Gold & Precious Metals

by G.I.

For the blogosphere, the most entertaining part of the Federal Reserve’s meeting today was Ben Bernanke’s defence during the press conference against Paul Krugman’s charge that he has betrayed his academic past in failing to ease more aggressively and aim for higher inflation.

That is a pity because while it was great theater, it obscured a more important revelation. Not only is Mr Bernanke still a dove, he is increasingly an isolated dove, and that isolation has significant consequences for monetary policy, the economy and the markets.

The statement released by the FOMC was largely as expected and a non-event for markets: “economic growth [will] remain moderate over coming quarters and then … pick up gradually,” inflation will fall from its temporarily elevated levels to 2% or lower, and the Fed expects to keep interest rates “at exceptionally low levels … at least through late 2014.”

The projections released along with the statement were far more interesting. FOMC members reduced their forecasts for the unemployment rate, and nudged up the outlook for inflation. That hawkish combination was made doubly so by the fact that just four of the 17 FOMC members think the Fed should start tightening after 2014, down from six in January.

The hawkish impression was reinforced by Mr Bernanke’s defence against Mr Krugman (whose name never came up but whose New York Times Magazine article, judging by the questions, had been read by all the reporters in the room). Mr Bernanke flatly rejected the accusation that he is acting inconsistently from the advice he gave the Bank of Japan over a decade ago, noting that Japan was in deflation then and America is not now, in no small part thanks to the aggressively easy monetary policy the Fed has pursued. He went on to argue that deliberately targeting higher inflation as Mr Krugman advises (because it would reduce real interest rates) in pursuit of a slightly faster fall in unemployment was a “reckless” tradeoff. Judging from my twitter feed, Mr Krugman’s partisans outnumber Mr Bernanke’s by a hefty margin. Mr Krugman himself dismissed Mr Bernanke’s response as “Disappointing stuff.”

To Read More CLICK HERE

By: Bloomberg

Bill Gross of PIMCO spoke to Bloomberg TV’s Trish Regan this afternoon and said that he is doubtful of another round of quantitative easing in June, but “if we see some weak employment reports over the next two months, then QE3 is back on.” He also said that there’s a risk of a double-dip recession “if liquidity disappears.”

Gross went on to say that “euro land is a dysfunctional family…more dysfunctional than Democrats and Republicans in Washington, DC.”

Courtesy of Bloomberg Television WATCH VIDEO HERE

Gross on whether he’s betting on another round of quantitative easing:

“I don’t at the moment. I am willing to listen and I did listen intently at the press conference and to prior speeches from Janet Yellin and Mr. Dudley in New York. The big three at the Fed I think have moved closer to the middle in terms of the need for additional QE. They in the market are going to wait for the next eight weeks for two key employment Friday reports between now and then, as well as tomorrow’s GDP number, which I think should be judged in my opinion by nominal growth as opposed to real growth. The Fed does not target nominal GDP. They target inflation though. They want lower unemployment, which requires 3% real growth. So the 2 plus the 3 equals a 5% nominal GDP growth target, which the Fed really wants to shoot for. So watch tomorrow’s numbers and don’t be dissuaded by the 2.5% number or the 3% real growth number. It’s the nominal growth number that is key.”

On whether the Federal Reserve will resist an additional round of quantitative easing:

“I think so. The Fed does want unemployment to come down. It has been coming down. As a matter of fact, it’s lower than their prior projections were. There’s little doubt in my mind that a target for unemployment of at least 7% and perhaps lower is what they’re shooting for and that is going to require, 6, 12, 18 months, in my view. It might and probably will require, maybe not on June 30, additional quantitative easing. Quantitative easing is basically writing checks. The Fed’s been writing checks, the ECB has been writing checks, the Bank of England has been writing checks, even the Bank of Japan has been writing checks. This is $2-3-4 trillion worth of check writing that has supported financial markets, but in turn has allowed for employment growth and lower unemployment. I really think that it’s required. I don’t welcome it from the standpoint of the negative consequences, but I think it is required.”

On whether he would rule out QE3 down the road:

To Read More CLICK HERE

BY CHRIS CIOVACCO

As we mentioned Tuesday, the reaction to Wednesday’s Fed statement is important to the market’s intermediate-term direction. However, Apple’s (AAPL) strong earnings have provided investors with a reason to step up to the buyer’s plate. From Bloomberg:

Apple Inc. (AAPL) profit almost doubled last quarter, reflecting robust demand for the iPhone in China and purchases of a new version of the iPad, allaying the growth concerns that sliced shares 12 percent in two weeks.

Since Europe continues to be the possible “fun sponge” for the bullish party, and Germany tends to pay the uncomfortable European clean-up tabs, the German DAX Index has served as a good proxy for the tolerance for risk assets. Germany has had a strong start to trading on Wednesday. Later in this article, we review the longer-term technical backdrop for the German stock market.

Picking market tops and bottoms is difficult at best. It is better to think in terms of a probabilistic bottom or top. One way to help discern if it is probable for a market to move higher is to look at long-, intermediate-, and short-term trendlines on both an absolute and relative basis.

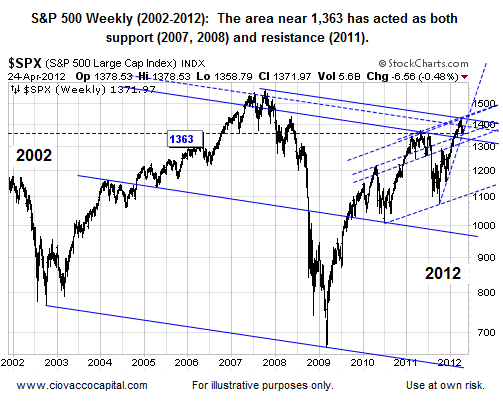

When reviewing the charts below ask yourself, “Does this market seem to be at a logical point where a reversal could take place?” If the answer is “yes”, then we become more open to a possible buying opportunity. A few weeks ago we identified 1,363 as a possible point of inflection for stocks. The S&P 500 has been testing 1,363 for two weeks. On April 10, the S&P 500 closed at 1,358, which thus far has represented the lowest close during the current pullback. While we want to see some real conviction from buyers, the chart below seems to have a reasonable probability of producing a reversal to the upside.

To Read More CLICK HERE

By Bill Bonner

“Monetary policy cannot fulfill each and every market expectation.”

So said the head of the Bundesbank, Jens Weidmann.

Why not, investors want to know.

Mr. Weidmann was talking to The Wall Street Journal. He was explaining why Germany was sticking to its guns. They don’t use that expression in Germany. But you know what he meant.

“The crisis can be solved only by embarking on often-painful structural reforms,” he insisted. “If policy makers think they can avoid this they will try to.”

Mr. Weidmann is talking about the present. He is also describing the future. In the old world there is a backlash growing against the Germans and their financial guns. Austerity doesn’t seem to work. Countries try it. They cut spending. They fire people. They get nothing from it. Their budgets are still far out of balance, with deficits way above the 3% limit demanded by the European Union. Unemployment goes up. GDP goes down. Unhappy mobs start breaking windows. Why bother?

Look what is happening in Britain, for example. The Telegraph reports:

The unexpected 0.2pc contraction in UK growth followed a 0.3pc fall in gross domestic product (GDP) in the fourth quarter of 2011, signalling a technical recession and Britain’s first double-dip since 1975.

Economists had expected the Office for National Statistics data to show the economy grew by 0.1pc between January and March.

The Prime Minister said the figure was “very, very disappointing” but added that that it would be “absolute folly” to change course and jeopardise Britain’s low borrowing rates. He told Parliament:

“We inherited from [Labour] a budget deficit of 11pc. That is bigger than Greece, bigger than Spain, bigger than Portugal […] The one thing we mustn’t do is abandon spending and deficit reduction plans, because the solution to a debt crisis cannot be more debt.”

Of course, you might look at these facts and conclude that they are not trying hard enough. Instead of making smallish cuts…why not make big ones? Why not actually balance government budgets so that they can tell German central bankers to drop dead?

Everyone agrees that that would be too radical. It would invite “social upheaval.” Apparently, actually living within your means is no longer politically or socially acceptable. You have to live beyond your means… The only question is ‘who will pay for it?’ The answers to that question are not easy. When debt levels were low, the answer was probably ‘future generations of taxpayers.’ At today’s debt levels it is unlikely that the debt will ever reach future generations. And with so much of the debt now being taken up by the central bank the burden shifts, from lenders to borrowers, taxpayers and consumers. Good debts may fall on debtors…even those who are not even born yet. But bad debt and inflation float down like leaves…blown by the winds…and eventually dropping down on innocent passers-by.

READ MORE: The Burgeoning Scam Market