Gold & Precious Metals

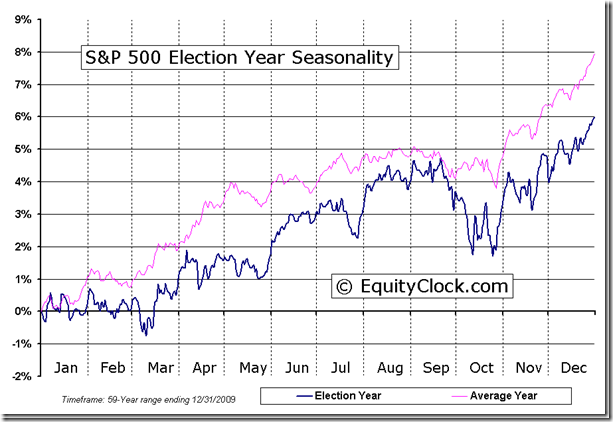

The entry point for the seasonal trade in North American equity markets (on average during the past 61 years: October 28th) is rapidly approaching. The expected short term correction from mid-September has happened, but has yet to show signs of bottoming. Watch short term technical indicators for signs of an intermediate bottom. Sectors to consider include due to their favourable seasonality starting by the end of October include technology, agriculture, forest products, transportation, industrials, steel, consumer discretionary and China.

Interesting Charts

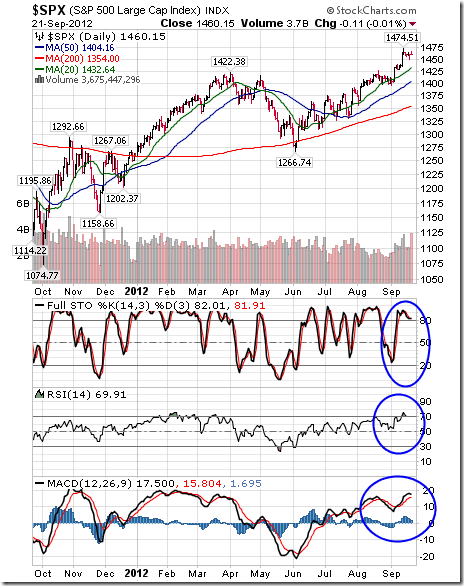

Short term momentum indicators for broadly based equity indices are recovering from oversold levels (notably a move by Stochastics above the 20% level). Typical of technical action at the start of the period of seasonal strength for equity markets!

The recovery is happening at an interesting time, just before the U.S. Presidential election when equity markets typically start an intermediate upside move lasting until at least Inauguration Day in the third week in January.

A word of caution about individual equities! Responses to third quarter reports released yesterday were exceptional, particularly by stocks reporting after the close. Most companies are reporting slightly higher than consensus earnings. However, many are missing consensus revenue estimates. Of companies that reported before the close yesterday, State Street gained 2.0% and Johnson & Johnson improved 1.4%. However, Goldman Sachs fell 1.3% and UnitedHealth Group slipped 0.6%. Responses to reports released after the close were downright scary. CSX added 1.7%. However, IBM plunged 3.5%, Intel dropped 2.2%, Linear Technology fell 4.0%, Apollo plunged 7.6% and Intuitive Surgical gave up 4.8%. Today and tomorrow are the days when the most S&P 500 companies are reporting third quarter results. Look for lots of volatility.

About the Great Author of this Daily Report – Don Vialoux

Don Vialoux has 37 years of experience in the Investment Industry. He is a past president of the Canadian Society of Technical Analysts (www.csta.org) and a former technical analyst at RBC Investments. Don earned his Chartered Market Technician (CMT) designation from the Market Technician Association in 1995. His CMT paper entitled “Seasonality in Canadian Equity Markets” was published in the Spring-Summer 1996 edition of the MTA Journal. Don also has extensive experience with Exchange Traded Funds (also know as Index Participation Units) as well as conservative option strategies. In 1990 he wrote a report that was released in the International Federation of Technical Analyst Journal entitled “Profiting from a Combination of Technical and Fundamental Analysis”. The report introduced ” The Eight Phases of the Stock Market Cycle”, an investment concept that continues to identify profitable entry and exit points for North American equity markets. He is currently a member of the Toronto Society of Fundamental Analyst’s Derivatives Committee. Now he is the author of a daily letter on equity markets available free on the internet. The reports can be accessed daily right here at www.dvtechtalk.com.

Maybe it is too much to say the global financial system is coming apart at the center, but I don’t think it’s too much to say global cooperation is close to complete breakdown based on the recent dismal IMF meeting.

I hate reading junk postings so let me start by saying that if you’re not interested in finding out the techniques that Tyler Bollhorn used in September to make money on 90% of his trades or finding out how you can literally take 15 minutes a month to significantly improve your investment results then don’t read another word – and please forgive the interruption.

I hate reading junk postings so let me start by saying that if you’re not interested in finding out the techniques that Tyler Bollhorn used in September to make money on 90% of his trades or finding out how you can literally take 15 minutes a month to significantly improve your investment results then don’t read another word – and please forgive the interruption. - A two month subscription to his daily newsletter and trade alert, normally a $118 cost, (for new subscribers only)

- PLUS a two months Stockscores Advanced membership, regularly a $58 cost, (again for new Stockscores members only).

- PLUS I am working one other special bonus for attendees that I’ll tell you about at the event.

PERSPECTIVE

As the saying goes, this is being written while at sea. Can’t help but think of Rod Stewart’s”Sailing”, but the Atlantic is quiet today and the sun is shining – making it rather nice for walking round the deck. Three times around amounts to a little more than a mile.

(Ed Note: Bob’s take on Stocks, Interest Rates, Commodities & his Wrap below)

Last week’s theme was that high level thinking in the orthodox seems to be changing. Some academics are calling our post-bubble contraction as the “Bernanke Depression”, which is appropriate. In the “cause and effect” world of orthodox thinking the financial agent “on watch” gets the credit for a natural boom and those on duty during a natural depression get the blame.

In the 1920s Treasury Secretary Mellon was celebrated as the greatest “since Alexander Hamilton” and was condemned during the bust. The next to be celebrated was Robert Rubin, who headed the treasury during the “Dot-com Mania”. And what did he and his sidekick Summers do deserve the accolade. They added fuelish amounts of gasoline to a financial conflagration.

Of course it the same thing can be said about Bernanke, but global assets have been deflating since the 2007 Bubble completed.

The other aspect of change is that some involved in policymaking have been uttering some commonsense about insane Fed ambition. Prudent people, such as Charles Prosser who heads up the Philadelphia Fed said as much a week ago. We invite readers to send in the examples they see. We will keep a tally.

Then you have the “Incurables” such as Paul Krugman who has been non-stop in calling for even greater central bank recklessness. Krugman’s error has been the popular notion that the Fed is THE perfect policy instrument. In certain circles this has been popular since the Fed opened its doors in January 1914, and the record has been a series of boom and busts. The most interesting of which have been the great financial manias, such as climaxed in 1929 and 2007.

This fascinating because each set of interventionists believed they were “charting new waters”, when they were replicating old bubble behaviour. Including the boast from previous bubble that “nothing can go wrong”. In 1873 it was that the US did not have a central bank and was not on a gold standard. Then in 1929 the agency that would prevent bad things from happening was the “new” Federal Reserve System. What’s more, it would keep the good times rolling.

Why?

Because the previously celebrated agency – the Treasury System – was gone. It had been the cause of so much financial distress and economic malaise.

Actually this melancholy condition is the feature of every post-bubble contraction. With the “new” Fed this would be impossible.

In fulfilling the record of financial history, 2007 clocked the main features of the conclusion of a classic bubble. At the time, the abilities of existing agencies where boasted as being proof against bad things. And then to use the establishment’s own descriptions, the worst recession since the 1930s followed. This was followed by the weakest recovery – since the 1930s.

Despite massive attempts at “stimulus” the first recovery out of a classic crash was weak. Even worse it is now being more widely seen as ending.

If history continues to guide, sometime soon, the establishment should begin to condemn the “old and disastrous” Federal Reserve System. This would be followed by a tout about a more perfect agency that really will be designed to prevent bad things.

During the initial and shocking crisis the media was full of stories that a bigger Fed would have prevented the problem. That doesn’t count, what will be needed is the tout about a new and different agency.

Time will tell.

STOCK MARKETS

Stock markets rallied as Romney came out on top after the debate. However, the action remains in a topping pattern following impressive momentum and sentiment readings accomplished around September 14th.

The following chart shows the interaction between the S&P and the VIX. Key negative divergences are detailed along with important stock market highs.

On this model all that is needed for completion is that the VIX rally above 15.5. This would be a “sell” signal.

The VIX is now at 14.3.

CREDIT MARKETS

Not much change over the past week. After a magnificent rush of narrowing, junk vs treasuries widened significantly and have paused late in the week. A test of the “high” would confirm a reversal to widening spreads.

A slowing global economy will impair the ability of corporations to service debt obligations.

While junk has bounced a little, long treasuries have declined in price a little. The former is working on a top and the latter are stair-stepping down.

For the shorter maturities there has been some volatility in the Ted-Spread. With narrowing that ran “forever” – well since the end of the dislocations that ended late last year – the action reached a very oversold on the weekly RSI.

The degree of oversold suggest this week’s volatility could be setting up a trend change. And any change in the curve along with change in spreads would be critical.

COMMODITIES

Most commodities have rebounded from the slide that began around September 14. The CRB declined from 321 to 302 and this week made it to 311. Although tied to the “good news” about the advance in Romney’s campaign, it should be considered as a normal test of the high.

Within this Ag prices (GKX) have been stair-stepping down.

WRAP

This is being written on board the Queen Mary 2 on the way to Southampton and the internet hook up has been irregular. So this edition has taken a couple of days to get this far. Ross will be able to update the Gold and Silver sector as opportunities arrive.

We are in the mid-Atlantic enjoying an interesting ride. Sunny and cloudy day with a Force 9 wind blowing, which is described as a “strong gale” with “very rough” seas. The wave height ranges from 14 to 18 feet. Sometimes the spray reaches Deck 8 which has the wooden surface that has been so nice to walk around. Three laps amounts to a little over a mile. With the “tunes” on the walk has been enjoyable, but there is too much spray today. This deck seems to be about 30 feet above the ocean. Considering the thought processes of the liberal-left, this could be considered as “proof” of rising sea levels.

The library is very nicely appointed, with comfortable arm chairs looking out over the bow.There is also an exercise room – offset by a number of bars and dining rooms.

By unusual circumstance, Lois and I “dined” with the captain last evening. One has to be booked into a high-end suite to dine at the captain’s table. We had found a nice table next to the window and were enjoying a pleasant Shiraz-Viognier. Then along came the captain (in a very smart uniform) and his wife who sat at the table next to us. We had an interesting conversation, but brief as the storm was increasing and he was returning to the bridge. Probably for the night.

Better get this finished while we still have sat hook up.

INSTITUTIONAL ADVISORS

TUESDAY, OCTOBER 16, 2012

BOB HOYE

PUBLISHED BY INSTITUTIONAL ADVISORS

The following is part of Pivotal Events that was

published for our subscribers October 5, 2012.

SIGNS OF THE TIMES

“German business confidence unexpectedly fell to the lowest in two and a half years.”

– Bloomberg, September 24

“Consumers and countries continued to pull money out of banks in Spain.”

– Dow Jones, September 26

* * * * *

BOB HOYE, INSTITUTIONAL ADVISORS

E-MAIL bhoye.institutionaladvisors@telus.net

WEBSITE: www.institutionaladvisors.com