Timing & trends

Smiley Face Liberalism

The collapse of liberal elites under a leftist offensive has been in the making for years.

By Daniel Henninger

The people in the streets—idealistic protesters, full time activists, anarchists—are the young men and women of the current American left. The people running the country’s institutions—mayors, cultural leaders, media executives, business managers—are a generation older and cut from the cloth of traditional American liberalism. Give the left some credit: After tolerating their liberal betters for years, they knew when the opportunity had arrived to push them over the cliff. They have just taken it. Events of the past four weeks have produced a lot of agog reactions, but among the most interesting have come from European friends who came to the U.S. years ago in search of what can only be called the American dream. Now they are asking: Why is there so little resistance to what is going on? How could cancel culture happen in a country with legally protected speech? Why has there been no defense of private property—which remains, believe it or not, a big idea in the minds of foreign born citizens, from taxi drivers to builders of new companies? The quick collapse of America’s elites under this left-wing offensive is striking and a historic event. Within a week of the left going after monuments to U.S. presidents—George Washington, Thomas Jefferson, Ulysses S. Grant—the head of the American

Museum of Natural History in New York said she had no problem with dismantling history, and asked the city to take down its statue of Teddy Roosevelt on the grounds that it is offensive to blacks and Native Americans, which is absolutely disputable.

In Brooklyn, residents are in despair over nightly fireworks noise, shootings and killings as the police, under threat of prosecution or firing, have pulled back. On Monday evening, Borough President Eric Adams responded with a solution: “empower” community groups to discuss with residents the dangers of shooting aerial bombs at each other. How did the capitulation happen so fast? In fact, it was a long time coming. It is hardly an insight by now to blame this on the schools. But revisiting 30 years of educational irresponsibility seems necessary, insofar as the reality of the moment represents an erasure of history. If U.S. Grant, just toppled in San Francisco, was a racist, American history has indeed ceased to exist. History has a way of returning, and some day it will record how a generation of university presidents produced this result. In the 1980s and early ’90s, when the notion of speech-codes emerged with formal restrictions on words and speech, the seeds of today’s cancel culture were planted with the acquiescence of university leaders. When liberal professors embarked on tenure denials for conservative colleagues, who were important ballast to the growing group think, campus administrators caved.

Then when the students turned on some of these same liberal professors, with accusations of racism, they caved again.

These rocks rolled steadily downhill with barely a peep of public resistance from trustees. In the 1990s, Yale famously returned a $20 million donation from alumnus Lee Bass to create a curriculum in Western civilization, a k a history. These acts of denial as liberal traditions eroded were mostly petty self-interest. If you didn’t lose your job, you were OK. This is what “silence is compliance” really looks like.

Here is why this is relevant to what happened so quickly the past four weeks. Liberal tolerance (their one cardinal virtue) eventually degraded into rote acceptance. They claimed to be defending evolving standards but eventually there were none.The activists’ steady descent into irrational and illogical claims was impossible to miss. It became obvious that wokeness had turned into a weapon, but liberal leadership blandly let it happen.

Even more important to understanding recent events is a recognition of how the left eliminated traditional liberalism’s moral leadership.

For decades, liberals have made claims of moral authority in the U.S.’s political life—through depressions, wars, the civil-rights movement. In recent years, the left has successfully established, at least among elites, that we live in a society with few constants of moral behavior. But if even the idea of a functioning consensus about morality has been erased, then no one has moral authority. About all that’s left is smiley face liberalism.The organized, professional left has played its hand well, filling the void of a no-longer relevant liberalism with an authoritative, reductionist assertion of “systemic” guilt—secular guilt being the most powerful political idea of our time—in matters of race and gender.By now, displaced liberal elites have so little self-confidence that they fear even criticism from their children or teenage grandchildren for trespassing the new racial and gender orthodoxies.

Will it last? I think people across the political spectrum are shell-shocked by the events of these weeks, especially the Taliban-like smashing of monuments and the embrace of lawlessness as an official ideology, with no credible push back from Joe Biden or other prominent Democrats. But if history teaches us anything, it’s that the American electorate won’t be pushed around permanently. Write henninger@wsj.com.

July 14th: 7:00pm Pacfic.

July 16th: 4:00pm Pacific.

CLICK Here to register

-

Find out what types of stocks to own for the next decade.

-

Tech Themes: cloud computing, cybersecurity, AI, IoT, remote work and more. Are Zoom, Slack and others too pricey or are they a must add to your portfolio?

-

Telemedicine & New Healthcare Opportunities: the shift to online and in home healthcare and where the opportunities may occur.

-

Alternative Energy & Green Investment Stocks: the shift from fossil fuels to green energy brings both threats and opportunities for power producers, energy infrastructure, storage, electric vehicles, and more.

-

Why cash rich, cash producing businesses and dividend growth stocks will be key for your portfolio success over the next decade.

-

Are there opportunities in beaten down segments such U.S. hospitality, travel & tourism, oil & gas or do they remain value traps?

-

Bonus Hot Topic: Is Day Trading Profitable Long-Term or Dangerous for Your Portfolio?

-

KeyStone will arm you with the research and tools to simplify, save on fees and create long-term wealth in a 15-25 stock portfolio – designed to benefit you, not your advisor.

-

Plus 5-6 stock picks to begin building your portfolio today including; 1) the best value in alternative energy, 2) the highest yielding gold related stock in Canada, 3) the best performing home healthcare stock, 3) a cloud computing giant, 4) an infrastructure stock for the next decade, 5) a great dividend growth stock and more…

While we are certainly more bullish on markets currently, as momentum is still in play, it doesn’t mean we aren’t keenly aware of the risk.

Pay attention to what you own, and how much risk you are taking to generate returns. Going forward, this market will likely have a nasty habit of biting you when you least expect it.

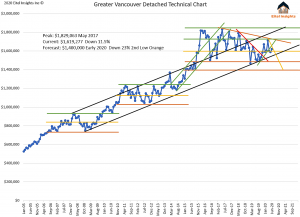

June sales increased along with the average price, major win for the bulls? Not even close, the headlines can be deceiving. Once you take deeper dive the recent data is very bleak. The accepted offers in June 2020 are the lowest June in the past 15 years. Homes sold for a higher price than the month before but, for the first time in a quarter, and only up 2% from May.

Even during a downtrend the prices will create higher low data points while still trending lower to find the bottom. Some have stated that the Corona Virus shut down will create a pent up demand, I hope this isn’t the demand they were anticipating because it’s a blip on the charts.

The average sales price for June came in at 1.619Million, signalling the first positive data point since February. July will be hugely important in setting the next short term trend for the Greater Vancouver price chart. If the July is lower than 1.619Million there is a strong likelihood that a new aggressive downtrend will be established. The possible downtrend is indicated with the yellow downtrend marker. We have purposely used yellow as we need confirmation before the downtrend is established.

One anticipated trend that we have spoken on before is now coming to fruition, that being, the high end market is selling more readily than the lot value properties. Buyers are wanting the most bang for their buck and as a result they want the 17Million dollar mansion for 12Million and one such sale took place in June. Not too many buyers are purchasing spec land, this has an effect on the average price. Which means once those foreclosures roll in, and investors begin to dip their toes in the water. That will shift the focus from trying to buy the high end on the cheap to buying homes near lot value.

This also indicates that even while mansions are selling for very high numbers, the average price is still in the middle of the market threshold. Once the foreclosures hit and inventory is high, investors will begin buying deeply discounted lots which will force the average price to further decline. Then the market will panic, but in reality, the investors buying lower valued properties will indeed force the prices to drop but simultaneously be creating the market bottom. The pricing bottom will likely occur at 1.40 million if this threshold breaks we look to 1.225Million as the next threshold.

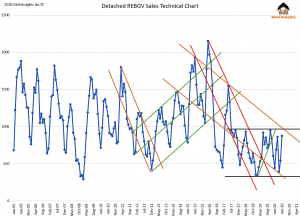

Detached Sales could be interpreted as “six of one and a half dozen of the other”. Simply meaning you will hear likely hear that the June 2020 sales were the highest over the preceding two year. Technically true, but the June 2020 sales was the lowest excluding the previous two year over the previous 15 years. Don’t let the language fool you when you hear best June in the previous two years. The past three years of June sales data are the lowest in the past 15 years. Not a great trend to be a part of yet Realtors and the Real Estate Boards will likely tout this as a win.

Another truth even though it may hurt some, the pricing peak for the market occurred in 2017, However sales numbers began to tank substantially since the frenzied mentality of 2015 & 2016. Sales numbers have not exceeded 1000 since June 2017, while the average over the previous 15 years is 1050. The reality is the Greater Vancouver detached market has been trending lower for many years already, while most analysts and definitely the GVRD real estate board have been saying we were nearing the end of the tunnel by being able to see light in 2019… Eitel Insights warned that the light was a train, not the end of the tunnel.

Last truth, we know sales are from previous months accepted offers. The accepted offers in June 2020 were only 561 and the absolute lowest June in the past 15 years. For context June 2019 accepted offers were 804, June 2018 were 755, June 2017 were 1,216, June 2016 were 1,446, June 2015 were 1,816. So much for best in the past 3 years, Eh? (Happy Canada Day)

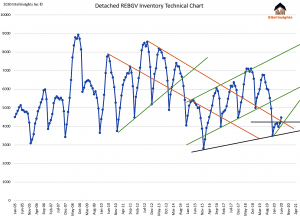

Sales are not good nor are they average in fact they are paltry, inventory is on the rise and will continue into 2021. None of this bodes well for prices in the short term.

Inventory finally surpassed 4200 active listings which hadn’t occurred since December 2019. The inventory currently sits at 4471. Once the mortgage deferral system comes to an end the inventory will rise rapidly.

Over the upcoming year an odd phenomenon will occur to the buyer’s mindset. Far from the chaos of 2015-2016 when frenzied buyers lined up and fought over who would pay the most in history for a home. Into 2021 a whole new kind of methodology will prevail, the fear of overpaying for a depreciating asset. When inventory is at the highs prices will be at the lows but purchasers will be fearful when they should be strong.

With all that said, purchasing when a market is actually at the lows of the cycle is a great idea .Eitel Insights will be releasing a full market analysis for Greater Vancouver in the upcoming week. We proudly announce that Eitel Insights will be promoted by Michael Campbell’s Money Talks. In this report we analyze all 20 markets inside of Greater Vancouver and update the data monthly so you can know exactly when and where the opportunities reside, which are currently rare but do exist right now.

With our newest product release you will know exactly where each market inside of Greater Vancouver is with respect to the individual market cycles, for prices, inventory, sales, moving averages, strength index, and our unique supply demand chart. Use our analytical interpretation for your actionable intelligence.

Not all markets in Greater Vancouver are created equal, some areas are closer to the bottom. While others still have significant percentage losses upcoming. Become an Eitel Insights client to find out which are which.

Dane Eitel

Founder & Lead Analyst, Eitel Insights

604 813-1418

Watch Eitel Insight’s Latest Video:

Yesterday offered another object lesson in this market’s inability to find direction, as a curious little ramping in EURUSD intraday toward the 1.1300 handle and a tempting break to a new 1-week high was quickly batted back lower, leaving EURUSD showing five consecutive days of near “doji” indecisiveness- classic! And given today’s holiday in the US, we may make it six days of extending the USD limbo. At present, the only currency with a proper “known unknown” on the immediate horizon is sterling, where it looks as if the Brexit talks are proceeding reasonably well, especially as the EU’s stance on the jurisdiction of the European court of Justice seems to be softening. The purest expression of GBP prospects are in EURGBP where we continue to eye the 0.9000 as a pivotal one as per Wednesday’s FX Update (also referenced below).