Gold & Precious Metals

Said another way one could argue that we are in the golden age of the individual investor. That might seem like an odd thing to say coming off what some people call a ‘lost decade for stocks.’ However over that same time period the technological advancements that made Web 2.0, like Facebook, Twitter andLinkedIn, possible have also led to unprecedented opportunities for investors not previously seen.

We are for the moment leaving aside the state of the markets at the moment. We could have written this same post a couple of months ago when the stock market was 20% lower. We are also leaving aside the issue of whether the zero interest rate policy of the Federal Reserve represents a “war on savers” or is simply the byproduct of necessary policies. The failure of MF Global and the systemtic risks it poses for all account holders are also outside the scope of this post.

This is not a novel theme for us. Indeed one thing we note in our forthcoming book, Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere, is that investing has never been “cheaper or easier.” Some of this has to do with the rise exchange traded funds. In other respects it has to do with the blossoming of the options markets. In large part, it has to do with technology. In short, never before have investors had access to data, analysis, opinion and social tools that are commonplace today. Let’s take these points one by one.

- Easier: Investors today can with a brokerage account and a computer is now only a few mouse clicks away from a globally diversified portfolio of ETFs that in terms of expenses rivals what institutions paid a decade ago. For all intents and purposes the expense ratio on the big ETFs iscloser to 0.0% that 1.0%. Many brokers now allow online trading of individual bonds and overseas securities.

…read points 2-5 HERE

Investor Jim Rogers, the chairman of Rogers Holdings who predicted a global commodities rally in 1999, said Myanmar is embracing reform as China did decades earlier and he’s optimistic about the resource-rich nation’s prospects.

If I could put all of my money into Myanmar, I would,’ Mr Rogers said at a conference in Singapore yesterday. ‘Myanmar is in the same place China was in early 1979, when Deng Xiaoping said we have to do something new. Myanmar is now opening up.’

Mr Rogers’ comments highlight increased investor interest in the economy that may be Asia’s ‘next economic frontier’, according to the International Monetary Fund (IMF).

The IMF is pushing for an overhaul of Myanmar’s finances as President Thein Sein releases dissidents and engages with opposition leader Aung San Suu Kyi in moves that have prompted the US and Europe to reassess sanctions against the former military dictatorship.

‘It’s right between China and India, 60 million people, massive natural resources, agriculture,’ Singapore-based Mr Rogers said at the gathering organised by New York-based INTL FCStone Inc. ‘You could feed much of Asia, they have metals, they have energy, they have everything.’

China’s Deng introduced capitalist reforms in the late 1970s, lifting more than 200 million people out of poverty and transforming the nation into the world’s second-largest economy and its biggest consumer of steel, copper and coal.

‘In 1962 Myanmar was the single richest country in Asia,’ said Mr Rogers, referring to the year that marked the start of military rule. ‘Now it’s the poorest because it’s been so badly managed in the past 50 years. But they are changing that now.’

Myanmar may grow 5.5 per cent in 2011-2012 and 6 per cent in 2012-2013 on commodity exports and higher investment, the IMF said last month. The country ‘could become the next economic frontier in Asia’ if it takes advantage of its natural resources and proximity to China and India, according to Meral Karasulu, who led an IMF mission to the country in January.

George Soros, the billionaire investor, said last month he had visited Myanmar recently and the president and his ministers ‘genuinely want an opening’.

Rice exports from Myanmar, formerly the world’s largest shipper, may more than double to 1.5 million tonnes this year, the Myanmar Rice Industry Association forecast last month. Sales totalled 700,000 tonnes in 2011.

China and India share more than 3,600km of border with Myanmar, whose 64 million people earn an average of just US$2.25 per day, according to IMF estimates. Both nations have sought increased access to the nation’s reserves of natural gas. — Bloomberg

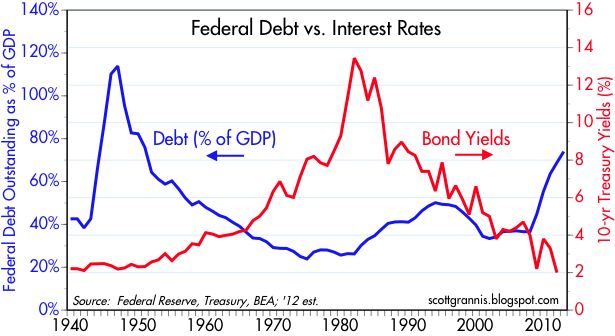

- Recent central bank behavior, including that of the U.S. Fed, provides assurances that short and intermediate yields will not change, and therefore bond prices are not likely threatened on the downside.

- Most short to intermediate Treasury yields are dangerously close to the zero-bound which imply limited potential room, if any, for price appreciation.

- We can’t put $100 trillion of credit in a system-wide mattress, but we can move in that direction by delevering and refusing to extend maturities and duration.

The transition from a levering, asset-inflating secular economy to a post bubble delevering era may be as difficult for one to imagine as our departure into the hereafter. A multitude of liability structures dependent on a certain level of nominal GDP growth require just that – nominal GDP growth with a little bit of inflation, a little bit of growth which in combination justify embedded costs of debt or liability structures that minimize the haircutting of or defaulting on prior debt commitments. Global central bank monetary policy – whether explicitly communicated or not – is now geared to keeping nominal GDP close to historical levels as is fiscal deficit spending that substitutes for a delevering private sector.

Yet the imagination and management of the transition ushers forth a plethora of disparate policy solutions. Most observers, however, would agree that monetary and fiscal excesses carry with them explicit costs. Letting your pet retriever roam the woods might do wonders for his “animal spirits,” for instance, but he could come back infested with fleas, ticks, leeches or worse. Fed Chairman Ben Bernanke, dog-lover or not, preannounced an awareness of the deleterious side effects of quantitative easing several years ago in a significant speech at Jackson Hole. Ever since, he has been open and honest about the drawbacks of a zero interest rate policy, but has plowed ahead and unleashed his “QE bowser” into the wild with the understanding that the negative consequences of not doing so would be far worse. At his November 2011 post-FOMC news briefing, for instance, he noted that “we are quite aware that very low interest rates, particularly for a protracted period, do have costs for a lot of people” – savers, pension funds, insurance companies and finance-based institutions among them. He countered though that “there is a greater good here, which is the health and recovery of the U.S. economy, and for that purpose we’ve been keeping monetary policy conditions accommodative.”

My goal in this Investment Outlook is not to pick a “doggie bone” with the Chairman. He is makin’ it up as he goes along in order to softly delever a credit-based financial system which became egregiously overlevered and assumed far too much risk long before his watch began. My intent really is to alert you, the reader, to the significant costs that may be ahead for a global economy and financial marketplace still functioning under the assumption that cheap and abundant central bank credit is always a positive dynamic.

….read the full article HERE