Timing & trends

If remote work has you missing your daily Starbucks cold brew (with 8 shots of espresso), you aren’t alone.

According to the coffee colossus, COVID-19 — and the related fall in foot traffic — led to a revenue decline of $2.3B last quarter.

As highlighted by Medium’s Steve LeVine, Starbucks is only one data point in a much bigger story: the destruction of the multitrillion-dollar office support economy.

From airlines to Starbucks, a massive part of our economy hinges on white-collar workers returning to the office Full Story

The S&P 500 is an exclusive club of the 500 biggest companies by market cap on the NYSE or Nasdaq, and the inclusion Friday of three new companies to replace three that are outgoing was a big deal–particularly because EV darling Tesla (NASDAQ:TSLA) wasn’t among those chosen for onboarding.

Because Tesla was given the cold S&P 500 shoulder, its stock is taking a beating.

The market-defying stock is down from $502.8 on September 1st to $354.67 at the time of writing on September 8th. That’s a major culling on a snub that no one expected from the S&P 500 club.

The club booted H&R Block, Kohl’s and Coty, and replaced them with Etsy, Teradyne and Catalent.

Investors will be forgiven for their confusion.

They will also be forgiven for not having ever heard of Teradyne, an industrial automation and robotics company, and Catalent, a pharmaceuticals developer.

And the surprise that a crafting marketplace such as ETSY has been admitted into the club over the Tesla giant is also easy to understand.

For anyone waiting for an explanation, there won’t be one. The S&P 500 doesn’t explain itself.

That said, the club has to decide whether it’s going to go along with market sentiment or beware the hype when it adds new members….CLICK for complete article

Over the last few months, the markets have become engulfed by a palpable feeling of exuberance. I remember the last time investors were engulfed in a near “panic” to invest. It was 1998, where following a correction, the market began a seemingly endless run to the peak in 2000.

I’m not too fond of market analogs as no two market environments are ever the same. However, there are many comparisons currently to the late 90s to explain the current bull market. The chart is below.

Gambling in the stock market may be fun in the short-term. However, it would be best if you always remembered why Las Vegas makes billions in profits every year.

If you play long enough, “the house always wins.” FULL STORY

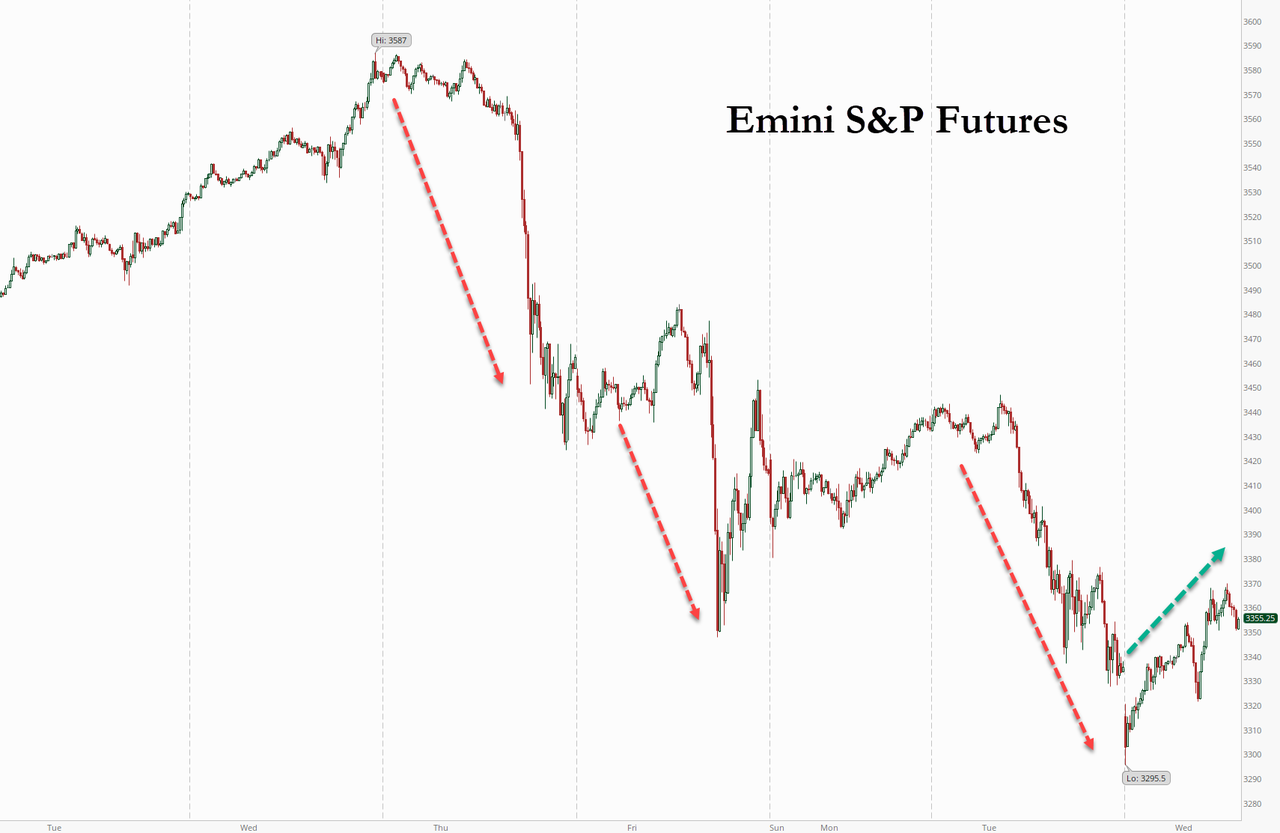

After three days of furious declines in the market culminating with the worst 3-day stretch for the Nasdaq since the financial crisis which entered a correction, stocks rebounded on Tuesday on the back of oversold conditions which approached the March puke…

… as traders, algos and Gen-Z BTFDers ignored news that AstraZeneca had paused covid vaccine trials after a participant in the UK developed an unexplained illness potentially crippling the race for a vaccine, and causing a “ripple as markets question recent vaccine optimism,” according SVB Leerink analyst Andrew Berens said. Then again, with futures some 20 points higher from Tuesday’s close, it doesn’t seem like pessimism will be allowed today as a 4-day selloff would be catastrophic for market sentiment, and as such look for a green close with the blessings of the Fed.

And with all eyes on the Nasdaq, it was imperative to find some support which is what the 50DMA has conveniently provided.

If you’ve got an extra $1,000 by some miracle, or perhaps thanks to COVID stimulus holdovers, it may not seem like much, but there’s no reason it can’t be the seedling of your first investment portfolio.

Perhaps if you’ve got serious debt to pay down, it’s better to do that first, but if not, there are plenty of places to park $1,000 that will make it grow rather than collecting dust in a savings account, or worse yet, under the euphemistic mattress.

And since zero-fee trading platform Robinhood descended on the Earth to democratize trading for the little people, retail investing–even when you don’t know what you’re doing–is all the rage.

The markets started to tank in March because of the COVID-19 pandemic but has also created an army of young investors that started investing out of boredom due to stay-at-home and lockdowns.

All major online stock trading platforms have seen a surge in demand in recent months, leading to a major spike in new accounts in the first quarter. Many of the new users are young or even first-time investors with over half of them aged 34 or younger. In fact, online brokers saw new accounts grow as much as 170% in the first quarter.

Recent studies show that 29% of wealthy investors are under the age of 50 and control 37% of investable assets. So, why not you?

That $1,000 you have right now could grow into years of great future financial choices.

Here are some tips for the best ways to invest $1,000 right now:

#1 Micro-Investing

A cool grand is not too shabby if you want to start with micro-investing. With new apps (such as Robinhood) on the market, you can even start investing with as little as $5. Squirreling away even $5 a week, for instance, creates a savings/investing habit and you won’t even miss the cash.

And if you want the ease of stock trading with diversification benefits of mutual funds, you should take a look at micro-investing apps that allow you to invest in exchange-traded funds (ETFs)–entire “baskets” of stocks centered around various themes….CLICK for complete article