Featured Article

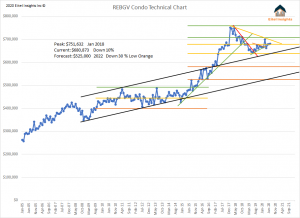

The Greater Vancouver Condo market is experiencing another stagnation period in price movement. Over the past three months prices have remained within a three thousand dollar bracket. Current prices are retesting the higher echelon of the middle threshold in the current market cycle. The average sales price is down 9% from the peak, signalling there is plenty of room to drop. Eitel Insights forecasts that during 2022 prices will have dropped nearly 30% from the peak experienced during 2018.

Prices have remained in another very tight range similar to the previous tight cluster of prices during 2019. The previous cluster sent prices higher pre pandemic. What is different this time is the Inventory is on the rise and growing much faster than the sales. Once the buyers eventually learn that they are in the driver’s seat, prices will begin to drop with gusto.

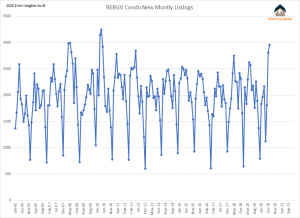

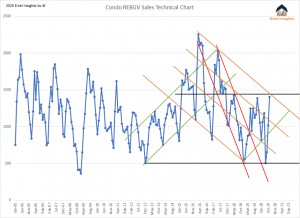

New listings grew at the highest pace since 2010 for the condo market, with over 2900 brand new active listings. Which is roughly 750 more new listings than the average over the previous 5 July data points. The sales did grow no denying that, but only by 159 sales from July 2019. Also over the previous 5 year average the July sales were actually down over 250. Seems like there is more of a need to sell than a demand to buy. The last two months of newly listed properties equals over 5700 new listings, the highest two month span in a decade.

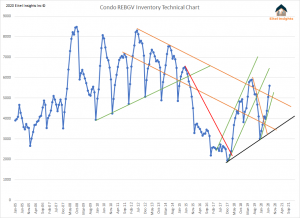

With the abundance of new listings, the overall inventory grew by another 600 compared to June’s inventory. While sales did rise, not enough to mitigate the growing need to sell. Inventory numbers have risen to the 2nd highest peak in the past 5 years, with over 5600 active listings. Still to come is monstrous amounts inventory to be introduced to the market from the presales. Worth mentioning is the end to the evictions ban will likely be occurring in September. While the CERB is also seemingly coming to an end, and those whose are still without work who qualify for EI will be getting less money and some simply will not qualify. None of this bodes well for the demand sector of the Condo market.

The notion offered by some perennial bullish market watchers that due to the higher sales numbers in July, the Covid-19 effect has been nullified is erroneous. Yes sales have increased, but ever stop to wonder why? One answer is prices are down 9% and the price per square foot continues to drop signalling properties are selling for less money. Secondly those who had been pre-approved, pre Covid have followed through with those rate holds. There is usually a 90 -120 day prequalification rate hold. The idea that someone would purchase a home before they are about to lose their job is seemingly farfetched, but in this ever indebted society that is exactly what has been occurring. The 1404 sales which occurred in July, hold a distinct possibility that some of those new owners would not have qualified for that mortgage if they applied today. Those CERB payments helped greatly with the first mortgage payment but what happens to that owner once the free money era comes to an end. As stated the last two months had over 5700 newly listed properties, while the sales have achieved just over 2400. The trend is in the buyer’s favour.

Business’ that have been on hold are eager to get back to work, the challenge that most business are experiencing is, the market isn’t as eager to purchase as they are to sell. This will result in staff returning to work, only to be let go in short order. The economic impact of the first shut down is still in its infancy, imagine a second shutdown and the long term effects that would hold. Even if there is no second shut down the economic landscape will remain changed. With personal job, wealth, and health uncertainties not to mention those in your family who you may need your help. The idea of buying another expensive pair of shoes or a new watch, just because, are days gone by for most.

The market has been artificially propped up with free money, once that comes to an end, taxes will inevitably be raised to refill the governments desolate coffers, the full impact of Covid will be felt. With a glut of inventory and a lack of potential renters and purchasers, the roll out of this recession is well underway. Ultimately resulting in assets being sold, primarily secondary condo properties.

In summary, Eitel Insights cannot wait to offer a positive outlook for the Greater Vancouver Condo market, but the analytics of the current data projected into the future is not positive, we believe it is our obligation to offer actionable intelligence through analytical interpretation not pie in the sky optimism.

Dane Eitel, Eitel Insights

Watch Eitel Insights latest video:

Last month, I’d discussed whether Cineplex (TSX:CGX) was headed toward bankruptcy. The COVID-19 pandemic forced theatres across North America to close their doors for the entirety of the spring season. When the summer arrived, theatre companies were forced to adjust to chaotic conditions and take a regional approach. Shares of Cineplex, the largest movie theatre operator in Canada, have plunged 76% in 2020 as of close on August 7.

Today, I want to look at how conditions may change for Cineplex for the rest of 2020.

Cineplex has started its phased reopening

In July, Ontario allowed for most regions to enter phase three of its reopening plan. Unfortunately, movie theatres were still left in a precarious position. The province stipulated that theatres could only allow up to 50 patrons per individual screen. Cineplex and other operators argued that this was not financially feasible. The company hoped to lobby the government for an exception for this industry.

On July 31, Cineplex unveiled its own phased reopening. This began with 25 locations opening on July 31, each adhering to the 50 individuals per screen regulation. The company expects that most its locations will open in the next several weeks. Ontario, Canada’s most populous province, was the last to reopen theatres to the public.

Will this be enough to give Cineplex a boost in the latter half of 2020? CLICK for complete article

Two of the questions I get most often these days are, “What kind of cycle are we in?” and “Where do we stand in it?” My main response is that the developments of the last five months are non-cyclical in nature, and thus not subject to the usual cycle analysis.

The normal cycle starts off from an economic and market low; overcomes psychological and capital market headwinds; benefits from gathering strength in the economy; witnesses corporate results that exceed expectations; is amplified by optimistic corporate decisions; is reinforced by increasingly positive investor sentiment; and thus fosters rising prices for stocks and other risk assets until they become excessive at the top (and vice versa on the downside). But in the current case, a moderate recovery – marked by reasonable growth, realistic expectations, an absence of corporate overexpansion and a lack of investor euphoria – was struck down by an unexpected meteor strike.

People also ask what’s different about this episode from those I’ve lived through in the past.

Another frequent question is, “What shape will the economic recovery take?” Everyone has his or her favorite candidate: a W, an L, a U or maybe a Nike Swoosh. Of course, the one we hear the most about is a V. While the terminology used isn’t crucial, and may basically be just a matter of semantics, I find the label “V-shaped” misleading.

Of all the people who use the label “V-shaped” to describe this recovery, I don’t think I’ve ever seen anyone define it. To me, a “V” has to satisfy two important requirements: Full Article

U.S. employers added 7.5 million jobs in May and June, following a devastating April in which millions filed for unemployment benefits. But July is the tricky month because the trend has failed to continue at the same pace making it look like the pandemic surge is now threatening the recovery momentum. Even though the Department of Labor will release official data by the end of the week, Dow Jones estimates that 1.26 million jobs were added in July.

That might sound fantastic, but the resurgence of the virus added new volatility to the outlook and economists now fear new layoffs.

Last month, medical experts called for a restart of the COVID lockdown as the United States adds tens of thousands of new cases daily. Twenty-two states, including Washington, Michigan and California, have imposed new restrictions, resulting in fresh layoffs.

As for the previous two months, the healthcare, logistics and construction industries presented with the highest demand for new workers.

In June alone, employers added nearly 5 million jobs. Of those, the leisure and hospitality sector dominated with 2.1 million jobs, while retailers added 740,000 jobs, and education and health services opened up 568,000 jobs.

Compared to the five-decade-low 4.4% unemployment rate we saw in early March, the current rate of 11% looks great, with the number of unemployed persons falling by 3.2 million to 17.8 million, according to the US Department of Labor…CLICK for complete article