Mike's Spotlight

and the Horizon Looks Ominous. Money Save is Money Earned.

May 2020 will be remembered as the month CMHC finally turned negative. They stated the two major markets in Canadian Real Estate will be going lower for the remaining portion of 2020 and into 2021. Something Eitel Insights has been stating correctly since 2017. The CMHC forecast sounds very familiar if you think about it.

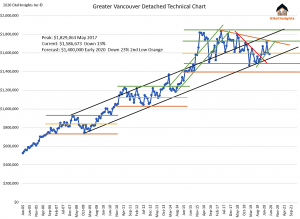

Eitel insights stated in 2017 prices had peaked and would decline until 2021 dropping from 1.830Million to 1.4Million. In 2018 we stated, if 1.4Million does not hold as a bottom then as low as 1.225Million would be tested.

The CMHC forecast as of May 2020 calls for a 9% – 18% drop. Interesting, since the average sales price in Vancouver was 1.6Million that would put their forecast at 1.45Million for 9% drop or 1.3Million at an 18% drop. Just a bit of a rosier colour than our forecast offered years ago.

The exactness of Eitel Insights forecasts been unmatched, while others have continued to flip flop their positions, we have remained true.

Greater Vancouver detached prices in May dropped to 1.585Million which is the middle threshold of the market cycle. Seemingly breaking the uptrend that has been prevalent since September 2019 and instigated with an average sales price of 1.5Million.

CMHC tightening the purchasing restrictions for mortgages with less than 20% down will only perpetuate the tough market conditions. With the old normal, prices were in decline, and our new normal is not very promising. Prices will continue to search for lower prices as the market goes forward. We do anticipate a test of 1.4Million in 2020 with 2021 confirming the market bottom.

Gone are the days of 10 year outlooks, Eitel insights has advised potential purchasers to steer clear from buying at the market peaks. To date over $245,000 (from 1.830Mil – 1.585Mil) saved if the temptation to purchase has been resisted through our analytical interpretation. The 10 year outlook, if purchased in 2016 after 5 years will be down by $430,000, once 2021 realizes the 1.4Million forecast. Meaning your investment is negative, which forces you to put more time and money into an asset that is underwater.

Once the bottom is confirmed by our analytical process, prices will begin to increase back up to the old market high and beyond. This is how Eitel Insights clients invest, we analyze and observe, and then step to the plate buy at the low echelon of the market cycle. We cannot wait to offer the opportunity to make money in the Real Estate market rather than saving you money like we have been, but remember, money saved is money earned.

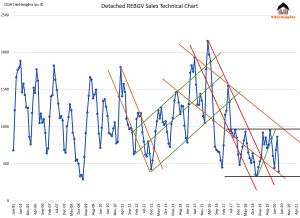

Sales are the headline, with only 544 detached sales taking place at land titles in May 2020. The accepted offers in May were only at 525. Which has been quoted as a great number compared to 370 in April and true enough but beating a lame duck doesn’t make you a champ.

Let’s take a look at the past 5 years of May accepted offers. 2015 had 1837, 2016 had 1820, 2017 had 1503, 2018 had 839, 2019 had 839, and of course we just had 525 accepted offers last month. This epitomizes what we have been try to explain would transpire. After peaks comes valley’s. The peak was frenzied, the bottom will look deserted. We advise purchasing during the desertion, while there is copious amounts of inventory and prices at the lower end of the market cycle.

The historically low sales numbers experienced recently, are occurring during the usual peaks, you can imagine what the sales number will look like during the seasonal market lulls.

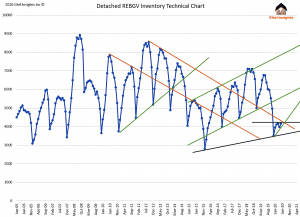

Inventory has hit an artificial ceiling of 4200 active listings across Greater Vancouver. This number has been tested twice thus far. Once the 4200 level is broken we anticipate the next levels to be broken with relative ease. The upcoming levels are 4500 and then of course 5000, at the 5800 level the market will meet up with the 15 year average.

One interesting point on the chart is the high levels of inventory during the market peak of 2017 was the seller’s choice to trade their property for an all-time high sale price. This upcoming high level of inventory will largely be out of need to sell. These upcoming sellers will have a very different modus operandi.

Once inventory return to normal levels which will inevitably occur, we anticipate the downturn in prices to return with gusto bringing the average price down an additonal $185,000 lower than the current price.

Again, Eitel Insights has saved a potential purchaser $245,000 to date with more savings on the horizon. Stick with the industry leader, since inception Eitel Insights have led all contemporaries.

Not all markets in Greater Vancouver are created equal, some areas are closer to the bottom. While others still have significant percentage losses upcoming. Become an Eitel Insights client to find out which are which.

Dane Eitel, Eitel Insights

Watch Eitel’s latest video:

“It’s strange what desire will make foolish people do..”

Where do financial markets go from here? Yesterday headlines were screaming US stocks are now positive for the year! Today it’s “Momentum stalls” as markets pause to consider just how high they’ve risen in the face of the US officially being in recession. The speed at which the 40% March crash has been reversed is “unprecedented”.

It’s not real.

We all know the rally and this market do not reflect any meaningful reality. Get used to it. This rally is not about value. It’s about day traders, get-rich-quick scams, FOMO, and, ultimately, who will be left holding the ticking parcel when it goes off… Read More

Food prices have risen at the fastest pace in more than 40 years and food makers and consumers are scrambling to find ways to mitigate the impact, The Wall Street Journal reported.

What Happened: Store-bought food prices rose at a seasonally adjusted 2.6% in April, marking the biggest monthly gain since 1974, according to WSJ. May data is scheduled to be released Wednesday and could show an acceleration in growth.

Food prices rose 5.8% for the 13-week period ended May 30, according to data from market research firm Nielsen.

This is partly due to companies buying new equipment, remodeling factories and configuring stores to better keep people safe from the COVID-19 pandemic…CLICK for complete article

Mobile games drive expansion

Globally, Covid-19 has accelerated an increase in consumer engagement with mobile games.

According to figures from Newzoo, the mobile games market will generate revenues of $77.2bn in 2020, representing year-on-year (y-o-y) growth of 13.3%. At the same time, the total of global smartphone users will grow to 3.5bn.

In terms of production, mobile games are relatively less affected by Covid-19 containment measures, as the development process for individual applications is simpler than for more complex platforms, and hence less prone to disruption.

Much growth in mobile gaming is coming from ‘mobile-first’ emerging markets.

This is partly attributable to the low barrier to entry in this segment, as there is no need to invest in equipment such as a gaming console, and many games use a free-to-play monetisation model.

Billionaire investor Ron Baron believes there’s still plenty of room for growth for Elon Musk’s Tesla and SpaceX companies.

Baron said Tuesday morning on “Squawk Box” that he believes “there’s 10 times more to go” with Tesla. He also said SpaceX, a privately held company, will grow by a multiple of 20 in the next 10 years. He previously predicted similar growth for Tesla.