Personal Finance

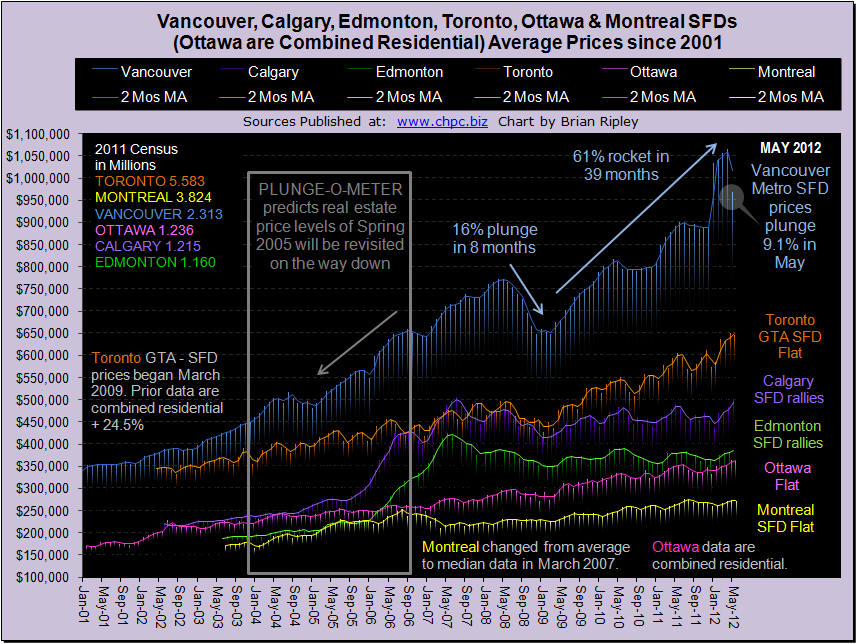

In May 2012 urban flippers met up with some price resistance despite energetic sales (Scorecard). Toronto and Ottawa prices stopped advancing, Vancouver prices fell off a cliff while in Alberta the animal spirits pressed on with Calgary prices bumping up against their top set way back in July 2007 (Plunge-O-Meter). The 10yr less the 2yr spread continues to narrow (36th month since May 2009). The last time this happened, the 10yr less the 2yr spread narrowed from Spring 2004 to Summer 2007 (similar duration as now) which set up the 2007-2009 crash. It’s an interesting comparison, buckle up.

In the panic correction into the March 2009 pit of gloom, the sell off was 16% (average price down $122,900). More charts and commentary HERE

The following chart from reader Tim Wallace shows three-month usage for March, April, May compared to the same three months in prior years.

The chart shows petroleum usage is back to levels seen in 1998. Gasoline usage is back to levels seen in 2002.

This chart is consistent with reports that show petroleum usage in the eurozone is expected to fall to 1996 levels.

For more details and an analysis of tanker rates, please see Oil Tanker Rates Lowest Since 1997 as Demand in Europe Plunges to 1996 Level, Production in US at 13-Year High; IMF Smoking Happy Dope.

14-16 years of petroleum supply demand growth has vanished.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Click HERE To Scroll Thru My Recent Post List including Merkel Bends, Equity Markets and Precious Metals Cheer, Bond Market Yawns; Lending to Peter so Peter Can Lend to Paul

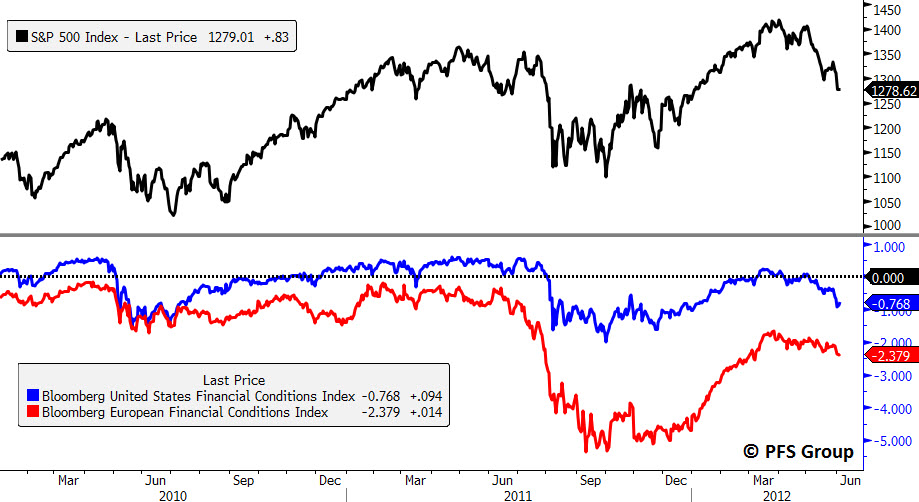

Investors are now faced with a dilemma. Where do they place money in an era of financial repression? Do they chase Treasury yields which are now in bubble territory? Or are there safe havens still available in the stock market? I thought I would never see the day where the yield on the Dow Industrials would exceed the yield on a thirty year Treasury bond. The current stock market correction has brought the PE multiple down to 12 on the Dow Industrials and raised the dividend yield up to 2.8%. Treasuries may be seen as a safe haven but they are also fraught with risk. What happens to the price on bond funds when yields eventually rise?

The worries that plagued the market over the last two years still remain: Europe’s debt difficulties, a hard landing in China, turmoil in the Middle East, and the U.S. fiscal cliff. All of those problems still hang over the market, Europe is in a recession, China’s economy is slowing down, and many of the BRIC countries are seeing economic growth soften as we are now seeing in the U.S. To make matters worse…

….read more HERE

Germany finalizing face-saving aid deal for Spain

The dismal U.S. jobs report for May, released last Friday, caused the price of gold to soar as the market appears to be pricing in an ever-greater chance of “QE3” – another round of quantitative easing by the Federal Reserve (Fed). But given that 10-year government debt is already down at 1.5%, the Fed may dive deeper into its toolbox in an effort to jumpstart the economy. Investors may want to consider taking advantage of the recent U.S. dollar rally to diversify out of the greenback ahead of QE3.

o a modern central banker, it may be very simple: if the economy does not steam ahead, sprinkle some money on the problem. The Fed has done its sprinkling; indeed, the Fed has employed what one may consider a fire hose. But after QE1 and QE2, we continue to have lackluster economic growth, unable to substantially boost employment. Never mind that the real problem the global monetary system is facing is that the free market has been taken out of the pricing of risk:

…..read more HERE