Gold & Precious Metals

“There is no life I know to compare with pure imagination. Living there, you’ll be free if you truly wish to be.”

– Willy Wonka

Chock another one up to the “let’s look like we’re doing something” category …

Hypothetical scenario:

Suppose all 5th grade teachers at a given elementary school give their students ample amounts of candy before recess each day. This sugar high has led to wilder children on the playground. It has also emboldened the kids to act more dangerously as their risk-taking is near perfectly correlation with their classroom popularity. Taken together, the now rowdier mob of children has led to an increased number of serious injuries on the playground. And pretend for a moment that the rest of the student body is responsible for the hospital bills of these injured 5th graders. And pretend that prior to the teacher’s decision to sugar-up her students before recess the rate of injury was insubstantial. What might they do to mitigate the increased cost the public must pay for the hospital bill?

Easy. Lower the heights of the playground equipment and pay new playground police to monitor the situation closely. But don’t alter the pre-recess candy supply (maybe even increase the supply if the kids begin to look sluggish now that the playground equipment isn’t as inviting …)

President Obama is talking tough – he’s going to crack down on the problem that’s driving gasoline prices beyond tolerable levels. He’s going to crack down on those wretched speculators.

Obama is urging the CFTC use its clout to get tougher on those trading in the crude oil futures market. Specifically, he wants to see higher margin rates per contract and wants them to enact some form of position limits to mitigate any abnormally large long positions that could serve to manipulate crude prices higher.

Ted Butler would be proud. [If you don’t know Ted, he’s been all over the CME and COMEX and the regulators to rain down on such large short positions that are allegedly manipulating precious metals’ prices lower. It will be interesting to see if this do-something attitude being applied to the crude oil market will translate to the precious metals et al.]

All that said, here’s a short list often used on a day-to-day basis to explain the fluctuation in crude oil prices:

Geopolitical risk (e.g. what might result from butting heads with Iran)

Supply/demand changes (e.g. falling energy consumption in the US or depletion of existing well output rates or Saudis pumping overtime or supertankers running out of gas or …)

Inflation hedge (e.g. hold real assets in case prices soar as a result of the declining purchasing power of the US dollar—the currency in which most commodities are priced)

Broad-market risk appetite (e.g. commodities moving in line with “risk assets” driven by growth opimtimism)

Let me say this: speculation is a necessary and natural form of price discovery in the markets. It is this price discovery that sends signals to all market players, financial and real. The pricing system is the core of the market system and what makes capitalism the best and more efficient way to structure an economy. Period! End of story.

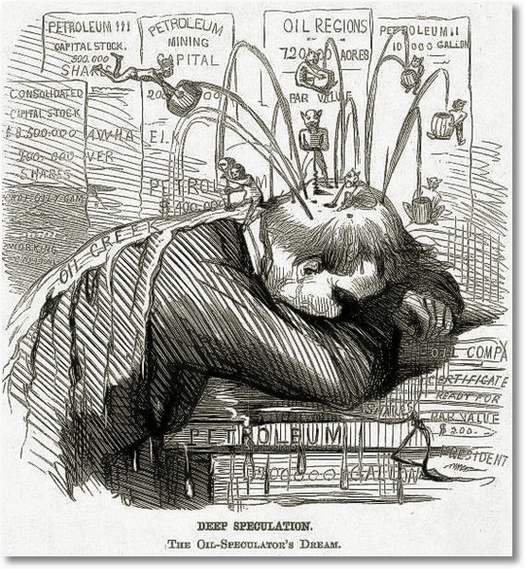

Yet politicos, through the ages, have attacked speculators as devious manipulators who are the cause of all ills economic. There is nothing new here; it’s the same tired scapegoat rhetoric.

Granted, there are speculative premiums embedded in prices; that is a fact and will not change as long as you have actively traded markets. Sometimes these premiums will be out of line, and those betting the wrong way will be punished by Mr. Market. But over time the real supply/demand dynamics will rule the day. Not speculation. Though I am not a big believer in so-called equilibrium, I do believe prices will trend toward some supply and demand equilibrium over the longer term. It’s true for oil, wheat, corn and every actively traded commodity. It has always been that way. This doesn’t mean markets or market mechanisms are perfect. They are not. And it doesn’t mean market efficiency can’t be improved. It doesn’t mean politically-protected con-artists—read Jon Corzine—should not be thrown in jail forever.

Liquidity.

Down here in Florida we are represented in the Senate by Republican Marco Rubio and Democrat Bill Nelson. Marco is good, but not perfect. Bill isn’t so good. In fact, he recently delivered the government’s preferred approach to crude speculators in an interview with CNN where he promised these recently proposed efforts were not “political”. He then passed around a YouTube link to that interview. Here is the interview with Mr. Nelson if you can sit through it without a barf-bag at your side: http://youtu.be/Rz3kysPnudU

I felt compelled to write him.

To Read The Rest CLICK HERE

Ashraf Laidi

Forced Liquidation or Improved Sentiment?

Recent intermittent bounces in EURUSD in the face of surging Eurozone spreads are said to be reflecting possible liquidation by European banks unloading US assets to relieve an ensuing shortage of US dollars. Other explanations were attributed to the IMF buying Irish and Portuguese bailout tranches during the late European trading hours, taking advantage of cheaper levels (lowest since Feb 15). But as long as traders find no confidence in battling the coordinated efforts of asset-buying central banks and the Fed produces no new dissenters to the ultra low rates til 2014 mantra, risk currencies may be assured to find support.

Spanish government bonds are now the latest victim of bond traders typical one-country assault amid speculation that Spain will be the 4th recipient of a Eurozone bailout. At a time of deepening recession, Spanish authorities have selected education and health sectors for 10 billion in budget cuts. Cuts in these sectors have yet to prove successful or sustainable the he Eurozone. Little surprise that the biggest yield gainers are of nations, which have not yet been bailed outSpain and Italy. Considering that Greece, Ireland and Portugal were each bailed out when their 10-year yields crossed the 7% level, we ought to watch Spanish yields, currently at 5.9%.

The chart below shows how zero purchases from the ECBs Securities Market Programme (SMP) was replaced by the LTRO-1/2 program and Greek Private Sector Initiative deal (PSI), all of which were effective in shorting up risk appetite and the euro at the expense of sovereign yields. Unless the ECB acts with the next dosage of stimulus (LTRO, SMP or swap operations with the Fed, EURUSD is most likely to finally break the $1.2950 floor.

CLICK HERE to Read More

Eric Fry

Derivatives are the “meat and meat by-products” of the financial markets. They look, smell and taste just like regular securities, but almost no one understands why we need them in the first place. After all, what’s wrong with actual meat? Or to re-phrase the question: Is Spam really an advancement over ham?

More importantly, can we trust the derivatives markets? Or might they be toxic? Might they subject the financial markets to devastating side effects?

No one really knows…and since lab rats refuse to eat them, we must assess the risks of derivatives by relying on suppositions, theories and conjecture. Therefore, as a public service, your California editor will offer a few suppositions, theories and conjectures about the rapidly expanding derivatives markets.

The worldwide marketplace of financial derivatives is enormous. No one disputes that fact. But the potential destructive impact of these arcane, opaque securities is very much in dispute.

The apologists for financial derivatives usually say something like, “Sure, the derivatives markets are huge on a gross basis, but relatively small on a net basis.” According to this logic, a bank that purchased $1 trillion worth of Spanish interest rate swaps from one-party, but also sold $1 trillion worth of Spanish interest rate swaps to another party, has zero “net exposure.”

Mathematically, that statement is correct. Realistically, it is a delusion. If the financial markets should hit a pothole or two, that “zero net exposure” has the potential to behave a lot more like the $2 trillion of gross exposure. How could that happen? Very simple. One or more of the parties to these enormous transactions would have to renege on its obligations, thereby triggering a domino effect. Very simple…and not difficult to imagine.

In fact, we’ve already seen the trailer for this horror film. The bankruptcy of Lehman Brothers in 2008 was not only the demise of a prestigious investment bank, it was also the demise of a major counterparty to numerous derivatives contracts. Without Lehman, billions of dollars’ worth of “zero net exposure” suddenly became billions of dollars of plain, old exposure — i.e., unhedged risk.

But that’s when the US Treasury stepped into the path of the falling dominoes with trillions of dollars of newly printed cash and government guarantees. As a result, the dominoes did not merely stop falling, but Wall Street banks were also able to take their fallen dominoes to the Fed and trade them for cash. Pretty nifty, no?

To Read More CLICK HERE