Gold & Precious Metals

Dear Reader,

Vedran Vuk here, filling in for David Galland. Today, I’ll discuss the scenario of a European recovery. Would one mean that we’re finally out of the woods? I have a couple of other interesting pieces along with the Friday Funnies, so let’s get started.

What If Europe Does Recover?

By Vedran Vuk, Senior Analyst

Let’s play along with the economic scenario many market participants are predicting: a calmer Europe. If the continent does recover, is it time to put on the party hats and celebrate? Well, not quite. Sure, the pressure on equities would ease up, causing a brief rise in the market. But what then? Are we really out of the woods?

If Europe escapes this mess without a major crisis, those countries won’t come back at a screaming pace. Instead, the path to economic recovery will still be a slow crawl. Furthermore, China continues to have problems of its own. What started as talk of a Chinese slowdown is turning into real numbers. Sure, China isn’t doing horribly, but it’s hardly the hot market of a few years ago. The promise of never-ending growth with minimal risk just isn’t materializing. There are also other major players with mixed performances. With commodity prices cooling a bit, Brazil’s GDP growth is projected at 3.2% in 2012, a slight improvement from last year’s 2.7% growth. However, only a few years ago, predicting double-digit growth rates would have drawn no laughter, based on Brazil’s impressive 7.5% growth rate in 2010.

And then there’s the US story. The job market is improving at a snail’s pace… much like the rest of the world. If the euro crisis ends, it won’t mean a burst of growth for the US – but it could mean some additional headwinds. US Treasuries will no longer be shielded by buyers protecting themselves from the worst-case scenario. As soon as the coast is clear, Treasury investors will leave in droves, either flooding back into equity markets or higher-yielding euro countries.

To Read More CLICK HERE

»» Strong U.S. earnings continued to prop up a number of equity markets. U.S. stocks outperformed for the week, but Asian indices lagged.

»» China has become a bigger swing factor for earnings results of multinational companies.

»» First-quarter U.S. GDP growth of 2.2% indicates the economy remains locked in a sub-par zone, making dividend investing and stock selection that much more important. (page 2)

»» Global Roundup: Updates from the U.S., Canada, Europe, and Asia. (pages 3-4)

Jordan Roy-Byrne

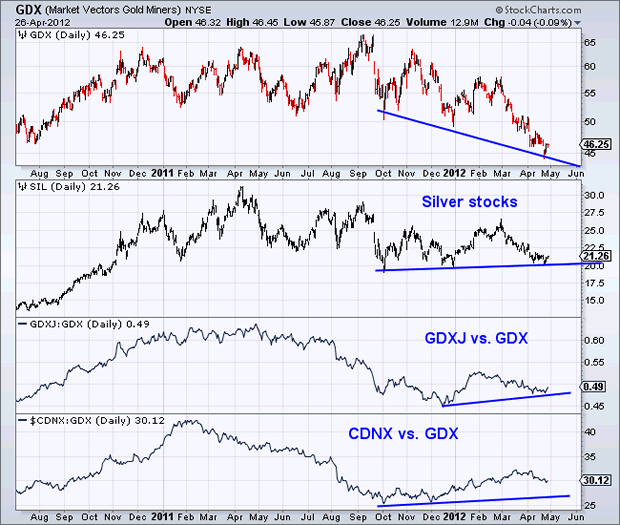

While the precious metals sector has consolidated and struggled to find a bottom, an important development has taken place. First, lets harken back to 2007-2008. Large cap mining stocks peaked in March 2008, yet the speculative sides of the sector “gave out” far earlier. The juniors and silver stocks actually peaked in April 2007. That was about a full year ahead of the large gold stocks. As the 2007-2008 crisis unfolded, juniors and silver stocks led the way down and displayed extreme relative weakness even as metals prices were firm.

Today, we have an entirely different and bullish development. As you can see in the chart below, the speculative areas of the sector have been outperforming the large gold producers (GDX). If this were really an end to the bull market or another collapse, the juniors and silver stocks would not be showing this kind of relative strength. In fact, the silver stocks have actually managed to hold near their 2010-2011 lows even as gold stocks have broken to new lows. We also see that the CDNX has been outperforming GDX since October while GDXJ has been outperforming since December.

GDX (Market Vectors Gold Miners) NYSE

Given the recovery of the past few days, we are likely witnessing the start of the next cyclical bull market for the gold and silver stocks which have essentially been in a cyclical bear or correction since December 2010. The above analysis implies that the more speculative areas of the sector, the juniors and silver stocks will be the leaders.

To Read More CLICK HERE