Bonds & Interest Rates

“Without question, if the Fed had not stimulated the economy with zero percent interest rates, two rounds of quantitative easing and operation twist, the initial economic contraction would have been sharper. But such short-term pain would have been constructive”.

The past week provided clear lessons not just in how central bankers have a limited ability to positively influence the economy but also how they are limited in their capacity to deliver the shortsighted policy actions that investors currently crave. The developments should provide new reasons for investors and economy watchers to abandon their faith in central bankers as super heroes capable of saving the economy.

The employment report released on Friday confirmed that the U.S. economy is stagnating at best and actively deteriorating at worst. While the numbers of jobs created in July was actually better than many economists expected, it was still far below the levels that would indicate a growing economy. But more important than the official unemployment rate (which ticked up to 8.3%) or the number of jobs created, is the number of people who have left the workforce out of frustration or despair. This number continues to head higher. The labor force participation rate, which is the percentage of healthy working age Americans who actually have jobs, is at one of the lowest points since women first started working en masse in the 1970’s. It’s also instructive to add back into the unemployment rate those who want full time jobs but who have had to settle for part time work. This figure, reported under the “U6” category, currently stands at 15.0%. This is just a 12% decline from the 17.1% high seen December 2009. In contrast the “official” (U3) unemployment figure has declined 17% from its peak.

In explaining these bad results, most economists simply look at the stimulating effects of monetary and fiscal policy,not at the problems that those measures create. As a result, it is assumed that not enough stimulation, in the form of quantitative easing or federal deficit spending has been applied to the economy. The next logical assumption is that if the measures of the past few years had not been applied, we would have seen much weaker results over that time. In other words, no matter how bad things are now, defenders of the status quo will always describe how bad things “could have been” if the Fed hadn’t stepped in. This counterfactual argument gets increasingly threadbare as the years wear on.

Rather than admit that its policies have failed, the Fed statement last week gave all indications that it will continue with its current inflationary policy to the bitter end. These are the same errors that inflated the stock and real estate bubbles and ultimately resulted in the 2008 financial crisis and our continuing economic malaise. Without any fresh ideas,Fed press releases have become a Groundhog Day repetition of the same pronouncements and diagnoses. Oddly, many market watchers are frustrated that the Fed has not telegraphed that more stimulus is forthcoming. While it should be obvious that our current “recovery” is dependent on monetary support, it should be equally plain that the Fed can’t actually admit that fragility without spooking markets. To be clear, QE III is coming, but the markets should not expect Bernanke to supply a precise timetable.

Without question, if the Fed had not stimulated the economy with zero percent interest rates, two rounds of quantitative easing and operation twist, the initial economic contraction would have been sharper. But such short-term pain would have been constructive. By not taking away the cheap-money punch bowl, the Fed has delayed the pain and prolonged the party. But to what end? So far all we have received is a tepid phony recovery that has sown the seeds of its own destruction.

In contrast, real economic restructuring would have resulted if the Fed had withdrawn its monetary props. This would have paved the way for a robust, sustainable recovery. Instead, the Fed helped numb the pain with unprecedented (and apparently permanent) liquidity injections. Its actions merely exacerbate the underlying imbalances that lie at the root of our structural problems, and thus act as a barrier to a real recovery. So long as the Fed fails to learn from its prior mistakes, the phony recovery it has concocted will continue to fade until we find ourselves in an even deeper recession thanthe one we experienced in 2008.

Those who believe that artificially low interest rates are needed now,fail to see the price that will be paid down the road. By keeping rates too low, the Fed continues to lead an overly indebted economy deeper into the financial abyss. However, its ability to maintain rates at such low levels is not without limits. Just as real estate prices could not stay high forever, interest rates cannot stay low forever. When rates finally rise, the extent of the economic damage will finally be revealed.

The sad fact is that no matter how impotent and dishonest Fed officials become, their elected rivals on Capitol Hill (who control the fiscal side of the equation) have become even less significant. The complete lack of any political conviction to take steps to confront our fiscal imbalances means that Ben Bernanke and his cohorts are seen as the only cavalry capable of riding to the rescue. But no matter how often they blow their bugles,our economy will continue to deteriorate until we stop waiting for a savior and instead fight the battle for prosperity ourselves.

Peter Schiff’s new book, The Real Crash: America’s Coming Bankruptcy – How to Save Yourself and Your Country is now available. Order your copy today.

For in-depth analysis of this and other investment topics, subscribe to Peter Schiff’s Global Investor newsletter. CLICK HERE for your free subscription.

Last week: my blog comments noted that, “This market wants to go higher“…this week: the major US and European stock indices all closed at new 3 month highs despite the mid-week sell-off on the lack of new programs from the Fed and the ECB. The US$ Index closed at a one month low…the AUD went to a 4 month high, while the CAD touched par for the first time in 3 months…US and CAD government bond yields rose.

Last week I noted:

1) We had Key Weekly Reversals higher in Euro, Swiss, CAD, AUD, DJI, S+P, TSE, Gold (in USD terms) US treasury yields from 2 through 30 year maturities, and a Key Weekly Reversal lower in the US Dollar Index.

2) Despite the manic-depressive mood swings, despite the torrent of capital rushing into perceived safe haven bonds, despite the seemingly intractable European debt crisis, despite the sluggish US and global economy… it seems that THE STOCK MARKET WANTS TO GO HIGHER…the DJI has rallied over 1000 points from the June 4 lows…over 2,700 points from the October 4 lows.

3) Why? It seems as though we are mainly trading off macro political or central bank inspired headlines…or rumors…its seems as though the markets expect central banks will take further reflationary action…will print more money…which will inspire risk on…and higher asset prices.

4) The technical view: Technicians make the point that you can never know all you need to know to make the best market decisions…but if you look at the market you can see what it’s doing…so freeyourself of your opinions about what the market should be doing…and look at what it is doing…the US stock market rallied right through this month’s previous highs and closed at its best levels in nearly three months…this market is a classic case of climbing a wall of worry.

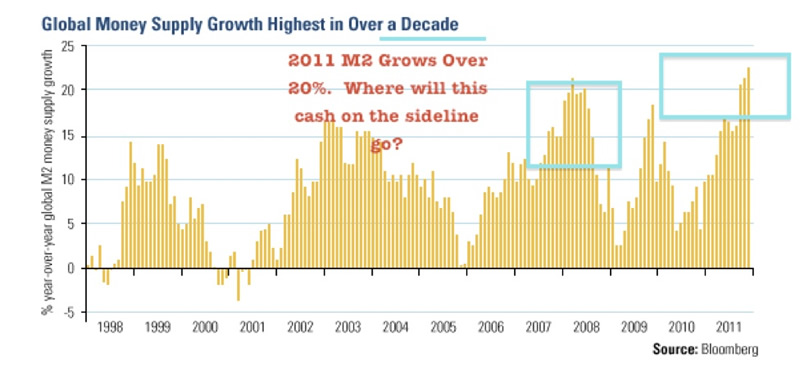

5) There has been a huge amount of cash sitting on the sidelines for the past few years due to economic and political uncertainty and that money could come into this market…taking it much higher…yes, the economic and political uncertainty that has kept that cash on the sidelines still exists…yes, those problems may only be intensifying…and yes, it’s entirely possible that the stock market may reverse tomorrow and drop a few thousand points before Christmas…but…since March, 2009, the US stock market has been trending higher and, as skeptical as I am and as skeptical as I have been, I have to say it looks like this market wants to go higher.

Trading:

For my short term trading accounts I’m long the

Market Psychology:

The dramatic crashes in the stock market, the commodity market, and the housing market over the last five years caused a real crash in investor confidence…in investor’s willingness to take on risk…we see that demonstrated by the high levels of corporate cash as companies are collectively cautious….with good reason, perhaps, but cautious none-the-less. Certainly investors are more likely to see the glass half-empty now than they were during the times of irrational exuberance. So despite the stock market rallies we can see in the charts below the tone remains fretful…fearful…as though worried that all the gains could be gone in a heartbeat…a classic example of a market climbing a wall of worry.

Charts Section:

The US stock market turned higher on (Key Turn Date) June 4 and has chopped higher ever since…now at its best levels in 3 months

The US stock market has been grinding higher for over 3 years…note the very rare and very powerful Monthly Key Reversal Higher in October 2011 (the DJI is up 2700 points from the Oct 4 Key Turn Date.)

The AUD (the high-beta risk-on/risk-off currency) has rallied over 10% since the June 4 Key Turn Date…

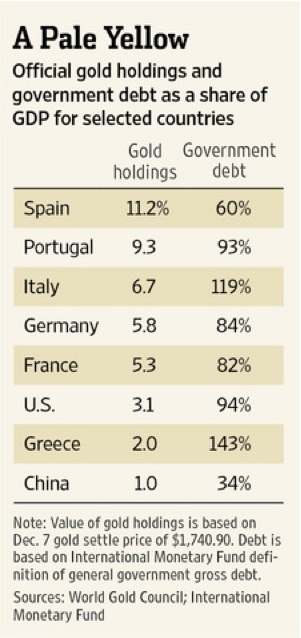

Gold made its All Time High above $1900 last August and has found a floor around $1525-30 several times since then. It popped above its s/t downtrend the past two weeks on USD weakness…a rally above $1630 could set up a test of $1700+ while a breakdown below $1550 would set up a test, and likely a break, of the $1525-30 floor.

Victor Adair

Senior Vice President and Derivatives Portfolio Manager

Contact Victor E-mail @ vadair@union-securities.com” data-mce-href=”mailto:vadair@union-securities.com“>vadair@union-securities.com

Victor Adair is a Senior Vice President and Derivatives Portfolio Manager at Union Securities Ltd. Victor began trading financial markets over 40 years ago and has held a number of senior positions during his long career as a commodity and stockbroker. He provides daily market commentary on CKNW AM 980 radio Vancouver and is nationally syndicated on Mike Campbell’s weekly Moneytalks radio show.

Victor’s trading focus is primarily on the currency, precious metal, interest rate and stock index markets and his clients are high net worth individuals and corporations.

Bill Bonner

Since founding Agora Inc. in 1979, Bill Bonner has found success and garnered camaraderie in numerous communities and industries. A man of many talents, his entrepreneurial savvy, unique writings, philanthropic undertakings, and preservationist activities have all been recognized and awarded by some of America’s most respected authorities. Along with Addison Wiggin, his friend and colleague, Bill has written two New York Times best-selling books, Financial Reckoning Day and Empire of Debt. Both works have been critically acclaimed internationally. With political journalist Lila Rajiva, he wrote his third New York Times best-selling book, Mobs, Messiahs and Markets, which offers concrete advice on how to avoid the public spectacle of modern finance. Since 1999, Bill has been a daily contributor and the driving force behind The Daily Reckoning. Dice Have No Memory: Big Bets & Bad Economics from Paris to the Pampas, the newest book from Bill Bonner, is the definitive compendium of Bill’s daily reckonings from more than a decade: 1999-2010.

Special Report: How Will Your Life Change If The U.S. Gov’t Can’t Borrow Another Dollar? Complete political and social unrest could be just the beginning. You owe it to your family’s safety and security to watch this urgent video report right now. There might not be much time for you to act… Don’t wait, watch now.

Read more: Uncharted Territory: An Interview with Bill Bonner http://dailyreckoning.com/uncharted-territory-an-interview-with-bill-bonner/#ixzz22lSLq4rV

“Equity markets on both sides of the border have had a good ride since their lows set on June 4th. The Dow Jones Industrial Average is up 8.8% and the S&P 500 Index has gained 9.8%. Investing in equity markets has become less attractive. Accumulation of seasonal trades on weakness continues to make sense as long as the seasonal trades are outperforming the market. Sectors in this category include agriculture, energy, leisure & entertainment, software and gold. A cautious bullish stance appears appropriate”.

Two major negative events and one positive event impacted equity markets last week. The negative events were no change in monetary policy by the Fed and no tangible news from European Central Bank head, Mario Draghi. The positive event was the employment report released on Friday. Unfortunately, news on these three events is unlikely to have a lasting impact on equity markets.

Economic news this week is quiet and is not expected to have a significant impact on equity markets.

Earnings news this week focuses on Canadian companies. Most of the biggest S&P 500 companies already have reported. A significant impact on equity markets is unlikely. Second quarter earnings continue to slightly exceed consensus earnings estimates, which, in turn are lower than the second quarter last year.

Macro events are expected to be relatively quiet this week. Watch out for the start of hurricane season!

North American equity markets have a history of moving flat to lower during the first two weeks in August.

Short and intermediate technical indicators for most equity markets and sectors are overbought, but have yet to show signs of peaking. Most equity indices and sector indices have entered into a band of intermediate resistance. Upside potential is possible, but limited.

North American equity markets have a history of moving higher from June to December during Presidential Election years. However, at least one correction during that period normally occurs.

Cash on the sidelines remains substantial and growing. However, political uncertainties (including the Fiscal Cliff) preclude major commitments by investors and corporations.

The S&P Energy Index added 1.49 points (0.28%) last week. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but continue to trend higher. Strength relative to the S&P 500 Index remains positive ‘Tis the season!

The above chart represents the seasonality for Crude Oil Futures Continuous Contract (CL) for the past 20 years Via EquityClock.com

Gold slipped $13.70 per ounce (0.85%) last week. Intermediate trend is down. Support is at $1,526.70 and resistance is at $1,642.40. Gold remains below its 200 day moving average, but bounced nicely on Friday from near its 20 and 50 day moving averages. Short term momentum indicators are neutral. Strength relative to the S&P 500 Index remains neutral/slightly positive ‘Tis the season!

The above chart represents the seasonality for Gold Futures (GC) Continuous Contract for the past 20 years Via EquityClock.com

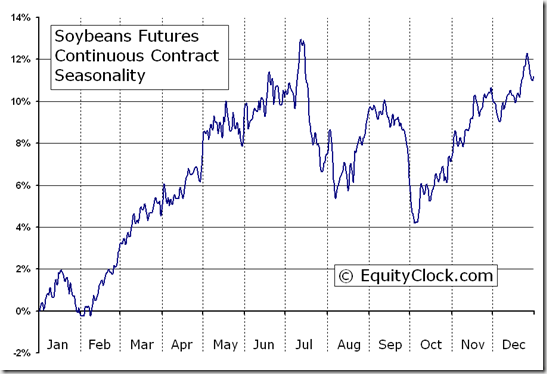

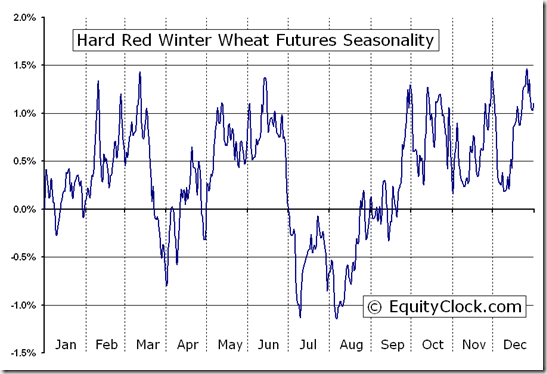

The Grain ETN added $0.46 (0.74%) last week. Intermediate trend is up. The ETN remains above its 20, 50 and 200 day MAs. Strength relative to the S&P 500 Index remains positive.

The Agriculture ETF slipped $0.48 (0.95%) last week. Intermediate trend is up. Units are testing resistance at $50.54. Units remain above their 20, 50 and 200 day moving averages. Short term momentum indicators are neutral. Strength relative to the S&P 500 Index is neutral/slightly negative.

About

Tech Talk / Timing The Market — Completely free seasonality, fundamental and technical analysis of the stock markets from a certified market leader. Market letters are published daily and are accessible though DVTechTalk.com and TimingTheMarket.ca. Comments in Tech Talk reports are the opinion of Mr. Vialoux.

Security positions held or not held by Mr. Vialoux will be indicated at the end of each Tech Talk report.