Timing & trends

Ed Note: Mike’s Guest Tomorrow is David Bensimon:

Mark Leibovit spells it out in a quick 6 minute comment below. In short, Mark went on a Sell Signal back on March 5th and continues to think Markets are in a normal Negative Seasonal pullback that has further to go. Mark thinks there is still time for the bears to bring the Stock Market, as measured by the S&P 500, down below the recent low of 1292 and if he were an investor he would remain in Cash waiting for a confirmed low sometime between now and July.

As for agressive traders he would be biased to the short side.

Click on either image or HERE for all the details:

Click on image or HERE for all the details:

For some perspective on the long-term performance of the stock market, today’s chart presents the Dow priced in another global currency — gold (i.e. the Dow / gold ratio). For example, it currently takes less than a mere eight ounces of gold to ‘buy the Dow’ which is considerably less than the 44.8 ounces it took back in 1999. Priced in gold, the Dow has been in a massive 12-year bear market. Recently, the downtrend of the Dow (priced in gold) has slowed to its slowest pace since peaking at the end of the previous century. In fact, the Dow (priced in gold) is now testing resistance of its reduced downtrend channel thanks in part to a significant correction in gold itself.

Notes:

The usual parade of clueless commentators are scrambling to explain the ongoing plunge in risk assets worldwide. One of today’s “shocker” headlines is captured in the below clip: “Crude oil futures extended declines after the U.S. Energy Department said stockpiles rose to a 22 year high”.

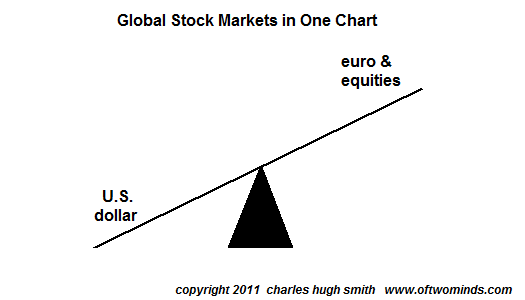

The global downturn is slowing world demand just as rising production continues to swamp the glut. (Remember all that (over) investment in the oil and commodities space during the past decade?) As Euro stress escalates and the global recession advances, the risk off teeter totter favors cash, the US dollar and treasuries over risk-credit, commodities and stocks. Remember this image to help understand present dynamics. It is precisely the pattern we have seen in previous bear markets. Ed Note: Bob Hoye also argues that in the post bubble economy “the serious money that’s still around goes to the most liquid items and that is gold, and it also is treasury bills in the worlds senior currency which is still the US Dollar.’

There is a link to a clip discussing today’s oil glut at Danielle Park’s Juggling Dynamite HERE