Real Estate

Our friends over at Green Mortgage Team sent us this informative comparative to illustrate whether it’s worth considering refinancing your mortgage during these uncertain times. ~Ed

What does COVID-19 have to do with interest rates?

Despite the substantial negative impact of COVID-19 across many industries, the virus has had a positive impact on mortgages, specifically for people getting a new mortgage today and for people that were in an existing variable rate mortgage. In general, when bad things are happening around the world, this tends to push interest rates down. Events such as 9/11, the credit crisis of 2008, Brexit and COVID-19 are all examples of situations in which interest rates subsequently fell 1% or more over a short period of time.

During trying times, money usually will flock to safety. Canada is a safe country to park money, and bonds are a safe asset class. Fixed mortgage rates are tied to bond yields, which means when bonds fall, fixed rates fall (to learn more about why this is, you can read another blog post here). For variable rates, the Bank of Canada dropped a full 1.5% over a short period of time to stem the bleeding and is in a position where they cannot reasonably go any lower without venturing into negative territory.

What is happening with rates?

After dropping in March and then spiking back up as spreads over top of the bond yield increased due to the COVID-19 “risk premium”, rates have been steadily falling since then and opportunity is brewing. With low interest rates, it makes more and more sense to break an existing mortgage and pay the penalty to take advantage of getting a new lower rate today.

Our clients are refinancing not only because they may save money over the remainder of their current term, but because now they will have a new mortgage for, say, five years instead of renewing in a year or two when rates could be higher at the time.

We believe we are very close to the bottom of the market. Typically interest rates are priced at bonds + 1.5%-1.8%. Currently bonds are hovering around 0.4%, which means fixed rates should be closer to 1.9%-2.2%, but currently most banks are closer to 2.49% for a 5-year fixed, or lower for an insured mortgage. The COVID-19 spreads are decreasing and we expect this will get closer to its normal spread band very soon. Following this, we will either see rates flatten out or begin to increase as we recover through the pandemic.

How do you know if it makes sense to break the mortgage?

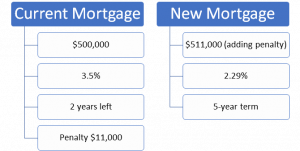

Let’s say that you have a $500,000 mortgage with two years left on the mortgage, at a rate of 3.5% interest. The first step is to establish what the penalty to break that mortgage is. Don’t worry, we will do the math and estimate this for you. If you would like to learn more about how the banks calculate the penalties, you can read more here.

We will then evaluate the amount of savings over the remainder of the term. In an ideal circumstance, the savings will exceed the penalty over the remainder of the term up until your maturity date.

One important item that is often forgotten is that if you take a new 5-year term, you will not be coming up for a renewal in two years time, you will instead renew in five years. If you kept your current mortgage you would have to renew in two years, and rates are unlikely to be as low as the rate we can get at the present moment during this pandemic. As a reference, we encourage you to view the bond yield chart here (select 1W or 1M to go back further into history). You will find that over the past ten years, bonds have never been this low.

What is the game plan?

Put yourself in the best position possible to take advantage of a refinance.

We recommend that you have your file prepared and ready for the point when rates hit bottom and then start rising. This will allow us to hold a rate for up to 120 days and see where rates go from there. If rates continue to go up, it will make more and more sense to pull the trigger and refinance. Moreover, rates going up will then shrink the spread on the penalty cost for the IRD (Interest Rate Differential) penalties for fixed rate mortgages.

Some of our clients have decided to break their mortgage and pay a $10,000 penalty, but will save over $30,000 over the term of their mortgage.

In order to be able to hold these rates, we will need a fully built file, including supporting documents, to get the approval.

Should you go variable or fixed?

There is a lot that goes into making the decision of going variable or fixed. However, with the discounts off of posted rates being so great, it will cost anyone who breaks their 5-year fixed rate mortgage before the maturity dearly. In my analysis, the penalties to break a 5-year fixed mortgage early are anywhere from 500%-1,000% more than if you break a variable mortgage (where the penalty is capped at three months interest). To learn more about whether you should choose a fixed rate or a variable rate, you can read more here.

Example

Let’s use some figures to illustrate this. We will use the example of a $500,000 mortgage at an interest rate of 3.5% today, with two years left on the mortgage, compared to a new refinance at 2.29%. The mortgage penalty is added to the outstanding balance of the new mortgage, which means there are no out of pocket costs.

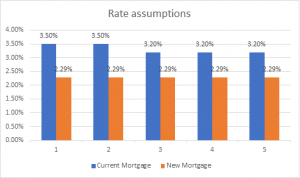

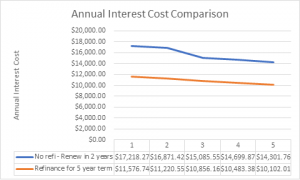

First, here is a look at the annual interest costs. This is assuming that interest rates in two years, when the renewal has come up, has normalized at 3.2%.

Another way to visualize this is to look at the total accumulation of interest over five years.

In most cases, the payments can be lower if you prefer a lower payment. If we keep the payments the same as the current mortgage, we can see that although the mortgage balance starts off higher due to adding the penalty to the outstanding balance, the mortgage outstanding balance after five years is $8,500 lower. This means that in this example, the borrower would be ahead by $8,500 over five years by refinancing.

How can you get prepared to take advantage of this opportunity?

Our team will be happy to help get this process started for you. We will need to collect the necessary information and documents to build your file, so that once we hit the low point with rates, we can send your application to the lender. To prepare yourself for this opportunity, contact us at GreenMortgageTeam.ca or 604-229-5515.

Joining the dots (and dashes)

Yesterday saw swings in the markets, some key stocks in the US in particular, and equal swings in our underlying backdrop. Let’s try and join them into a coherent whole.

From the dots side we need to start with the plotters at the Fed. Dallas Fed President Kaplan spoke yesterday – and made a classic error, noting Fed emergency lending facilities “won’t be left in place indefinitely” and that “he is a believer that we will need to get bac to more unaided market function without as much intervention from the Fed. We’re just not at that point yet.” The key point/dot here is that our Robin Hood-y/Barstool-y markets clearly do not want to conceive of EVER going back to “unaided function”. They are predicated on a quite logical assumption that any reduction in central bank liquidity will result in a crash, which will result in the resumption of said liquidity. More money, please. And don’t think about taking it away.

From the dashes side, the US moved beyond not taking a formal stance on maritime disputes while insisting on freedom of navigation to openly calling some Chinese claims in the South China Sea illegal. In short, the Chinese 9-dash line showing the South China Sea as its own is rejected. Does one need to join many dots or dashes to see where such conflicting claims can lead? Not towards any kind of return to the US-China economic status quo ante at least.

Yes, and crucially, Bloomberg reports the US will not be specifically targeting the HKD peg over Beijing’s actions on Hong Kong by limiting access to USD because “it would be difficult to implement and might end up hurting the US”. It seems the ‘because markets’ side of the Trump administration has the upper hand over the geostrategic hawks here; naturally this is also the case with the de minimis EU response given in foreign policy dey are de mini-me and only understand markets – Germany’s foreign ministry just removed the Taiwanese flag from its website, for example.

This is a positive because such a US policy to be able to turn off the taps the same way the Fed can turn them on (and on and on) remains the financial equivalent of war as potent as the two US carrier strike groups now in the region. Yet there does not seem to be much dot and dash joining from the US side: how does it confront China over the South China Sea and Hong Kong, which is says it wants to, if ‘because markets’ is the White House rule?

Decoupling, perhaps. As Reuters reports the “The Trump administration plans to soon scrap a 2013 agreement between US and Chinese auditing authorities…a move that could foreshadow a broader crackdown on US-listed Chinese firms under fire for sidestepping American disclosure rules.” So new Chinese listings in the US, it would seem. At least that’s more business for Hong Kong – but then why leave the peg alone and let the US lose out without effecting any real change? Again, the dots and dashes don’t join up.

Indeed, the risks of stronger US actions are arguably still there. Sanctions over Hong Kong still loom and would end up having the same negative effect on HKD, and CNY, if applied as in Iran (whom China is signing a 25-year geostrategic cooperation agreement with.) Moreover, the UK has stated they expect 200,000 Hong Kongers to arrive over the next four years. That’s far less than 10% of those allowed to come, but still points to a huge drain of capital/FX reserves if each migrant arrives with savings; more so if US, Australia and Canada see a similar number.

In which case, it’s a good job Chinese exports were up 0.5% y/y in June (vs. -2.0% consensus) and even imports were up 2.7% (vs. -9.0% consensus). But can we really expect this export trend to continue in H2 with lockdowns coming back and the back of the US increasingly up? Even Europe is miffed, given if there is one thing mercantilists don’t like, it’s mercantilism.

Could someone help Joe join the dots too? Either the apology tour won’t be very apologetic, or new US liquidity will lift boats other than American, or the US is going to continue America First anyway as it reflates. (Of course, to really close itself off it would need to impose capital controls on inflows….which are not going to happen ‘because markets’. )

Meanwhile, as a harbinger of how bad our Q2 is going to look when we get the data, Singapore’s GDP collapsed -42.1% q/q annualised.

This time last year one would have been brave to say even -4.2%. How the world changes. Indeed, with reports that: Covid-19 now infects more than 13 million people; natural immunity after catching it only lasts a few months; the latest Hong Kong outbreak variant is 30% more infectious than the previous wave; a large percentage of those who survive even moderate cases apparently end up with permanent heart damage; and as articles dribble out asking what the world looks like if we don’t get a vaccine at all, it’s perhaps time to join a few more dots and say ‘Dash it’.

A few weeks ago I was sucked into the positive vibe of surprisingly strong economic numbers and a sense the virus was diminishing. I was expecting stocks to have hit new record levels in June. For a moment on Monday, it felt like they did as the S&P turned briefly positive on the year… but then it faded. It felt like the last bloom of a fading rose….

Markets feel tired – I expect we’re in for long summer stuck in a rut. The economic data looks more sobering while the virus is still burning its way through the sunshine states, and threatens a southern hemisphere resurgency. Expectations aren’t quite what they once were…. For the meantime…

As Q2 Earnings season accelerates… just how painful could it get? Read More

Trust is a fickle thing. It’s there until it isn’t. This is especially true with paper currencies. Their value is based on trust that the sovereign issuer will act faithfully and responsibly. The standards for a reserve currency are even higher given their status in global trade and finance. Throughout history, there have been many reserve currencies and they have all failed, eventually. Every one.

The average shelf life of a reserve currency is approximately 100 years. Can anyone today recall the importance of the French Livre or the Dutch Guider in world trade? They were the “U.S. dollar” of their day. At their height, no one questioned their durability much the same as, until recently, most didn’t question the durability of the U.S. dollar. But for a few keen observers, the writing has been on the wall for several decades.

It first caught my attention in the late 1990s. I started to see a change in behaviour by the Federal Reserve under Alan Greenspan. He was coming to the rescue of markets under the guise of protecting the financial system with increasing frequency. First it was the bail out caused by the demise of the hedge fund Long Term Capital Management in 1998. During this same period, Greenspan — with the assistance of the media — helped fuel the dot com bubble which finally burst in 2000. By the time the 9/11 terrorist attacks occurred in September 2001, the Fed, under Greenspan, began its policy of keeping interest rates “accommodative“ permanently and also showing blatant disregard of its independence from federal government policy. Full Article

Since the onset of the pandemic, the Fed has entered into the most aggressive monetary campaign. Its goal was to bolster asset markets to restore confidence in the financial system. However, the trap is the Fed is in a position where they can never stop QE as interest rates can’t rise ever again.

As we discussed previously, Jeremy Siegel already declared the end to the 40-year bond bull market.

“History has shown that this liquidity has to come out somewhere, and we’re not going to get a free lunch out of this. I think ultimately, it’s going to be the bondholder that’s going to suffer. That’s certainly not the popular notion right now.” – J. Siegel via CNBC

However, this is not a new sentiment, but it has existed since I started calling for rates to fall below 1% as far back as 2013. The reasoning then, and is the same today, is the linkage between the debt and economic growth. Read More