monthly $VIX futures monthly contract roll-over, but interestingly it didn’t manage to fill the August gap which would have been standard fare if you will… CLICK for complete article

Why would the mainstream media want all of us to believe that stock prices are about to fall dramatically? Just like we witnessed earlier this year at the beginning of the pandemic, the corporate media is full of reports that seem to imply that it is a virtual certainty that stock prices are going to go even lower. Of course it would make perfect sense for stock prices to go down because they are incredibly overvalued right now, but normally the mainstream media does not try to tell us where stock prices are going next. And the fact that so many news outlets are repeating the same mantra right now is particularly troublesome.

Without a doubt, the momentum of stock prices is taking us in a downward direction at the moment. All of the major stock indexes have posted declines for three weeks in a row, and it looks like this week could make it four. Full Story

Historic government stimulus and mortgage deferrals not to mention the eviction ban has held prices buoyant in the intermediate, these stimuli’s are all coming to an end. Eitel Insights does not believe prices will hold their current level as the months continue to progress and the economic climate nationally, and locally worsens.

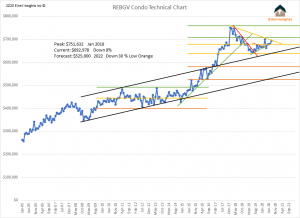

The Greater Vancouver price chart is testing the long term conservative downtrend which was initiated during the markets peak of January 2018. Prices during peak conditions were $751,000 current prices are $692,978 indicating an 8% decline from the peak. The current test of the downtrend is the second test in the past 6 months. During March 2020 the previous test of the downtrend resulted in a $38,000 price drop the following month.

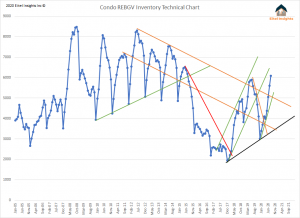

Inventory is the headline of the August market update. The Greater Vancouver condo market has just risen over 6000. The first time the inventory has been that high in over 5 years. Eitel Insights has warned that need based sellers would continue to force inventory levels higher.

The new normal has people working from home and the need to live downtown has diminished. This trend is likely continue, the old draws that had young working people moving to the city’s core are as gone, as the handshake. With businesses allowing more employees to work from home, no social gathering after work at the favourite watering hole, and no exciting weekends at the night clubs. These and more factors are leaving the downtown real estate market with a glut of inventory.

Lest we forget the upcoming onslaught of inventory that has been scheduled to complete during 2021, along with eviction bans being lifted and government stimulus to be rolled back. Eitel Insights forecasts the need to sell continuing to rise.

The rising need to sell is best exemplified through the new monthly listings, which once again was over 2900 new listings. Which marks the first time that has occurred in over a decade. What makes this data and chart interesting is the higher highs along with the higher lows over the previous 2 years. As technicians say the trend is your friend. Higher inventory out of a need to sell, will create intense competition amongst sellers of comparable units which inevitably leads to lower sales prices.

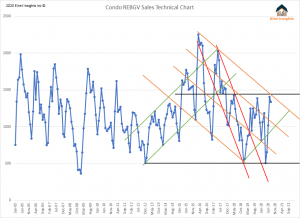

August sales of 1336 were lower than what occurred during July. The sales have remained inside of the Identified market cycle since 2017. With the August data concluded thus ends the seasonal hot market. Historically, April to August are the 5 hottest months of the year. During 2020 the sales over the 5 months averaged just 984. Some analysts and the Greater Vancouver Real Estate Board have touted 2020 as a great year simply because it was better than 2019. What a great year looked like was 2016 with the 5 months of hot selling season averaging over 1850 sales per month.

There was good reason for why sales did rise during the past two months. With the second wave of the Corona Virus long talked about, there was a rush for those who had a need to buy to do so, before a potential second shut down occurred. Another reason for the rush, is the extremely low interest rate environment. Now that the US Federal Reserve has stated there will not be any rise to the interest rates until inflation rises well above 2% for a sustained period of time. There earliest projection for accomplishing the 2% breakeven is 2023.

Eitel Insights does not see any reason to rush into the Greater Vancouver condo market especially as a strict investment. Location matters, but timing is everything. There are 20 markets which make up the Greater Vancouver data, and each area has its own velocity inside of their market cycles. Become and Eitel Insights client to find out which market trends are dominant in your neighbourhood.

Dane Eitel, Eitel Insights

604-813-1418

Watch Eitel’s latest video here:

Peloton falls after rival exercise bike maker Echelon and e-commerce giant Amazon.com reveal a competing tech-enabled bike at a significantly lower price.

Shares of Peloton were down 4.22% at $90.80 at the start of regular trading on Tuesday after Echelon and Amazon announced the launch of their own exercise bike and accompanying interactive online workout service called Prime Bike.

Touted as Amazon’s first-ever connected fitness product, the Prime Bike will give customers access to hundreds of live and on-demand classes, Echelon said in a statement. It will retail for $499.

Peloton has been on a tear over the past six months as fitness buffs have turned to the internet-connected workout-at-home machines and the company’s online interactive fitness classes as the coronavirus pandemic has kept many gyms closed.

And it’s not slowing down. Peloton earlier this month launched more economical versions of its at-home gym equipment – Bike+ and the Tread – though both retail for $2,495, about five times the price of Amazon’s Prime Bike.

Peloton said it has doubled its connected-fitness-subscription base from a year earlier to more than 1.09 million, while paid digital subscriptions tripled to more than 316,800. The company pegged its total membership base at 3.1 million.

For its fiscal first quarter, Peloton expects connected-fitness subscriptions of between 1.32 million and 1.33 million. It expects revenue to triple from a year earlier, to between $720 million and $730 million.

For fiscal 2021, Peloton expects to have between 2.05 million and 2.1 million connected fitness subscriptions and revenue between $3.5 billion and $3.65 billion.

Last week, we noted a list of concerns relating to the market, which could undoubtedly pressure markets lower. One of those, in particular, was the lack of additional “fiscal stimulus” coming from Congress.

Over the weekend, and summed up in the video below, a collision of events brought concerns to the forefront.

The death of Supreme Court Justice Ruth Ginsberg has sparked a replay of the 2016 passing of Justice Scalia. At that time, President Obama wanted to appoint a replacement for Scalia even as the Presidential election was just a few months away. Congress got into a contested debate over whether a justice should be selected so close to an election. That debate is again on display as President Trump wants to appoint a replacement for Ginsberg as soon as possible. Still, the Democratically controlled Congress is fighting to delay it until after the election.

Politically, this is an incredibly important appointment. Since justices get appointed for life, if President Trump adds another “conservative” justice to the Supreme Court, rulings on more liberal causes could be stymied for a decade or more.

A Collision Of Events

Why is this important to the market? Because Congress is facing three different events that have removed the focus from additional financial support for the economy.

- With the election fast approaching, Congress does not want to pass a fiscal support bill to help the other Presidential candidate. Such is why there are dueling bills between the House and Senate currently.

- September ends the 2020 fiscal year of Congress. Such requires either a “budget,” or another C.R. (Continuing Resolution) to fund the government and avoid another shut-down.

- Lastly, the death of RBG will have the entire Democratic Party, which controls the House, focused on how to stop President Trump from nominating a replacement before the election. All Trump needs is a simple majority in the Senate to confirm a justice that he can likely get.