Personal Finance

»» Eurozone sovereign debt headwinds from Spain jostled global markets and

weighed on European equities, particularly on the region’s banks. However,

Asian and U.S. markets withstood the pressure relatively well.

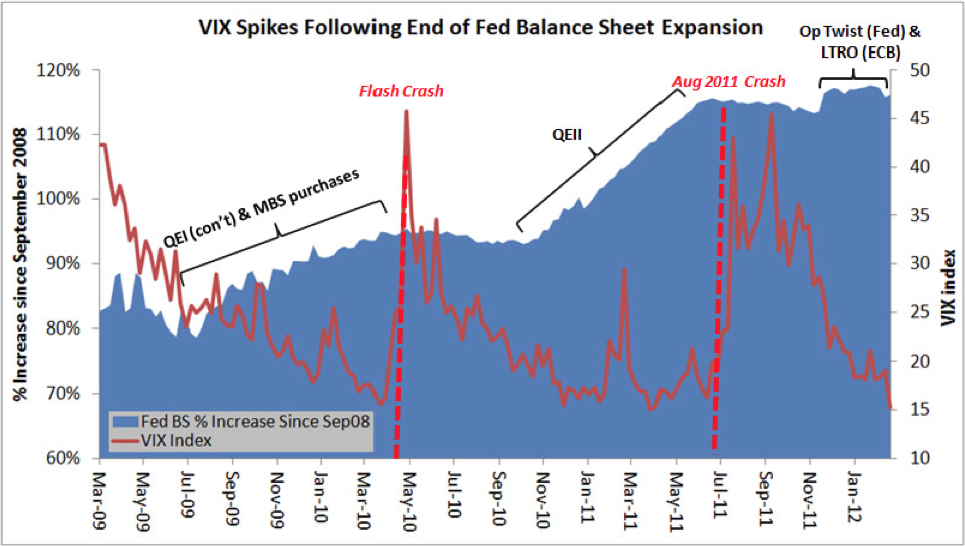

»» Mixed signals from the Fed contributed to the pullback in precious metals and

Canadian equities.

»» Skepticism about Spain’s aggressive austerity plan and economic growth

prospects seem well-founded. Current firewalls may be inadequate. (page 2)

»» Global Roundup: Updates from the U.S., Canada, Europe, and Asia. (pages 3-4)

For the complete report as well as Daily Updates CLICK HERE.

“Artemis Capital Management, whose latest epic letter is an absolute must read for all” – ZeroHedge

Imagine the world economy as an armada of ships passing through a narrow and dangerous strait leading to the sea of prosperity. Navigating the channel is treacherous for to err too far to one side and your ship plunges off the waterfall of deflation but too close to the other and it burns in the hellfire of inflation. The global fleet is tethered by chains of trade and investment so if one ship veers perilously off course it pulls the others with it. Our only salvation is to hoist our economic sails and harness the winds of innovation and productivity. It is said that de-leveraging is a perilous journey and beneath these dark waters are many a sunken economy of lore. Print too little money and we cascade off the waterfall like the Great Depression of the 1930s… print too much and we burn like the Weimar Republic Germany in the 1920s… fail to harness the trade winds and we sink like Japan in the 1990s. On cold nights when the moon is full you can watch these ghost ships making their journey back to hell… they appear to warn us that our resolution to avoid one fate may damn us to the other.

….read it all HERE

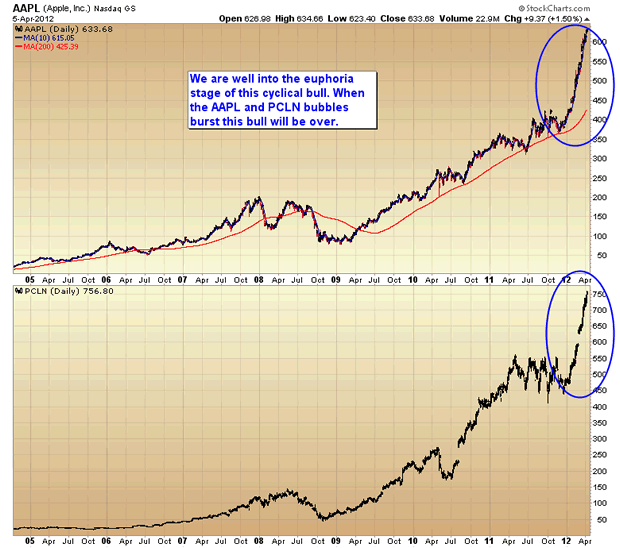

Two stocks, AAPL and PCLN, have been the leaders of this bull market. Both have entered the euphoric “bubble” stage. When the Apple and Priceline parabolas break it will almost certainly signal the end of this bull market.

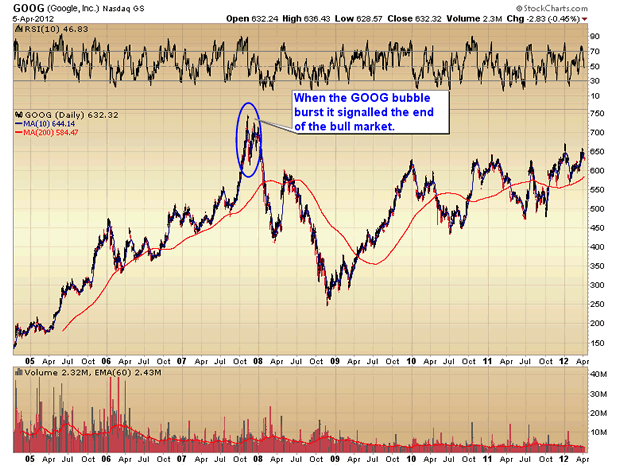

The last bull ended when the leading stock, GOOG, entered a parabolic “bubble” phase. That was the signal that the bull had reached the euphoria stage. When the GOOG bubble popped it signaled the end of the bull market.

Apple is now stretched 49% above the 200 day moving average. Anything between 50 and 60% above the mean is extreme dangerous territory.

As I pointed out in my last article the dollar is beginning its second daily cycle up in what could very well be a cyclical bull market. This should correspond with the stock market topping and the next leg down in the secular bear market.

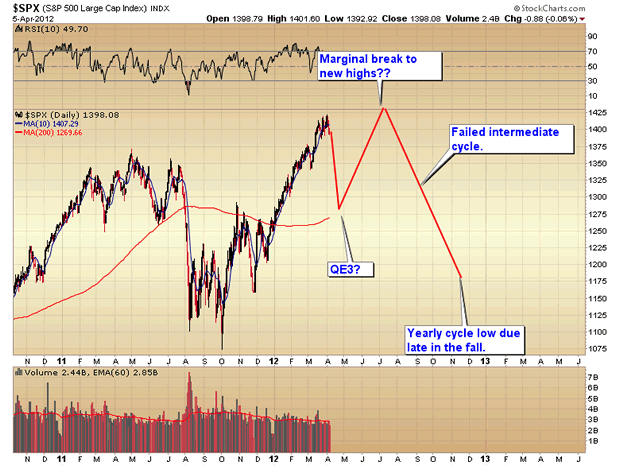

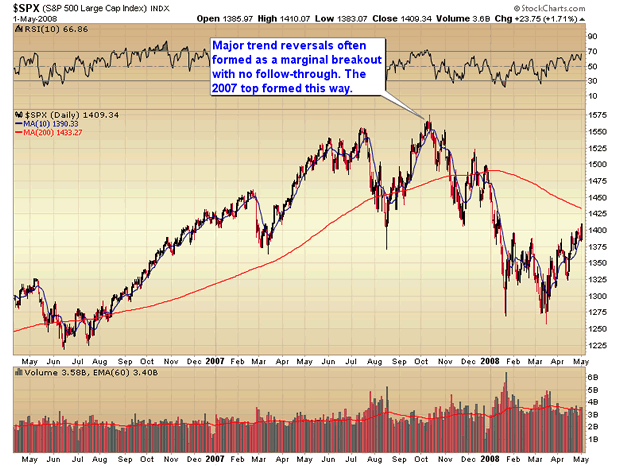

My best guess is that we will see a sharp selloff over the next 2 to 3 weeks, followed by a sharp rebound (QE3) that may, or may not, move stocks to marginal new highs, similar to the 2007 top.

The poor employment report on Friday is the first warning shot across the bow that the economy is slowing in preparation for moving down into the next recession/depression.

Bernanke is in the same position he was in 2007. Printing more money won’t stop the collapse. It will only continue to spike the price of energy and exacerbate the decline.

About Safehaven

At some point in your life you will want to, or be forced to consider an investment program. The main criteria in choosing one that is right for you is summed up in three words “Preservation of Capital”. Sounds pretty simple doesn’t it? Remember, “Investing is not Saving”! The mainstream media would lead us to believe otherwise and seldom comment on the risks inherent in equity ownership or debt investments. They are quick to point out the positive aspects of every news event with prepared soundbites of information. They provide simple, continual commentary on the respective markets to show they are up to date with the latest developments. They don’t comment on developing trends until the trend is obvious to everyone; acting as cheerleaders for the greatest bull market of the twentieth century. A cautious and more reasoned approach is needed.

We are not permabears, nor are we bullish for the foreseeable future. The Stock Market Bubble is not our greatest concern. The Credit Bubble, however, when it inevitably implodes, will wreak havoc on all sectors of the World Economy, including the Stock Market.

The articles from GoldenBar and PrudentBear are all a must read. As a starter, we suggest you read On the Manipulation of Money and Credit by Doug Noland of Prudent Bear and Inflation versus Deflationby Ed Bugos of GoldenBar. These articles help towards an understanding of the Bubble and monetary inflation. GoldenBar articles are published bi-weekly, and PrudentBear is published Wednesday and Friday evenings. Please visit their web sites.

If you have an interest in long-term cycles, then start with Generations and Business Cycles by Michael A. Alexander and Measuring Financial Time: The Magic of Pi by Barclay T. Leib.

Also strongly recommended is David Jensen’s In Denial of Crisis and Antal Fekete’s two series,Revisionist View of the Great Depression and The Goldbug Variations I.

We won’t update every hour of every day- it is not necessary. Bull and bear markets evolve over many months and years, and a single news event has never changed the long-term direction of markets. If you have written an article, if you wish to provide a link to a newsworthy item, or if you have comments, suggestions, or recommendations, please Contact Us.

The site has been kept simple to allow quick download times and to keep problems with old browsers to a minimum. If you are having a problem, please email us and we will try to adjust for your browser or printer.

Enjoy your visit and visit often!

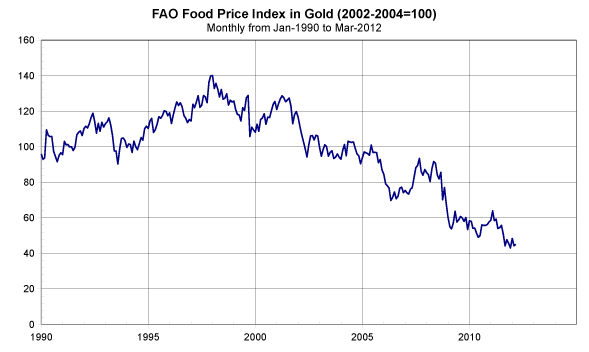

Jim Rogers: Farmers will make ‘huge’ amounts of money… An aging workforce… China pushes agriculture…

- In an interview with China’s national English-language newspaper China Daily, legendary investor and commodities bull Jim Rogers sang the praises of farming. Rogers said you’ll “make a huge amount of money” if you buy a farm and become a farmer today… “The price of your products is going to go up. You’re going to make more and more money every year… The price of your land is going to become more and more valuable.”

- Rogers, ever the contrarian, believes farmers will be some of the most successful people in the world over the next 20 to 30 years. (He noted how terrible the business has been for the past 20 or 30 years.)

- Today, farmers are dying out. The average age of a farmer in America is 58. It’s 66 in Japan. But the world still needs food (more and more, in fact). Still, farming will have to become more profitable in order to attract labor and capital.

- We expect the situation in farming will develop a lot like the mining sector… We discussed the global shortage of mining employees in the November 16, 2011 Digest. As demand and prices for metals increased, the normally low-margin business of mining improved. But the workers weren’t there:

According to Sigurd Mareels, director of global mining for McKinsey & Co., there’s a “historical shortage” of mine workers around the world. Australia, the world’s largest source of iron ore and the second-largest gold producer, needs an additional 86,000 workers by 2020, according to the Minerals Council of Australia. That’s on top of the current work force of 216,000. Miners in Australia – some of whom commute from the Philippines and New Zealand – make between $100,000 and $200,000 a year.

“It’s a tight labor market and difficult cost environment,” said Ian Ashby, president of the iron-ore division at BHP Billiton, the world’s largest miner. To attract workers, BHP and other miners are building recreation centers, sports facilities, and art galleries in mining towns. Costs to attract and pay new talent decreased earnings by $1.2 billion in the first half of 2011. (BHP Billiton still earned $11.2 billion over that period.)

In farming (as with mining), we expect capital will be pulled into the sector as the products become more attractively priced and the return on that capital gets better.

- If you don’t want to become a farmer, don’t worry… There are still ways to profit from the boom. For example… Rogers suggests you can sell seeds, fertilizer, and tractors.

- The biggest driver of food demand is China. Food is one of the first things people spend their money on as they get a little bit wealthier. As China’s economy modernizes, its gigantic population is growing wealthier and will spend some of that money on eating better.

The Chinese government knows the country needs food… It’s already giving incentives to farmers. As we noted during our time in Hong Kong…

Jing Ulrich, the JPMorgan managing director who spoke at the Hong Kong conference, said the Chinese central bank cut the reserve ratio by two percentage points (in addition to the two previous cuts) for several hundred branches of the Agricultural Bank of China earlier this month. Lower reserve ratios mean the bank may hold less of its deposits in reserve, freeing capital for lending.

“It’s March,” she said. “Planting season is coming.” The move will allow the Agricultural Bank to lend more money to the Chinese agricultural sector. The central bank wants to specifically support local agriculture with its latest stimulus efforts.

Jim Rogers also just gave an interview to our own Frank Curzio, editor of Phase 1 Investor and Small Stock Specialist. On the latest installment of Frank’s S&A Investor Radio podcast (now available), Rogers – whose bullish view of gold is well-known – explains why he expects a pullback in the precious metal… and what might lead him to short it. To listen for free to all of Frank’s podcasts, click HERE.